NBFC Business Loans: Reasons to Choose Them Over Bank Loans

Shivani Jain | Updated: Aug 07, 2020 | Category: NBFC, RBI Advisory

The term “NBFC Business Loans” denotes financial support given by the NBFCs to Business Ventures, whether operating at a large scale or as MSME in India. Earlier, the traditional banks and other informal lending sources have been the most chosen way-outs, when it comes to personal or small business loans.

However, over the years, there has been a considerable shift in the choice, especially in the case of MSMEs. The reasons for this shift are as follows:

- Banks follow Stringent and Intricate Eligibility Criteria;

- Documents required by Banks are coupled with the demand for Collateral Security;

This Blog will discuss the topic NBFC Business Loans and why MSMEs choose them over Bank Loans.

Table of Contents

Concept of NBFC Business Loans

Taking a business loan is the most suitable option for meeting business goals and objectives. However, more than half of the population faces a dilemma between NBFC Business Loans and Banks Business Loans.

Before starting the reasons to choose NBFC Business Loans, it is significant to have basic clarity regarding both the financial intermediaries.

Non Banking Financial Company or NBFC is an organisation that offers banking services up to an extent without obtaining a banking license or agreement. In India, an NBFC is registered under the provisions of Companies Act 2013 but is a private institution regulated and administered by the Apex Bank.

In contrast, banks are those financial institutions that provide credit and accept deposits from the general public.

Further, in between the two, the loan given by an NBFC is readily available to people, as it not only involves less documentation but is less intricate as well.

Moreover, in the year 2017, the Apex Bank in its Financial Stability Report (FSR) declared that nowadays, NBFCs are more successful than traditional banks in offering loans, and their balance sheet had shown a growth of 15%.

Concept of Investment Credit Company

NBFC-ICC is a harmonization of three NBFCs that are Asset Finance Company, Loan Company, and Investment Company. The main objective of this NBFC is to provide financial support in the form of loans and advances. It offers support for every activity other than the acquisition of securities.

The Reserve Bank of India[1] has the power to regulate and control the Investment Credit Company in India. Further, the objective of this business format is to ease the operational flexibility of the NBFC Sector.

