CGST, SGST, and IGST: Understanding the difference

Khushboo Priya | Updated: Apr 06, 2019 | Category: GST

Goods and Services Tax, is one of the most reforming tax schemes ever introduced in the Indian economy and constitution. The reason why GST is the most-talked taxes is that it has replaced all the indirect taxes levied on the supply of goods and services.

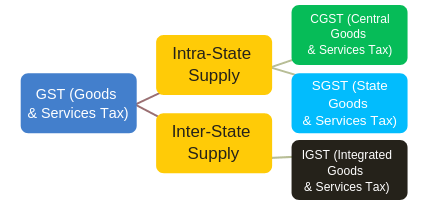

With the introduction of GST, there have been many changes which had both good and adverse impacts on the business industry. However, GST has more success stories than failure. Basically, there are three main categories of GST under which every business is placed: CGST, SGST, and IGST.

A specific GST structure applies to every business depending on their nature of work and operating region. Therefore, in this blog, we have aimed at extending your knowledge on three different GST structures .i.e., CGST, SGST, and IGST. One of the greatest advantages of GST is that it has eradicated the addition of a tax on tax, unlike earlier. Therefore, let us first understand what taxes are there that GST has replaced.

Table of Contents

Taxes replaced by GST

If you remember, consumers and suppliers had to pay several taxes such as Service Tax, Central Excise, and State VAT, etc., until GST came into existence. However, now, there are no such taxes. All the aforesaid taxes have been dissolved into one which is Goods and Services Tax.

Replaced State Taxes

Goods and Services Tax has replaced the following States Taxes:

- VAT (Value-Added Tax) or Sales Tax;

- Luxury Tax;

- Octroi;

- Entertainment Tax;

- Purchase tax; and

- Tax on Betting or Gambling or Lottery.

Replaced Central Taxes

Central taxes replaced by the GST are as follows:

- Central Excise Duty;

- Service Tax;

- Additional Customs duty;

- Additional Excise duty;

- Excise duty imposes under Medicinal and Toiletries preparations;

- Special Additional duty of Customs.

CGST, SGST, and IGST have now replaced all the taxes mentioned above. But to understand the difference between these three different categories of GST, firstly, it’s important to understand the distinction between an inter-state and intra-state supply of goods and services.

The Concept of Intra-State and Inter-State Supply of Goods & Services

In order to identify whether the supply of goods and services is intra-state or inter-state, it is crucial to determine the place of supply as well as from where the supplier is supplying. Let us understand both the terms individually:

Intra-State Supply

The supply of goods and services is Intra-State in the case the location of the supplier and buyer are within the same state. In transactions of Intra-State, the seller needs to collect both SGST and CGST from the buyer. The SGST collected goes to the State Government. However, the tax CGST goes to the Central Government.

Inter-State Supply

The supply of goods and services is Inter-State when the place of supply and the location of the supplier are in different cases. Besides, there are several other cases, where the supply of goods and services can be considered as Inter-state. Such cases are as follows:

- In the case of import and export of goods and services, and

- If the supply of goods or services is in the SEZ unit which Special Economic Zone unit.

Suppliers engaged in Inter-State transaction need to collect IGST from the buyer.

To Be Noted

Inter-State supply of Goods and Services never include supply in the Special Economic Zone unit.

Categorization of GST and how it is imposed

All the taxes levied on the supply of goods or services either go to the Central Government or the State Government or to both. Depending on the nature of transaction and supply, Inter-state and Intra-State, the collected tax is deposited to either or both the government. Furthermore, the authority of imposing the tax on the supply of goods and services is in the hands of both governments.

Broadly, GST has been categorized into three major categories: CGST, SGST, and IGST. We have made a prototype of GST levied on GST in India:

Central Goods and Services Tax (CGST)

CGST under GST is a form of tax that Central Government levies on the Intra-State supply of goods and services. CGST is governed and regulated by the CGST Act. Collection of tax under CGST is the revenue for Central Government. However, SGST will be also imposed on the same supply of Intra State but the State Government will govern this tax.

The above statements indicate that both the State and Central government have to agree on summing their taxes within an appropriate fraction for sharing the revenues among each other. Although, Section 8 of the GST Act clearly mentions that the rate of taxes levied on all Intra State supplies shall not exceed 14% each.

State Goods and Services Tax (SGST)

SGST under GST is a tax on Intra State supply of both goods and services. The State government holds the authority of levying SGST on supplies. Again, along with SGST, CGST will also be imposed on the same Intra State supply of goods and services. But CGST will be only governed by the Central Government.

Key features of CGST and SGST:

- CGST and SGST both would be applicable to Intra State supply of the same goods and services;

- The central government has the authority to levy CGST while State Government levies SGST on the transactions of goods and services; and

- The taxes levied by the Central and State government should not exceed 14% each.

An example of CGST and SGST levied on same Intra State supply

Suppose Mr. X (dealer) in Uttar Pradesh sold products worth Rs. 12000 to Mr. Y (buyer) in Uttar Pradesh. The GST rate is 12% including both CGST and SGST rate of 6% each. In this case, the dealer, Mr. X will collect Rs. 1440 of which Rs. 720 will go to the UP Government and Rs. 720 will to the Central Government.

Integrated Goods and Services Tax (IGST)

IGST is one of the taxes which levies on every Inter State supply of goods and services. Furthermore, the IGST is governed by the IGST Act. IGST is applicable to the supply of goods or/and services under both the circumstances: both in the case of export and import in India.

- Exports will be zero-rated

- Tax would be shared among the State and Central Government

Adjustment of Input Tax Credits between Centre and States

Let us assume that a Manufacturer X sells items worth Rs. 20,000 in Uttar Pradesh to the Dealer Y in Uttar Pradesh. Further, the Dealer Y resells the same items to a Trader Z in Goa for Rs. 25,000.

Ultimately, the Trader Z sells to the end user A in Goa for Rs. 30,000.

Consider the applicable CGST, SGST and IGST on the items sold are: CGST = 9%, SGST = 9%, and IGST= 9+9=18%.

As X has sold this to Y in the same state .i.e., Uttar Pradesh, it’s an Intra State sale. Therefore, both CGST and SGST of 9% each will be applicable to the item.

Y (Uttar Pradesh) has sold to Z (Goa). Since the sale is Inter-State; IGST at the rate of 18% will apply on the item.

Z (Goa) has sold the item to A (Goa). Again, the sale is an Intra State. Therefore, both SGST and CGST at the rate of 9% each will apply.

Conclusion

The main difference between CGST, SGST, and IGST lies in the acts each one is governed by. The CGST goes to Central Government while SGST goes to State Government. IGST is the summation of both.

If you wish to obtain GST registration for your business, contact Swarit Advisors.