Committees Under The Companies Act 2013: How they Function?

Shivani Jain | Updated: Jul 25, 2020 | Category: Business

For improving the efficiency and efficacy of the Board of Directors, various Committees under the Companies Act 2013 are formed. These committees are formed for the sectors that need more technical, focused, and specialized decisions.

The main function of these committees is to prepare and draft documents for decision making at the Board Meetings. In this blog, we will talk about the functioning of the committees under the Companies Act 2013[1] .

Table of Contents

Concept of Committees

The term “Committees” denotes a group or association of persons who work together to achieve a common objective and to perform a particular work that requires expert knowledge. Further, all the members of these committees are expected to have professional and specialized experience regarding the functioning of the committee.

However, it is significant to note that a committee is just responsible for performing the work and role prescribed by the Board of Directors (BOD). That means the ultimate authority is with BOD only.

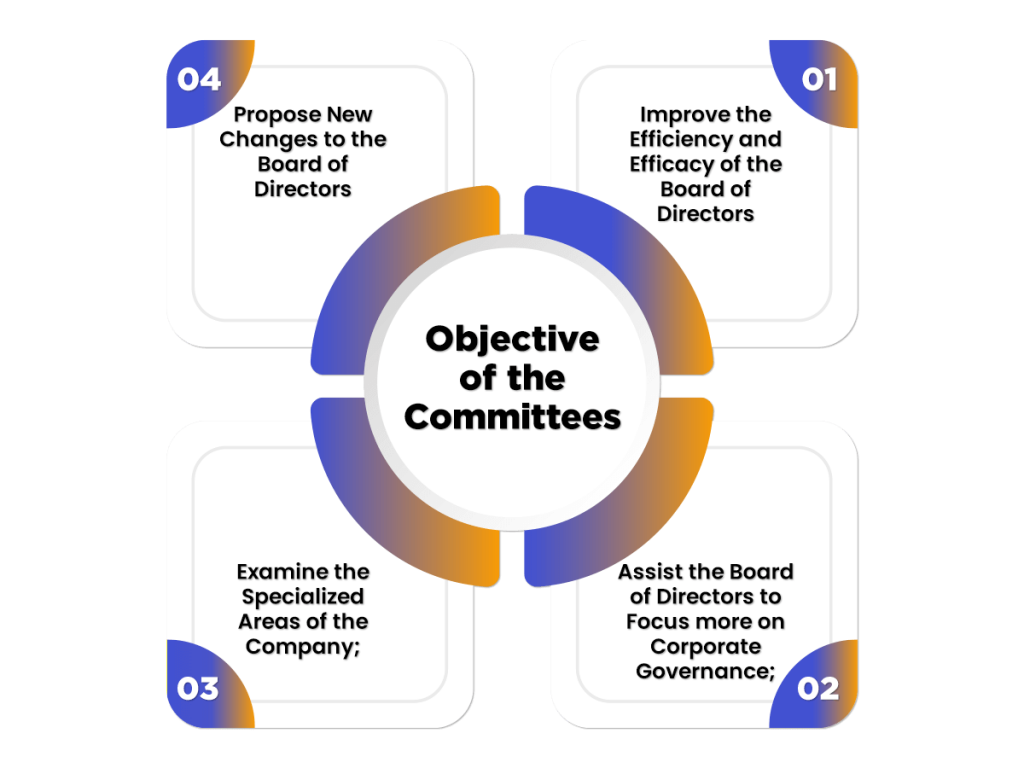

Objective of the Committees

The objectives and aim of the committees under the Companies Act 2013 are as follows:

- Improve the Efficiency and Efficacy of the Board of Directors;

- Assist the Board of Directors to Focus more on Corporate Governance;

- Examine the Specialized Areas of the Company;

- Propose New Changes to the Board of Directors.

Need of the Committees

Normally, the need to form a committee is high in the companies that comprise of both Executive and Non-Executive Independent Directors. Further, the main reasons behind the Constitution of Committees under the Companies Act 2013 are as follows:

- To Assist the Board of Directors: Normally, it is tough to consider every issue and matter in the Board Meeting. But when a company have small committees, it is easy to tackle and address every matter effectively

- To Maintain Corporate Governance: In order to concentrate on targeted issues and maintain Corporate Social Responsibility (CSR), Stakeholder’s Relationship, these committees are needed by every company.

