Director KYC: How to File DIR-3 KYC Form with the MCA?

Shivani Jain | Updated: Jul 31, 2020 | Category: Business

Director KYC Form has been introduced by the MCA (Ministry of Corporate Affairs) for carrying out verification of the directors who have been issued Director Identification Number (DIN). Earlier, this form was used to issue DIN. However, after the introduction of new company incorporation rules, DIN is now automatically issued after filing the SPICe Form.

In this learning blog, we will talk about the concept and the procedure to file the DIR-3 KYC form with MCA.

Table of Contents

Concept of Form DIR-3 KYC

The term “DIN” denotes a unique identification number allotted to every proposed director. Earlier, it was issued only after filing the form DIR-3 with the MCA and was a one-time process for every individual who wishes to become a director in more than one public limited and private limited company.

However, with the change in the regulations, all the directors who have already been issued DIN need to file their KYC details every year on the MCA portal in the form DIR 3 KYC.

Further, every disqualified director needs to submit this form with the MCA as well.

Who Needs to File DIR-3 KYC?

According to the notification issued by the Ministry of Corporate Affairs[1] , a director needs to file his/her KYC details after fulfilling the conditions as follows:

- DIN (Director Identification Number) issued by or on 31.03.2018;

- Approved DIN;

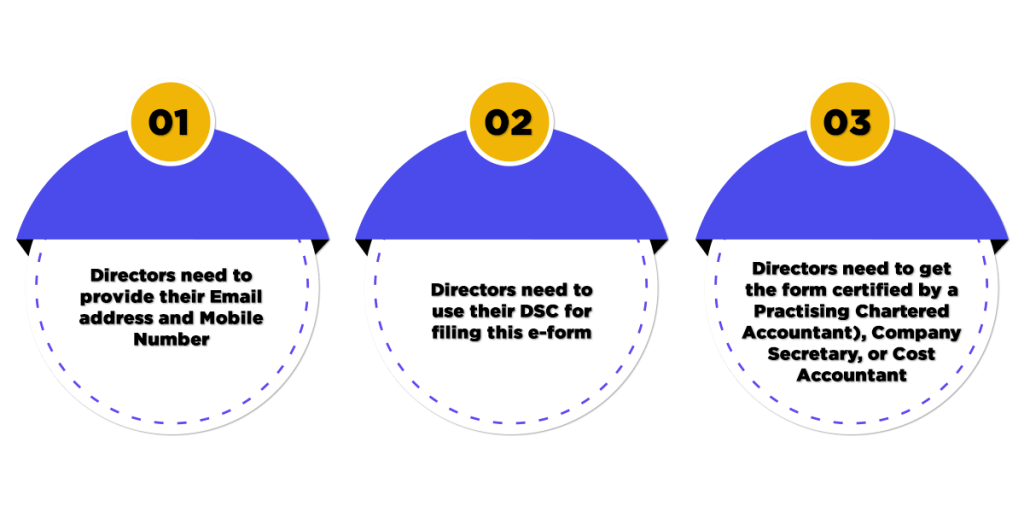

Things to Consider While Filing this Form

The things or the facts to consider while filing DIR-3 KYC Form are as follows:

- All the Directors need to provide their Email address and Mobile Number while submitting this form on the MCA portal. Also, this detail will be verified by OTP (One Time Password);

- Directors need to use their DSC for filing this e-form;

- All the Directors must ensure that this form is duly certified by a Practising CA (Chartered Accountant), CS (Company Secretary), or Cost Accountant.

Objective of Filing This Form

The objectives behind the Filing of Director KYC are as follows:

- Record the correct and accurate details regarding the DIN holder;

- Verify the details of the Holder in case he/she furnishes wrong information;

- Update the details of the DIN Holder in case there is a change in his/her address or contact details.

Consequences of Not Filling Director KYC

In case a director fails to submit his/her KYC details in the E-form DIR-3 KYC by the due date or extended due date prescribed on the MCA portal, he/she will be marked as “Deactivated due to Non-Filing” by the Department.

Further, the said director can reactivate his/her DIN by filing the DIR-3 KYC Form, and the late fees of Rs 5000.

Latest Updates by the Ministry of Corporate Affairs

As per the latest notification issued by the MCA on 24.03.2020 and 30.03.2020, all the DIN holders who are termed as “Deactivated” are eligible to file E-form DIR 3 KYC (Know Your Customer) or Form DIR 3 KYC-Web by 30.09.2020. This date will be considered as DIR 3 KYC Last date. Further, there is no need for these holders to pay the fees of Rs 5000 for submitting this form.

Furthermore, the companies declared as “ACTIVE Non-Compliant” are eligible to submit E-form “ACTIVE” up to 30.09.2020. These holders can also submit the form without providing the fees of Rs 10000.

