Company Auditor’s Report Order (CARO), 2016-Reporting Requirements

Sanchita Choudhary | Updated: Oct 16, 2020 | Category: Business, Private Limited Company

The Company Auditor’s Report Order (CARO) 2016, is a reporting requirement order which was added by the Central Government under section 143(11) of the Companies Act, 2013. The Ministry of Corporate Affairs (MCA) has issued the Companies Audit Report Order, 2016 on 29th March 2016. This order supersedes the earlier order of the Companies Audit Report Order, 2015.

The CARO applies to private companies thus increasing its applicability threshold. CARO, 2016 is an order which lists the matters on which an auditor is required to report. This order does not limit the duties and responsibilities of auditors but also requires statements which are to be included in the audit report.

Table of Contents

Applicability

CARO 2016 is applicable to all the companies which include foreign companies as well. This Order is applicable for Financial Year 2015-16, Financial Year 2016-17 and the subsequent years.

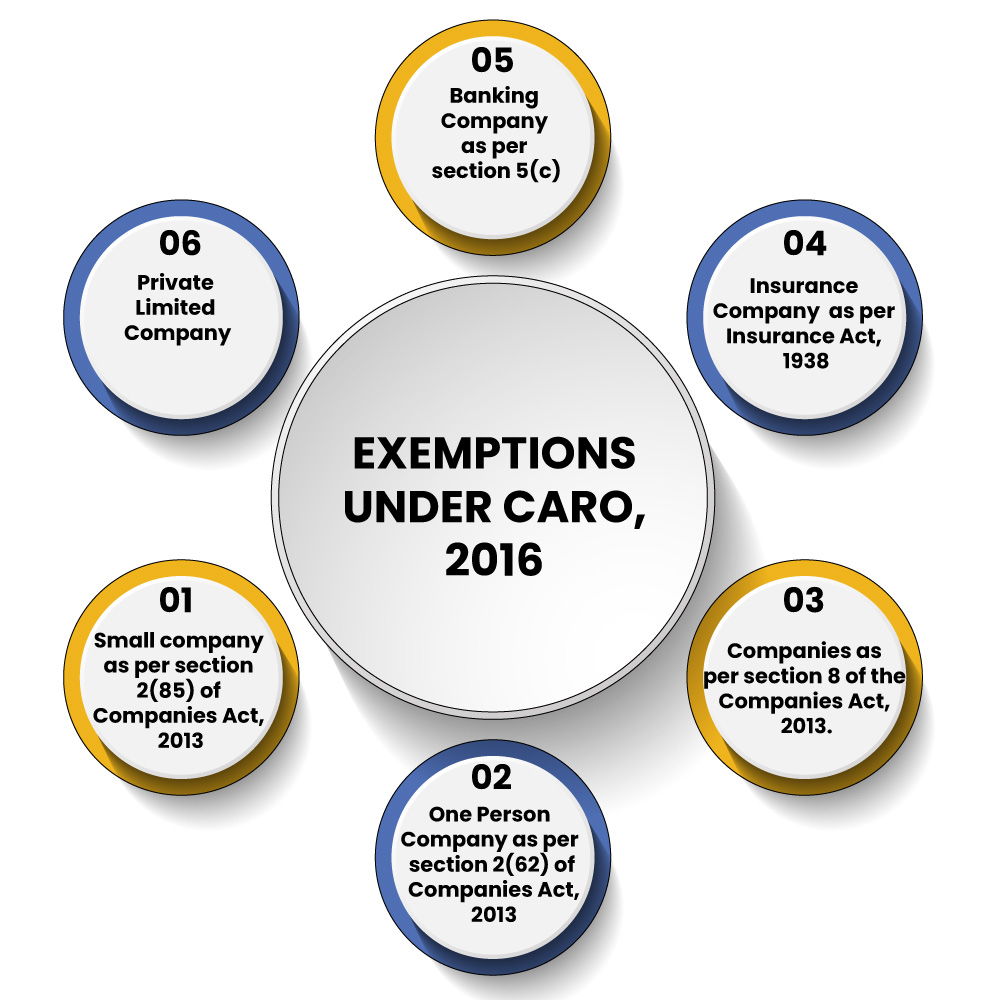

Exemptions Under CARO, 2016

Below mentioned are the classes of companies which are exempted and are outside of the purview of the specified order:

- Banking Company as per section 5(c) of Banking Regulation Act, 1949.