Different Committees under the Companies Act 2013

The different types of committees under the Companies Act 2013 are as follows:

- Audit Committee under Section 177;

- Nomination and Remuneration Committee under Section 178 (1) to (4);

- Stakeholders Relationship Committee under Section 178 (5) to (8);

- Corporate Social Responsibility under Section 135

Audit Committee under Section 177

| Basis of Discussion | Details |

| Applicability | The provisions of Section 177 of the Companies Act applies to the companies as follows: a) Every Listed Public Company; b) Any Public Company having the Paid-up Share Capital of Rs 10 crore or more; c) Any Public Company having an Annual Turnover of Rs 100 crore or more; d) Any Public Company having an aggregate Outstanding Loans, Deposits, and Debentures, more than Rs 50 crore. |

| Constitution | A minimum of 3 Directors; This committee will have a majority of Independent Directors. |

| Qualification | All the Members of an Audit Committee must have in-depth knowledge about the Financial Statements. |

| Persons Eligible to Attend Audit Committee Meeting | All the Auditors and Key Managerial Personnel (KMP) of the company has the right to attend the Meeting of Audit Committee. However, these people will not have the right to Cast Vote in the Meeting. |

| Functions | The Functions of an Audit Committee under Section 177 of the Companies Act 2013 are as follows: a) Give Recommendation for the Remuneration, Appointment, and Tenure of Appointment of Auditors of the Company; b) Monitor and Supervise the Work, Performance, and Independence of Auditors, along with the Effectiveness of the Audit Process; c) Examination of the Auditors Report and Financial Statements; d) Approval or Modification of Transactions concerning Related Parties. ADDITIONAL PROVISIONS: a) Power to provide omnibus approval for some transactions, subject to conditions prescribed; b) May Give Recommendation to the Board for the issues not mentioned under Section 188; c) Examination of Inter-corporate Loans and Investments; d) Valuation of the Assets and undertaking of the Company; e) Assessment of the Risk Management System and Internal Financial Control; f) Monitoring the Use of Funds raised through the Public. Note: Clause (b) will not be applicable in the case of Holding and Wholly-owned Subsidiary Company. The Consequence of Non-Approval or Non-Ratification of Transaction by the Company If in case any transaction worth up to Rs 1 crore carried out by the Directors of Company, without obtaining approval from Audit Committee and not ratified within 3 months from the date of transactions, then: a) Such transaction will be Voidable at the option of Committee; b) In case such a transaction involves Related Party or is authorized by the Director, then the said director will be liable to Indemnify the Loss incurred. |

| Powers | The Powers of an Audit Committee are as follows: a) Investigate any Matter specified by the Board of Directors; b) Power to acquire Professional Advice from the External Sources; c) Full access to obtain information recorded in the Books of Accounts; d) May Call for the Auditor’s Comment regarding the Internal Control Systems, Scope of Audit; e) Review Financial Statements before their Submission to BOD (Board of Directors); f) Can Discuss Issues be concerning Statutory and Internal Auditors; g) Can Handle Issues concerning the Management of the Company. |

| Disclosure in the Board Report | The Items to be disclosed in the Board Report are as follows: a) Composition of the Audit Committee; b) Recommendations not approved by the Board of Directors. |

Exceptions to Audit Committee

The exceptions to provisions of the Audit Committee are as follows:

- Section 8 Company: For a Section 8 Company the phrase “form Audit Committee with a Majority of Independent Directors” shall be omitted;

- Government Company: For a Government company the “Recommendation for Remuneration” shall be omitted;

- IFSC Public Company: The provisions of Section 177 shall not apply to an IFSC Public Company.

Nomination and Remuneration Committee under Section 178

| Basis of Discussion | Details |

| Applicability | The provisions of Section 178 of the Companies Act applies to the companies as follows: a) Every Listed Public Company; b) Any Public Company having the Paid-up Share Capital of Rs10 crore or more; c) Any Public Company having an Annual Turnover of Rs 100 crore or more; d) Any Public Company having an aggregate Outstanding Loans, Deposits, and Debentures, more than Rs 50 crore. |

| Constitution | a) 3 or more Non-Executive Directors, out of which at least One-half needs to be the Independent Directors; b) The Chairman of the company can also be appointed as the Member of the Nomination and Remuneration Committee. However, such a person will not be eligible to Chair such a committee. |

