Transfer of Equity Shares: Its Concept and Procedure

Shivani Jain | Updated: Sep 26, 2020 | Category: SEBI Advisory

The term “Transfer of Equity Shares” denotes a procedure under which all the rights and duties of a shareholder or a member are voluntarily handed over back to the company. Further, this process is undertaken by the shareholder at the time when he/she does not wish to continue his/her shareholding.

In this blog, we will discuss the concept of Transfer of Equity Shares, together with the difference between both.

Table of Contents

Concept of Transfer of Securities

The term “Transfer of Securities” denotes a process in which a shareholder or a member of a company voluntarily handover his/her shares back to the company. In other words, a shareholder decides to terminate his/her shareholding in a company.

However, it shall be relevant to note that the Process of Transfer of Equity Shares is subject to the restrictions specified in the Articles of Association (AOA).

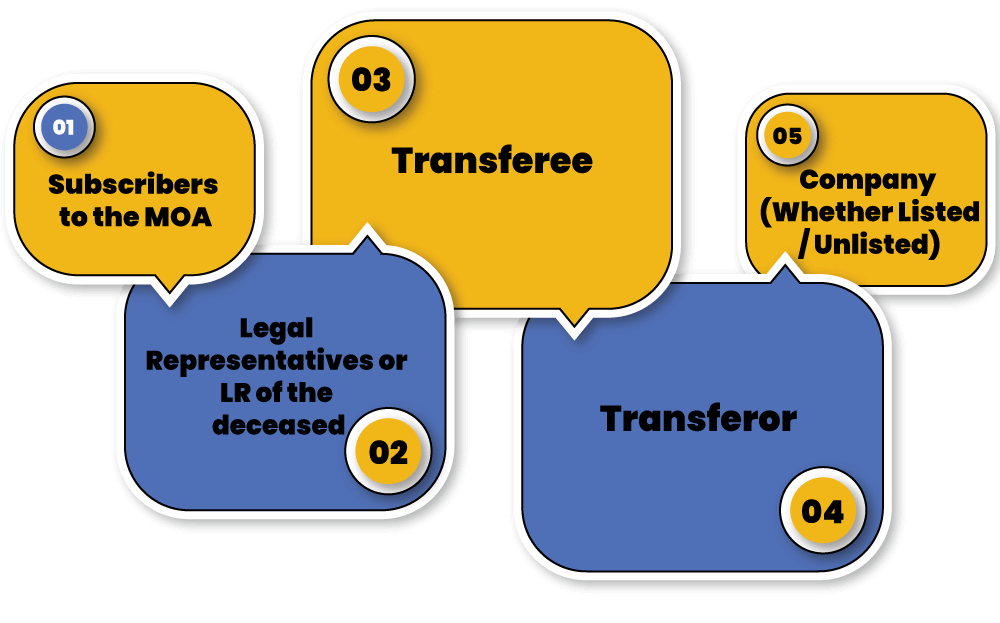

Parties Involved in the Process of Transfer of Shares

The Parties involved in the process of Transfer of Shares are as follows:

- Subscribers to the MOA (Memorandum of Association);

- Legal Representatives or LR of the deceased;

- Transferee;

- Transferor;

- Company (Whether Listed/Unlisted);

Governing Laws for Transfer of Equity Shares

The Section 56 of the Companies Act 2013 acts as the Governing Laws for the Transfer of Shares. As per this section securities are movable property and are eligible to be transferred subject to the provisions of the Articles of Associations. Therefore, a shareholder has a right to freely transfer his/ her shares to anyone.

Further, Rule 11 of the Companies (Share Capital and Debentures) Rules 2020 and the provisions gave under Model AOA in Table F of Schedule I act as the governing laws as well.

However, it shall be relevant to note that only the shareholders of a registered public limited company have the right to transfer their shares. That means the shareholders of a Private Limited Company do not have the right to transfer their shares.

