Everything you need to know about Currency Exchange Business Model

Dashmeet Kaur | Updated: Apr 11, 2020 | Category: FFMC, RBI Advisory

In recent times, the Forex industry has flourished at a rapid pace in India. The currency exchange business model is a gateway to profit-making opportunities for budding entrepreneurs. Since the money changers play a vital role to thrive in the Indian economy, RBI has laid some stringent guidelines to monitor their functions. Further, the Reserve Bank of India authorizes a currency exchange business with FFMC License. Section 10 of the Foreign Exchange Management Act, 1999, mandates the FFMC License for any entity that wants to pursue money exchanging activities.

If you also strive to start a currency exchange business, then this write-up will act as a complete guide for you.

Table of Contents

An overview of Full Fledged Money Changer- FFMC

A Full Fledged Money Changer abbreviated as FFMC is an RBI approved entity. Such business entities hold power to purchase foreign currency from the residents as well as non-residents of India, thereby sell it to those people who intend to visit abroad for private and business travel.

All aspirants of currency exchange business model need to keep these specifications in mind prescribed under the Foreign Exchange Market Act, 1999:

- Only FFMC registered or authorized money changers can run the activities of currency exchange.

- Unauthorized currency exchange businesses cannot advertise their money-changing operations until they procure a valid FFMC license.

- If an individual is found guilty of undertaking a money exchange business without a valid license, then he/she shall be penalized under the Act.

- RBI has issued some guidelines to deal with foreign notes, coins, and cheques for safeguarding the interest of foreign tourists

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your NBFC registration or NBFC for Sale or RBI Advisory Services.

Functions of Authorized Money Changer

Following are the activities undertaken by the registered AMCs:

- An Authorized Money Changer can enter into a franchise agreement to carry the Restricted Money Changing business that includes the conversion of foreign currency coins, notes & travellers’ cheques into Indian currency (INR).

- A registered currency exchange business model and its franchises can purchase any foreign currency from the non-residents and residents of India.

- RBI facilitates FFMCs to sell Indian Currency (INR) to foreign tourists or visitors against International Debit Cards or International Credit Cards.

- Full Fledged Money Changers can commence in foreign exchange dealings for the purpose of Forex prepaid cards, private visits and business visits.

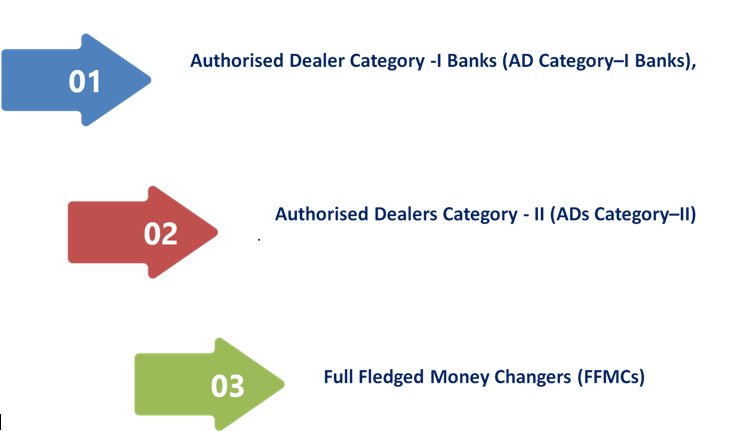

Types of FFMC License

Eligibility Criteria to acquire FFMC License

You are eligible for FFMC license if you have the following characteristics:

- Only a registered entity under Companies Act 2013, can apply for an (FFMC) Full Fledged Money Changer License.

- Your entity must have a minimum Net Owned Funds (NOF) of INR 25 Lakhs to apply for a single-branch license while it increases to INR 50 Lakhs for the multiple-branch license.

- There should not be any pending criminal or civil cases against your entity with the enforcement of DRI (Directorate of Revenue Intelligence).

- The object clause of the Memorandum of Association (MOA) must reflect the money changing activities that were previously undertaken by your entity.

- After obtaining the FFMC license, your entity must execute its currency exchange business activities within 6 months from the issuance date of the Forex License.