Meaning and Process of Online Payment Gateway in India 2020

Sanchita Choudhary | Updated: Oct 27, 2020 | Category: Payment Gateway System

Online payment has become an integral part of our life in no time. Today when everything is just a click away from the consumers, every online business platform provides the service of an online payment gateway. This is not only considered to be a simple way for the payment to be made but also a swift and hassle-free method.

Table of Contents

Meaning of Online Payment Gateway

Online Payment Gateway, if defined in simple words, is a means to make and receive any payment made. An online payment gateway is a business or a merchant service that is rendered through an e-commerce platform. The online payment gateway acts as a link between the banks as well as the websites which facilitate such service.

A payment gateway thus is the simplest and the hassle-free method for a business to collect any digital or online payments from the website or an application.

Need for Payment Gateway

To keep a check on frauds

An payment gateway license helps to keep a check on the fraud which may happen during the process of the card transaction. This helps the customer to keep an eye on the payment made by them.

Acts as a gatekeeper

Online payment gateway helps to protect the merchants or business from expired cards, or from insufficient funds, closed accounts and also from the exceeding credit card limit of a buyer.

Role of Online Payment Gateway

- Payment gateway services are such services which are required for any transaction to be made online by the consumer or by any customer.

- These online payment gateways play a vital role during the authorization of any transaction to be made online between the bank and the customer.

- Without approval from the bank, no transaction can be made or done by any such online payment gateway.

- Thus, in order to avoid this failure of transactions payment gateways are considered useful.

Are Payment Gateways Secured Enough?

An online payment gateway service company goes through an exhausting and lengthy process in order to approve the communication with the payment processors. Further, this reduces the liability of the business and helps in ensuring that the payment made through these gateways are completely safe and secured.

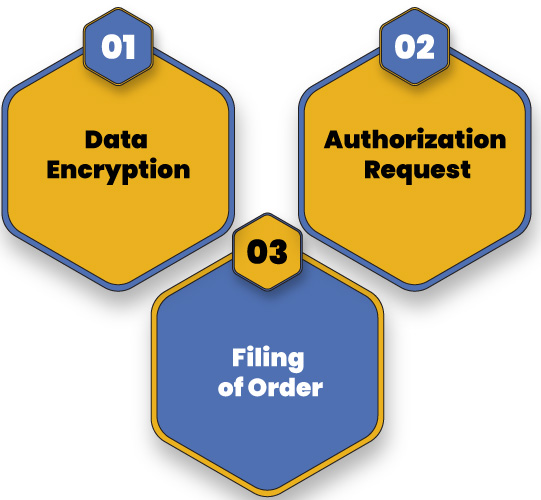

How Does It work?

Once an order has been placed by the customer from any online portal or website, there are numerous tasks that are to be conducted by the Payment Gateway. Some of these tasks are mentioned below:

Encryption of Data:

The web page used by the customer encrypts the data must be sent to vendor’s server. Further, the payment gateway sends the transaction data for the process of payment.

Request for Authorization

After receiving the transactional data from the payment processor, the same transmits the data to the card association. The Bank which has issued the card will further check for the transaction and will accordingly move forward.

Filling of the Order

Once the Bank agrees for the transaction, the authorization in relation to the consumer and the merchant is further forwarded to the processor of these payment gateways. Moreover, after receiving the response from the processor, the same is transmitted to the website for processing of the payment. It may only take few seconds for the completion of this method.

Also, Read: Top 5 Best Payment Gateway Systems in India

Components of Payment Gateway

The vital components of any online payment gateway are mentioned below:

- Merchant Agreement

- Secure Electronic Transaction(SET)

License for Online Payment Gateway in India

As mentioned in Section 4 of the PSS Act, no other person except the RBI can either operate or commence a payment system until it has been authorized from the RBI. Further, it is stated that such application for authorization to the RBI is to be made under Section 5 of the PSS Act.

