Know Everything about Payment of Income Tax on Diwali Gifts

Sanchita Choudhary | Updated: Nov 10, 2020 | Category: Income Tax

Diwali the festival of lights, sweets and colourful decorations has finally on the corner, and thus is the time to exchange gifts with your friends, families, relatives or even employees. Although small gifts such as sweets or any other small item are considered to be immaterial for taxation purpose however there are certain tax implications for those gifts that cross a certain ceiling.

Traditionally, we Indians consider Diwali as the major occasion where gifts are given as well as received. There are different sorts of items given as gifts which may vary from boxes of dry fruits and sweets to valuables like gold and silver coins.

However, majority of the recipients are under the impression that such gifts have no implications related to income tax, which is not true. In this blog, we will understand and discuss about the implications of gifts received at the occasion of festivals.

Table of Contents

Meaning of Gifts as Per Income Tax Provision

The term “Gifts” has been defined under section 2(24) of the Income Tax Act. Generally, gifts received by any employee or relative or by anyone are not considered under Income chargeable to Tax.

However, by virtue of or as stated under section 2(24)(xiii) read with section 56(2)(v) explains that, any sum of money exceeding ₹ 50,000 received without consideration by an individual or a Hindu Undivided Family (HUF)[1] from any person is chargeable to tax as Income under the head “Other Sources”.

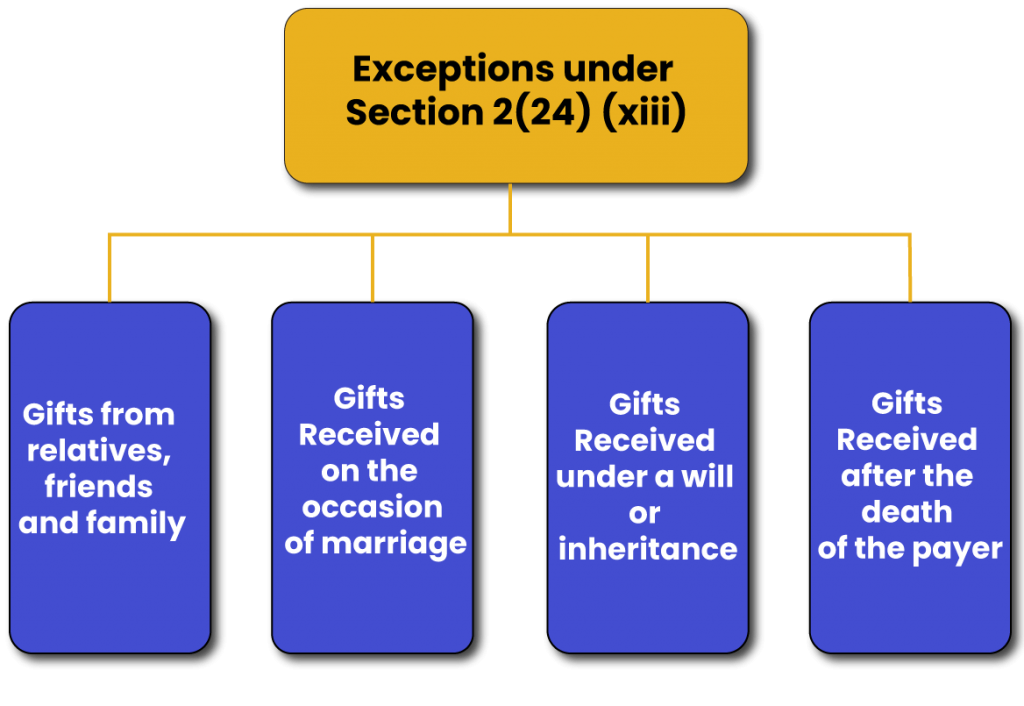

Exceptions under Section 2(24) (xiii)

Some of the exceptions mentioned under the definition of gifts are as follows:

- Gifts Received from certain relatives as mentioned in the section.

- Gifts Received on the occasion of the marriage of an individual.

- Gifts Received under a will or inheritance.

- Gifts Received after the death of the payer.

