Changes Made in the Process of GST Registration: WEF 21/08/2020

Shivani Jain | Updated: Nov 07, 2020 | Category: GST

Recently, CBIC (Central Board of Indirect Taxes and Customs) by way of Notification No 62/ 2020 had amended CGST Rules 2017 and declared a change in GST Registration Process.

Further, the rules amended are known as Central Goods and Services Tax (Tenth Amendment) Rules 2020 and amendments made came into effect from 21.08.2020. Also, while applying for GST Registration, the applicant now requires to get the same validated with his/ her Aadhar Number.

Moreover, if the authorities concerned do not take any required action, i.e., does not issue any SCN, within 3 days of the successful Aadhar Card Authentication, then the GST registration is considered to be granted.

In this blog, we will discuss in detail about the change in GST Registration Process, together with the time limit for automatic GST Registration.

Table of Contents

Concept of Aadhar Authentication

The term “Aadhaar” denotes a 12 digit unique identification number that is granted by the UIDAI (Unique Identification Authority of India) to the Indian Residents after undergoing the identification process set by the Authority.

Also, the term “Aadhar Authentication” denotes the process by which the Aadhar Number, together with the Biometric Statistics and Demographics Location of the Aadhar Cardholder is deposited to CIDR for authentication.

Further, CIDR (Central Identities Data Repository)authenticates and validates the accuracy of data submitted to know whether or not the same is sufficient based on the available data or not.

Objective of Aadhar Authentication Process

The main objective of the Aadhaar Authentication Process is to offer an “Online Platform of Identity” to substantiate the identity of the Aadhaar Card Holder quickly at any place and at any time.

