Difference Between Banks v/s NBFCs

Monisha Chaudhary | Updated: Oct 04, 2017 | Category: NBFC

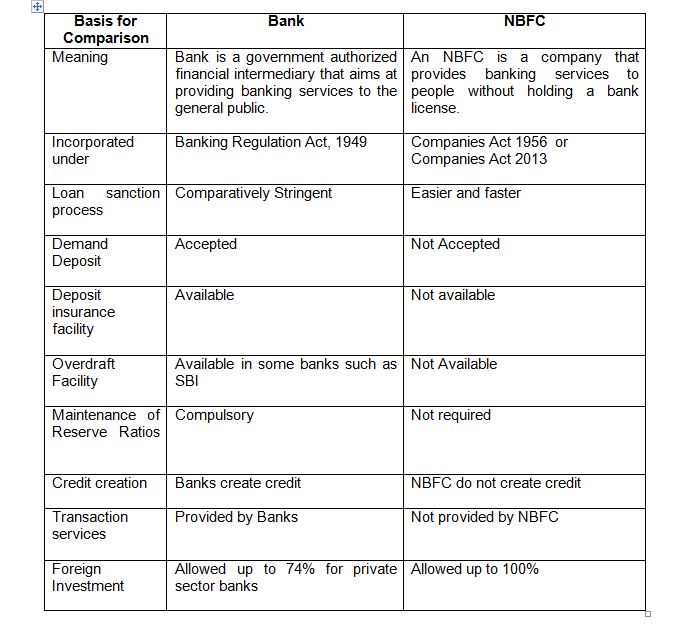

Succeeding in attaining a loan in India is no more a tough task if one meets the eligibility criteria but the key concern among many is to decide whether to choose a bank or NBFC for shopping of loans in India. Banks vs NBFCs Non-Banking Financial Companies (NBFCs) are both financial intermediaries playing somewhat similar roles in the space of financial products. Yet there are large differences between them and the two maintain their distinct identities. Borrowers often wonder which one to approach for their loans and why.

Table of Contents

Difference between Bank & NBFC

Major differences with perspective to loan

- Banks are more stringent when it comes to paperwork, requirements, and eligibility while processing your loan application. Your credit score also needs to be above acceptable levels as well. The upside of going through greater scrutiny is that loan applicants can get lower processing fees and lower interest rates. Banks may also offer discounts to women, which most NBFCs don’t at the moment.

- While NBFCs have a faster loan processing time which means applicants can get loan approval and disbursal faster. NBFCs can be more accepting of lower credit scores, and they balance their risks by charging higher interest rates. While taking home loans as well, the paperwork requirements for NBFCs may be less stringent than banks. NBFCs too must be careful to keep their bad debt and NPAs under check since they lend largely to the retail sector largely and not to the corporate sector.

How to pick one while shopping for loans between Banks v/s NBFCs?

All things considered equal, a loan applicant may find that the repayment tenure and interest rates on offer from banks and NBFCs to be similar. Based on a thorough reading of the loan applicant’s income data, credit history, property documents etc., variations in interest rates and charges may occur. To select between banks and NBFCs while borrowing, the decision may often come down to who offers you the cheapest loan. The lower the interest rate and processing fees, the cheaper the loan.

While choosing between a bank and an NBFC, one should take into account the kind of loan you are seeking. Many NBFC Registrations, for example, offer a host of consumer durable loans allowing for quick processing and easy repayment structure. Banks, on the other hand, may have a larger variety of loan products, such as home loans, car loans, education loans, personal loans etc. The following points could be key differentiators.

Interest Rates

- The rate of interest is one of the main aspects of all types of loans.

- Non-Banking Financial Sectors have started to concentrate on this area in recent decades and have brought down the interest rates to either equally to bank lending rates or at times even lower to bank rates. With all the other benefits when a rate of interest is also lowered, borrowers found this more easy and affordable. This has also resulted in lower EMI (Equated Monthly Instalment) for borrowers. Based on the income, a credit scoring ad repayment rate of interest is charged on the borrowers however it is at competitive rates.