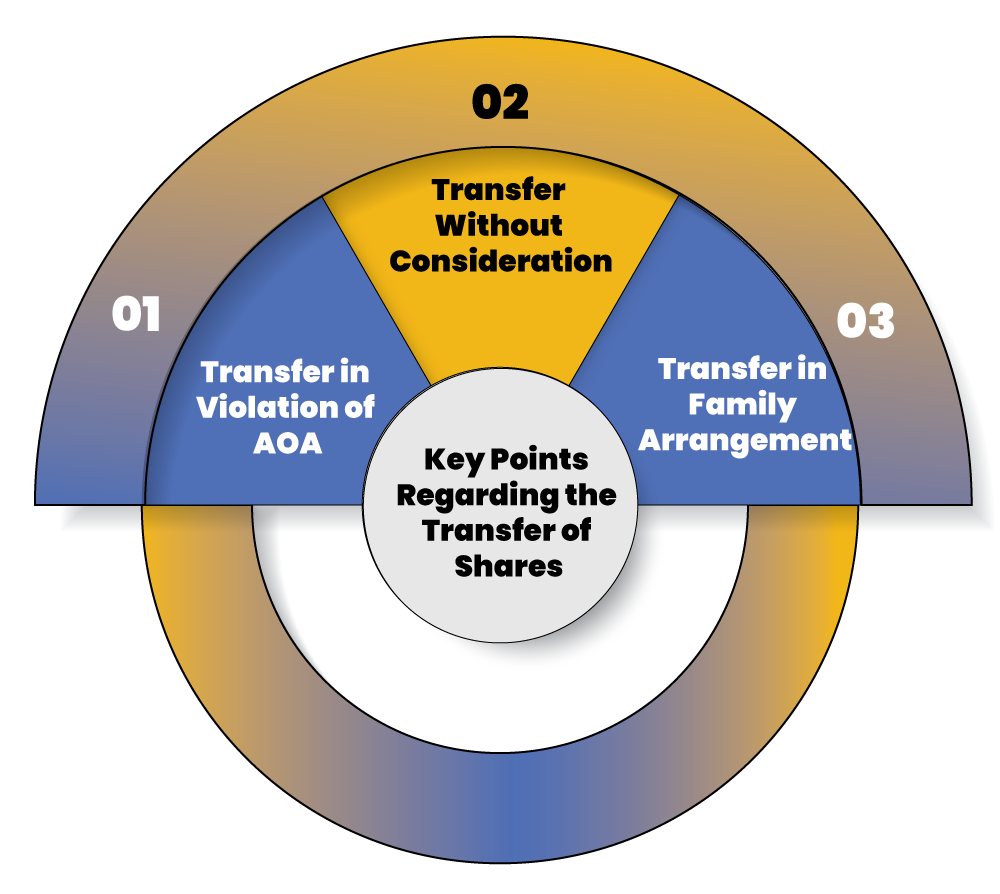

Key Points Regarding the Transfer of Shares

The key points regarding the Transfer of Shares are as follows:

Transfer in Violation of AOA

Any share transferred in the violation of the Articles of Association (AOA) of the Company is void.

Transfer Without Consideration

Any share transferred without adequate or no considerations shall be considered as void.

Transfer in Family Arrangement

It shall be relevant to note that any transfer made as per the provision of section 108 of the Companies Act 2013 in the Family Arrangement is valid in the eyes of laws.

