Composition Scheme under GST Act: A Guide on its Key Reforms

Shivani Jain | Updated: Jul 18, 2020 | Category: GST

Although the implementation of GST (Goods and Service Tax) in India was a significant change from the prevailing tax regime. However, it was a back-breaking task for the start-ups or SMEs to comply with its provisions. Therefore, to lower down the stress of these sectors government decided to introduce the Composition Scheme under GST Act.

Further, this blog will discuss the concept, eligibility, updates, tax rates, reforms, process, and annual returns under Composition Scheme.

Table of Contents

Concept of GST Composition Scheme

The GST Composition Scheme acts[1] as an alternative way of paying taxes for small taxpayers. This method aims to simplify the process and reduce the compliance cost for these taxpayers. Further, section 10 governs the Composition Scheme under GST Act.

Furthermore, if we compare the composition scheme and normal GST Filing, the scheme offers two benefits. First, the lower tax liability and second the reduced paperwork.

Moreover, under this scheme, the taxpayer is liable to pay tax at a fixed rate, i.e., 1% to 6% of the annual turnover.

Eligibility for Composition Scheme under GST Act

All those taxpayers whose annual turnover is up to Rs 1.5 crore can choose to register under the Composition Scheme. However, the limit for Himachal Pradesh and the North-Eastern States[2] has been reduced to Rs 75 lakh.

Further, by choosing this scheme, the small taxpayers will get relief from the tedious and back-breaking formalities concerning GST. Under this scheme, they need to pay tax at a fixed rate of annual turnover.

Furthermore, the CBIC (Central Board of Indirect Taxes and Customs) has increased the annual turnover limit from Rs 1 crore to Rs 1.5 crore.

Persons not Eligible to Apply for Composition Scheme under GST Act

The taxable persons not eligible to apply for composition scheme under GST Act are as follows:

- Supplier of service other than restaurant owners

- NRI (Non-Resident of India) taxable person;

- Supplier of Non-Taxable Goods;

- A Person engaged in the Inter-State Supplies;

- A Supplier who is supplying goods through E-commerce operator;

- Manufacturer of ice-cream, tobacco, and pan masala;

- Casual Taxable Person.

Note:

- Earlier, the service providers, other than the one engaged in restaurant services, did not have the permission to get registered under the composition scheme. However, after the 32nd GST Council Meeting, held in January 2019[3] , these sectors were allowed to register under the Composition Scheme.

- The entities or individuals registered under the Composition Scheme are not allowed to engage in the interstate supply. However, these businesses can acquire goods and services from suppliers eligible to perform interstate functions under the GST Act.

Key Aspects of GST Composition Scheme

The key aspects of the Composition Scheme under GST Act are as follows:

- Eligibility: Only the taxpayers having Rs 1.5 crore as the annual turnover can apply for registration under the GST Composition Scheme.

- Special Eligibility Criterion: The GST Council has allowed the normal taxpayers to apply for Composition Scheme Registration. However, these taxpayers are permitted only if they have 10% of the turnover from providing services.

- Filing of Quarterly Returns: A taxable person registered under the composition scheme needs to file only one return every quarter.

- Intra-state Supplies: Inter-state suppliers or local suppliers can acquire benefits under the GST Composition Scheme.

- Bill of Supply: A taxable person registered under the GST Composition Scheme needs to show a bill of supply instead of a tax invoice to the authorities.

- No Input Tax Credit: As per section 16 of the GST Act, the goods and services on which the composition tax has already been paid are not eligible to claim ITC.

- Tax Rates: The tax rates for the Composition Scheme under the GST Act are as follows:

- Manufacturers: 1% GST (0.5% CGST and 0.5% SGST);

- Restaurant Services (that do not serve alcohol): 5% GST (2.5% CGST and 2.5% SGST);

- Service Providers: 6% GST (3% CGST and 3% SGST);

- All Other Traders: 1% GST (0.5 CGST and 0.5% SGST)

- GST applicable only on Taxable Supplies: After the amendment made on 01 Jan 2018, GST will be applicable only for taxable supplies. That means earlier, there was a need to pay taxes for exempted goods as well.

- Penal Provisions: Section 73 and 74 of the GST Act deals with the offense of providing false data under the scheme.

- Voluntary Registrations: Taxpayers registered under the VAT (Value Added Tax) composition scheme need to apply under the GST Composition Scheme.

Benefits of Composition Scheme

In India, the benefits of the Composition Scheme under GST Act are as follows:

- Limited Compliances for Small Taxpayers;

- Timely Recovery of Taxes;

- Limited Tax Liability;

- High Liquidity for Taxpayers;

- Quick filing of Returns;

- Easy maintenance and generation of records;

- Simplified invoices and other documents.