- Bank loans with floating rates are linked to the MCLR (Marginal Cost of Lending Rate) which are linked to macroeconomic factors such as the RBI-mandated lending rates.

- NBFCs and housing finance corporations (HFCs) lend as per the Prime Lending Rate (PLR), which is not regulated by the RBI. And due to this greater freedom to increase or decrease these rates are allowed to NBFCs and HFCs as it fits.

- This also suits customers who may sometimes benefit from special, low-interest loans (for instance, zero interest car loans), or high-interest loans just in case they do not meet a bank’s loan eligibility criteria. Which provides NBFCs an edge over banks who cannot lend below the MCLR.

Credit Score Requirements

- Both NBFCs and banks will offer their best interest rates to customers with high credit scores. However, customers with a lower score (in the 550-700 range) may find loans from NBFCs to be less stringent in terms of eligibility requirements.

- Individuals with poor credit rating generally will not get loans from banks. The reason for this is banks consider borrowers are high-risk individuals if the credit scoring is low. Unless the credit score is above 600 -650, it is very difficult to get a loan sanctioned from banks.

- Instead, loans will be offered to individuals with low credit score by NBFCs but most of the time the interest rates for such borrowers will be higher than market rates. Due to these aforementioned advantages, most of the NBFCs are growing.

- With regard to offering loans, banks and NBFCs will offer business, personal and retail loans. And this is totally on the basis of the repayment capacity of the borrower. Most of the corporate sector prefers banks, however; retails sector chooses NBFCs over banks.

- Simple loans such are vehicle financing loans, gold loans, home loans, and durable loans are offered by NBFCs. And customer satisfaction ratio is high here. NBFC sector is also set to expand even further in the coming days. If someone is looking to get a quick loan approved then the first option is NBFCs as banks are more stringent in approving loans.

Read, Also: A Peek into the Future of NBFCs in India.

Loan Eligibility

- A more relaxed approach to one’s loan eligibility is available to NBFCs in the amount that may be sanctioned as per one’s repayment capacity, credit score, etc. For example, banks will typically fund up to a certain percentage of one’s home value and would exclude costs towards stamp duty and registration. NBFCs may formulate ways to help customers and will include these extra costs in the loan. This is to the customer’s benefit as one may be able to take on a larger loan.

Stringent Paperwork

- NBFCs have an impressive market share for retail loans. This they’ve been able to achieve through relaxed paperwork and processing requirements. Banks, on the other hand, are more thorough with paperwork.

Fewer Rules and Regulations

- As NBFC are under the Companies Act, the rules and regulations for lending are not as stringent as banks. This helps borrowers to get loans easily. And the less complicated loan processing is; borrowers are highly satisfied. But, the risk of evasion is high with NBFC, hence the rates of interest and other charges will be accordingly priced by the NBFC. Even the loan amount approved will be quite lesser than the collateral value. This is due to the high risk of default.

- Quick Processing

- At banks, it is very vital that the applicant should fulfil the eligibility criteria but NBFC are indulgent in this aspect. This makes loan approval easier, smoother process and quicker.

- Most of the times, people apply for a loan when they are in immediate need of money. NBFCs have taken this as an opportunity to meet the demand by quickly processing the loans at a competitive rate of interest. At times, borrowers are even ready to compromise on the interest rates if the loan amount is huge and if they could get it approved quickly.

Conclusion

- Most of the corporate sector prefers banks, however; retails sector chooses NBFCs over banks. Simple loans such are vehicle financing loans, gold loans, home loans, and durable loans are offered by NBFCs. And customer satisfaction ratio is high here.

- Both banks and NBFCs have their advantages and a final decision must be made keeping in mind the loan type, the interest rates, charges, credit score, and the loan disbursal timelines.

- NBFC sector is also set to expand even further in the upcoming days. If someone is looking to get a quick loan approved then the first option is NBFCs as banks are more stringent in approving loans.

- Many factors have to be considered before making the decision between the two, such as credit score, the tenure of the loan, loan amount, and the Interest rate. Based on these factors it then becomes easier to pick one of the two while shopping for a loan.

Also, Read: How to Apply for NBFC License?.