Outcomes of the 42nd GST Council Meeting

Shivani Jain | Updated: Oct 10, 2020 | Category: GST, News

The 42nd GST Council Meeting was held on 05.10.2020 in New Delhi. The meeting was chaired by our Union Finance Minister, Ms. Nirmala Sitharaman[1]. Further, the meeting was attended by Mr Anurag Thakur, Minister of State for Finance and Corporate Affairs.

Apart from this, the Finance Minister of States and Union Territories, together with the Senior Officials of both the Finance Ministry and States and UTs attended the meeting as well.

Further, it shall be relevant to state that it was an 8 hour long meeting, however, the council failed to reach a consensus on the subject of “Borrowing to Make up for the Compensation Cess Shortfall”. As a result, the GST Council will meet again on 12.10.2020 to determine the Compensation Issue for States.

In this blog, we will discuss the Outcomes of the 42nd GST Council Meeting.

Table of Contents

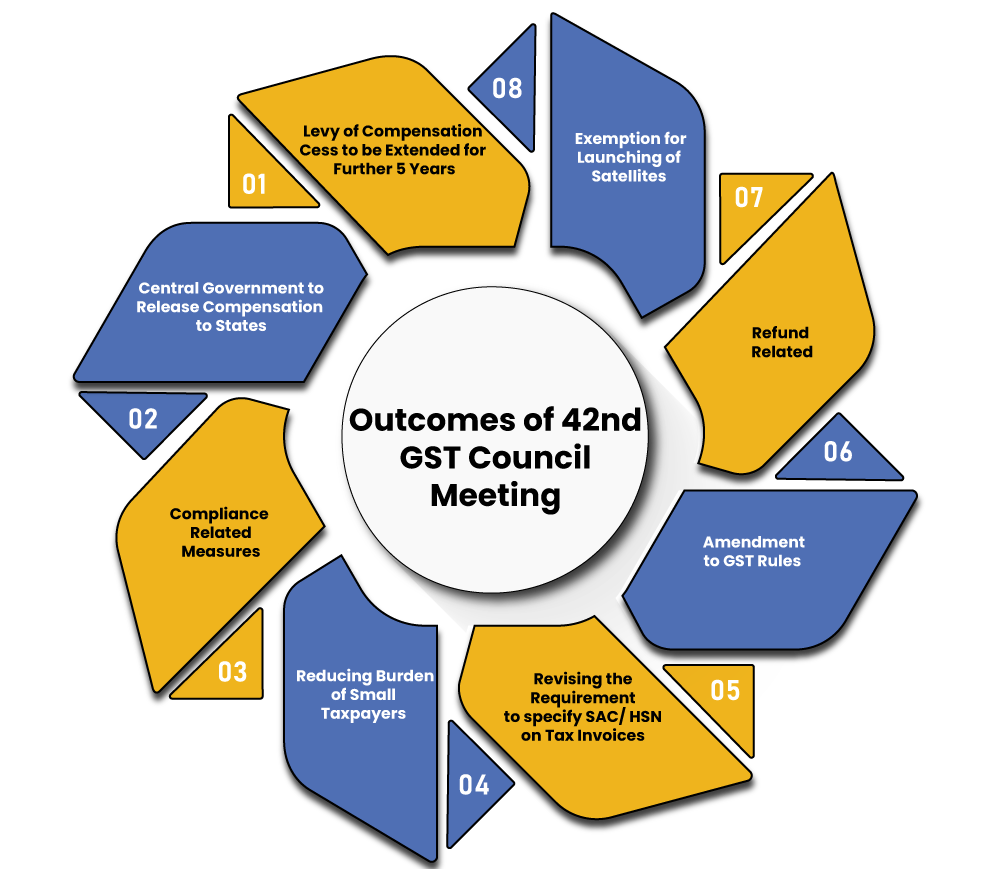

Outcomes of 42nd GST Council Meeting

The Outcomes of 42nd GST Council Meeting are as follows:

- Levy of Compensation Cess to be Extended for Further 5 Years;

- Central Government to Release Compensation to States;

- Compliance Related Measures;

- Reducing Burden of Small Taxpayers;

- Revising the Requirement to specify SAC/ HSN on Tax Invoices;

- Amendment to GST Rules;

- Refund Related;

- Exemption for Launching of Satellites;

Levy of Compensation Cess to be Extended Further for 5 Years

The Compensation Cess of the Goods and Service Tax has been extended further for a period of 5 years, i.e., beyond June 2022. Further, the reason for the same is to fulfil the Revenue Gap.

However, it shall be relevant to state that during the implementation of GST Registration in July 2017, the compensation cess was already levied for 5 years.

