What does NBFC for Sale mean?

While the sale of NBFC is the concern of NBFC owner, as a buyer of NBFC, one must be thoroughly acquainted with the functions, market size, future and what NBFC is in real sense?

Non-Banking Financial Company (NBFC) is a financial entity which does not hold a banking License or is not governed by the national banking laws and regulations.

As per Reserve Bank of India (RBI), “A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares/stocks/bonds/debentures/securities issued by Government or local authority or other marketable securities of a like nature, leasing, hire-purchase, insurance business, chit business but does not include any institution whose principal business is that of agriculture activity, industrial activity, purchase or sale of any goods (other than securities) or providing any services and sale/purchase/construction of immovable property”.

It is pertinent to note that NBFC’s are registered under Companies Act while they are managed and regulated under Reserve Bank of India.

Types of NBFC’s

The NBFC’s are of two types:

- Deposit accepting

- Non-deposit accepting

NBFC’s with asset size of more than INR 500 crores or more, as per the last Audited Balance Sheet are considered to be systematically important NBFC’s.

Types of NBFC’s as per their Activity

- Asset Finance Company

- Loan Company

- Systematically Important Core Investment Company

- Micro-Finance Institution

- Mortgage Guarantee Companies

- Investment Companies

- Infrastructure Finance Company

- Infrastructure Debt Fund

- Factors

- Non-Operating Financial Holding Company

Mostly, the Companies whose business is chiefly involved in financial activities are registered as NBFC’s with RBI. These are under the supervision and have to comply with the regulations of RBI.

How to start NBFC business in India?

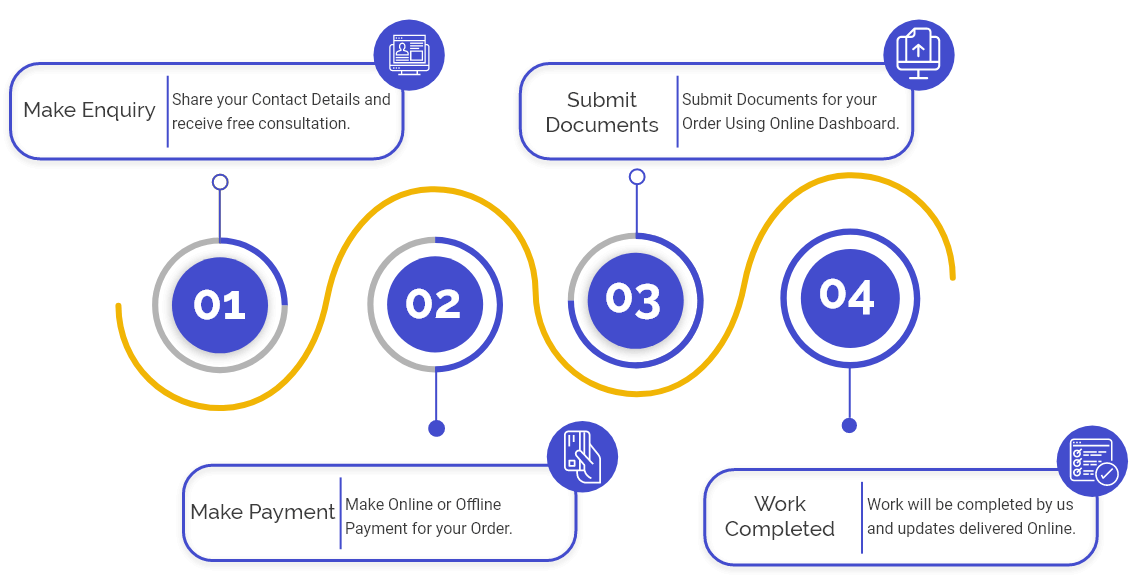

If you are looking forward to establish your own NBFC business in India, there are two ways to go about it:

- Applying for New Registration with RBI

- Takeover an already existing NBFC

Out of these two ways, Takeover of NBFC is the simpler one as it requires lesser time and is not complicated. Takeover an already existing NBFC takes between 45-60 days only.

Due Diligence of NBFC

Due Diligence of NBFC would include the assessment of its business activities to ascertain its assets and liabilities to estimate its commercial potential.

Any buyer who intends to purchase NBFC would undertake a comprehensive appraisal of the same. Due Diligence that the buyer undertakes is of four types:

- Legal Due Diligence

This involves the scrutiny of the legal basis of all the transactions of NBFC which includes contracts, property, loans, impending litigations and cases, employment and overall legal structure.

- Financial Due Diligence

This involves an examination of the financial information of NBFC, which includes information pertaining to the assets, liabilities, debts, cash flow, Management, capital etc.

- Commercial Due Diligence

This involves the evaluation of NBFC as a unit of the business market of which it is a part. This includes a careful perusal of the competitors, customer relationship, business plan, expected sales, strategies taken by the Company, popularity of business etc.

