Partnership Deed Format: A Guide to Draft Partnership Deed?

Shivani Jain | Updated: Jul 27, 2020 | Category: Business, Partnership Firm

A written agreement that forms the basis of a Partnership Firm and defines the roles and duties for every partner is known as a Partnership Deed. Out of all the Business Formats prevalent in India, Partnership Firm is the second most chosen form by embryonic entrepreneurs and business owners. In today’s blog, we will talk about the concept and contents of a Partnership Deed Format.

Table of Contents

Concept of Partnership Firm

A Partnership Firm registration means an association of two or more individuals who decide to work together on mutual terms and conditions and agree to share profits and losses equally.

Further, all the functions and workings of a Partnership Firm are governed and regulated by the provisions of the Indian Partnership Act 1932[1] . Moreover, the act does not provide an upper limit for the maximum number of members.

However, a Firm is a not Separate Legal Entity and suffers from Unlimited Liability. That means the partners of this business format need to indemnify the losses incurred by the firm beyond the amount invested by them.

Further, this business format lacks in continuity as well. That means in the event of death, bankruptcy, and insolvency, the firm will come to an end, and the partners need to draft a new partnership deed.

Moreover, only a natural person is eligible to become a partner in a partnership firm. There are two types of Partnership Firms, which are as follows:

- General Partnership;

- Partnership at Will.

Some of the renowned examples of a Partnership Firm are as follows:

- Red Bull and Go Pro;

- Uber and Spotify;

- Pinterest and Levi’s;

- Maruti Suzuki; and

- Hindustan Petroleum

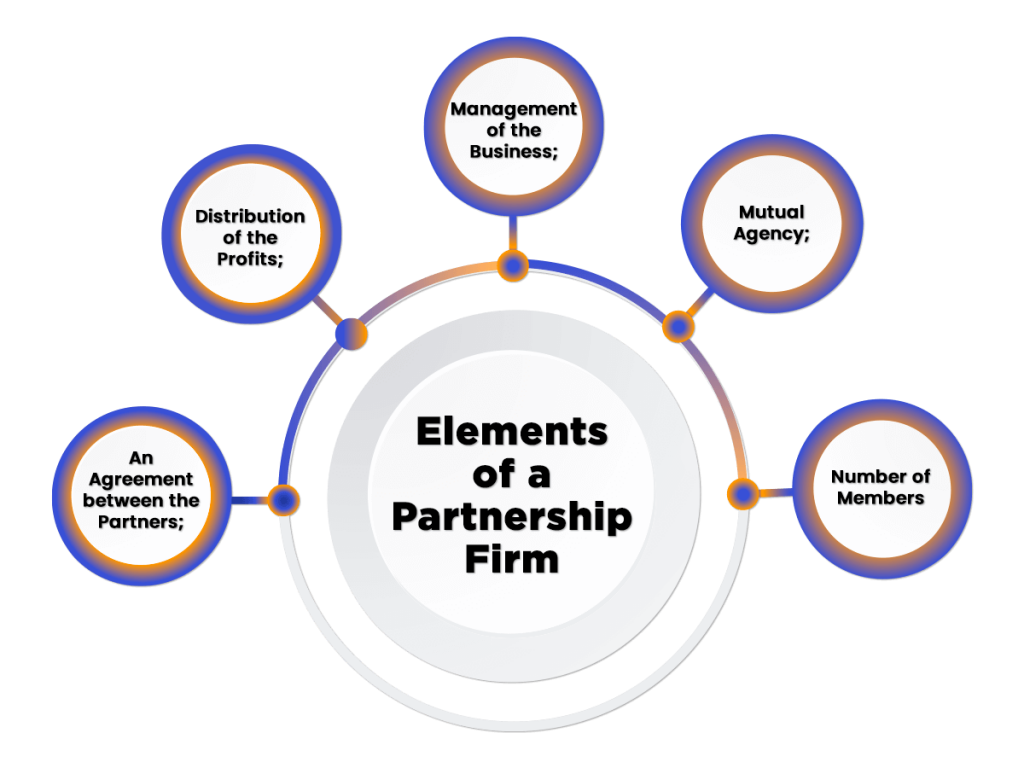

Elements of a Partnership Firm

The elements to constitute a partnership firm are as follows:

- An Agreement between the Partners;

- Distribution of the Profits;

- Management of the Business;

- Mutual Agency;

- Number of Members

Concept of Partnership Deed

A Partnership Deed means a record or document that outlines the function and role of each partner in detail. It acts as the governing force for all the partners working in the firm. It is also known as the Partnership Agreement.

