Shop and Establishment License in India: A Complete Overview

Shivani Jain | Updated: Aug 25, 2020 | Category: Business

The term Shop and Establishment License denotes a Certificate that every business or entity in India needs before employing people. This license aims to regulate the working conditions and ensure that the rights of an employee are well-protected. Further, another name for this certificate is Shop License.

In today’s blog, we will discuss an overview of the Shop and Establishment License in India.

Table of Contents

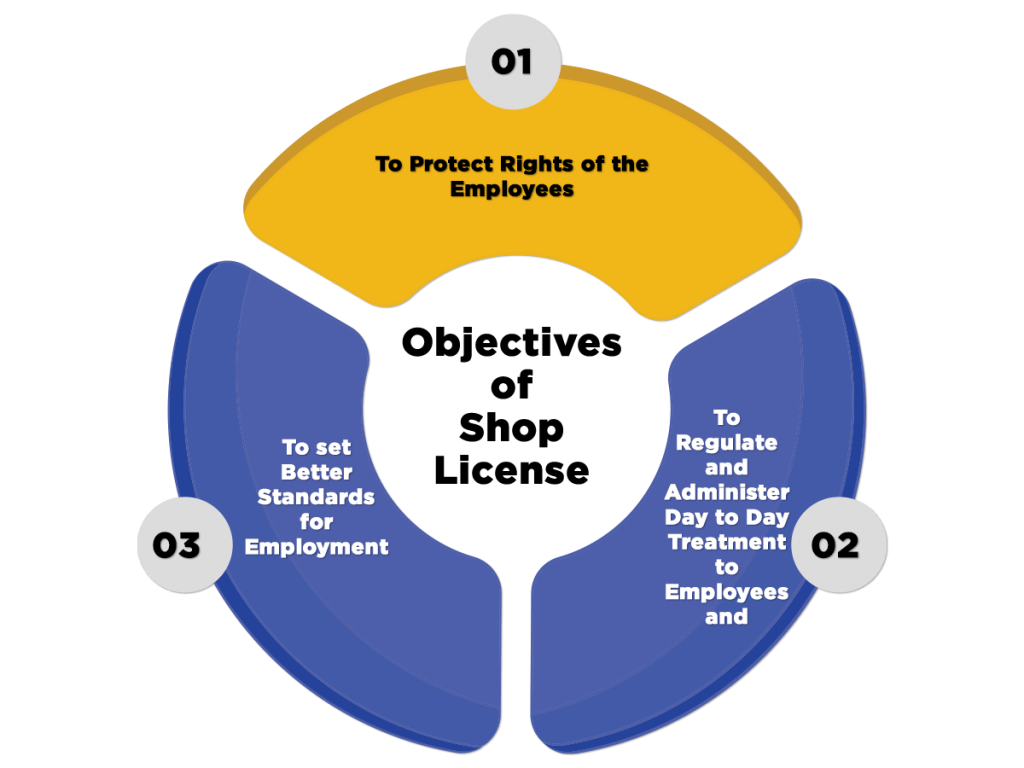

Objectives of Shop License

The objectives of Shop License are as follows:

- To Protect the Rights of the Employees.

- To Regulate and Administer Day to Day Treatment to Employees.

- To set Better Standards for Employment.

Benefits of Shop and Establishment Certificate

The benefits of a Shop and Establishment Certificate are as follows:

- Provides Legal Status to an Establishment;

- Ease in Opening in a Current Bank Account;

- Ensures Peace between Employer and Employee;

- Offers Better Pay and Holiday Policy;

- Restricts Unethical Business Practices;

- Promotes Growth and Expansion;

- Establishes Brand Image in Market;