Central Government to Release Compensation to States

In the 42nd GST Council Meeting, the Central Government had decided to Release of Compensation Cess worth Rs 20000 crores for the States. Further, the main aim behind the same is to meet up the loss of revenue incurred during the Financial Year 2020-2021.

Also, the Central Government has decided to further grant Rs 25000 crore by the end of next week towards the IGST Act 2017.

Compliance Related Measures

With an aim to further improve the “Ease of Doing Business” and enhance the Compliance Experience, the GST Council in its 42nd Meeting had approved a “Future Roadmap for GST Return Filing”.

Further, the main aim of this approved framework is to simplify the process of Return Filing and to further reduce the compliance burden on taxpayers in this regard. However, the same will be done in the manner given below:

- With effect from 01.01.2021, the due dates of furnishing quarterly Form GSTR 1 by the taxpayers to be amended to 13th of the month succeeding the quarter;

- Auto-generation of liability in Form GSTR 1, with effect from 01.01.2021;

- There will be Auto-generation of ITC (Input Tax Credit) from the suppliers of Form GSTR 1 by the newly developed mechanism in Form GSTR 2B. Further, the same will be from 01.01.2021 for the monthly filers and 01.04.2021 for quarterly filers;

- In order to confirm auto generation of ITC and liability in Form GSTR 3B as mentioned above, Form GSTR 1 would be compulsorily required to be filed prior to Form GSTR 3B with effect from 01.04.2021;

- The prevailing Form GSTR 1 and 3B return filing mechanism to be extended further till 31.03.2021. Further, an amendment will be made in the GST laws to make the Form GSTR 1 and GSTR 3B return filing mechanism as the default mechanism for return filing.

Also, Read: Expectations and Outcomes of 41st GST Council Meeting

Reducing Burden of Small Taxpayers under 42nd GST Council Meeting

With effect from 01.01.2021, the small taxpayers who are having an annual turnover up to Rs 5 crores have been allowed to file GST Returns on a Quarterly basis with Monthly payments.

Further, such small taxpayers, for the first two months of the quarter, have a choice to pay 35% of the Net Tax Liability of the last quarter with an auto-generated Challan.

Revising the Requirement to specify SAC/ HSN on Tax Invoices

As per Rule 46(g) of the CGST Rules, there will be a need to mention HSN and SAC on the Tax Invoice.

Further, the table given below will elucidate the current requirement of HSN and SAC on the tax invoice, together with the comparison with the expected change suggested by the GST Council.

| Current Position | Suggested | ||||||

| Aggregate Turnover | Digits | Aggregate Turnover | Digits | ||||

| Up to Rs 1.5 crores | Not required | Up to Rs 5 crores | 4 Digits (for B2B (Business to Business) transactions) | ||||

| More than Rs 1.5 crore but up to Rs 5 crores | 2 Digits |

Above Rs 5 crores | 6 Digits | ||||

| More Than Rs 5 crores | 4 Digits | Imports and Exports of Goods | 8 Digits | ||||

| Import Exports of Goods | 8 digits | Government notified supplies | 8 digits | ||||

Amendment to GST Rules

The GST Council has recommended various amendments in the CGST Rules and GST Forms. Further, the same includes furnishing of Nil GST Form CMP 08 through SMS.

Refund Related

It was decided that from now onwards, the Refund will be paid/disbursed in a validated bank account which is linked with the PAN (Permanent Account Number) and Aadhaar of the registrant.

PIB1661827Exemption for Launching of Satellites

In order to encourage the domestic launching of satellites specifically by the young start-ups, the satellites launch services provided by the ISRO (Indian Space Research Organisation), Antrix Corporation Ltd, and NSIL to be exempted.

Conclusion

In our opinion, it seems that regardless of the heavy deficit in the GST collections due to the COVID- 19 epidemic, the GST Council will not be increasing the “Rate of Compensation Cess”. However, it has been determined to extend the levy of “Compensation Cess” beyond the transition period of 5 years, which will expire in June 2022.

Further, the familiarity achieved by the businesses with the prevailing return filing mechanism, i.e., Form GSTR 1 and GSTR 3B over the last 3 years, the decision to carry on with them is a welcome move. Also, this decision will avert avoidable disruptions that would have been happened while transferring to a new return filing system.

However, it shall be relevant to state that with the introduction of Form GSTR 2B and its connection with Form GSTR 3B, it will be interesting to notice whether the GST Council eventually decides to curb the ITC eligibility of businesses to tax invoices appearing in Form GSTR 2B.

Also, with the decision to specify HSN (Harmonized System Nomenclature) and SAC (Services Accounting Code) in the Tax Invoice, the businesses need to revisit their ERP (Enterprise Resource Planning) mechanism to make sure that their accounting and billing systems are fully equipped to disclose and record the HSN code of their Outward supplies at 8 digits level.

Also, Read: Key Highlights of 39th GST Council Meeting