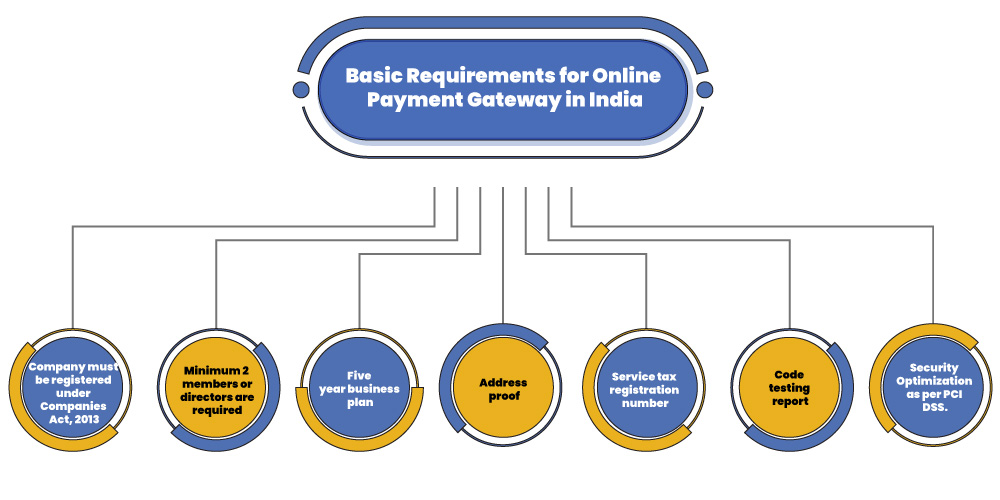

Basic Requirements for Online Payment Gateway in India

In order to obtain an online payment gateway license in India there are some of requirements which must be fulfilled. These are mentioned as:

- Any company applying for online payment gateway license must be registered under the Companies Act, 2013.

- There should be at least two member or directors in the company.

- A complete business plan for five years is required for a company to have in order to apply for the online payment gateway license.

- Address proof of the business to be conducted.

- A company must have a registered service tax registration number.

- Code testing report must be submitted from the Software Certifying Agency in order to apply for the online payment gateway license.

- Optimization of the security must be done for the online payment gateway under the rules laid down in Payment Card Industry Data Security Standard (PCI DSS).

Documents Required to Grant Payment Gateway Licence

Following are the set of documents required to obtain an online payment gateway licence:

- Copy of Certificate of Incorporation of company received from the Registrar of the company.

- Copy of PAN Card details.

- Address proof of the Directors of the company.

- Digital Signature Certificate (DSC) along with the Director’s Identification Number (DIN) of the Directors must be provided.

- Bank Account details of the company.

- Five year business plan of the company.

- Code testing report to be submitted by the Software Agency.

Methods for Obtaining Licence for Online Payment Gateway

As explained in PSS Act, any willing company or an entity should apply or file for an application to the Reserve Bank of India (RBI)[1] for obtaining the license. Some of the steps involved in the process of obtaining licence for payment gateway are as follows:

Step 1: Filing of Application

As mentioned under Section 5 (1) of the PSS Act, the entity or a company must file an application to the Chief General Manager of the Department of PSS or to any such other offices of RBI as authorised by Reserve Bank of India on a timely basis.

Step 2: Credentials to be checked

As mentioned under section 6 of the PSS Act, RBI has the power to hold inquires regarding the credibility of the details submitted by the applicant entity. This is done in order to be confirm and sure for the involved entities.

Step 3: Verification of other details by RBI

Before granting of license, the RBI shall take into account following conditions:

- Need for such online payment gateway system.

- Medium through which the transfer of such payments will take place.

- Terms and conditions required for such online payment gateway system.

- Financial status of the company must be checked before the license to be granted.

- Integrity of the company or an entity must be checked before granting of licence.

- Methods of payment instructions.

- Time period for any such authorization.

- Credit as well as monetary policies of the entity.

Conclusion

The payment gateway system or outlook is changing rapidly in India. Apart from the authentic traditional payment methods, the customers now can accept money from various online wallets also. These online payment gateways play a vital role during the authorization of any transaction to be made online. Thus, there are multiple parties involved in the payment gateway, keeping these methods to be hassle free in nature.

Also, Read our Article: RBI new guidelines for Payment Aggregators