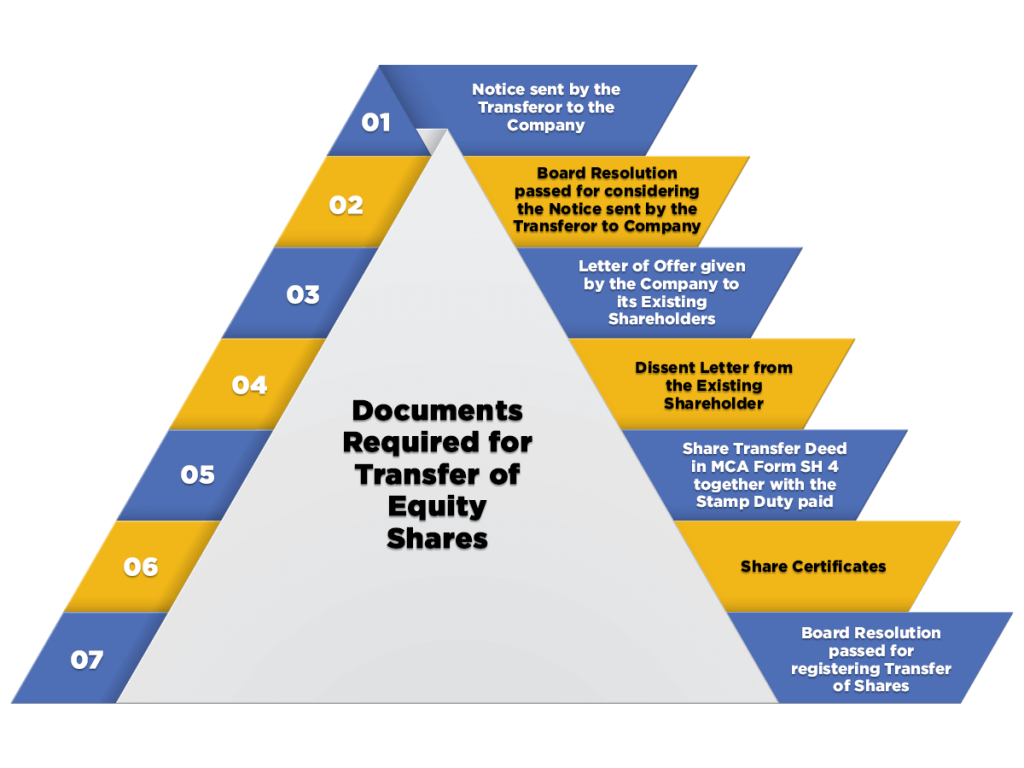

Documents Required for Transfer of Equity Shares

The documents required for Transfer of Equity Shares are as follows:

- Notice sent by the Transferor to the Company;

- Board Resolution (BR) passed for considering the Notice sent by the Transferor to Company;

- Letter of Offer given by the Company to its Existing Shareholders;

- Dissent Letter from the Existing Shareholder;

- Share Transfer Deed in MCA Form SH 4 together with the Stamp Duty paid;

- Share Certificates;

- Board Resolution (BR) passed for registering Transfer of Shares;

Also, Read: What is the Difference between Takeover and Merger?