Further, it is not compulsory to have a written Deed. That means this agreement can either be oral or written. However, a written partnership deed prevents future conflicts between the partners.

All the partners must get their partnership agreement stamped as per the provisions of the Indian Stamp Act[2] and registered with the Registrar of Firms.

Significance of the Partnership Agreement

The significance of a Partnership Agreement can be summarised as:

- Monitors and supervises the rights, duties, liabilities, and responsibilities of all the partners;

- Prevent dispute among the partners;

- Reduce the chances of Misunderstanding between the partners regarding the distribution of Profit and Loss;

- Clearly outlines the Responsibilities and duties of every partner;

- Defines the salary or remuneration offered to each partner;

- Provides details regarding the amount invested by each partner in the firm.

Factors to Consider in a Partnership Deed Format

The factors to consider while drafting a Partnership Deed Format are as follows:

- A Partnership Agreement establishes a legal relationship among all the partners;

- This deed acts as a mutual contract between the partners;

- A minimum of two partners a required to form a partnership in India;

- A partnership firm dealing in banking purposes cannot have more than 20 partners. In contrast, a firm dealing in non-banking business cannot have more than 10 partners;

- All the partners must have Mutual Understanding among them;

- The partners must decide their profit and loss sharing ratio in advance;

- There will be a Principal-Agent relationship between the partners. That means every partner will be liable and accountable for the actions of other partners.

Contents of a Partnership Deed Format

The components of a Partner Deed Format are as follows:

- Name of all the Partners;

- Address of all the Partners;

- Name of the Partnership Firm;

- Registered Address of the Partnership Firm;

- Date of Incorporation of Partnership Firm;

- Accounting Period for the Partnership Firm;

- Term and Duration of Partnership;

- Capital Contribution by each Partner;

- Guidelines regarding the Opening of Bank Accounts;

- Drawings allowed to each Partner;

- Profit and Loss Ratio for each Partner;

- Rate of Interest on Borrowed Loan and Capital;

- Remuneration to each Partner;

- Rights and Duties of each Partner;

- Specific Liabilities of each Partner;

- Mode of Auditor’s Appointment;

- Provisions for the Settlement of Disputes between Partners;

- Provisions regarding the Admission, Retirement, and Death of Partner;

- Method of calculating Goodwill;

- Non-Disclosure clause;

- Any other aspect concerning the Code of Conduct of Business.

Execution of a Partnership Deed in India

All the partners of a partnership firm need to print the agreement on a Non-Judicial Stamp Paper. The stamp paper must be of value Rs 100/- or more, depending on the properties and assets held in the Partnership Firm.

Further, the partnership deed format is signed by all the partners, and every partner needs to retain an original copy of the signed deed for his/her record. The signed deed held by each partner is either in duplicate or triplicate.

Documents Required for Registration of Partnership Agreement

The Documents required for the Registration of Partnership Deed Format are as follows:

- Identity Proof of all the Partners;

- Address Proof of all the Partners;

- Address Proof of the Registered Office;

- Non-Judicial Stamp Paper of the Prescribed Format;

- Registration Fee;

- Aadhar Card Number of all the Partners;

- PAN (Permanent Account Number) of all the Partners;

- Two-Passport Sized Photographs of each Business Partner.

Steps to Register a Partnership Deed in India

The steps involved in registering a Partnership Deed Format in India are as follows:

- Draft a Partnership Agreement: All the partners need to mutually draft a Partnership Agreement with all the pertinent details of the partners and firm.

- Print on the E-stamp Paper: Get the deed printed on the Non-Judicial Stamp Paper of value Rs 100/- or more.

- Sign the Partnership Deed: All the partners need to sign the mandatorily sign the deed. It will ensure that everyone accepts stipulations provided in the deed.

- Attestation or Registration of Deed: Lastly, the partners can either get the deed Attested by the Notary Officer or Registered by the Registrar of Firms (ROF).

Format of the Partnership Deed between Two Partners

Partnership-Deed-FormatConclusion

A Partnership Agreement is a written document that acts as the regulating force for all the partners working in the firm. The main reason behind drafting a Partnership Agreement is to minimize the chances of any future dispute between the partners. The partners can choose to either register the deed with the ROF (Registrar of Firms) or get it to attest by the Notary Officer.

Further, one can reach out to the official website of Swarit Advisors in case of any confusion. Our can experts can assist with both Partnership Firm Registration and Drafting of Partnership Deed.

Also, Read: Steps to Change of Name of the Company: A Complete Guide