Know About GST Registration process step by step

Khushboo Priya | Updated: Mar 04, 2019 | Category: GST

In order to gather knowledge on GST registration process step by step, we suggest you to read the entire article thoroughly so that you don’t miss any vital part essential for the process.

On 1st July 2017, India got a historic reform in the tax system with the introduction of GST. The law came into existence with the motive to revamp the tax structure of India. GST stands for Goods and Services Tax and is an indirect tax which has replaced all the other indirect taxes imposed earlier on the supply of goods and services.

Based on the reports, we can say that GST has experienced both success and failure. Unlike other countries, India didn’t experience any inflation which is indeed a good sign. Furthermore, the council is looking forward to improving the structure through modification in the GST tax slab rates. Let’s find out the necessary info regarding the GST registration and then we will move on to GST registration process step by step.

Table of Contents

GST registration in India

In India, GST registration is a mandatory permit for all the suppliers of goods and services whose business turnover exceeds a certain threshold limit. Every taxpayer whose aggregate turnover surpasses Rs. 40 lakhs should obtain the GST registration mandatorily under the GST Act. However, the threshold changes to Rs 20 lakhs for North-Eastern states (Sikkim, Himachal Pradesh, Assam, Meghalaya, and Arunachal Pradesh).

The said threshold limit will be effective from 1st April 2019. Earlier the threshold limit for GST registration was Rs. 10 lakhs for businesses in the North-Eastern States and Rs. 20 lakhs for all other states.

Mandatory conditions for GST registration in India

If you fall under any of the criteria described below, then you should get the GST registration for sure.

- If the aggregate turnover of the taxpayer exceeds Rs. 40 lakhs, then GST registration is obligatory. However, in some instances (North-Eastern states), the limit of aggregate turnover is Rs. 20 lakhs. Entities under these threshold limits are exempted from paying taxes.

- If you are running an e-commerce business, then also GST registration is mandatory. Please note that there’s no threshold limit for e-commerce service providers.

- Every individual or business registered under the Pre-GST law such as VAT, Service Tax, Excise, etc. are also eligible for GST registration.

- Every Casual taxable person or non-resident taxable person.

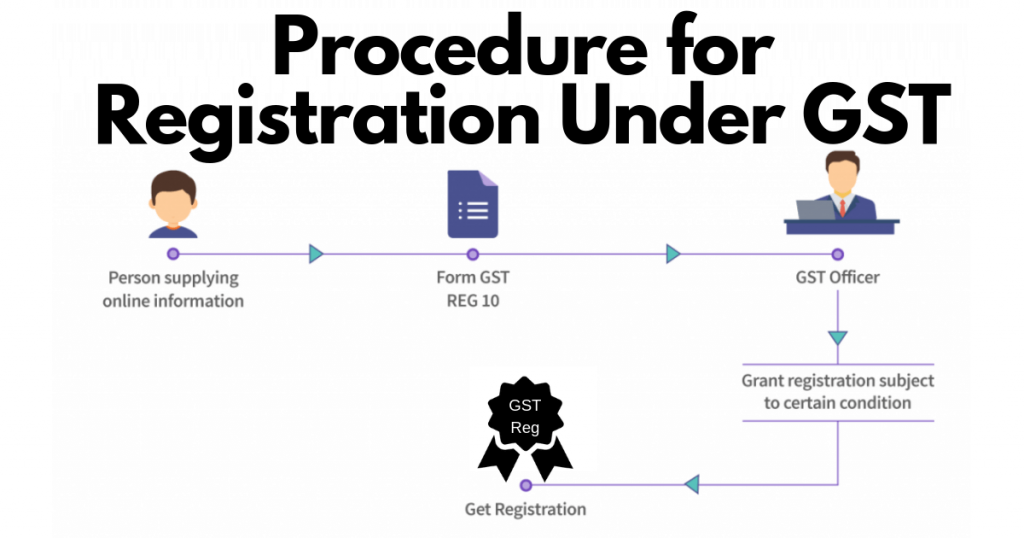

- A person who supplies online information and retrieval services or database access from a foreign country to a person in India, unless the person is a registered taxable person.

- In case, you are an Input service distributor and agent of a supplier.

Documents required for GST registration

Documents are one of the essential prerequisites for every legal permits and license. Therefore, you must know what documents you will require while applying for GST registration. Documents needed for GST registration procedure are as follows:

- PAN of the applicant or taxpayer;

- Photographs of all the directors, partners, and owners;

- Proof of registration of business such as Certificate of Incorporation;

- Partnership deed, in case the company is LLP or partnership firm;

- Identity proof of all the promoters of the business;

- Identity proof of all the directors, promoters, and shareholder;

- Address proof of the registered business location;

- Details of the bank accounts of the business;

- Letter of Authorization from the Board of Directors or Partners.

