What are the Different Types of Debentures?

Dashmeet Kaur | Updated: Dec 23, 2019 | Category: SEBI Advisory

Setting up a business is like a mountain to climb, wherein an entrepreneur has to face several challenges. Even if one manages to incorporate a company, it is just the tip of the iceberg. The most common issue while running either a startup or a large organization is insufficient finances. Often to deal with the shortage of funds, companies prefer to issue of debentures.This blog will introduce you to different types of debentures and essential facts related to them.

Table of Contents

A Clear Picture of the term “Debentures”

In the corporate world, a debenture is a medium to long term debt instrument which helps companies to borrow money from the public. As per its legal definition, ‘debenture refers to a document that either creates a debt or acknowledges it.’ Thus, a debenture is a certificate of loan that acts as valid evidence of the company’s liability to pay a specific amount with interest. Besides the money which a company raises through the debentures, becomes a part of the company’s capital structure; instead of share capital.

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your IPO or Comapny Takeover or SEBI Advisory Services.

Provisions Regulating Issue of Debentures under Companies Act

Several statutory provisions regulate multiple types of debentures under the Companies Act, 2013. Let’s have a look at the applicable laws which governs the issue of debentures:

Conversion

Section 7 (1) of the Companies Act states that ‘a company may issue debentures with an option to convert such debentures into shares, either entirely or partially at the time of redemption.’ t requires passing a special resolution at a general meeting to approve the conversion of debentures into shares either wholly or partly. Moreover, no company shall issue any debentures with voting rights.

Issue of secured debentures

As per Section 71(3), a company can issue secured debentures by complying to prescribed such terms and conditions.

Rules for debenture trustee

Under Section 71(4), a debenture trustee is responsible for protecting the interests of the debenture holders. Also, he must redress the grievances of debenture holders as per the prescribed rules.

Appointment of Debenture Trustee

In regards to Section 71(5), no company shall issue a prospectus or make invitation/offer to the public or its members exceeding five hundred for the subscription of its debentures. It can only do that if the company has appointed one or more debenture trustees before such an issue or offer. The conditions which apply to the appointment of such trustees shall be such as prescribed.

The power vested with Tribunal

If the debenture trustee realizes that the assets of the company are insufficient to discharge the principal amount when it becomes due. He may file a petition before the Tribunal in such a case.

Penal provision for non-compliance

If a company fails to compel with the order of the Tribunal, then it has to bear massive repercussions. Every officer of the company who is in default shall be punishable with imprisonment for a long term that may extend to three years. However, the defaulter shall also have to pay a fine of not less than two lakh rupees that further extend to five lakh rupees.

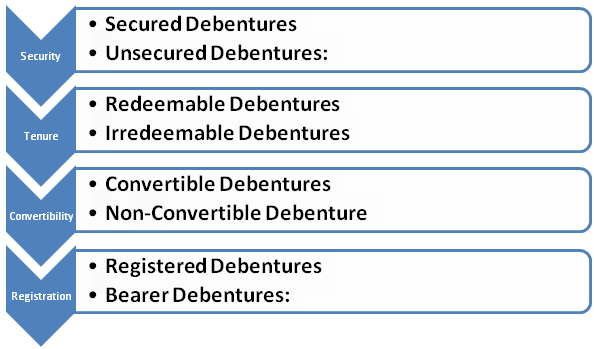

Different types of Debentures

There are various types of debentures that a company can issue. Here is a clear segregation of debentures on the basis of security, tenure, convertibility, registration and many other factors:

Secured Debentures: Such debentures get issued by securing them against the asset of the company. It implies that if the trustee charge against the assets of the company due to failure in repayment, then the company can secure its assets. Usually, the assets get sold to pay such loan amounts. Moreover, the charges can be fixed or floating, which means the trustee can charge either against specified assets or all the assets of the company. Thus, through the issue of secured debenture, the company safeguards its assets against any charges.

Unsecured Debentures: As the name suggests, such debentures are not secured from any charges against the assets of a company, neither fixed nor floating.

Redeemable Debentures: The redeemable debentures are the one which is payable at the expiry of their term. Thus, they are payable at the maturity of the specified period, either in the lump sum or in installments. Such debentures can be redeemable at par, discount, or a premium.

Irredeemable Debentures: Irredeemable debentures are perpetual in nature. Therefore, there isn’t any fixed date on which it becomes payable. These debentures are redeemable when the company goes on the liquidation process or after an unspecified long time interval.

Fully Convertible Debentures: These shares can be converted into equity shares as per the choice of the debenture holder. So if the debenture holder wishes then after a specific time interval, all his shares will get converted to equity shares, and he will become a shareholder.

Partly Convertible Debentures: Here the debenture holder of partial conversion of the debentures into shares. If he does so, he becomes both the creditor and a shareholder of the company.

Non-Convertible Debentures: These are one of the most common types of debentures wherein, there is no option of conversion to shares or any kind of equity. Hence, such debentures remain until their maturity, and no conversion can take place.

Registered Debentures: The registered debentures comprise all details about names, addresses, and particulars of the debenture holder. That information gets further filed in a register kept by the company. Such debentures are movable only while performing a standard transfer deed.

Bearer Debentures: These debentures are transferrable by way of delivery, and the company does not need to keep any record of the concerned debenture holders. Interest on bearer debenture is paid to a person who provides the interest coupon attached to it.

Advantages of Issue of Debentures

Debentures are a great way to raise the capital. These are the perks of using this tool:

- The company procures the needed funds without diluting equity.

- Interests paid on debentures are charged against the profit. Thus it is a tax-deductible expense.

- Debenture issue is the cheapest form of loan in contrast to other borrowings.

- Debentures emphasize a company to do long-term planning & gather funds for the long term.

- Debentures are the least risky type of loan that a company can take. As they are secure & one only has to pay the interest is in the case of losses.

Conclusion

Also, Read: How a Company Issue Debentures to Public?.