Income Tax Return Filing, Slabs, ITR Forms, Benefits, e-Filing, Penalty

Khushboo Priya | Updated: Apr 19, 2019 | Category: Income Tax

Income Tax Return (ITR) is no less than a nightmare to taxpayers. After all, who likes to pay tax? Possibly, nobody. But if you don’t file ITR in time, you would be in huge trouble. Therefore, according to the Income Tax (IT) Act, 1961, every earning entity with a certain income is entitled to pay income tax to the government every year.

Further, filing ITR is not only necessary because of the imposed penalty but also because it can give you refunds and several other benefits. Therefore, ITR filing is one of the necessities for every citizen of India.

In this write-up, we have tried to cover up all the crucial detail regarding Income Tax and Income Tax Return. Thus, keep reading the blog until the end so that you don’t miss any critical aspect of ITR. Before we plunge on to the definition of Income Tax Returns, let us first understand what Income Tax is.

Table of Contents

What is Income Tax?

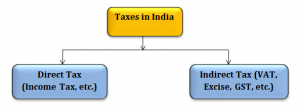

In India, there are two types of taxes: Direct tax and Indirect tax.

Direct tax is a tax that taxpayers pay on their income, directly to the government like income tax. However, indirect tax is a form of tax that somebody else collects on behalf of taxpayers and pays it to the government such as GST, etc. Now, let us move on to income tax.

An income tax is a direct tax that taxpayers such as a Hindu Undivided Family, any individual, or any taxpayer except companies pay on the income they earn. Income Tax law directs the rate at which the income of the person shall be taxed. Since we are now aware of the income tax, let us discuss income tax returns.

Income Tax Return

An income tax return is a statement of taxpayers’ income and claims for exemptions and deductions and taxes payable on the taxable income.

Besides, the ITR form also reflects the details of taxes paid. If the taxpayer has paid any additional tax for a year, then he/she can claim it as a refund.

There are a few taxpayers who operate some other business too. They disclose the details such as the expenses, turnover, profits from the business or profession, etc. in the ITR statement.

Hence, all such info together needs to be filed with the Income Tax Department since they too form a part of their return.

Who should file Income Tax Returns in India?

Every earning individual falling in a certain category needs to file ITR. Whether you are the resident of India or an NRI, ITR filing obligatory. We have enlisted a few entities who need to file the ITR mandatory:

- Every individual whose annual income exceeds Rs. 2, 50,000/– per annum need to file ITR mandatorily.

- Every company or firm such as Sole Proprietorship Firm, LLPs, Partnership Firm, and other companies should file ITR irrespective of their income, turnover, or profit and/or loss.

- Individuals earning from House Property, Interest, Fixed Deposits (FD), Capital Gains such as stocks and mutual funds, and etc.

- Individuals with foreign assets, non-resident Indian (NRI), foreign income (onsite deputation), etc.

- Those who have switched their jobs during the financial year need to file ITR.

- Such entities who only possess salary income need to file with or without Income Tax Form 16.

Benefits of filing ITR

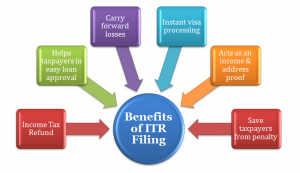

Many people have the question, why do we file income tax returns? Actually, ITR filing drives several benefits to the taxpayers. A few of them are as follows:

Income tax refund

It’s one of the greatest benefits of filing ITR. If a taxpayer has any refund due from the income tax department or if he/she has paid any extra tax for a year, then the taxpayer can claim the income tax refund while ITR filing process.

Helps taxpayers in an easy loan approval

When you apply for loans for a vehicle or a house loan, etc. in the banks, there are high possibilities that banks could ask for a copy of ITR statement. Hence, filing ITR can help taxpayers in easy loan approval while applying for a loa

Carry forward losses

Being a taxpayer, you should always file the return on time. This will help you to carry forward your losses to subsequent years. Further, these losses may be utilized to set off against income of the following years.

