Why Startups Choose LLP to Start Business in India?

Shivani Jain | Updated: Nov 27, 2020 | Category: Limited Liability Partnership

Startups are entrepreneurial undertakings, projects, or enterprises that are normally young in age and growing in nature. Also, embryonic entrepreneurs tend to be ambitious in approach as they want to create a marketplace where they offer and develop both inventive and innovative products and service. As a result, out of all the business formats available, startups choose LLP to start a business in India.

Table of Contents

Know the Concept of Limited Liability Partnership

Limited Liability Partnership is a breath of fresh air in the realm of Company Law. It is viewed as an Alternate Corporate Vehicle that seeks to acquire the principal benefits of both Private Company and Partnership.

Moreover, to obtain LLP Registration in India, a minimum of 2 people are required. However, there is no need to have any amount as a minimum capital requirement for the same.

Further, the reasons behind the growth of LLP in India is that it provides limited liability to its designated partners and flexibility in its internal management. However, it shall be considerate to mention that the concept of LLP (Limited Liability Partnership) is a different and distinct form LLC (Limited Liability Company).

Minimum Requirements for Startups to Incorporate an LLP

When startups choose LLP to start a business in India, the minimum requirements that they need to fulfil are as follows:

- A minimum of 2people are required as Designated Partners;

- Out of the 2 partners, one must be an Indian Citizen, who is residing in India;

- The registered office of the Firm must be situated in India;

Why Startups Choose LLP?

The reasons as to why Startups Choose LLP to start Business in India are as follows:

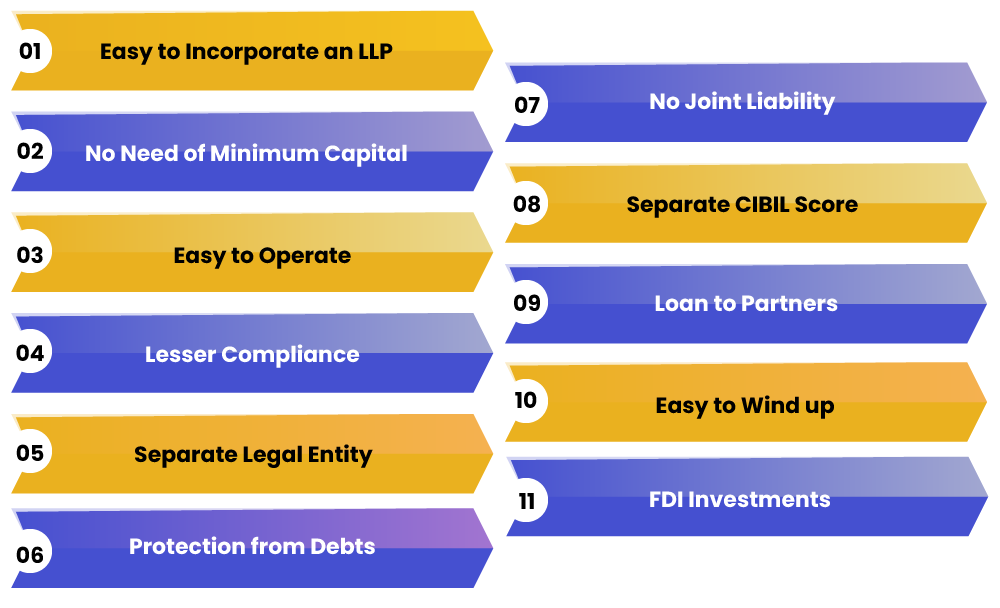

Easy to Incorporate an LLP

Nowadays, budding entrepreneurs choose something that is both easy and smooth to register. LLP fulfils both the conditions and includes just the basic registration requirements, such as follows:

- A minimum of 2 partners;

- No upper limit for the maximum number of partners;

- Out of the 2 partners, one must be the Citizen of India;

- Its registered office must be in India;

No Need of Minimum Capital

An LLP does not include any minimum capital requirement. That means one can start an LLP with just Rs 5000, or with no money as well. Further, the reason behind the same is that people normally face a financial crunch in their initial business days. As a result, the fee for obtaining LLP Registration is also very less.

