Advantages and Disadvantages of P2P Lending

Khushboo Priya | Updated: Aug 19, 2019 | Category: Peer to Peer lending

In the past few years, P2P Lending has made rapid progress and is one of the fastest-growing sectors of alternative lending. As of now, the current worth of India’s P2P lending industry stands at $3.2 million. However, it is estimated to grow around $4 to $5 billion by 2023. Let’s discuss the Advantages and Disadvantages of P2P Lending sector.

In 2016, there was around 30 peer to peer lending platforms in India, out of which only a few of them succeeded in procuring the P2P license from RBI.

2018 proved to be a landmark year for the P2P industry. RBI issued the license for operating NBFC-P2P Company to as many as eleven companies.

Hence, it’s quite evident that in the upcoming years, Peer to Peer lending industry would be leading the market of alternative finance. So, if you, as a start-up, are willing to start a P2P company, it would be the best option.

But before you leap on to starting a P2P company or opt to apply for the P2P license, find out its pros and cons.

Table of Contents

What is P2P Lending?

P2P Lending, also known as peer to peer lending, is a process of debt financing which lets people borrow and lend money without involving any mediator or any financial institution.

Like NBFCs (Non-Banking Financial Companies)[1], P2P companies are also regulated by the RBI. Such companies operate online comprising low overhead costs.

Furthermore, these are found to be profitable for both lenders and borrowers. On the one hand, investors can earn a higher return on investments. However, on the other hand, borrowers can avail loans at lower interest rates.

Besides, P2P lending has been observed to be one of the best choices for entrepreneurs and startups who want to fuel their business. The platform provides individuals with venture and seed funding.

Significant Features of P2P Lending

There are multiple options for lending and borrowing loans. But peer to peer lending is winning the market because of its several unanticipated features. We have described a few of them below:

- The platform allows online transactions;

- It isn’t mandatory for lenders and borrowers to have a prior relationship;

- The platform lets lenders or investors choose the borrowers according to their interest;

- It offers transparency on where the money is to be invested;

- There’s no direct intermediary to negotiate on interest rates or amounts.

Advantages of Peer to Peer Lending

The platform isn’t beneficial for only one entity, but it offers advantages to both lenders and borrowers. We will discuss the benefits offered to both of them individually. Let’s find out-

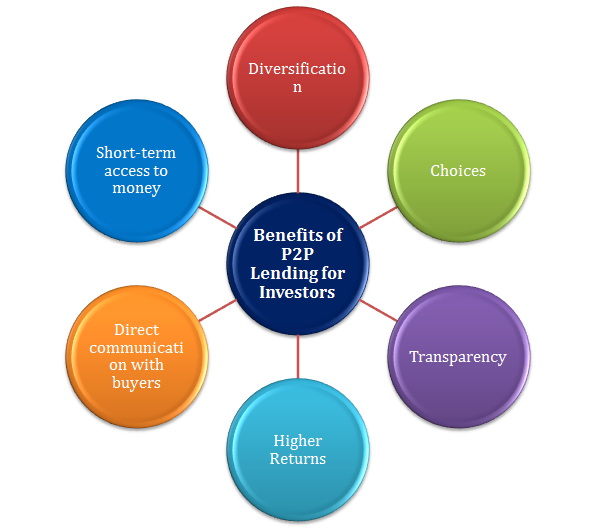

Benefits of P2P Lending for Lenders & Investors

Higher returns to the investors

One of the biggest advantages for investors in peer to peer lending platforms is that they can get higher returns depending on the type of risk they undertake.

Being an investor, you stay well-informed about the borrower, loan agreement, loan originators, and things to expect in return.

You can develop several strategies for auto investment for loans and adjust the priorities as per the requirement. With this, you could determine the risk and hence, gain greater interest on the loan you offer.

Diversification

The P2P lending platform offers a huge variety of options to the investors to invest their capital in whatever way they want to. To be clear, the platform offers “notes” to the investors, which are small parts of a whole loan.

However, there are some sites that let you fund an entire loan. But most of the P2P investors still choose to invest in portions.

For instance, you can purchase notes for as low as Rs. 25 each. Therefore, if you wish to invest Rs. 1000, you need to buy shares in as many as forty separate loans. However, if you tend to invest Rs. 10,000, then you need to invest in as many as 400 notes or many such separate loans as you want.

Let investors make choices

P2P lenders have got the advantage of classifying the borrowers and ensure that they qualify identity verification. Borrowers get interest rates and terms related to the risk associated with credit score, the term of the loan, and other factors in their funding algorithm.

Moreover, lenders prefer to invest only in the loans in which they are interested. If he/she doesn’t like somebody who is consolidating credit card debt, he/she doesn’t invest. Lenders choose to fund the borrowers that match their preferences.

Direct communication with the borrower

With P2P lending, lenders have the option to communicate directly with the borrowers. In turn, this will help them to finalize the deals in a more effective way with the borrowers.

Short-term access to money

Most of the P2P platforms allow you to invest your funds before the loan actually ends and as long as you need them. Hence, being a lender or investor, you can have short-term access to money. Furthermore, you can check for the same on the individual platform.