Documents and Details Needed for Director KYC

The documents and details required for Director KYC are as follows:

- Applicant’s details regarding Nationality and Citizenship;

- Date of Birth of the Applicant;

- Gender of the Applicant;

- PAN (Permanent Account Number) Card details;

- Voter ID/ Election ID Card;

- A copy of Passport (Compulsory in case of Foreign National);

- Driving License;

- Aadhar Card details;

- Registered Mobile Number;

- Proof of Residential Address;

Apart from the details and documents provided above, a director also needs to be ready with the following things:

- DSC (Digital Signature Certificate) to file Director KYC;

- Attestation of all the documents by a Practising CA (Chartered Accountant), CS (Company Secretary), or Cost Accountant;

- Attestation by the prescribed authorities in case of Foreign Nationals;

- Compulsory Attestation of the Declaration made by the Applicant or Director by a Practising CA (Chartered Accountant), CS (Company Secretary), or Cost Accountant;

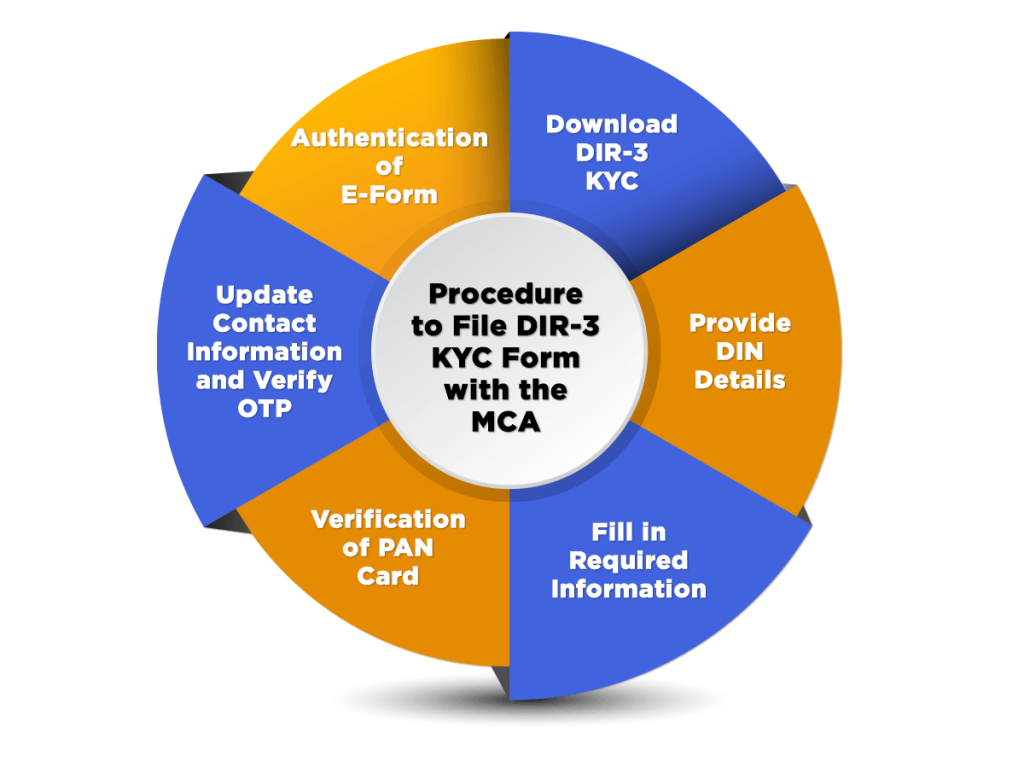

Procedure to File DIR-3 KYC Form with the MCA

The documents required to file DIR-3 KYC with the Ministry of Corporate Affairs are as follows:

Download DIR-3 KYC

The First step is to download the Director KYC form by visiting the MCA Portal at http://www.mca.gov.in/MinistryV2/companyformsdownload.html.

Provide DIN Details

In the next step, the applicant or the director needs to provide the details or information as follows:

- Details of “Approved DIN” in the KYC form;

- Directors with “Deactivated DIN” due to non-filing of Director KYC Form, can also fill the form by paying late filing charges;

Fill in Required Information

Now, the applicant or director needs to fill in the information asked as follows:

Name and Important Credentials

The director needs to enter his/her first and last name, along with the father’s name. Further, the details needed to be considered while filing name are:

- The Name entered must match with the name of PAN Card;

- The Address provided must match with the PAN database;

- Acronyms, short forms, single alphabets are not allowed in the form;

Nationality

Now, the director is required to enter details of his nationality. However, if a director or applicant is of foreign nationality, then he/she needs to submit a copy of the Passport.