Conditions for Availing Composition Scheme

In India, the conditions for availing composition scheme under GST Act are as follows:

- Any dealer choosing Composition Scheme cannot claim ITC (Input Tax Credit);

- A dealer cannot supply GST Exempted Goods;

- A dealer cannot engage in Inter-state supply;

- The taxpayer needs to pay tax at a nominal rate under the RCM (Reverse Charge Mechanism);

- A person involved in several businesses like textiles, groceries, accessories, etc. with the same, then he/she needs to opt for the GST Composition Scheme collectively;

- Every taxpayer registered under the Composite Taxable Person needs to mention “Composition Taxable Person” on every supply bill that he/she issues;

- Further, the taxpayer needs to specify “Composition Taxable Person” on every notice and signboard at the business site.

- Since, 01 Feb 2019, a Manufacturer or Trader can supply services or goods up to 10% of the annual turnover, or Rs 5 Lakhs, whichever is higher.

Modes of Making GST Payment by the Composition Dealer

The different modes of making GST payment by the Composition Dealer are as follows:

- GST on supplies made;

- Tax on Reverse Charge;

Different Forms for the GST Composition Scheme

The different forms for the GST Composition Scheme can be summarised as:

| Form No | Particulars | Due Date |

| GST CMP-01 | To opt into Composition Scheme by Provisional GST Registration Holder. | Within 30 days from the date of appointment |

| GST CMP-02 | To opt into GST Composition Scheme by the unregistered persons. | Before the Commencement of Financial Year. |

| GST CMP-03 | Information regarding the stock/ inward supply from the unregistered person/ business. | Within 90 days from the date of exercising the option. |

| GST CMP-04 | Application for the withdrawal from the GST Composition Scheme. | Within seven days from the date of the happening of the event |

| GST CMP-05 | Issuance of Show Cause Notice by the Proper Officer | On any contravention |

| GST CMP-06 | Reply to the Show Cause notice issued by the proper officer | Within 15 days from the receipt of notice |

| GST CMP-07 | Order for the Acceptance or Rejection of the Reply filed to the Proper Officer. | Within 30 days from the filing of the notice |

| GST REG-01 | Registration under the GST Composition Scheme | Before the appointed date |

| GST ITC-01 | Details regarding the semi-finished, finished and stocks | Within 30 days of the withdrawal from the GST Composition Scheme |

| GST ITC-03 | Intimation about the Input Tax Credit | Within 60 days from the beginning of the Financial Year. |

Filing of Return under the Composition Scheme

The returns to be filed under the GST Composition Scheme are as follows:

- Form GSTR-4: It is a Quarterly Return and needs to be filed by the 18th of the month after quarter-end.

- Form GSTR-9A: It is an Annual Return and needs to file by the 31st of the respective financial year.

Billing under GST Composition Scheme

- As per the rules and regulations of the composition scheme under the GST Act, a composition dealer cannot issue a GST (Goods and Service Tax). The reason behind this is that in this case, the tax liability is on the taxpayer.

- It is obligatory for a composition dealer to issue a bill of supply as per the rules and regulations of the composition scheme under GST Act.

- Further, it is compulsory to mention “composition taxable person, ineligible to receive tax on supplies” on every bill issued.

Latest Updates on the Composition Scheme under GST Act

Some of the latest updates on the Composition Scheme under GST Act are as follows:

- The time period for filing Form GST ITC-03 has been extended till 31 July 2020;

- The time period for submitting Form GSTR-4 by the composition dealers for the financial year 2019-2020 was extended till 31 August 2020;

- All the dealers were allowed to make Challan-cum-Statement for the January to March Quarter in Form GST CMP-8 till 07 July 2020;

- The time-limit for the normal as well as registered taxpayers who want to apply in composition scheme for the Financial Year 2020-2021 was extended till 30 June 2020;

Online Procedure to Apply for Composition Scheme under GST Act

The steps involved in the procedure to apply for the Composition Scheme under GST Act are as follows:

- Visit Official Portal: The first and foremost step for the applicant is to visit the official GST portal on https://www.gst.gov.in/;

