A Complete Guide to Start Insurance Web Aggregator Business Model

Dashmeet Kaur | Updated: Mar 18, 2020 | Category: IRDA Advisory

Life is uncertain; nobody can foresee what adversity might happen next moment. People often rely upon insurance policies to reduce the impact of such mishaps. As several Insurance Companies claim to provide a wide range of services to protect the belongings & business, it makes the selection process nerve-racking for customers. In order to streamline the search process, the industry has harnessed technology to establish a new Business Model called Insurance Web Aggregator. Presently, 26 Web Aggregators in India connects insurers to prospective customers through online portals. If you also want to be a Web Aggregator, then you have landed on the right platform. This document will provide an exclusive insight into the Insurance Web Aggregator Business Model.

Table of Contents

What is the concept of Insurance Web Aggregator?

Insurance Web Aggregator is an IRDA approved business entity which is registered under Companies Act, 2013 that maintains a website to enable relevant information regarding different insurance services & products of various insurers.

A Web Aggregator is an intermediary that bridges the gap between the Insurance Company and people who want insurance policies. An Aggregator collects, compiles, maintains and provide the data of various insurers on a single online portal. Further, it facilitates insurance prospects to compare the prices, products and terms of conditions offered by numerous Insurance Companies which help them to make the best choice.

An Insurance Web Aggregator Business Model operates under the strict regulations of IRDA. It is utmost essential for a Web Aggregator to adhere to the provisions of Insurance Regulatory and Development Authority of India to sustain in the market.

IRDA guidelines for Insurance Web Aggregators

IRDA has set a list of do’s and don’ts for the smooth functioning of Insurance Web Aggregators.

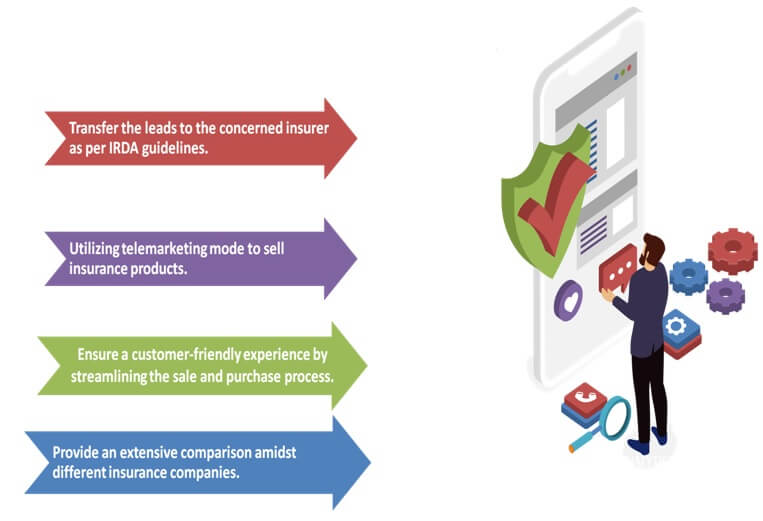

Insurance Web Aggregator must carry out these activities:

- The website needs to display complete information such as scope, coverage, premium terms of policies and other significant details about the product.

- An Insurance Web Aggregator needs to transfer all the leads and inquiries of the customers to the concerned insurer in a clear format.

- A Registered Web Aggregator must lay an online comparison of products and services rendered by multiple insurers to ease the process of selection for customers.

- The website should also indicate the conditions for each product, as prescribed by the insurer.

- Web Aggregators have to undertake online sale & purchase of insurance products and services. Also, they must ensure a customer-friendly experience during the sale and purchase.

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your NBFC registration or NBFC for Sale or RBI Advisory Services.

Insurance Web Aggregator must not perform these activities:

- A Certified Insurance Web Aggregator Business Model cannot promote or advertise a particular insurance product/ service on its website.

- Once an Aggregator obtains the License, he/she can only operate a single insurance portal at a time. IRDA prohibits a Web Aggregator from associating with any unlicensed, approved or unapproved entity for lead generation.

- Web Aggregators cannot display any additional information on the website other than Insurance Companies.

- An Insurance Web Aggregator must not operate other websites of financial, commercial or marketing entities. Moreover, IRDA has also curbed the usage of social media platforms for product comparison.

- Web Aggregators must follow a set format of sales and purchase, as inscribed under IRDA Regulations. Thus, Aggregators cannot deploy any other approach to transmit the leads to the Insurance Companies.

- An Insurance Web Aggregator must not offer any discount or rebate to the prospect customers since it is considered as breaching of (Section 41) Insurance Act, 1938.

Functions of Web Aggregators

Eligibility criteria

Insurance Regulatory and Development Authority has instilled some prerequisites for the applicants of Insurance Web Aggregator which are as follows:

- Any individual or an entity applying for Web Aggregator License must have a minimum Paid-Up Capital of INR 25 lakhs.

- The applicant cannot be an already existent Insurance agent, Corporate agent or Registered Insurance intermediary.

- Insurance Web Aggregator applicant must have a well-designed website to run the intermediation process.

- The MOA of the applicant Company should cover the prospect to function as a Web Aggregator in its ambit.

- These applicants are eligible to commence the business of Insurance Web Aggregator:

- A Company registered under the Companies Act, 2013.

- LLPs registered under Limited Liability Partnership Act, 2008.

- An individual recognized by IRDA.

Procedure to start an Insurance Web Aggregator Business Model

Here is the simplest way to register under (IRDA) Insurance Regulatory and Development Authority:

- The first step is to apply in Form A of Schedule I of IRDA Web Aggregator Regulation, 2017 and pay a non-refundable fee of INR 10,000.

- You get the choice to either pay online fee or make a demand draft in favor of IRDA.

- Now file an Application to get the permit to undertake the functions of Outsource & Telemarketing. Also, attach the essential documents with your Application.

- Once you submit the Application, the Regulatory Officer will verify the provided information to check its correctness.

- The Regulatory Officer holds power to reject an incomplete Application. Therefore, you need to file a fresh Application and repay the fees in case of rejection.

- If you feel aggrieved by the Officer’s decision, you can file an appeal to Securities Appellant Tribunal within 45 days of Application rejection.

- On the other hand, if the Regulatory Officer is satisfied with your Application, then he shall grant Insurance Web Aggregator Certificate which is valid for 3 years from issuance.

Documents required

Prepare and submit the documents mentioned below along with your Insurance Web Aggregator Application:

- Company’s Certificate of Incorporation;

- Copies of MOA and AOA;

- Complete information of Directors or Shareholders;

- Detailed data of the interested and associated Insurance Companies;

- Details of statutory Auditors and KYC;

- Audited Financial Statements and Annual Report of the last 3 years;

- Net Worth Certificate issued by a proficient Chartered Accountant;

- Business Plan for subsequent 3 years;

- Information of the person who will maintain the website;

- PAN and GST of the Company;

- Qualification details of the Principal Officer;

- An Affidavit that guarantees no Director, Shareholder or Principal Officer has never committed a fraudulent activity.

- Evidence which certifies that the Company’s net worth has never fallen below INR 10 Lakhs;

- Infrastructural details;

- An organizational chart that entails all functional responsibilities;

- A proof that the Company or its Directors, Shareholders are not currently linked with any Insurance Company, Insurance agent or an Insurance broker.

- In case of any pending or settled disputes, mention all the details regarding it.

Conclusion

To start up your business at the earliest and get Insurance Web Aggregator License, reach out to Swarit Advisors.