Transmission of Equity Shares: Its Complete Procedure

Shivani Jain | Updated: Sep 29, 2020 | Category: SEBI Advisory

The term “Transmission of Equity Shares” means the transfer of title over shares by the operation of law. Further, the transmission of shares takes place when the registered member of the company has died, declared insolvent or lunatic by the court of competent law.

In this blog, we will discuss the concept of Transmission of Equity Shares, together with its procedure and how it is different from the Transfer of Equity Shares.

Table of Contents

Concept of Transmission of Equity Shares

The term “Transmission of Shares” denotes a process under which the title over the shares is transferred by the operation of law. Further, the term “Operation of Law” includes the following:

- Death of a member;

- In the case of a Joint Holding, transmission happens only when the last Surviving Member Dies;

- When a Member has been Adjudicated Insolvent;

- When a Member has been Declared Mentally Ill (Lunatic);

- When a Company has been Amalgamated and Fresh Shares have been issued by the New Company;

- When the Member is a Company and it has been merged with other company or goes into liquidation

- When shares are being by the legal guardian for the benefit of a minor, till the time he/she becomes a major;

- By the order of the Court;

- By the order passed as Arbitration Award;

Further, this process is initiated by the receiver or legal heir of the deceased person and does not include any transfer deed. Moreover, there is no need to have a clause of adequate consideration under this contract.

However, it shall be relevant to note that the original liability on the shares continues to exist even after the completion of the process of transmission of shares, and there is no need to pay any stamp duty as well.

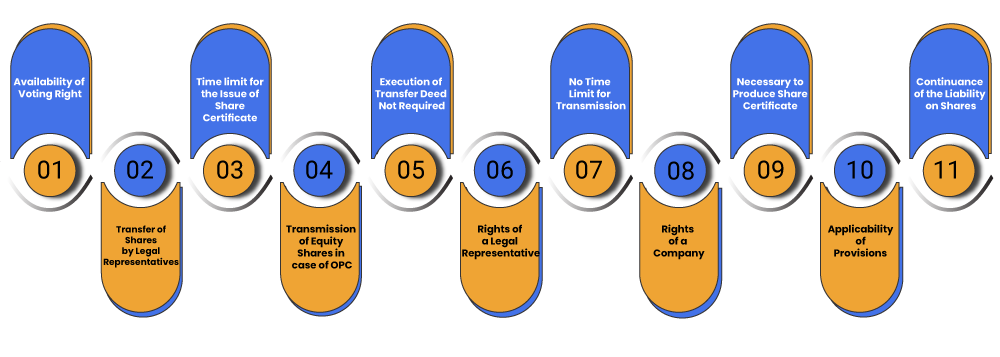

Matters Concerning the Process of Transmission of Equity Shares

The matters concerning the Process of Transmission of Equity Shares are as follows:

Voting Right only after Recording the Name of the Transferee

A transferee can become owner on an immediate basis; however, he will acquire the voting rights only after the recording of his name in the register of members of the Company.

The time limit for the Issue of Share Certificate after Transmission

As per section 56 (4) of the Companies Act 2013, every company, unless restricted by any regulation or provision of law or by any order of any Tribunal, Court, or other authority, shall, within a period of 1 month needs to deliver, the certificates of all the shares transmitted after the filing of an application for the registration of the process of transmission of any such shares received.

Execution of Transfer Deed Not Required

It shall be relevant to note that in the Process of Transmission, there is no need to get the Share Transfer Deed executed and stamped.

Moreover, the process of transmission of equity shares is regulated by the “operation of law”, so the transfer of deed is not an essential requirement for transmission.

Further, there is no need to pay any “Stamp Duty” on transmission.

No Time Limit for Transmission

It shall be relevant to note that there is “no limitation period” for making an application for transmission. Similarly, the process of transmission of equity shares cannot be refused even during the lock-in period of shares.

Necessary to Produce Share Certificate

It is compulsory to produce a share certificate for the process of transmission, as a new member has to be endorsed on the share certificate.