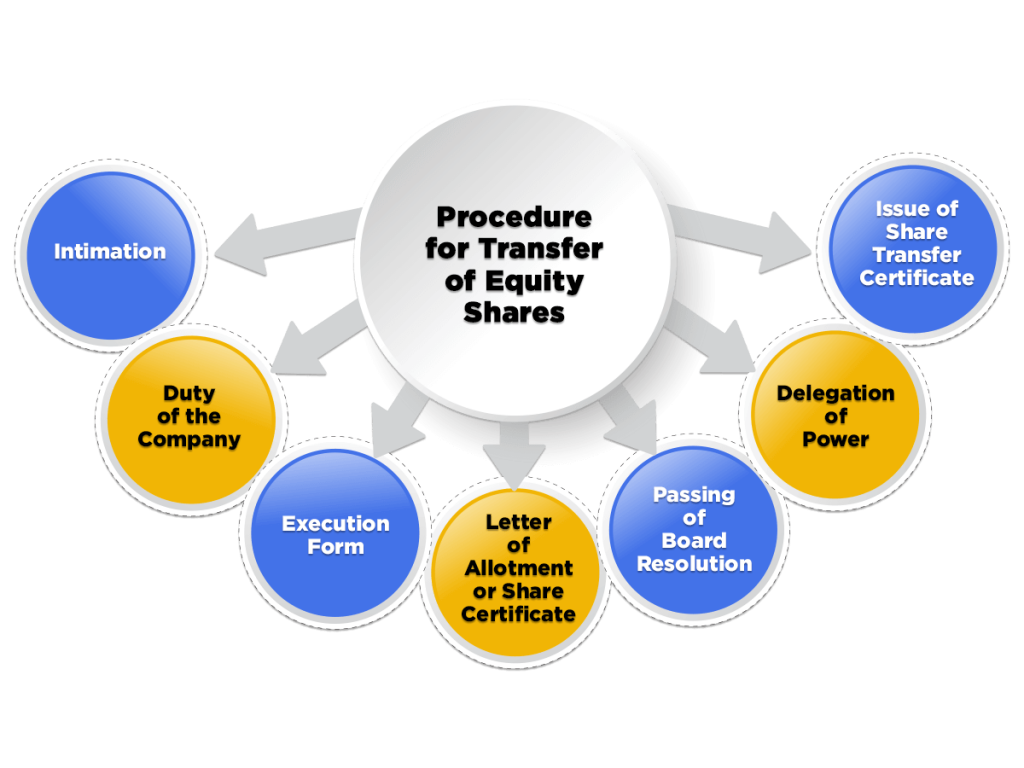

Procedure for Transfer of Equity Shares

The steps involved in the process of transfer of equity shares are as follows:

Intimation

The first and the foremost step in the process of transfer of shares is that the transferor must give his/ her intention of transferring shares in writing to the company.

Duty of the Company

The duties of a company in the process of Transfer of Shares can be summarised as:

- A company must notify its member regarding the availability of shares and the price at which such shares will be offered to them.

- The price of a share is determined by the directors and auditor of the company on the basis of the book value of shares.

- The company must inform its member regarding the time limit within which they need to communicate their option to purchase their shares on transfer.

- In case none of the members chooses to purchase the shares, the same are then transferred to the outsider, and it will become compulsory for the company to accept the transfer.

Execution Form

Now, in the next step, the company needs to execute a Share Transfer Deed in form SH 4. Such execution will be done by both the Transferor and Transferee.

Further, Form SH 4 must include the following things:

- It should be Duly Stamped;

- Properly Dated;

- Must specify the Name, Father Name, Address, and Occupation of both Transferor and Transferee;

- Folio No of both Transferor and Transferee;

- Distinctive No.;

- Certificate No of the Shares Transferred;

- No of Share Transferred;

- Nominal Value of the Shares Transferred;

- Consideration Received;

- Must be executed by or on behalf of the transferee and transferor;

Time Period for the Deposit of Instrument for Transfer with the Company

- The company needs to file the instrument for Transfer of Shares, i.e., Form SH 4 within 60 days from the date of execution. Further, the form must have the date of execution.

- If in case, the instrument for transfer has been lost or has not been delivered within the specified period, then the company may register such transfer on the terms of indemnity as the Board thinks fit.

Stamp Duty for the Transfer of Equity Shares

The stamp duty for the Transfer of Equity Shares is 25 paisa for every Rs 100 or part thereof.

Letter of Allotment or Share Certificate

The transferor must file the Share Certificate with the company. If in case there is no share certificate, then the said transferor needs to file Letter of Allotment (LOA) with the company, together with the instrument of transfer.

Passing of Board Resolution

After receiving the share transfer deed and the requisite documents, the company will then check the documents and deed passed. After that, the company needs to hold a board meeting to pass a Board Resolution for entering the name of the transferee in the “Register of Members” as the beneficial owner for such shares.

Further, if the documents submitted are in order, the board shall approve the transfer by passing a board resolution.

Delegation of Power

The Board of Directors (BOD) can delegate the power of transfer of share to one director, which will be called “One Man Committee”.

Further, the board can place restrictions and limitations on the power of the committee as well. For example, allowing transfer up to a prescribed limit.

Moreover, the Board of Directors or Committee can approve the transfer by “Circular Resolution” as well.

Issue of Share Transfer Certificate

As per section 56 (4) (c) of the Companies Act 2013, the Company within a period of 1 month, starting from the date of passing of Board Resolution needs to issue a “Share Transfer Certificate” in favour of transferee.

Further, the Company will endorse the Transferee’s name behind the Share Certificates.