Instant visa processing

Again, here’s another huge reason why you should file ITR every year. At the time of visa application, most of the consulates and embassies ask the applicant to furnish the copies of income tax returns for the last few years. Hence, filing ITR would be a wise option for every individual.

Acts as an income and address proof

Several departments demand income certificate and address proof. Although people can have various address proofs such as Aadhaar card, Passport, etc., one can get an income certificate when he/she files income tax returns.

Saves taxpayers from the penalty

Income tax returns filing in due time will help the taxpayer avoid penalty. In case, the applicant misses to file the tax returns, then the income tax officers hold the power to levy a fine of up to Rs. 5,000. Hence, it’s another biggest reason why you should file ITR in time.

Types for Income Tax Return

There are a total of seven income tax return forms. However, depending upon the applicability, the taxpayer is supposed to file any of the seven forms. Find a list of the forms and their description as described below:

|

S. No. | ITR Forms | Applicability |

|

1. | ITR-1 or SAHAJ | Individuals having income from salary or pension, one house property, other sources (excluding income from Race Horses and Lottery), and having a total income up to or below Rs. 50 lakh |

|

2. |

ITR-2 |

Individuals and Hindu Undivided Family (HUF) who don’t carry out business under any proprietorship |

|

3. |

ITR-3 |

Individuals and HUF whose income comes from a proprietary business or profession. |

|

4. |

ITR-4 or Sugam |

As per the Section 44AD, Section 44ADA, and Section 44AE of the Income Tax Act, individuals and HUFs who have opted for the presumptive scheme should file ITR |

|

5. |

ITR-5 |

For Body of Individuals (BOI), Limited Liability Partnership (LLP), Private Discretionary Trust, Artificial Juridical Person, Association of Persons (AOP), Registered Society, Cooperative Society, Local Authority. However, an entity who needs to file ITR-7 shall not file this form. |

|

6. |

ITR-6 |

For the company, excluding those who claim an exemption under Section 11 |

|

7. |

ITR-7 |

Entities including Companies who need to furnish return under Section 139 (4A) to Section 139 (4F) of the Income Tax Act, 1961 which include trusts, investment funds, institutions, colleges, political parties, etc. |

Income Tax Slabs Rate

We have presented below the income tax slabs rate for different entities such as individuals, senior citizens, and domestic companies.

- Income Tax Slabs rates for individual taxpayers and Hindu Undivided Family (HUF) for FY 2018-2019 and AY 2019-20.

|

Income Tax Slabs | Tax Rate |

| Up to Rs. 2.5 lakhs |

NIL |

| Rs. 2.5 lakhs to Rs. 5 lakhs | 5% of the total income + 4% cess |

| Rs. 5 lakhs to Rs. 10 lakhs | 20% of the total income + 4% cess |

| Rs. 10 lakhs to Rs. 50 lakhs | 30% of the total income + 4% cess |

| Rs. 50 lakhs to Rs. 1 crore | 30% of the total income + 4% cess + 10% surcharge |

| Above Rs. 1 crore | 30% of the total income + 4% cess + 15% surcharge |

- Income tax slabs rates for senior citizens including both male and female taxpayers of age above 60 years and below 80 years for FY 2018-19 and AY 2019-20:

|

Income Tax Slabs |

Tax Rate |

| Up to Rs. 3 lakhs |

NIL |

| Rs. 3 lakhs to Rs. 5 lakhs | 5% of the total income + 4% cess |

| Rs. 5 lakhs to Rs. 10 lakhs | 20% of the total income + 4% cess |

| Rs. 10 lakhs to Rs. 50 lakhs | 30% of the total income + 4% cess |

| Rs. 50 lakhs to Rs. 1 crore | 30% of the total income + 4% cess + 10% surcharge |

| Above Rs. 1 crore | 30% of the total income + 4% cess + 15% surcharge |

- For senior citizens including both male and female taxpayers of age above 80 years for FY 2018-19 and AY 2019-20, the income tax slabs rate is as follows:

