What are the Things to Consider While Planning Mergers and Acquisitions in Financial Institutions?

Dashmeet Kaur | Updated: Nov 08, 2019 | Category: SEBI Advisory

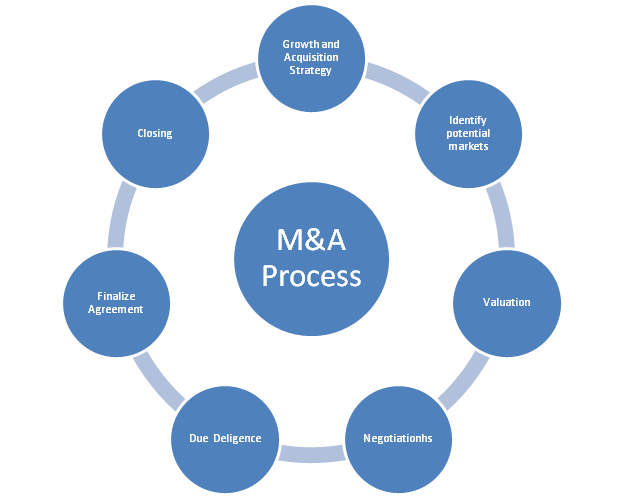

The mergers and acquisitions (M&A) is a multi-staged process that involves several steps and often gets completed within a period of 6 months to many years. It acts as a boon for companies that are struggling to expand the business and generating less revenue. Generally, Entrepreneurs finds it challenging to sustain in a financial constraint environment. Thereby, corporate professionals seek growth opportunity platforms to strengthen their company’s financial performance and market stature.

To gain a reputation in the corporate world, one needs to create growth strategies of diversifying service lines or entering into joint ventures via merger and acquisition. If you are running a financial institution or aspire to prosper in the banking realm, then you must be well-versed with the entire process of M&A. Needless to worry, this blog will provide a step by step guide to planning merger and acquisition.

Table of Contents

What are Mergers and Acquisitions?

As the terms suggest, the merger and acquisition refer to the consolidation of assets or companies through several types of financial transactions, like tender offers, mergers, acquisitions, purchase of assets and management acquisitions. The term M&A also means the desks at financial

institutions which deal in such activities. Often these terms of merger and acquisition get misinterpreted as one; however, they differ extensively in implications.

Merger -When two companies unite together to form a single entity; it is known as a merger. It is an agreement that combines two existing companies into a new company.

Acquisition – An acquisition takes place when one company buys another company, and the buyer company integrates the other entity with itself.

Jointly the mergers and acquisitions help to expand a company’s business and gain more shares in the market. Financial institutions who faces severe competition to increase their shareholder value in the market seize to the process of merger and acquisition.

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your IPO or Comapny Takeover or SEBI Advisory Services.

A Comprehensive Guide to Merger and Acquisition

Here are the steps to follow while planning the merger and acquisition of a financial institution:

Brainstorm and form an acquisition strategy– One needs to set a master plan before positioning the course of action in merger & acquisition process. A brilliant acquisition strategy comprises of the acquirer having a clear idea of what he expects to gain by acquiring another organisation. Also, he must exactly know about the purpose of the acquisition.

Identify the potential markets- Build M&A search criteria to determine the potential target companies. Shortlist those companies which have higher profit margins, premium geographic location, and more customer base.

Also, Read: Different Types of Mergers and Acquisitions.

Select the best company for acquisition– After identifying potential target companies, the acquirer contacts the concerned companies and choose the one which fits well to its search criteria. It’s essential to gather the target company’s information and check whether it is amenable to merger and acquisition or not.

Take valuation analysis– Don’t seal the deal before you are sure. Ask for substantial information of the target company like current financials and analyse its suitability for an acquisition target.

Negotiations– After procuring sufficient information about the target company, the acquirer has to create a reasonable offer. Once the acquirer presents the initial offer to the target company, then both the parties can negotiate terms.

Due diligence – Due diligence is a complex process which takes place after both parties confirm on negotiation terms. It aims to rectify the acquirer’s assessment of the target company’s evaluation. Due diligence implies conducting a detailed examination of every aspect of the target company’s operations such as an analysis of its human resources, financial metrics, customers, assets and liabilities, etc.

Finalize an agreement of purchase and sale – Once the due diligence is complete successfully with no major problems arising, the next step is to execute a final contract for sale. Both acquirer and the target company then make a final settlement on the type of purchase agreement they want between asset purchase or share purchase.

Closing of the acquisition -Lastly, the acquisition deal get closed, and the management teams of the acquirer and acquired work together on the process of merging the two companies.

Things to Keep in mind while planning Merger and Acquisition

Before you plan to initiate the merger and acquisition process for your financial entity, you need to consider a few things in mind that are listed below:

- Strengthen your business relationship– The most successful acquisitions are a result of a personal understanding amidst the acquirer and acquiring company. Before doing the paperwork, you should strengthen your bond as it can simplify due diligence and makes negotiations easier.

- Decide on hiring an investment banker– Contemplate on the decision of hiring an investment banker. Your choice may depend on the analytical skills of your financial team. Generally, bankers with a direct pipeline in target entities can be an asset for your company.

- Define roles and duties– It is utmost essential to distribute the roles and responsibilities among the old employees as well as the new ones. Since there will be an increase in the workforce, so things may get messy if you don’t define the roles from the start. The best way to distribute the duties is by identifying the weaker departments and filling them with competent employees.

- Find the Perfect Match– You can’t afford to skip any aspect when your company’s reputation is at stake. Before becoming one with the target company, you must study its work ethics and culture. The company’s culture plays a significant part in the success and failure of merger &acquisition process. In case the acquires company’s culture is poles apart from the acquired company then it may cause confusion and mismanagement.

Conclusion

Read, Also: Due Diligence Process for Merger and Acquisition.