Age Declaration

After that, the director or the applicant requires to enter his/her DOB (Date of Birth) in the DD/MM/YYYY format. Further, the reason behind the age declaration is that a person who is below the age of 18 years is not eligible to submit this application form.

Address

In this column, the director needs to mandatorily enter his/her permanent residential address, along with the proof of the permanent address. However, if the permanent residential address is different from the current residential address, then it becomes mandatory for the director or applicant to furnish his/her current residential address. Further, one can also provide a Foreign PIN code if he/she choose N/A in the state section.

Verification of PAN Card

The verification of PAN (Permanent Account Number) is mandatory and compulsory for every director. Firstly, the director needs to enter his/her PAN card details and then click on the option of “Verify Income Tax PAN”.

After that, the system will verify all the details provided on the basis of his/her PAN Card Number.

Note: It shall be relevant to note that the PAN card details furnished must match with the PAN card details specified in the DSC (Digital Signature Certificate) for successful verification and authentication.

Further, if the Foreign National/ NRI does not have a PAN, then the name submitted in the verification form must match with the name specified in the DSC (Digital Signature Certificate) for successful verification and authentication.

Update Contact Information and Verify OTP

- A director must update his/her contact details by entering his/her registered e-mail id and mobile number, which will afterward be verified through an OTP (One Time Password);

- After entering and submitting the details, click on the button saying “Generate OTP”;

- It is relevant to note that separate OTP is sent for both email address and mobile number;

- Further, only the directors who are not the residents of India are permitted to provide their country codes other than +91/91/0;

- It shall be noteworthy to note that an OTP will successfully be sent to the registered email address and mobile number for a maximum of 10 times a day and twice in a period of 30 minutes against one form.

Attachments Needed

The attachments or the documents needed to attest and upload by the applicant/ director are as follows:

- Proof of Permanent Residential Address;

Other Conditional Attachments include the following:

- Proof of Present Address;

- A copy of Aadhaar Card;

- A copy of Passport;

Note: Any other attachments must be digitally signed by the applicant.

Authentication of E-Form

In this step, the director or the applicant needs to ensure that the Director KYC is properly authenticated. That means it is digitally signed by a Practising Chartered Accountant/ Company Secretary/ Cost Accountant.

Note: It is mandatory for a director to furnish his/her DSC (Digital Signature Certificate), together with the details of the professional certifying the E-form.

Now, click on the button “Submit” after a complete and comprehensive proofread.

Procedure after Submission of Director KYC

The steps to be fulfilled after submission of Director KYC are as follows:

SRN Generation

The term “SRN” stands for “Service Request Number”. Once the Director KYC is successfully submitted, an SRN will be generated and allotted to the applicant for future reference with the MCA (Ministry of Corporate Affairs).

Email Communication

The applicant or the director will receive an email on his/her personal Email-Id. This email will be regarding the acknowledgment of the receipt of the form.

Procedure to File DIR-3 KYC Web

The steps involved in the Procedure to File DIR-3 KYC Web are as follows:

- Log in to the Official MCA Portal;

- Enter the provided Login Credentials;

- Click on “MCA Service” then “DIN Services” and then “DIR-3-KYC Web”;

- Now, enter the allotted DIN (Director Identification Number);

- Both Email Address and Mobile Number that are pre-loaded will display on the screen;

- Click on “Send OTP”;

- After that an OTP (One Time Password) will be sent to the registered email Id and mobile number;

- Now, enter the OTP (One Time Password) given;

- Click on “Verify OTP”;

- Pre-loaded details regarding the DIN holder will display on the screen;

- Now, tally all the details shown;

- If required make the necessary change;

- Finally, click on “Submit”;

- Lastly, a Zero Rupee challan and SRN (service request number) will be generated if the said form is filed on or before 30th September.

Conclusion

The main reason behind the introduction of Director KYC Form was to verify the directors who have already been issued Director Identification Number (DIN).

However, if a director fails to submit his/her KYC details in the E-form DIR-3 KYC by the due date on the MCA portal, he/she will be marked as “Deactivated due to Non-Filing” by the Department. After that, the deactivated director will need to pay late fees of Rs 5000, along with the DIR-3 KYC Form, to reactivate his/her DIN.

In case of any other perplexity and confusion, reach out to Swarit Advisors, our professionals will help you in getting a clear understanding of the Director KYC.

Moreover, our experts can also help you with the Appointment of Additional Director, Change in Directors, and Removal of Directors, along with the Private Limited Company Registration, Public Limited Company, or OPC Registration, if you want to start your own company in India.

Read, Also:Committees Under The Companies Act 2013: How they Function?