| Role | The Functions of a Nomination and Remuneration Committee under Section 178 of the Companies Act 2013 are as follows: a) Identify the people eligible to become Director or promoted to Senior-level Management; b) Recommend the Board of Directors regarding the Appointment and Removal of Directors; c) Evaluate the Performance of Committees, Directors and other Individuals; d) Review the Implementation and Compliance of Committees; e) Determine the Criteria for assessing the Qualification, f) Positive Attributes and most importantly Independence of a Director; g) Recommend the Board of Directors regarding the remuneration of Directors, KMP (Key Managerial Personnel), and other Employees. |

| Points to Consider while Formulating Policy | The things to consider while formulating a Policy under Section 178 are as follows: a) The Composition and Remuneration is sufficient and reasonable to Retain, b) Attract and Motivate the Directors to run the company efficiently; c) The Relation between the Performance and Remuneration is clearly defined and meets the Performance Benchmarks; d) The Remuneration payable to Key Managerial Personnel (KMP), Senior Management, and Directors involve a balance between the Incentive and Fixed Pay. Moreover, the remuneration should be apt for short and long-term performance objectives. |

| Disclosure regarding the Policy in the Board Report and on Official Website | The directors of the company need to upload the Remuneration Policy on their Official Website. Moreover, all the changes, modifications, and key features of the policy must be disclosed in the Board Report. |

Exceptions to Nomination and Remuneration Committee

The exceptions to provisions of the Nomination and Remuneration Committee are as follows:

- Government Company: The provisions of section 178 will not apply to a government company except the appointment of senior-level management.

- Section 8 Company: The provisions of section 178 will not apply to a Section 8 Company.

- IFSC Public Company: The provisions of section 178 will not apply to an IFSC Public Company

Stakeholder Relationship Committee under Section 178

| Basis of Discussion | Details |

| Applicability | The provisions of Section 178 of the Companies Act applies to the companies as follows: a) Any company having more than 1000: I. Shareholders; II. Debenture-holders; III. Deposit-holders; and IV. Any other security holder |

| Constitution | a) Chairperson who will be a Non-executive Director; b) Any other member as decided by the BOD (Board of Directors). Note: In case the Chairperson or any other member of the stakeholder relationship committee is absent from the meeting of the Stakeholder Relationship Committee, and then such person will need to attend the Company’s General Meetings. |

| Role | The main function of this committee is to consider and resolve the grievances raised by the security holders of the company. |

Exceptions to Stakeholder Relationship Committee

The exceptions to provisions of the Stakeholder Relationship Committee are as follows:

- Section 8 Company: The provisions of section 178 will not apply to a Section 8 Company.

- IFSC Public Company: The provisions of section 178 will not apply to an IFSC Public Company

Corporate Social Responsibility Committee under Section 135

| Basis of Discussion | Details |

| Applicability | The provisions of Section 178 of the Companies Act applies to the companies as follows: a) Any Company that is having either of the following: I. Net Worth of Rs 500 crore or more; II. Annual Turnover of Rs 1000 crore or more; III. Net Profit of Rs 5 crore or more; At any time during the previous financial year. |

| Constitution | a) 3 or more Directors, out of which at least 1 needs to be an Independent Director. If in case a company is not required to appoint an Independent Director under section 149(4), then it shall comprise of 2 or more directors; If in case a Private Limited Company is having 2 directors, then it shall comprise of 2 directors; In the case of a Foreign Company, the committee needs to consist of at least 2 directors, out of which: a) 1 director needs to be an Indian Resident who is authorised to accept notices and documents on behalf of a foreign company; b) Other directors will be nominated by the Foreign Company. |

| Role | The Functions of a Corporate Social Responsibility Committee under Section 135 of the Companies Act 2013 are as follows: a) Formulate and Recommend the Board of Directors, a Corporate Social Responsibility Policy representing the activities and issues undertaken by the company in subjects or areas prescribed in Schedule VII; b) Suggest the total amount of expenditure be incurred on the issues and activities referred to under the (1); c) Monitor and Supervise the Corporate Social Responsibility (CSR) Policy of the company on a timely basis. |

| Role of Board | The Board of Directors will approve the CSR (Corporate Social Responsibility) Policy only after incorporating the recommendations given by the committee. This will confirm that the activities and items included in the Policy are properly undertaken by the company. |

| Disclosure in the Board Report and Official Website of the Company | The Board of Directors needs to disclose the composition of the Corporate Social Responsibility in the Board Report. Further, the company needs to disclose the contents and items of the CSR Policy on its Official Website as well, in the manner prescribed. |