- Insurance Company as mentioned under Insurance Act, 1938.

- Companies which are incorporated and licensed to operate as per section 8 of the Companies Act, 2013.

- A One Person Company Registration (OPC) as per Clause 62 of section 2 of Companies Act, 2013.

- A Small Company as defined under section 2 Clause 85 of the Companies Act, 2013.

- A Private Limited Company which is neither a subsidiary company nor a holding company of any public company , does not have a paid up capital or reserve exceeding rupees 1 Crore as mentioned in the balance sheet, total borrowing should not exceed rupees 1 Crore from any bank or financial institution at any point of time during the financial year.

Also, Read: Section 8 Companies in India

Reporting Requirements OF CARO, 2016

In comparison of CARO 2015 the reporting requirements under CARO 2016[1] have been increased. Matters which are to be included under the Company Auditor’s Report Order, 2016 are listed below:

Fixed Assets-

- Whether the proper records of the company are being maintained showing full particulars which include quantitative details along with the situation of fixed assets.

- Physical verification of these fixed assets has been conducted by the management at reasonable intervals.

- Whether any title deeds of immovable property are mentioned in the name of the company. If so, provide the details, thereof.

- Whether any material discrepancies were found and noticed and the same has been accounted for in books of accounts.

Inventory

- Whether any physical verification of inventory has been conducted by the management at reasonable time with reasonable intervals.

- Whether any material discrepancies were found during the process of this verification and the same has been accounted for in books of accounts.

Loan to Directors

- Whether the provision of section 185 and 186 of the Companies Act, 2013 has been complied with in respect of a loan, investment, guarantees.

- If not, provide the details of the same.

Loan and Guarantees Made by The Company-

Whether any loan has been granted by the company secured or unsecured to companies firms, limited liability partnership or any other parties mentioned in the register under section 189 of the Companies Act, 2013.If any such loan has been granted, following things must be taken under consideration:

- The terms of such loans are detrimental to company’s interest.

- Proper repayment should be there if any along with the receipt.

- In case of overdue of amount for more than 90 days whether any reasonable steps has been taken by the company for the recovery of principal and interest.

Deposits

In case the Company has accepted the deposits whether the following have been complied with:

- The directives issued by the RBI or the provision of section 73 to section 76 or any other such provisions of Companies Act, 2013

- If any order has been passed by the Company Law Board or NCLT or RBI or any other such tribunal.

Cost Records

- Whether as per section 148 (1) of the Companies Act, 2013 the Central Government has specified any maintenance of cost record .

- If yes, whether such accounts and records have been made and maintained.

Statutory Dues

Undisputed Statutory Dues –

Whether regularity has been maintained by the company in depositing undisputed statutory dues including provident funds, income tax, sales tax, employees state insurance, service tax, duty of excise, duty of customs, Cess or any such other statutory dues to the appropriate authorities. If the company fails to do so, the extent of the arrears of outstanding statutory dues as on the last day of the financial year for a period of more than six months from the date they become payable, shall be indicated.

Disputed Statutory Dues-

Whether on account of any dispute dues related to income tax, service tax, sales tax, or duty of excise or duty of customs have not been deposited then the same must be mentioned.

Default in Repayment of Loans-

The period and the amount of default must be reported if the company has defaulted in the repayment of any loan or borrowings to any such financial institution, bank or Government.

Nidhi Company-

In case of Nidhi Company rules, in order to meet out the liability, the net owned funds to deposit should be in the ratio of 1:20. Nidhi Company should also maintain at least 10% unattached deposits in order to meet out the liability.

Conclusion

The Ministry of Corporate Affairs was of view point that there are certain issues which are important and should be reported along with the financial statements for certain companies as a part of their audit reports. This lead towards the issuance of CARO, 2016. The order not only applied to the private companies but also extended toward the foreign companies. Thu, the auditor’s of such companies are also required to report on any such matters specified in Company Auditor’s Report Order (CARO) 2016, .

Also, Read: Procedure of Striking off Company under Companies Act, 2013