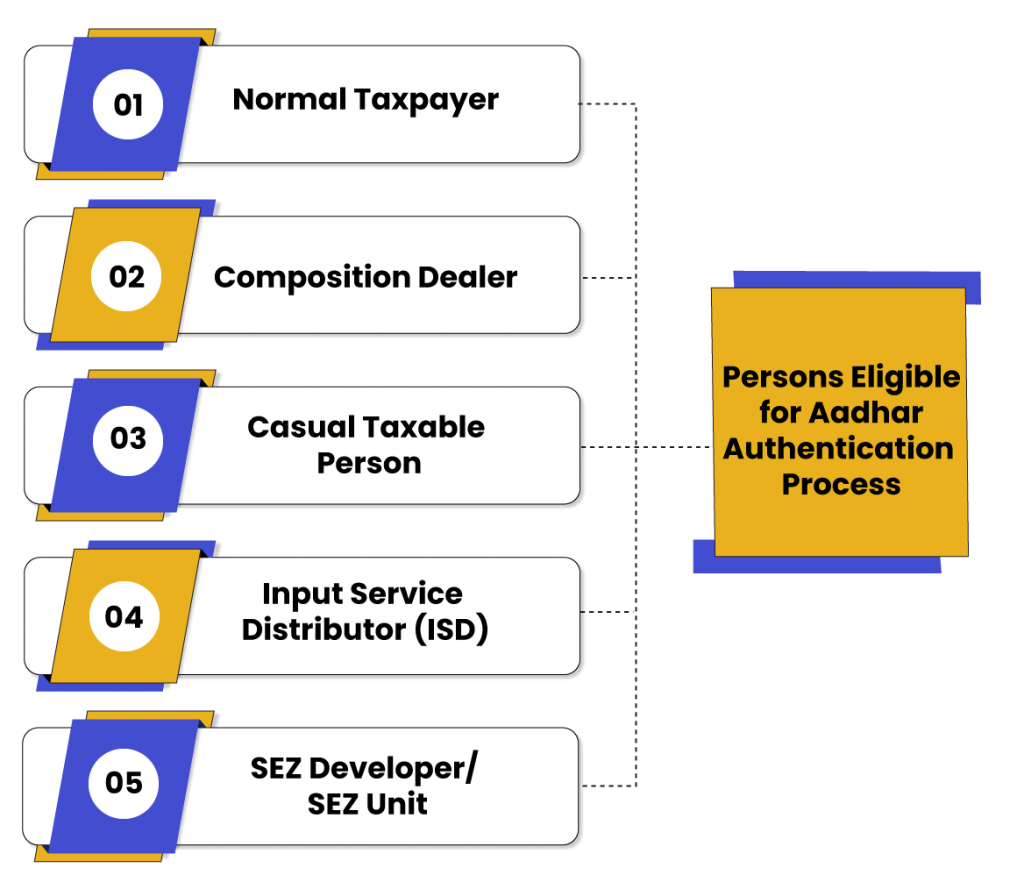

Who are all Eligible for Aadhar Authentication Process?

As per the notification issued and the change in GST Registration Process, the individuals eligible for Aadhar Authentication Process are as follows:

- Normal Taxpayer

- Composition Dealer

- Casual Taxable Person

- Input Service Distributor (ISD).

- SEZ Developer/SEZ Unit

Further, these people need to file an application for GST Registration in GST Form REG 01.

Insertion of Rules for Aadhar Authentication Process

The rules inserted in the CGST Rules 2020 for change in GST Registration Process are as follows:

Insertion of Sub-Rule 4A

Sub-rule 4A is inserted under Rule 8 of the CGST Rules 2020, which deals with the application for registration under CGST.

Further, as per this newly introduced Sub Rule, if an applicant, other than the person notified under the provisions of section 25 (6D), chooses to get his/ her Aadhar Number authenticated, then he/she needs to file an application under this sub-rule from 21.08.2020.

Also, the submission date of the application form in such cases will be the authentication date of the Aadhaar number or 15 days, starting from the furnishing of the application in Part B of GST Form REG 01 under sub-rule (4), whichever is earlier.

Insertion of Proviso to Rule 9(1)

The Proviso is inserted under Rule 9 (1) of the CGST Rules 2020, which deals with the verification and approval of the application form.

Further, as per the newly introduced proviso, the provisions are as follows:

- In case a person, other than the person notified under section 25 (6D), fails to undergo the process of Aadhar Number as mentioned under sub-rule 4(A) of rule 8 or does not choose authentication of Aadhar Number, then the authorities will grant registration only after physical verification of the premise being used for business in the manner provided under Rule 25;

- The Proper Officer needs to record the reasons in writing after getting approval from the officer who is not below the rank of Joint Commissioner, instead of the physical verification of the premise being used for business, will carry out the scrutiny of the documents he may deem fit;

That means the only way to avoid Physical Verification is to get approval from the Joint Commissioner.

Insertion of Proviso to Rule 9(2)

The Proviso is inserted under Rule 9 (2) of the CGST Rules 2020, which deals with the clarification regarding the information provided.

Further, as per the newly introduced proviso, whenever a person, other than the person notified under section 25 (6D), fails to undergo the process of Aadhar Number as mentioned under sub-rule 4(A) of rule 8 or does not chooses authentication of Aadhar Number, then the authorities will issue the notice in GST Form REG 03, within a period of 21 days, starting from the date of submission of the application.

Insertion of Rule 9(5)

The newly introduced rule deals with the situations wherein the Proper Officer fails to take action. Further, such situations are as follows:

|

Particulars |

Time Period Prescribed |

Date of Starting the Period Prescribed |

|

In case a person successfully undergoes a change in GST Registration Process, i.e., Aadhar Number Authentication. |

Within 3 Business Working Days |

Starting from the Date of Filing the Application |

|

In case a person is notified under section 25 (6D) |

Within 3 Business Working Days |

Starting from the Date of Filing the Application |

|

In case a person does not choose for change in GST Registration Process, i.e., Authentication of Aadhar Number |