GST registration process step by step

We have brought a helpful guide for you on GST registration process step by step. We ensure that at the end of this article, you will overcome all your doubts on the registration process. Hence, let’s get started with the steps-

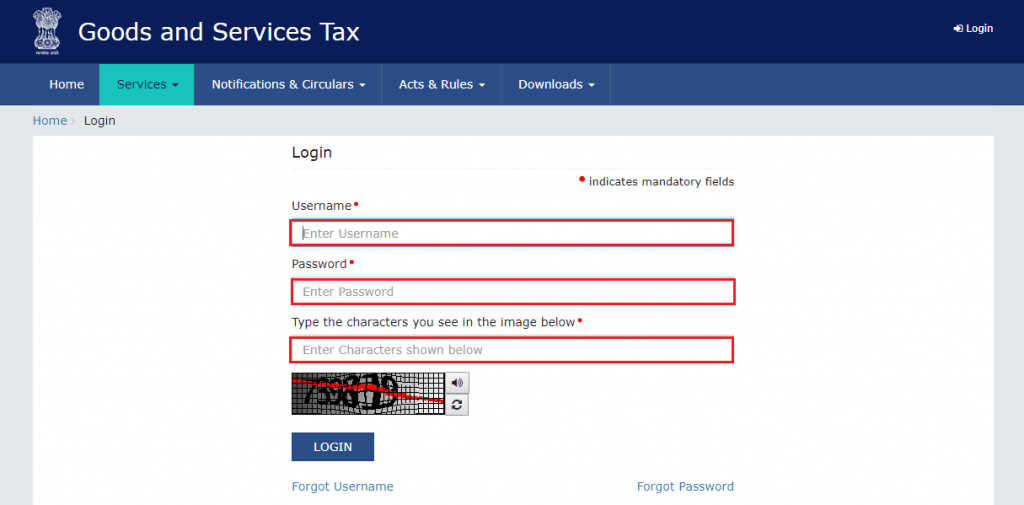

Step1: Login to GST portal

The first step to GST registration is to log in to the GST portal[1]. Since you’re a taxpayer, click on ‘Register Now’ under Taxpayers (normal) as shown below:

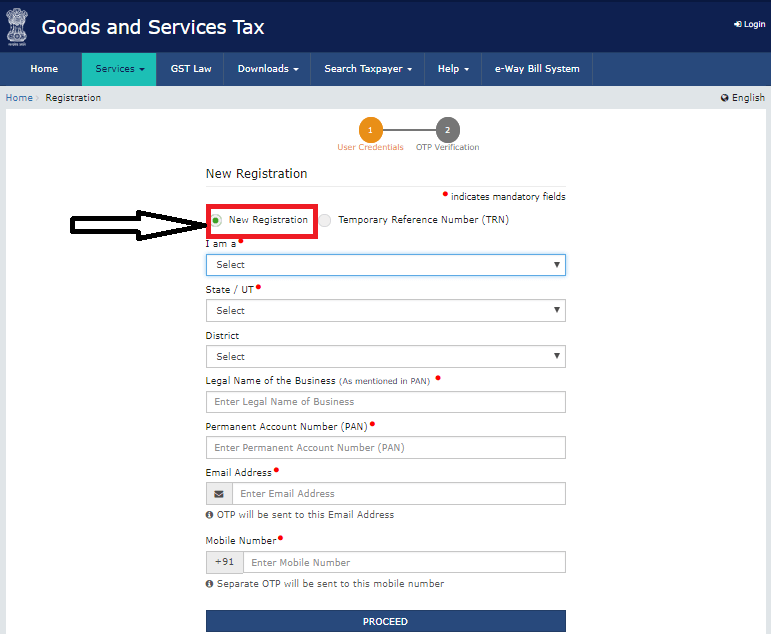

Step2: Select New registration and fill the required details on the page

Once you have clicked on Register now, you will be directed to a page where you will need to choose either of the options- New registration or Temporary Reference Number (TRN). Because you’re a new user, you will opt for New Registration.

Then, you are required to fill up the following details as follows:

- I am a- you have to select Taxpayer;

- State or Union Territory for which you need GST registration;

- Choose the district;

- Enter the legal name of your business as mentioned in the PAN;

- Provide the PAN number;

- Enter your email address. Soon you will receive an OTP on your email id for verification;

- Then, enter your registered mobile number. Again you will receive an OTP on the same;

- Finally, click on proceed.