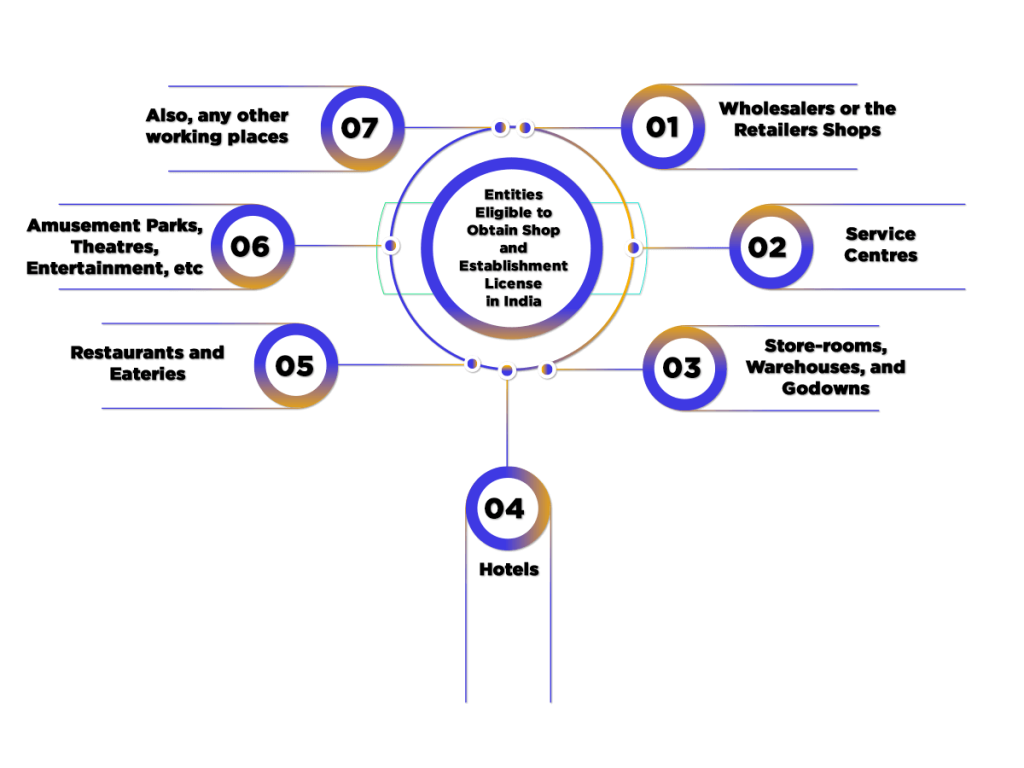

Entities Eligible to Obtain Shop and Establishment License in India

The entities eligible to obtain Shop and Establishment License in India are as follows:

- Wholesalers or the Retailers Shops;

- Service Centres;

- Store-rooms, Warehouses, and Godowns;

- Hotels;

- Restaurants and Eateries;

- Amusement Parks, Theatres, Entertainment, etc.;

- Also, any other working places.

Prerequisites for Shop and Establishment Registration

The Prerequisites for Shop and Establishment License in India are as follows:

- Name of Employer;

- Name of Manager;

- Postal Address of the Establishment;

- Name of the Establishment;

- Category of Establishment;

- Number of Employees Working;

Ambit of Shop License

A Shop and Establishment License in India regulates the following:

- Maximum Working Hours for Employees and Laborers;

- Time Duration for having Lunch and Rest;

- Laws relating to Child Labour in Factories;

- Women Employment;

- Compulsory Weekly Holidays offered;

- Close or off days;

- Opening and Closing Time;

- Paid Leaves;

- Accidents Coverage Policies;

- Preventive Measures against Fire;

- Facility of Proper Ventilation and Lighting;

- Cleanliness and Hygiene of Premises;

- Conditions and Timing provisions for the Payment Calculation;

- Regulations concerning Payment Deductions;

- Leave Policy;

- Dismissal;

- Proper Maintenance of Employee Records;

Primary Documents Required for Shop License

The documents required for Shop License are as follows:

- Identity Proof of the Employer in the form of PAN Card, Aadhar Card, Driving License, and Voter ID;

- Passport-sized Photograph of the Employer;

- Photo of the Shop;

- In the case of Rented Property, a copy of the Rent Agreement or Lease Deed;

- Any Utility Bill, such as Water Tax Receipt, Electricity Bill of the Premise;