Transparency

It’s quite crucial to know where your money is going and must be aware of your every investment. On P2P platforms, investors have complete information regarding the background of the business.

Furthermore, you know the purpose of the loan and how the capital raised would be helpful in growing the business and accomplishing its ambitions. Besides, this also consists of financial information such as filed accounts and management information.

In turn, this provides you with a clearer view of the borrower and lets you make a more and well-informed investment decision.

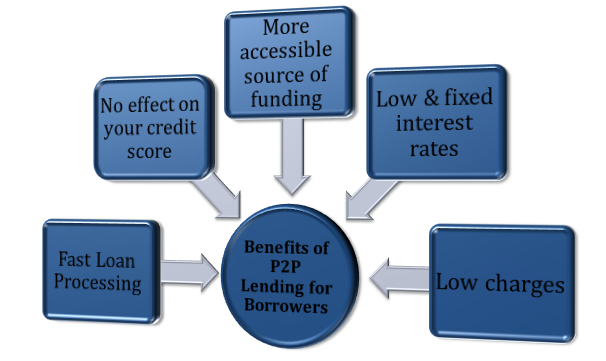

Benefits of P2P Lending for Borrowers

Quick and convenient loan processing

As of now, we are already aware that P2P lending is entirely an online platform. It implies that the loaning process through P2P lending becomes quite fast and convenient.

Generally, such platforms have a waiting list of investors who are ready to provide loans to borrowers.

When these are integrated with an automated process, the turnaround time of getting the money from investors become less and as little as a few hours.

No effect on your credit score

For borrowers, peer to peer lending serves as one of the best platforms for getting loans. You can get a personalized quote that too, without the risk of any effect on your credit score.

With this, you will get a clear insight into the affordability and rate on loan you will be offered.

More accessible source of funding

When compared to conventional loans obtained from the financial institutions, peer to peer lending is preferred as a more accessible funding source for many borrowers.

The reason why it is considered more accessible as compared to others is that P2P offers loan even in case of low credit ratings to the borrowers.

Low and fixed interest rates

The borrowers could avail loans at quite lower interest rates in comparison to credit cards and banks. In fact, there has been a reduction of about 35% in some cases.

Furthermore, there is a fixed interest rate, which implies that even in the case of late payments, you won’t have to any penalty. Hence, the P2P platform serves as a worthwhile option for borrowers.

Charges are low

When compared with other modes of finances, P2P charges lower fees. Additionally, it doesn’t attract any penalty for pre-payment.

Disadvantages of Peer to Peer Lending

P2P platforms have surely got several pros that have made the process of lending and borrowing quite simple and quick. But there’s always some risk associated with every business you do, and P2P lending is no exception.

Below we have described a few disadvantages that every individual must know before engaging with the business:

High Credit Risks

P2P lenders are exposed to high credit risks because of its loan offering to borrowers with low credit ratings. Mostly borrowers applying for loans in the P2P companies have low credit ratings due to which they can’t avail conventional loans from banks. Hence, lenders always need to be aware of the default probability of their counterpart.

Cash may not be lent immediately

One of the drawbacks of the P2P platform is that if you are to lend your cash immediately, then there’s a high possibility that it won’t earn any interest. Likewise, there are many other P2P platforms that eagerly wait to get their cash deployed. However, in case your money is taking time to get lent out, the overall effect on your return is expected to be minimal in the long term.

Interest rate isn’t free

Apart from the facility of Personal Savings Allowance, you will have to pay tax for any interest you earn. Furthermore, if you have earned any interest on the annual tax return, then you must provide the declaration of the same.

Time constraints

Sometimes there are too many choices in the P2P lending. Due to the wide range of loan choices and considerations, it becomes quite challenging to manage a varied portfolio which becomes much time-consuming.

Risk of losing all the money

In case you lend money only in the high-risk-category loans with double-digit interest rates, there’s a high possibility that you will lose all your money. Therefore, if you don’t have understandings of the risk completely, then don’t chase high returns.

There is no Secondary Market for Your Investments

Suppose that any lender purchases a note, for now, he/she must be ready to hold on until it gets matured or it’s completely paid. However, there are some notes whose maturity takes up to five years, which is quite a long time for many investors.

Besides, if you want to withdraw your cash out of your investment, finding a buyer for the same would become pretty daunting.

Concluding Thoughts

It’s quite apparent that P2P lending serves as an excellent platform for those who seek loans at lower interest rates and for those who want to earn a higher return on investment.

As far as it’s about the risk associated with the P2P platforms, there’s no business that doesn’t have any kind of risk. However, if you proceed with an appropriate business plan, then you can surely earn higher returns.

Apart from this, the platform offers complete transparency to the lenders which are of great importance. In comparison, such transparency cannot be seen with Banks.

Therefore, if you are excited about starting a non-banking financial company online, P2P lending is the best option. In case of queries, kindly leave a comment below.

Also, Read: P2P Lending RBI Regulations – Know the Future of P2P Lending in India