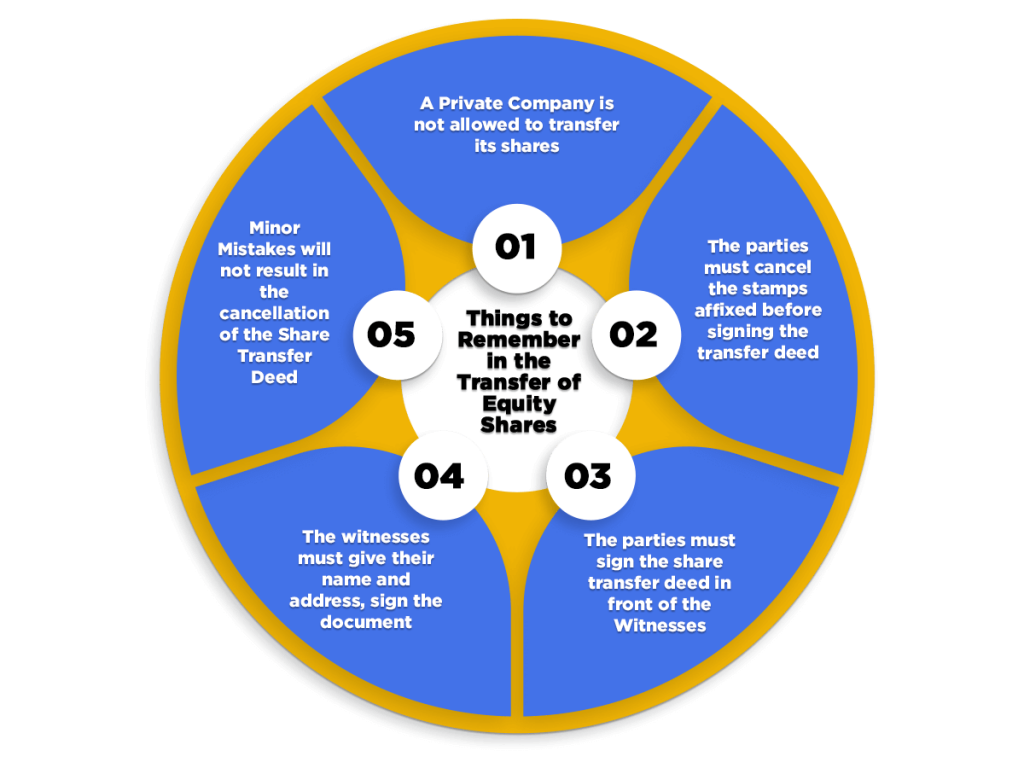

Things to Remember in the Transfer of Equity Shares

The things to remember in the Transfer of Equity Shares are as follows:

- A Private Company is not allowed to transfer its shares;

- The parties must cancel the stamps affixed before signing the transfer deed;

- The parties must sign the share transfer deed in front of the Witnesses;

- The witnesses must give their name and address, sign the document;

- Minor Mistakes will not result in the cancellation of the Share Transfer Deed;

Penalty for Non-Compliance

In case of any default or violation is made in complying with the regulations and provisions related to transfer of equity shares, the company will be punishable with a fine which will not be less than Rs 25000, but the same may extend to Rs 500000.

Further, every officer of the company who is a part in default will be punishable with a fine, which shall not be less than Rs 10000, but the same may extend to Rs 100000.

Conclusion

In a nutshell, the “Transfer of Securities” denotes a process in which a shareholder or a member of a company voluntarily handover his/her shares back to the company. In other words, a shareholder decides to terminate his/her shareholding in a company.

Further, Section 56 of the Companies Act 2013 acts as the Governing Laws for the Transfer of Shares. Moreover, only a public company is allowed to transfer its shares.

In case of any other doubt, reach out to Swarit Advisors, our experts will not only give a lucid understanding but will assist you in the process of Transfer of Equity Shares as well.

Also, Read: SEBI Guidelines for IPO: Guidelines for Making Public Offer in India