- Other (Miscellaneous) Due Diligence

This includes Due Diligence of other vital components that form part of NBFC such as Taxation, Intellectual Property, Information Technology System, Organizational Structure of NBFC, hierarchy system of Management, communication channels followed by the Organization etc.

Checklist of Things before Investing in NBFC

It is important that the following list of things is checked to make a decision as to whether to buy NBFC or not-

- Minutes of the Meetings of NBFC

- Secretarial compliance

- Material Agreements

- Regulatory matters, especially the compliance with RBI regulations

- Litigation

- Insurance

- Taxation compliances

- Corporate matters

- Foreign Direct Investment

- Financing matters

- Property

- Human Resource

- Taxation compliance

Additional checklist of documents

You can check the following documents to be sure of your decisions:

- Registration to Financial Intelligence Unit-India

- Creation of Statutory Reserve at the rate of 20% of profit- this the compliance with Section 45-IC of Reserve Bank of India Act, 1934

- Registration with Information Utility under Insolvency and Bankruptcy Code (IBC), 2016

- Appointing nominated legal counsel at the Delhi High Court

- Audit Report to Directors as per the circular – DNBS (PD) CC No. 129/03.02.82/2008-09 dated 23 September 2008

- Statutory Auditor Certificate (SAC)

- Registration with the Central KYC Portal

- Membership of Credit Information Company (CIC)

What is the Procedure for Sale of NBFC?

The foremost step in the sale of NBFC is the prior approval of RBI in case any of the following conditions would apply during the sale:

- There may or may not be any change in Management after sale.

- Any change in shareholding of the Company which results in at least 26% of the selling or buying of Paid-Up Capital.

- Any change in the Management of the Company.

What is the difference between NBFC’s and Banks?

There are certain functions that NBFC cannot undertake like a bank, which are as follows:

- NBFC’s, unlike banks, cannot accept demand deposits.

- NBFC’s are not permitted to issue cheques drawn on itself. The cheques are not a part of their payment and settlement system.

- People making deposits with NBFC do not have the option of Deposit Insurance and Credit Guarantee Corporation.

Collecting the Relevant Information Pertaining to NBFC

It is vital that the information collected in the process of Due Diligence is reliable and accurate. The source collecting information during Due Diligence should be dependable as the decision of purchase is based on it.

A systematic manner has to be followed to gather information to ensure that all the relevant legal provisions are complied with in the process to undertake Due Diligence. This information is mostly gathered from the financials of the Company, market data, business news and Directors of the Company.

Looking to invest in NBFC but not sure about it? Let Swarit Advisors help you with it.

Can a Foreign Entity buy NBFC in India?

Yes, a foreign entity or a resident can acquire an existing NBFC in India. For this, the process of inward remittances of funding will have to be followed in which funds are channelized through the banking route. The whole funding process shall be done after intimating and under the supervision of RBI. This entire process should be followed in accordance with Foreign Exchange and Management Act (FEMA), 1999, Foreign Direct Investment (FDI) Scheme and RBI regulation for reporting.

In case the Target Company is purely of an investment nature, then prior approval of Department of Economic Affairs would also be required to the extent of FDI policy and FEMA regulation.

For any further information in relation to sale and purchase of NBFC, conducting Due Diligence or collection of information, contact Swarit Advisors .

Frequently Asked Questions

The main thing to check by an individual before investing in an NBFC is that it must be registered with Reserve Bank of India.

A person or an entity situated outside India can purchase an NBFC in India, but under the complete supervision of Reserve Bank of India by following the method of inward remittances via the banking route.

Yes, an action can be taken against anyone making such claim as it is illegal for a financial Company or individuals who make such claim of being under the regulation of RBI.

If any Company that is supposed to get registered as NBFC with RBI but does not do so, RBI can impose a penalty on such Company or may even prosecute in the Court of Law.

The different categories of an NBFC are Investment Credit Company, Microfinance Company, NBFC Factors, Peer to Peer Lending, NBFC Account Aggregator, Infrastructure Finance Company, and Core Investment Company.

The Reserve Bank of India regulates the Non-Banking Financial Company in India.

To sell an NBFC in India, the balance sheet of the “seller company” has to stand at null or zero after all its assets and liabilities are transferred to the acquirer company.

Yes, it is necessary to acquire prior approval from the RBI in all the case of transfer of shareholding or acquisition.

Yes, it is necessary to acquire prior approval from the RBI in all the case of transfer of shareholding, acquisition, merger, or amalgamation.

Approximately a period of 2 to 3 months is required to sell an NNFC in India.

Yes, it is necessary to undergo the process of Due Diligence before selling an NBFC in India.

If you want to know the procedure for selling an NBFC in India, then reach out to Swarit Advisors, our experts will not give a lucid understanding of the concept but will guide you with the process as well.