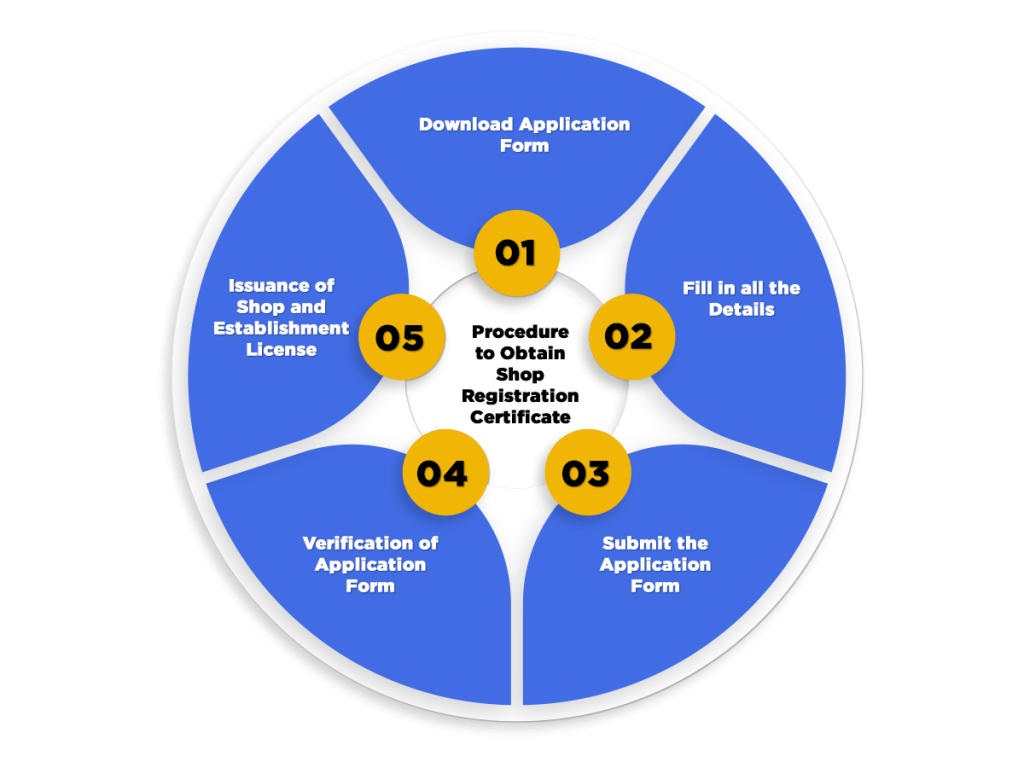

Procedure to Obtain Shop Registration Certificate

The steps involved in the Process to obtain Shop Registration Certificate are as follows:

Download Application Form

In the first step, the applicant needs to download the application form from the Official Website[1] of the particular state in which the shop is located.

Fill in all the Details

In this step, the owner or applicant needs to fill in all the details necessary. The term “necessary” includes the details as follows:

- Name of the proposed shop;

- Name of the Employer;

- Details of the Employer;

- Name of the Employees working;

- Details of the Employee working;

- Address Proof of the Establishment;

- In the Case of Rented Premises, No Objection Certificate (NOC) from the owner;

- PAN (Permanent Account Number) of the Employer;

Submit the Application Form

After properly filing the application form, the applicant or owner now needs to submit the form either to the Chief Inspector or Inspector-in-charge of the Shop and Establishment Act, together with the fees prescribed.

Verification of Application Form

Now, the higher authorities will verify the application form and documents submitted before the issuance of Shop and Establishment License in India.

Issuance of Shop and Establishment License

If the authorities are satisfied with the application form and documents submitted, it will issue a COR (Certificate of Registration) to that shop or establishment.