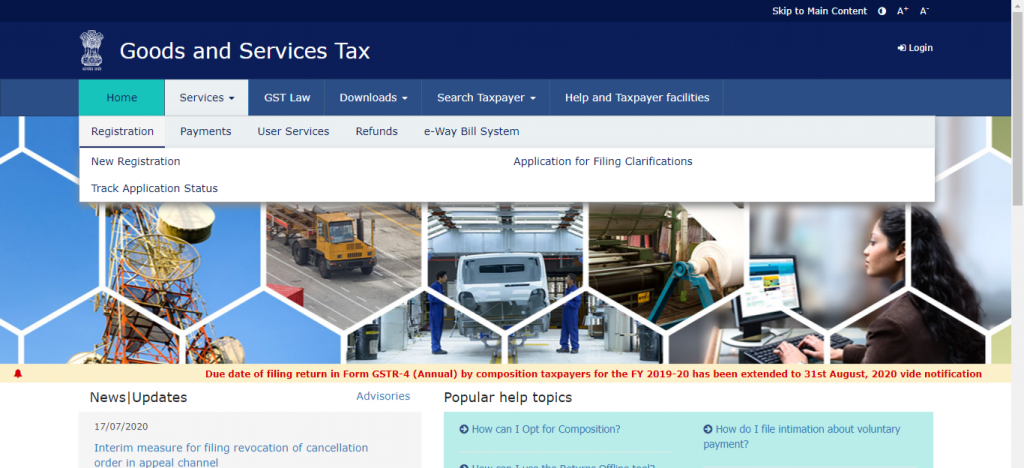

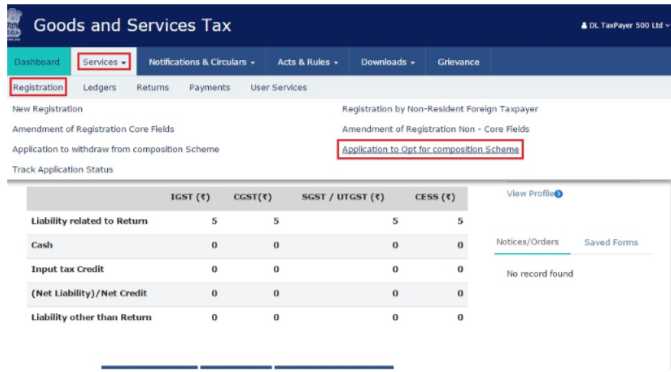

- Services: Now, the Applicant needs to click on the “Service” tab on the homepage. Further, this application procedure includes two parts;

- New Registration;

- TRN (Temporary Reference Number)

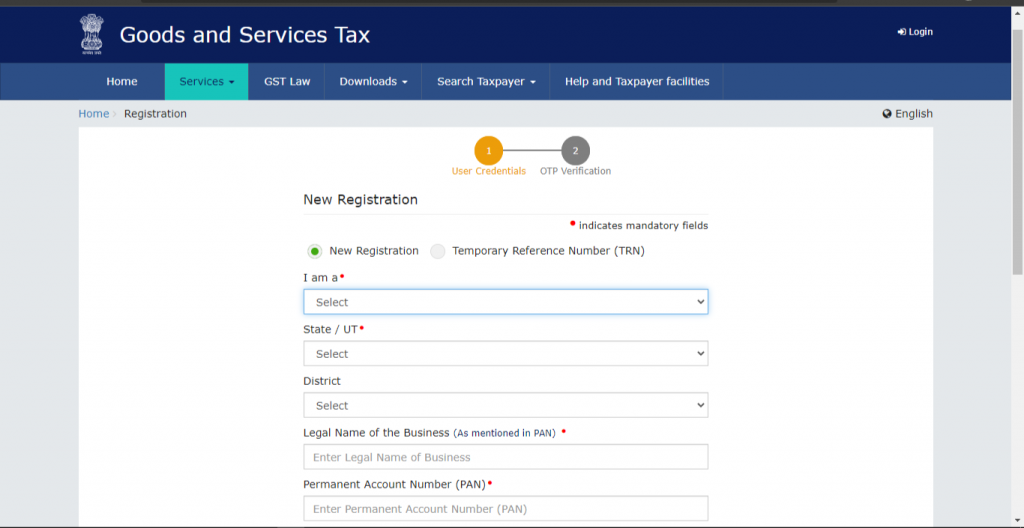

- New Registration: Now, the applicant needs to choose “New Registration”;

- Details: The applicant needs to fill in the following details;

- Type of Taxpayer;

- District and State for which the Composition Scheme registration is needed;

- Business Name;

- PAN Card particulars of the Business or Proprietor;

- Mobile Number and E-mail Address of the Primary Authorised Signatory;

- One Time Password: The applicant needs to enter the OTP received on the registered e-mail address and mobile number;

- Enter OTP: The applicant needs to enter the given OTP and Captcha. Thereafter click on the “Proceed” button;