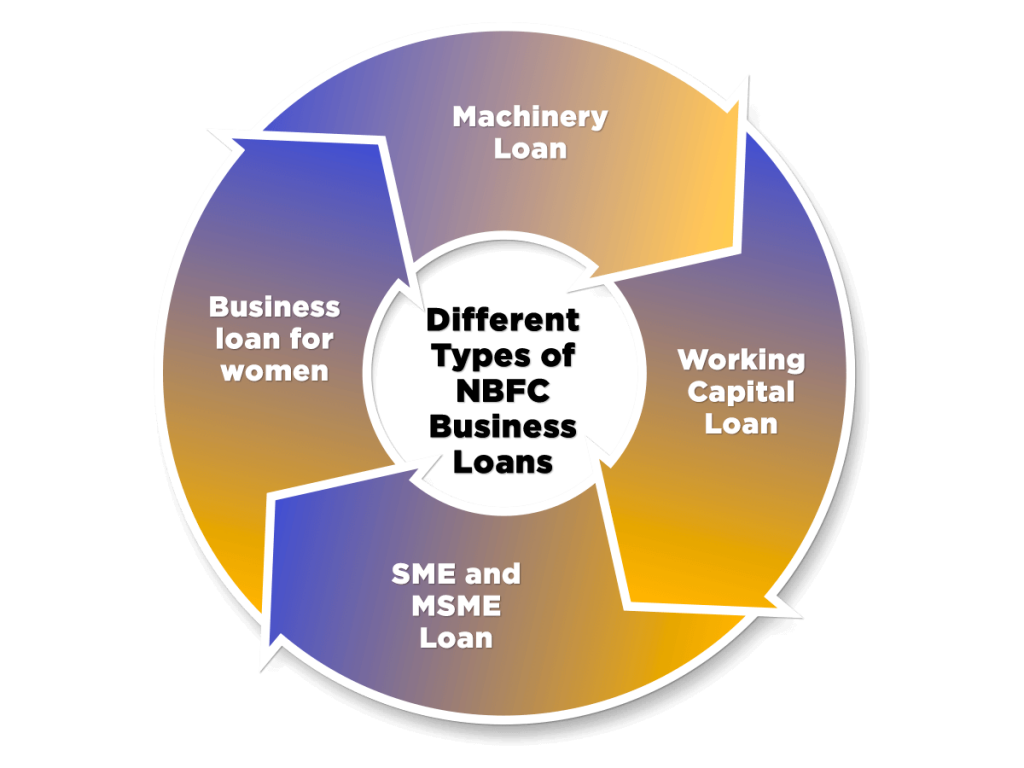

Types of Business Loans in India

The different types of Business Loans available in India are as follows:

- Machinery Loan;

- Working Capital Loan;

- MSME and SME Loan;

- Business Loan for Women;

Read, Also:Importance of NBFC

Why MSMEs Choose NBFC Business Loans over Bank Business Loans?

Earlier, the banks had a speciality in lending credit to the MSME sector. However, over a period of time, NBFCs have made their presence in the credit lending sector.

As we know, MSMEs are known as the Growth Engines and contribute almost 1/3rd in the country’s GDP, and the main reason for their shift was the lending process of banks.

The lending process involves intricate regulatory norms, humongous paperwork, and the requirement to provide collateral security. In contrast, NBFCs follow a relaxed and straightforward for granting business loans. That means there is no need to pledge any collateral security and engage in voluminous documentation to acquire loans. Moreover, an applicant just needs to have a loan application form along with a good credit score to obtain NBFC Business Loans.

As a result, the NBFC Business Loans become the go-getters for MSMEs. Moreover, an NBFC can provide loans as high as Rs 30 lakhs.

Features of Business Loans Offered by NBFC

The features of NBFC Business Loans are as follows:

- Avail Stress-free Unsecured Business Loans;

- Offers Flexible Re-payment Option;

- No need to pay any Collateral Security;

- One can easily access his/her Loan Account from anywhere at any time;

- Loan Process does not involve any Hidden Charges;

- An Applicant can apply for Business Loan on the Official NBFC Portal;

- Offers attractive Interest Rates for Loan;

- Provides Door-to-Door services;