Documents Required for the Renewal of Shop License

The documents required for the renewal of shop and establishment license in India are as follows:

- Scanned copy of PAN Card of Partners/ Directors/ Proprietor;

- Scanned copy of Voter ID/ Passport/Driving License;

- Scanned Passport-sized Photograph;

- Rental agreement/ Lease Deed/ Sale deed of the Commercial Space;

- Number of Employees Working;

- Name of Shop or Establishment;

- Registers maintained till Date;

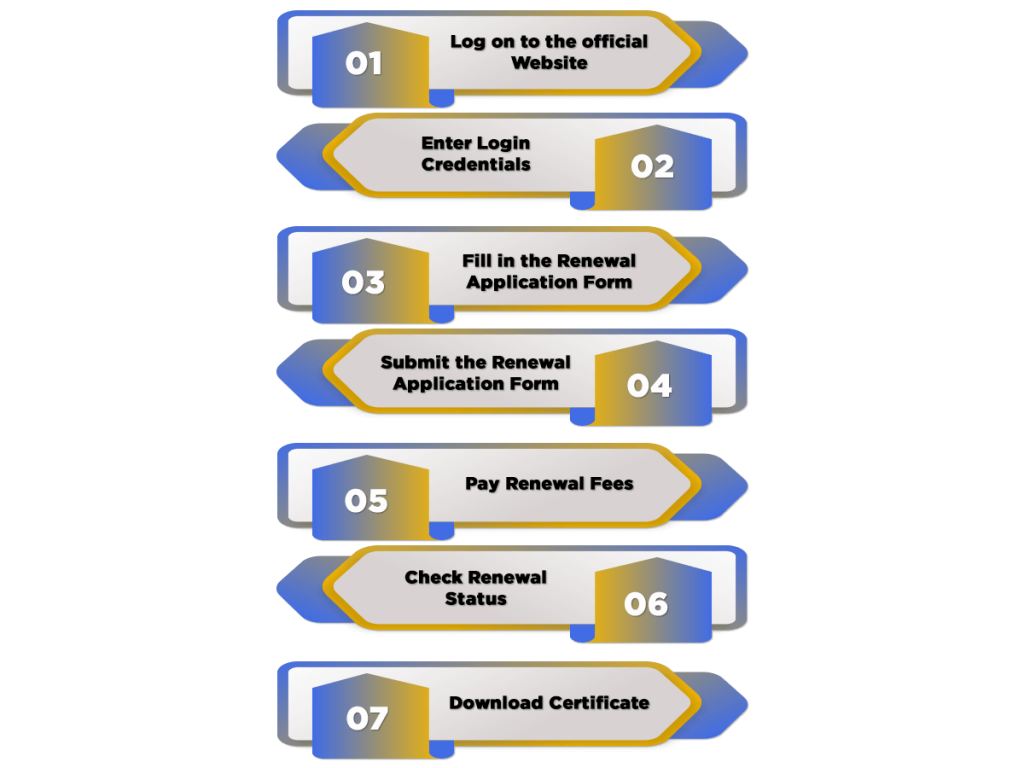

Process to Renew State and Establishment License

The steps included in the process to renew the state and Establishment License in India are as follows:

Log on to Official Website

In the first step, the applicant needs to log on the Official Portal of the respective state and for the renewal of the Shop License. The term “applicant” includes both individual and organisation.

Enter Login Credentials

Further, enter the Login Credentials provided at the time of Registration.

Fill in the Renewal Application Form

In this step, the applicant or owner needs to fill the application form for the renewal of Shop and Establishment License in India and must provide all the details asked.

Submit the Renewal Application Form

Further, after properly filling the form, upload the documents asked for renewal. After that, place the request for renewal.

Pay Renewal Fees

The fee for the renewal of the Shop and Establishment License varies from one state to another. For example, the Renewal Fee in Delhi is Rs 150.

Check Renewal Status

After making payment, the status of application form will change to “Under Scrutiny”. The applicant needs to wait till the time it changes to “Completed”.

Download Certificate

In last, the owner or applicant can “Download Certificate”, which is an option placed on the right side of the screen.

Closing of Shop or Establishment

In case, an owner wants to close his/her shop or premises, he/she needs to notify the Inspector-in-charge within 15 days of closing of such establishment.

Further, such notification must be made in writing. After receiving such notification, the inspector will strike-off the name of establishment from the register and cancel the certificate of registration.

Conclusion

In this blog, we have tried to include maximum information concerning the Shop and Establishment License in India. However, in case you are looking for some more information related to shop license, then reach out to our Shop and Establishment License services. We rank high in providing faster services and on-time registration.

Read, Also:Procedure to apply for the Shop and Establishment License