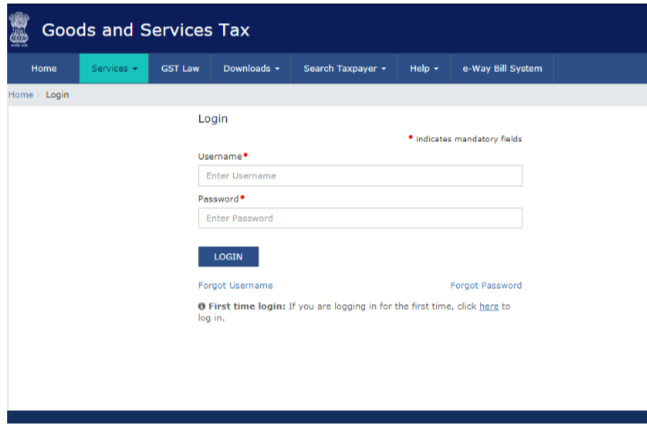

- Login on GST Portal: Now, enter the provided username and password, together with the Captcha in the required place and thereafter click on the “Login” option;

- Application for Composition Scheme under GST Act: When the applicant has logged on to the account, then he/she needs to select “Application to opt for Composition Scheme under GST Act”. The applicant can select the same from the “Registration Menu” provided under the “Service” tab on the home page.

- Review Details Provided: After selecting the applicant will be redirected to the application page. Here the following details of the applicant will be listed on the form:

- GSTIN (Goods and Service Tax Identification Number);

- Business Name;

- Trade Name;

- Address of the Registered Office;

- Nature of the Business;

- Jurisdiction.

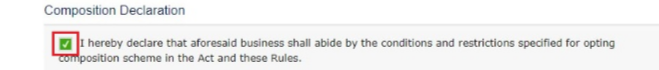

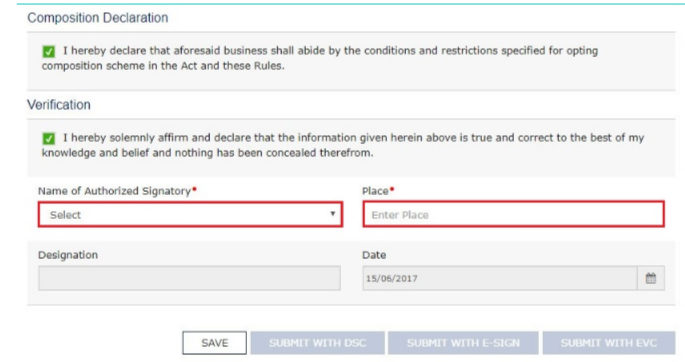

- Composition Declaration: Further, after reviewing all the information provided, the applicant needs to tick the Composition Declaration Box given at the end of the application form.

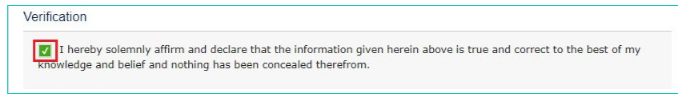

- Verification Process: Now, after ticking the composition declaration, the applicant needs to check the box of the Verification Process. This box is given just below the Composition Declaration.

- Other Details: After Verification, choose the Authorised Signatory from the drop-down menu and also mention the place of filing the application. Now, click on the “Save” button to save the details provided.

- Submit the Application Form: After saving the said form, the “Submit” option gets activated. Further, the Applicant requires to sign the application form. He/she can either sign it by using DSC (Digital Signature Certificate) or by EVC option.

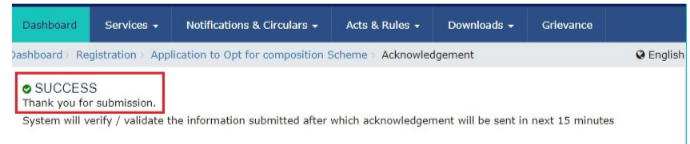

- Submit Form after Signing: Lastly, click on the “Submit” option after signing the form.

Conclusion

The main reason behind the implementation of the Composition Scheme under GST Act was to provide an alternative or optional way to the small taxpayers. Further, this scheme aims to reduce the tax burden and compliance cost on these taxpayers.

Moreover, this scheme has simplified the lives of small taxpayers, as now they are not required to maintain lots of records. Therefore, it will be correct to mention that the composition scheme under GST Act has turned out very beneficial for small taxpayers.

However, GST Registration and GST Return Filing is an extensive process that is efficiently and smoothly handled by the experts at Swarit Advisors. Take the assistance of our experts who are coherent in dealing with GST registration.

Also, Read:GST Registration Requirement