Easy to Operate

Limited Liability Partnership is one of the easiest forms of business structures available in India. It does not prescribe many responsibilities and obligations on its partners other than the ones mentioned in the LLP Agreement. Moreover, LLP, as a business format, is easy to operate and conduct management.

However, in the case of a private limited company, directors require to pass board resolutions in meetings for taking any decision, but, there is no such requirement in an LLP. The reason for the same is that in a Limited Liability Partnership, decisions are taken by the majority or in consonance with the LLP agreement.

Lesser Compliance

Once an individual has registered an LLP in India, there not many compliances that he/she requires to follow. Therefore, for budding entrepreneurs obtaining LLP Registration is better than obtaining Private Limited Company Registration.

Further, there is no need for the partners of an LLP to hold general meetings, board meetings, and annual general meeting, as the operations and management of an LLP are based on the provisions of LLP Agreement.

In the same manner, partners can mutually decide and organize the internal management of an LLP, which will then be included in the LLP Agreement. Further, the partners of an LLP require to file only two forms on an annual basis, i.e., Form 8 and Form 11.

Separate Legal Entity

A Limited Liability Partnership enjoys the feature of being a Separate Legal Entity. That means it has the power to sue. Also, it shall be considerate to mention that the partners will not be liable for any legal case, and the authorities or creditors can sue only the firm.

Protection from Debts

Just like Private Limited Companies, the partners of an LLP are well protected against the debts taken by the Firm. Also, they will not be held personally liable for the Firm’s debts. That means an LLP provides the benefit of Limited Liability to its partners.

No Joint Liability

One of the most significant reasons as to why Startups Choose LLP to start Business in India is that there is no concept of Joint Liability. As per this feature, if in case a partner of an LLP commits fraud or forgery, then the remaining partners will not be held liable for his/ her act.

Likewise, if any partner acts negligently or carelessly, or does some act which causes loss, then, in that case, only that specific partner will bear the loss incurred.

Separate CIBIL Score

Another significant reason as to why Startups Choose LLP to start Business in India is that there are separate CIBIL Scores for Partners and Firm. The reason behind the same is that the partners of an LLP are its agents. As a result, separate CIBIL scores are provided for partners and firm.

Loan to Partners

As per the provisions of the company law, a private company is not allowed to provide loan to its directors. However, in the case of an LLP, partners can get a loan from the Firm, if the same is allowed in the provisions of the LLP Agreement.

Easy to Wind up

In case anything goes wrong and partners decide to wind up the firm, then the partners can do the same without undergoing intricate formalities. Also, a limited liability partnership can be wound up either voluntarily or by the order passed by the tribunal.

FDI Investments

By way of RBI/201314/566 A.P. (DIR. Series) Circular No. 123, dated 16.4.2014, the Indian Government has allowed LLPs to have foreign direct investments (FDI).

That means as per the provisions of the LLP Act 2008, the flow of FDI is allowed in both the formation and registration of a limited liability partnership. However, the same is subject to certain terms and conditions as specified in the circular mentioned above.

Conclusion

As acclaimed by J.J. Irani[1] Committee that, in view of the possibility for growth and development of the service sector, the need of providing the flexibility to small scale enterprises to participate in agreements and joint ventures that allow them to access technology and know-how; to bring together all the business synergies; and to face the increasing global competition allowed through WTO (World Trade Organisation), etc., the formation and registration of limited liability partnerships (LLPs) in India should be encouraged.

Also, an LLP or a Limited Liability will prove to be a windfall for both the startups and small and medium enterprises (SMEs), once the loopholes will be construed and rectified by the Government. Therefore, LLP is the need of the hour and has the capacity to take our corporate sector to all over new heights in the global platform.

At Swarit Advisors, our expert will guide you with both the process of LLP Registration and Annual LLP Compliance.

Also, Read: Major Differences Between Sole Proprietorship Vs LLP in India