Penal Provisions for Not Forming Committees under the Companies Act 2013

The Penal Provisions for Not Forming Committees under the Companies Act 2013 are as follows:

| Basis | Penal Provision |

| Company | Fine Amount: a) A Minimum of Rs 1 Lakh; b) A Maximum of Rs 5 Lakh |

| Every Officer of the Company | Fine Amount: a) A Minimum of Rs 25000 b) A Maximum of Rs 1 Lakh Or Imprisonment a) A Maximum of Rs 1 Year Or Both |

| Relaxation from Penalty | If the Stakeholders Relationship Committee is not able to consider and resolve any grievance in good faith will not be construed as contravention. |

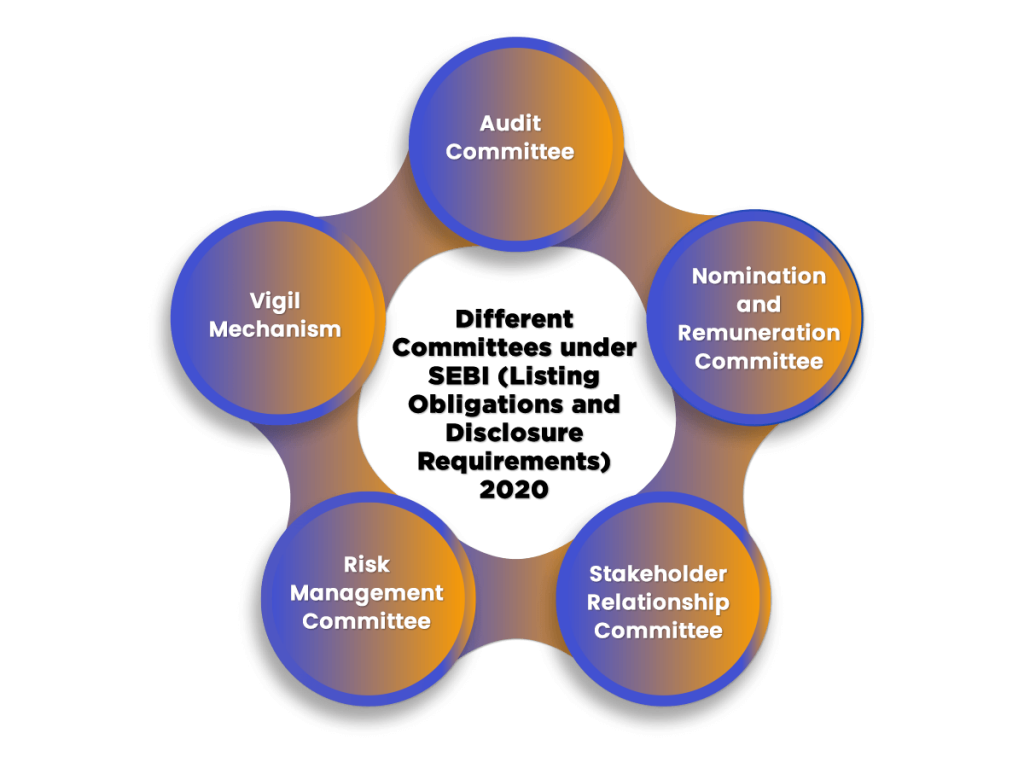

Different Committees under SEBI (Listing Obligations and Disclosure Requirements) 2020

The different types of committees under the SEBI (Listing Obligations and Disclosure Requirements) 2020 are as follows:

- Audit Committee under Regulation 18;

- Nomination and Remuneration Committee under Regulation 19;

- Stakeholder Relationship Committee under Regulation 20;

- Risk Management Committee under Regulation 21;

- Vigil Mechanism under Regulation 22.

Conclusion

In comparison to the Companies Act 1956, there is a significant expansion of committees under the Companies Act 2013. This Act clearly defines the roles and responsibilities of the committees, which was missing in the provisions of the Companies Act, 1956.

It is always better to consult experts to have in-depth knowledge regarding the Committees under the Companies Act 2013. We at Swarit Advisors have a team of experts who will assist you and provide customized solutions for the successful completion of the process.

Read, Also:Designations in a Private Company