However, if in case the person claiming transmission is unable to produce an original share certificate, then he/she should be asked to furnish an Indemnity Bond to the company.

Continuance of the Liability on Shares

It shall be noteworthy to state that in the case of “Transmission of Shares”, the shares continue to be subject to the “Original Liabilities”. Similarly, if there was any lien existing on the shares for the outstanding sum, the same would subsist, despite the devaluation of the shares.

Legal Representatives can Directly Transfer Shares

Only section 56 (5) of the Companies Act 2013 deals with the provisions concerning the transfer of shares by the Legal Representative or LR of the deceased member.

Further, the Legal Representative of the deceased has the authority to directly transfer shares to the third party instead of getting it transmitted in his/ her name.

Transmission of Equity Shares in case of OPC

In the case of OPC, the person nominated by the sole member will have the title of all the shares of the deceased sole member. The nominee shall inform the member’s death to the Board. The nominee will be entitled to dividends and all rights as members.

Once he becomes a member, he will nominate another person as a member, after obtaining his prior consent.

Rights of a Legal Representative

The person entitled to shares is qualified for dividends and other advantages of shares as well. That means a Legal Representative or LR is eligible to attend Company’s General Meeting and can vote only after the registration of his name as a member.

Rights of a Company

If a person is not elected to become a member and has not even transferred his/ her shares, then the company can issue him/ her notice to register himself/ herself for transfer.

However, if he still doesn’t comply with the provisions within a period of 90 days, the BOD or Board of Directors can withhold the payment of bonuses, dividends, and other money payable.

Applicability of Provisions concerning Transfer of Securities

If in case a nominee decides to transfer his/her securities, then all the restrictions, limitations, and provisions of the Companies Act 2013 concerning transfer and registration of “Transfer of Securities” will apply.

Further, it will be assumed that the death of the debenture holder or shareholder had not occurred, and the notice for transfer and the transfer deed is duly signed by the shareholder or debenture holder.

Difference between Transfer of Shares and Transmission of Shares

| Basis of Comparison | Transfer of Shares | Transmission of Shares |

| Definition Clause | The process of share transfer is done “voluntarily” done by one party with another. | The process of Share Transmission takes place by the operation of law, in an instance, when the member of the company is either not alive or has been declared insolvent. |

| Reason for the Transmission or Transfer of Shares | It is a “voluntary decision” of the members of a company. | It happens only in the case of insolvency, death, or inheritance of the member. |

| Initiated by | Transferor or Transferee | Legal Heir or Receiver |

| Extent of Liability | The liabilities of a transferor cease to exist on the completion of the transfer. | Original Liability on shares continues to exist even after the completion of the project. |

Transfer of Share in the Case of Death of the Shareholder

On the event of the death of the shareholder, the shares held by the shareholder are directly transferred to his/ her legal heirs. Moreover, in this case, the company just enters the name of their legal heirs and does secretarial work once the requirements of the Articles are duly complied.