Ambit of Section 52 as Amended under Taxation Laws

There are various amendments done under different sections of the Income Tax Act. One such amendment done was Section 56(2) (v) by the Taxation Laws (Amendment) Act, 2006. This amendment was done in order to exempt the receipts from the following:

- Local Authority,

- Institutions as Exempted under section 10(23C) and

- Trusts or Institutions Registered under section 12AA.

Moreover, on October 1st, 2009 Section 56(2) was further amended. This amendment stated that, “the scope or the ambit of a gift is increased by adding immovable property or any property besides a sum of money excluding trade in stock, raw material, consumable stores or any other trading assets”.

List of Property to be treated as Gift

Following are the list of property which can be treated as Gifts:-

- Any immovable property such as land or building or even both,

- All kinds of Shares and Securities,

- Different kinds of Jewellery,

- Diverse Archaeological collections.

- Various drawings and paintings,

- Sculptures,

- Any work is related to art.

Income Tax on Immovable Property

Any such immovable property whose stamp duty value exceeds the consideration amount of Rs.50,000, then in such situation the stamp duty falls under the ambit of Income Tax Act.

Gifts Received by those Engaged in Business and Profession

Gifts received by those engaged in any business or profession of any value in the course of business or profession is termed under the heading of business income without any basic threshold limit. Diwali is such an occasion where it is a common practice to gift each other be it professionally or personally.

Gifts like Dry fruits as well as sweet boxes are required to be considered under income for tax as the purpose of such gifts are to represent perquisite received during the course of carrying out professionalism.

Also, Read: Valuation of GST on MRP products

Implication of Income Tax on Gifts Received by Salaried Person

There are various kinds of organisations in India. During the occasion of Diwali every organisation, whether it’s a small scale or a mid-level or large provides gifts to their employees. However, employees at the lower level of the organisation receive gifts which are of small values such as boxes of dry fruit and sweets.

But, there are people in an organisation that occupies seats of power in that organisation and works at the senior level of management receives costly gifts such as gold or silver coins or something valuable. Thus, it can be stated, for those who receive the small gifts of sweet and dry fruit box, there is no probability of the aggregate value of all such gifts exceeding the threshold limit of fifty thousand.

Moreover, for those who receive gifts of high value, the aggregate value may incidentally exceed the threshold limit of fifty thousand and thus bring all gifts under the Income Tax net. As mentioned in law, such gifts should be granted as income under the head “Income from other sources.”

When can Income Tax be deducted?

Further it has been stated as per law that, gifts received from any employer during the year is exempt up to Rs 5,000 in the hands of an employee beyond which it will become taxable and the employer is supposed to deduct income tax on such gifts.

Implication of Income Tax on Gifts Received from Relatives and Friends

During the occasion of festival of lights, not only for those who are engaged in business or in profession receive gifts but those who are not gainfully employed also receive gifts from their friends, family, relatives and elders. However, in case the elders are not covered within the ambit of definition of relatives, then such gifts become taxable in case the amount of such gifts during the year exceeds the threshold limit of fifty thousand.

For the purpose of income tax, below mentioned is the list of relationships that will be considered under the head relatives:-

- Husband and wife

- Brother and sister

- Brother or sister of each spouse

- Maternal brother or sister

- Both Son and Daughter

- Brother’s Spouse

- Sister’s Spouse

Illustration

This heading can be understood by the help of an illustration or an example. For instance, if any person receives a gift worth of Rs 1,00,000 from your parents during this Diwali, then such gifts received are not liable to pay any tax or does not fall under the tax slab. However, in case if any person receives any income from such gift either in the form of interest or profits from any particular investment, then in such cases you will have to report those income while filing the Income tax return filing under the head ‘Income from other sources’ and pay tax as stated in tax slab.

Conclusion

Diwali is not only called as festival of light but also a festival of gifts which is given either by the employer or by friends or relatives to each other. If any gift received by any person exceeds the threshold limit of 50,000 then such gifts are taxable as per the law mention in Income Tax Act and return has to be filled accordingly for the same. Thus, after reading the blog we will be able to understand about the deduction of Income tax made on gifts received by any person during this Diwali.

Also, Read: Will GST impact on Diwali Gifts 2020