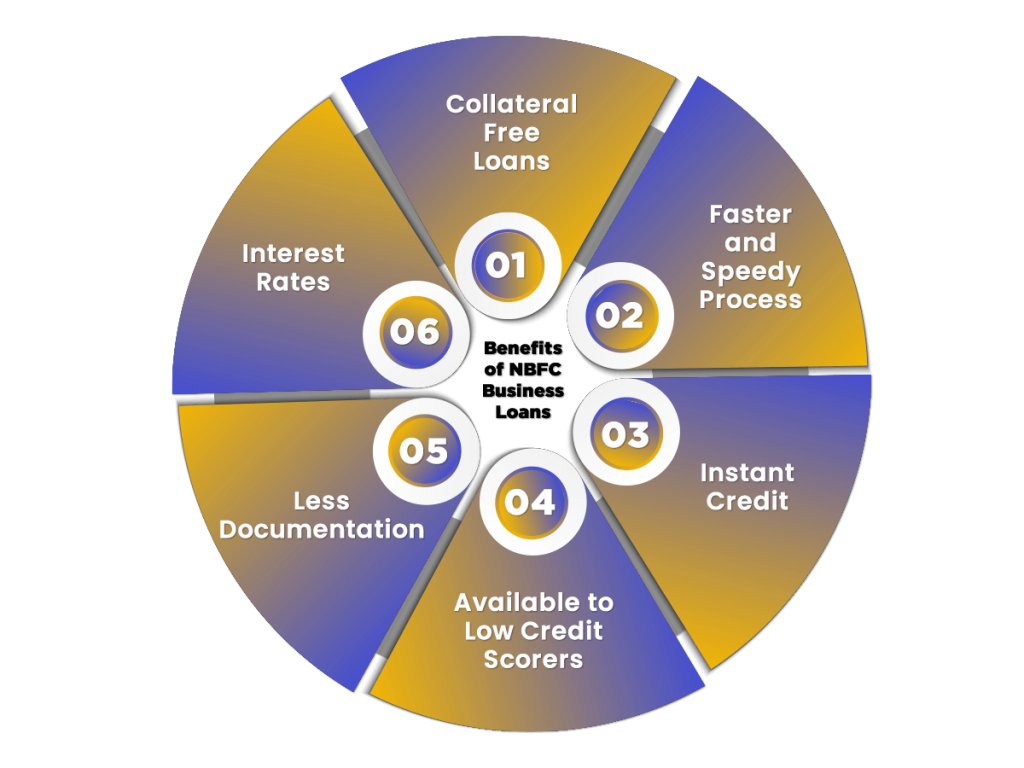

Benefits of NBFC Business Loans

The benefits of NBFC Business Loans are as follows:

Collateral Free Loans

One of the main benefits of taking Business Loans from NBFC is collateral free loans. That means there is no need for an applicant to put collateral security to get his/her loan request approved. However, banks do not approve a loan request without an adequate amount of collateral security.

Faster and Speedy Process

For obtaining Business Loans from NBFC, there is no need for the applicant to meet the lender personally, as NBFCs follow the online lending process. That means from application to verification of documents, everything is done online.

Instant Credit

As soon as the loan request gets approved, every NBFC makes sure that the amount of loans gets credit in the borrower’s account with few business working days.

Available to Low Credit Scorers

Traditional Banks follow a strict procedure and approve loan requests of only those who have a good credit score. However, an NBFC aims to provide easy finance to the deprived section and MSME sector in India. Therefore, it offers business loans to low credit scorers as well. However, it shall be relevant to note that there are chances that a low credit scorer may pay high interest rate in comparison to the good credit scorers.

Less Documentation

One of the most significant features of an NBFC is that it provides loans and credit with no collateral and less paperwork and documentation. In contrast, conventional banks follow strict regulations with voluminous documentation and paperwork. That means if an applicant fails to provide necessary documents together with collateral security and good credit score, then there are chances that the bank might reject his/her loan request application.

Interest Rates

In India, bank loans are linked to the Marginal Cost of Fund Based Lending Rates (MCLR) and various Macro-Economic factors, such as International Market Rates, RBI Lending Rates, etc. It means that a bank cannot lend funds below the prescribed minimum interest rate. In contrast, NBFC offers business loans on Prime Lending Rate (PLR), which are not administered by the Apex Bank. Therefore, an NBFC enjoys freedom in deciding the interest rates before granting loans.

Eligibility Criteria for NBFC Business Loans

The eligibility criteria for obtaining Business Loans are as follows:

- A Minimum Turnover of Rs 10 lakhs for the last 12 months;

- ITR (Income Tax Return) of at least Rs 1.5 lakhs or more for the previous financial year;

- Residence of the Owner shall not be the Registered Office;

- Business is in continuation for the last two financial years.

Basic Documents for Obtaining Business Loans

The primary documents needed to obtain a Business Loan in India are as follows:

- Updated Passbook for the last 9 months;

- ITR (Income Tax Return) for the previous financial year;

- PAN Card of the Applicant;

- Address Proof of the Registered Office;

- Proof of Business Registration;

NBFCs that Provide Business Loans

The NBFCs that provide Business Loans in India are as follows:

- Bajaj Finserve;

- Tata Capital;

- Lending Kart;

- Zip Loan;

- Fullerton India;

- India Bulls with Dhani Biz;

- Indifi;

- Capital Float;

- Magma Fincorp;

- Hero Fincorp;

Conclusion

Lastly, the benefits and the ease in obtaining loans are the main reasons why nowadays, NBFCs are becoming the first choice amongst the MSMEs (Micro, Small and Medium Enterprises) and weaker section of the society.

Further, if you have any other doubts regarding the NBFC Business Loans, then reach out to Swarit Advisors, our experts will provide you a lucid understanding of this concept. As our professionals rank high in NBFC Registration and Advisory Services.

More on NBFCs:NBFC Home Loans: How It Is Better Than Bank Home Loans?