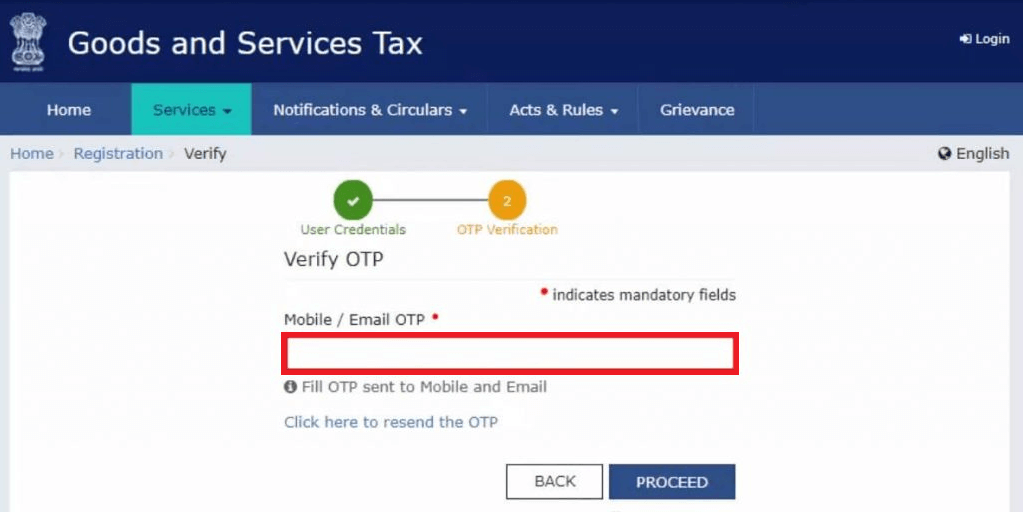

Step3: Enter the OTPs received

Once you have clicked on Proceed, you will be asked to enter the OTPs received on the email and mobile separately. Enter the OTPs and click on continue. However, in case, you have not received any OTP, click on resend OTP.

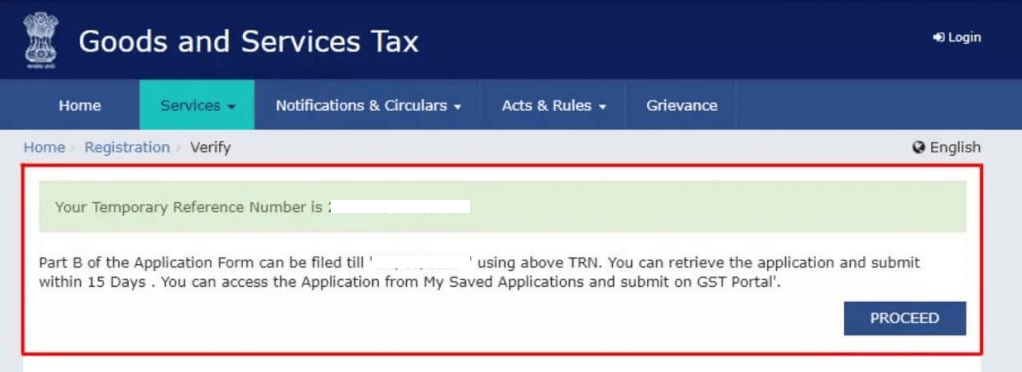

Step4: Temporary Reference Number (TRN) generation

After the successful verification of OTPs, you will receive a TRN on your email as well as mobile. Jot it down.

Step5: Restart the process from logging on to GST portal

Since you have now received your TRN (Temporary Reference Number), you can go back to GST portal and again click on Register Now.

Step6: Start the process by choosing the Temporary Reference Number (TRN)

Unlike before, you have to now select and click on Temporary Reference Number. Then, enter the received TRN, type the captcha code as shown in the image and click on Proceed.

Step7: Enter the OTP and proceed

You will again receive OTPs on both the email and mobile. Enter the correct OTP as required in both the sections and click on Proceed.

Step8: Status of the application

You will finally be able to track the status of the application as drafts. Now, you need to click on the edit icon.

Step9: Fill in the second part of the form

The part B of the application has ten sections. You need to fill in the details and submit all the required documents. You are required to keep the following details at hands while applying for GST registration-

- Photographs;

- Details of bank accounts;

- Proof of the registered office;

- Authorization form;

- Constitution of the taxpayer.

