Incorporation Of Limited Liability Partnership

Yashu Singhal | Updated: Apr 10, 2020 | Category: Business, Limited Liability Partnership

Limited Liability Partnership (LLP) is the combination of Partnership and Company. It contains the features of both. Nowadays, LLP has become the choice of businessmen due to its advantages over the registration of the private limited Company.

As per Section 1(n) of the LLP Act, 2008 Limited Liability Partnership means a partnership formed and registered under this act. The process of Incorporation of LLP has been revised after the enforcement of Limited Liability Partnership Amendment Rules, 2018.

Table of Contents

Process Of Registration Of LLP

Step 1. Name Application

File Form RUN-LLP for name application. One must check the availability of the proposed name through the Name Search Facility and Trademark facility of MCA. The name is reserved for sixty days from the date of the name approval.

Step 2. Apply for Digital Signature Certificate

The Applicant must apply for DSC as all filing is to be done electronically. DSC is the e-signature of the Applicant.

Step 3. Preparation of Documents for Incorporation of LLP

Once the name of LLP approved by CRC, prepare the following documents:-

- Proof of address of registered office of LLP along with utility bill not older than two months;

- Subscribers’ sheet including consent in Form INC-9;

- Details of LLP/ Companies in which designated partners are interested;

- KYC of Designated Partners (PAN card, Aadhaar card, Voter id card);

- NOC from the owner of the premise where the registered office of the LLP will be situated.

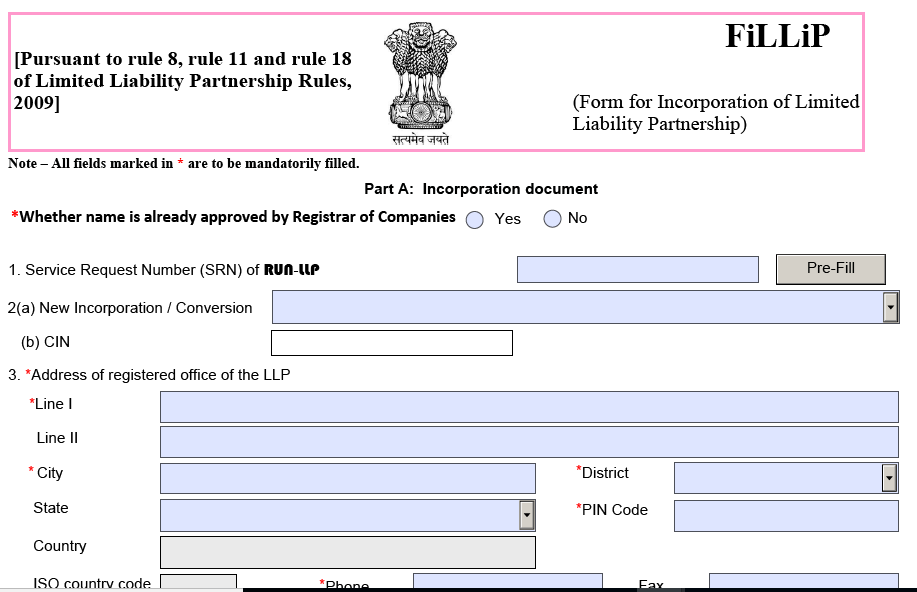

Step 4. File Form FiLLiP for Incorporation of LLP

After filling all information and attaching all the above documents, file Form FiLLiP for the Incorporation of LLP. It is a single-window form providing the services of name application, DIN application, providing the information of the registered office of the LLP, etc. One can apply the name of LLP in this form also. Designated Partners can apply for DIN in FiLLiP.

Step 5. Registrar of Companies will issue a Certificate of Incorporation with LLPIN.