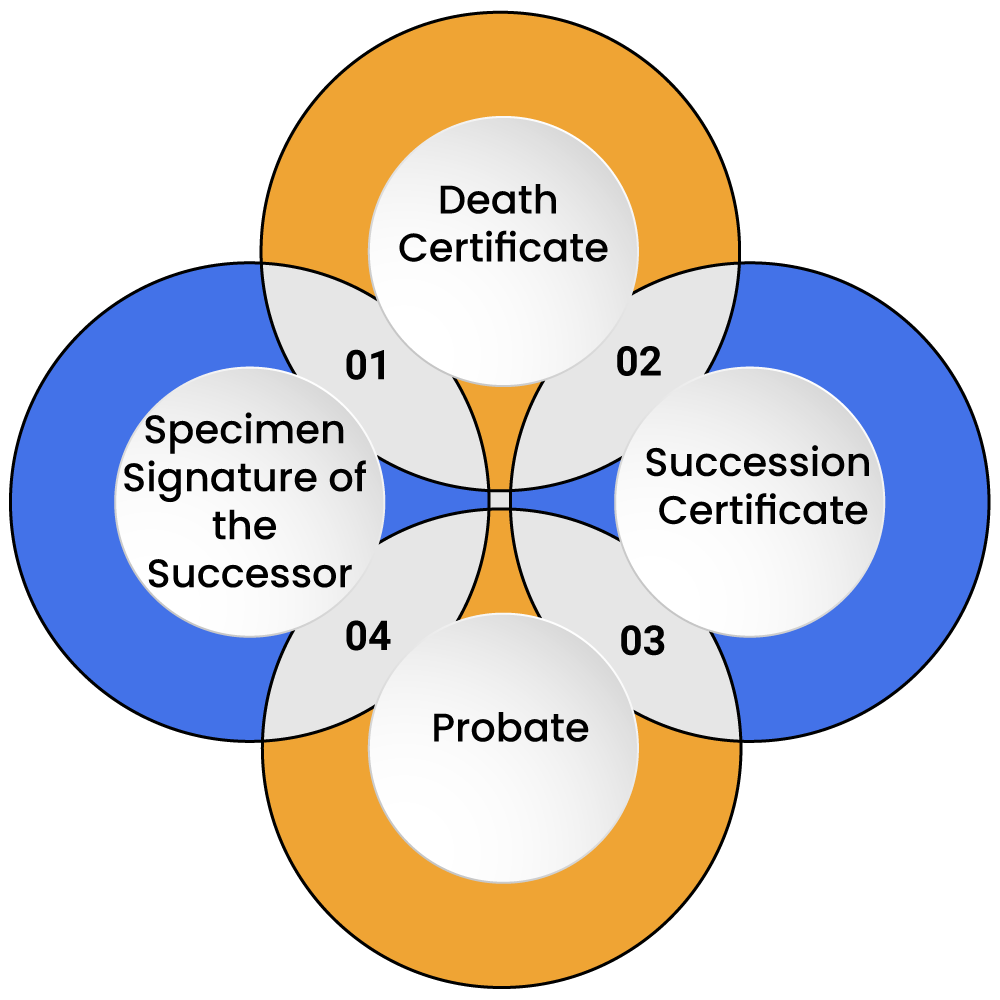

Documents Required for the Transmission of Equity Shares

The documents required for the Transmission of Equity Shares are as follows:

- Death Certificate;

- Succession Certificate;

- Probate;

- Specimen Signature of the Successor;

Procedure for the Transmission of Equity Shares

The steps involved in the process of Transmission of Equity Shares are as follows:

- In the case of a “Joint Holding”, the survivor or LR who wants to transmit the shares by the operation of law requires to file a simple application with the company, together with the documents required;

- After that, the company needs to record the details of the Death Certificate. Further, a reference number will be given to the shareholder;

- Once the documents are submitted, the company will review all the documents submitted;

- If the Private company is satisfied with the details furnished and documents submitted, it will approve the request of transmission;

- However, if in case the details furnished and the documents submitted are not in order, the company has the right to refuse the request for the transmission of equity shares;

- In case of refusal, the company needs to communicate about the same to the survivors or LRs within a period of 30 days, starting from the date of rejection of the request for the transmission of equity shares;

- Further, the dividend declared before the death of the shareholder will be paid to his/her survivors or legal representatives;

- However, if the dividend declared after the death of the shareholder, the same will be to him/her only that too, after the registration of his/her name.

Conclusion

In a nutshell, “Transmission of Shares” denotes a process under which the title over the shares is transferred by the operation of law. However, it will take place only when the registered member of the company has died, declared insolvent or lunatic by the court of competent law.

Further, in case of any other doubt and dilemma, reach out to Swarit Advisors, our experts will not only give a lucid and clear understanding but will assist you in the process of Transmission of Equity Shares as well.

Also, Read: Transfer of Equity Shares