Within 21 Business Working Days |

Starting from the Date of Filing the Application |

|

In case a person has clarification, Details and Documents submitted under sub-rule (2) for the grant of registration |

Within 7 Business Working Days |

Starting from the Date of Receipt of clarification, Details and Documents submitted under sub-rule (2) |

Also, Read: GST On Travel Agents and Tour Operators

Provisions for Aadhar Authentication under GST Registration

The provisions for Aadhar Authentication or change in GST Registration Process are as follows:

- In the process of Aadhar Authentication, the Authorised signatory (for all businesses)/Authorised and Managing Partners for a Partnership Firm/ and Karta of a HUF (Hindu Undivided Family), who are applying for new GST registration, can choose for e-KYC Authentication of their Aadhaar Card Number. However, the authentication process is completely optional and not compulsory. You should also know about the process of cancellation of GST.

- Also, for the cases where the people do not provide their Aadhaar Number or the cases where the process of Aadhar Authentication fails, are subjected to On-site Verification by the authorities of the Tax Department.

- Further, the authorities may grant registration, based on the documents submitted for obtaining registration.

Time Limit for Authentication Process

|

Sl. No. |

Category |

Time Period for Grant of Registration |

| 1 |

On the Successful Authentication of Aadhar Number |

Deemed Approval in 3 Business Working Days |

| 2 |

On not choosing for Authentication of Aadhar or on the Failure of the process of Aadhar Authentication and no SCN is granted by the Officer |

Deemed approval in 21 Business Working Days |

Other Important Aspects of Change in GST Registration Process

The other important aspects of change in the GST Registration Process are as follows:

- The applicants need to submit their reply after the Issuance of SCN within a period of 7 business working days.

- After the submission of the application, an authentication link will be shared on the GST registered email address and mobile number.

- After clicking on the received verification link, the applicant needs to provide his/her Aadhar Number and the OTP (One Time Password) received on the registered mobile number.

- The process of Aadhar Authentication is for all the Promoters/Authorised Signatories/Partners/Karta as specified in the application.

- A person can access Aadhar Authentication by following the steps as follows.

- Visit the Official GST Portal.

- Go to Services.

- Select Registration from the drop-down menu.

- Choose New Registration.

- Provide TRN and OTP.

- Now, click on My Saved Applications.

- Choose Aadhar Authentication Status;

- Lastly, click on the Resend Verification Link.

- There is no need for the existing taxpayers or the ones registered on the GST portal to undergo the process of Aadhar Authentication.

- Also, an NRI (Non-Resident of India) or a person who is not an Indian Citizen are exempted from the process of Aadhar Authentication.

Conclusion

In a nutshell, the role of Aadhar Card has undergone a massive transformation since its implementation in the year 2010. Earlier, it was only used to give unique identification to the Indian Residents and to provide government benefits.

In a nutshell, the role of Aadhar Card has undergone a massive transformation since its implementation in the year 2010. Earlier, it was only used to give unique identification to the Indian Residents and to provide government benefits.

But now a new tab has been activated in the GST Form REG 01, which deals with the process of Aadhar Authentication. Further, this new tab provides the applicant with an option to choose or not choose the process of Aadhar Authentication.

If in case the applicant chooses the option of authentication, then a link will be sent to the registered email address after the submission of Aadhar Authentication. However, if he/she goes for the option of physical verification, then the officer designated by the Tax Department will visit the premise, and after which the GST Registration will be granted.

Therefore, it can rightly be said that over the period of time, Aadhar Number has emerged from being voluntary to compulsory detail required for direct cash transfers. Also, the government has made it compulsory to link Aadhar Number with PAN to monitor Income Tax Filings and check the occasions of Tax Evasion.

As a result, it will now be exceptionally essential to validate one’s Aadhaar Number if in case he/she wants to opt for a change in the GST registration process or otherwise be prepared for an on-site visit by the GST Officers.

Also, Read: Know About GST Registration process step by step