Certificate-of-Incorporation-with-LLPINStep 6. Preparation of LLP Agreement

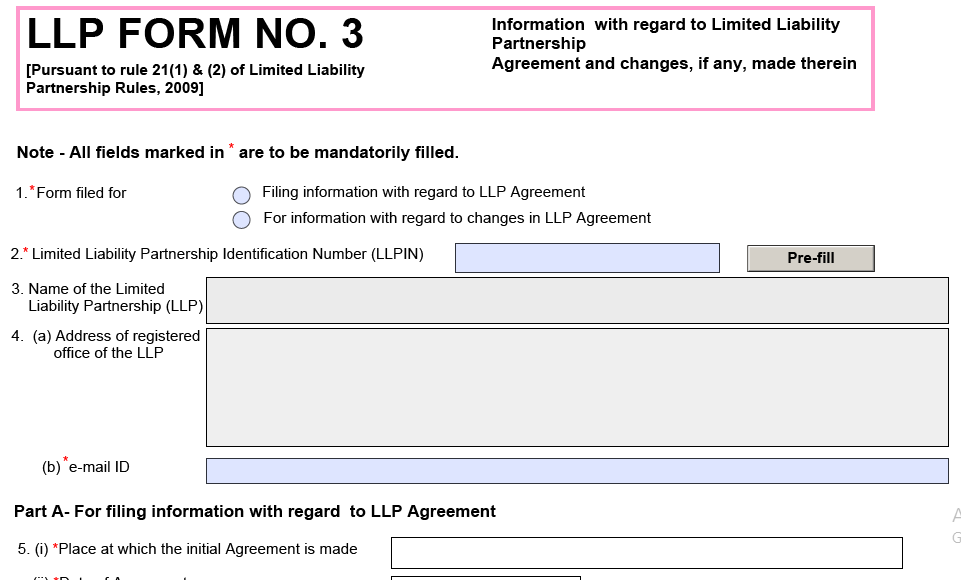

LLP Agreement consists of mutual rights and duties of partners of LLP. Basic Clause of LLP Agreement are:

- Name of LLP

- Name of Partners & Designated Partners

- Form of contribution

- Profit-Sharing ratio

- Proposed Business

- Rights & Duties of Partners

- Meetings

- Voting Rights

- Powers of partners and designated partners

- Obligations of partners and designated partners

- Liabilities of partners and designated partners

- Rules for governing an LLP

Step 7. File Form 3 attaching the LLP Agreement within thirty days from the date of Incorporation.

Difference Between Private Company and LLP

Entrepreneur, Businessman, Investors have many choices in selecting the type of business in which they want to invest their hard money, like Private Company, Public Company, LLP, Partnership, etc. If one has to make a choice between Private Company and LLP, they get confused, although there is a huge difference in both.

As per Section 2(68), Private Company means a company having a minimum paid-up share capital as may be prescribed, and which by its articles,—

(i) restricts the right to transfer its shares;

(ii) except in the case of One Person Company, limits the number of its members to two hundred.

Whereas, as per Section 1(n) of the LLP Act, 2008 Limited Liability Partnership means a partnership formed and registered under this act.

Basic Difference Between the Two is as Follows:-

| S. No. | Basis | Private Company | Limited Liability Partnership |

| 1. | Regulatory Authority | It is regulated under the Companies Act, 2013 | It is regulated under the Limited Liability Partnership Act, 2008 |

| 2. | Incorporation process | Form SPICe + Part A and B, Form SPICe + MOA, Form SPICe + AOA, AGILE Pro, Form INC-9 are required to be filed for Incorporation of Private Comp[any | Whereas, Form RUN-LLP, Form FiLLiP, Form 3 are required to incorporate LLP. |

| 3. | End Name | Private Companies end their name with “Private Limited.” | LLP’s end their names with “LLP.” |

| 4. | Number of Member | Maximum 200 members can be there in a Private company | There is no limit on a number of members. |

| 5. | Meetings | They need to hold and conduct proper Board Meetings and General meetings | There is no such requirement to hold a minimum number of meetings. |

| 6. | Audit | It is mandatory for private companies. | The audit is mandatory if the contribution is more than 25 Lakhs or turnover is more than Rs. 40 Lakhs |

| 7. | Conversion | A Private Company can be converted into LLP | But LLP can not be converted into Company |

| 8. | Ownership | Although, members are the owner of Company directors hold the position of manager for day to day working. | There is no such confusion between management and ownership. As Designated partners are the owner as well as managers of the LLP |

| 9. | Tax | The company is required to pay Dividend Distribution Tax when it declares its dividend. | ITR filing is required to be paid by LLP. There is no requirement to pay Dividend Distribution Tax. |

Conclusion

So while concluding, we can say that LLP is more beneficial to entrepreneurs than company incorporation. Although LLP and Private Company appear to be the same, there are some differences that make LLP a better choice.

Swarit Advisors provides its services to incorporate LLP as well as private Company and their compliances too. There are highly qualified professionals, experts in the field of Law, Auditing, Accounting, Taxation, etc.

Also, Read: Procedure and Requirements relating to LLP Registered Office change