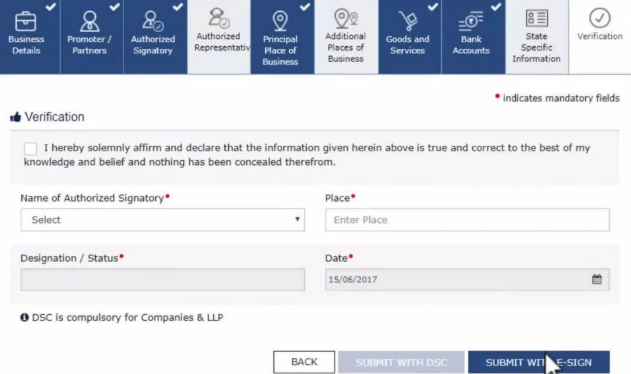

Step10: Go to the Verification page and choose to submit the application from either option available on the page

Once if you have provided every essential detail, you need to verify it on Verification page. Select the declaration and submit the GST registration application choosing any of the following options:

- Submit with DSC (Digital Signature Certificate[1]).

- Submit with E-Sign. You will receive an OTP on the Aadhaar linked registered number.

- Or you can submit the form using EVC. Again, you will receive an OTP on your registered number.

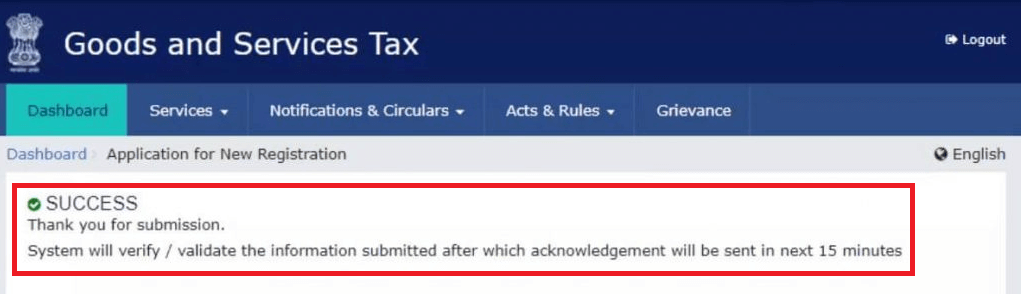

Step11: Success message and ARN generation

Eventually, you will see a success message displayed on the screen. Furthermore, Application Reference Number will be generated and will be sent to your mobile as well as email id.

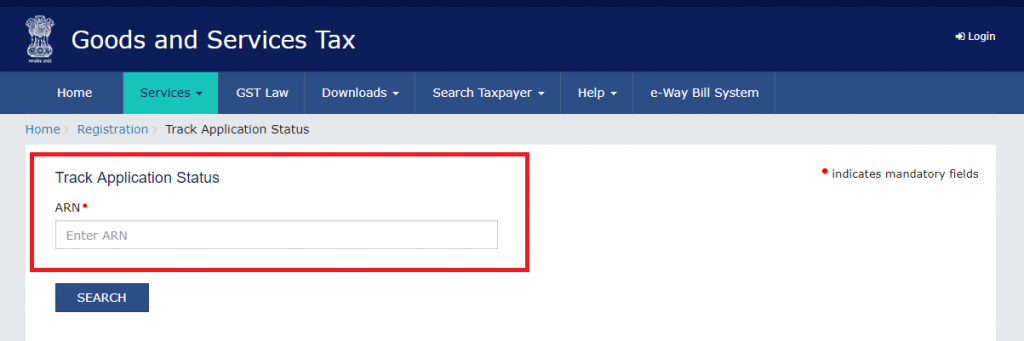

Step12: Track the ARN status

Once you are done with all the above steps, you can now monitor the ARN status for your GST registration by entering the ARN in the required section of the GST portal.

Penalty for ignorance

If you fall under the above-described category and haven’t registered your business under GST law, then you will have to face a heavy penalty. The offender will be subject to the following fine-

- A fine of 10% of the tax amount in case of a minimum due amount of Rs. 10,000.

- 100% of the tax amount due in case the taxpayer has purposefully eluded paying taxes.

Winding up

Moreover, we assume that you have understood the process quite well. We have presented the GST registration process step by step, and hence, we expect that you don’t have any query regarding the same.

In case you have any further query or finding it difficult to register, then contact Swarit Advisors. We will make sure that your questions are answered well and that your business has been registered successfully under the GST.

Read, Also: Invoicing for GST in India.