| Income Tax Slabs | Tax Rate |

| Up to Rs. 2.5 lakhs | NIL |

| Rs. 2.5 lakhs to Rs. 5 lakhs | NIL |

| Rs. 5 lakhs to Rs. 10 lakhs | 20% of the total income + 4% cess |

| Rs. 10 lakhs to Rs. 50 lakhs | 30% of the total income + 4% cess |

| Rs. 50 lakhs to Rs. 1 crore | 30% of the total income + 4% cess + 10% surcharge |

| Above Rs. 1 crore | 30% of the total income + 4% cess + 15% surcharge |

- Income Tax slabs rates for Domestic companies for FY 2018-19 and AY 2019-20

|

Companies with Gross Turnover |

Tax Rate |

| Up to Rs. 250 cr. in the previous year | 25% |

| Exceeds Rs. 250 cr. in the previous year | 30% |

However, according to the recent Interim Budget for FY 2019-20, the tax rate for individuals earning up to Rs. 5 would be NIL.

Due dates for filing Income Tax Return

The due dates for filing ITR differs from corporate to individual taxpayers. However, we have described the date for both entities as follows:

- For individuals, the due date for ITR filing is 31st July;

- For companies and other taxpayers whose tax audit is mandatory need to file the ITR on or before the due date 30th September.

How to file income tax returns online?

If you want, you can file ITR yourself. However, the process is quite lengthy. Therefore, we suggest you take the help of professionals for filing income tax returns. Below we have described steps for efiling income tax returns to help with easy filing:

Step 1: Check the eligibility

Before you start, you must check the eligibility for filing ITR. Check the slabs under which you fall. If you fall under the prescribed category, then you can proceed further. However, if the conditions don’t apply to you, you don’t need to apply for ITR. Besides, you can also opt for NIL return.

Step 2: Prepare all the required documents

The second most important thing to consider is the document. You must have the scan copy of necessary documents ready with you at the time of filing ITR. Or you may face several issues. Employees need to provide their salary slips along with other required documents.

Step 3: Log in on the Income Tax Department’s website

For efiling, you need income tax returns login on to the official website of the Income Tax Department [1] . If you are a new user, then you must first register. You will get an income tax login id and income tax return password. However, if you are already registered, you can simply log in with your previous id and password.

Step 4: Upload Income Tax Form 16

If you are thinking how to file income tax return online for salaried employee, then follow with the steps as described. You need to upload form 16 on the income tax website where you have to fill details regarding your salary and deductions.

Step 5: Claim deductions, if any

If you have opted for LIC (Life Insurance Corporation), Fixed Deposit (FD), etc. you can claim deductions while filing ITR.

Step 6: Payment of tax liability

Ultimately, here you have to make an income tax payment. Whatever slabs you fall into, you can check and calculate your income tax with income tax calculator [2] and pay the dues.

Step 7: Acknowledgement generation

Once you are done with the payment, an acknowledgment form will be generated. Download it.

Step 8: Send ITR 5 to the headquarter

Finally, you have to fill the form ITR 5 and send the physical copy of the same to the Income Tax Department headquarter at Bengaluru. Then, you can wait for your refund, if any.

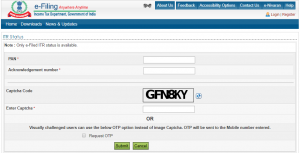

Step 9: Check for refund status

After a few days, you can check for income tax returns status on the online portal [3] of the income tax department.

Penalty for late filing of Income tax returns

What happens if we don’t file income tax returns in India? Well, under the Income Tax Act, 1961, there are certain penalty provisions for taxpayers who don’t file ITR in the due time. The Income Tax Department imposes a penalty on the taxpayer for both late filing and no filing at all. Recently, the government has increased the penalty on late income tax filing. Therefore, according to the latest changes, the late fee or penalty for ITR filing are as follows:

- 5000/- for ITR filing between 1st August to 31st December.

- 10,000/- for filing returns after 31st December.

- 1000/- in case the taxable income of the taxpayer is below Rs. 5 lakhs.

Conclusion

Income Tax Return is filed with the Income Tax Department where the taxpayers declare their taxable income, tax payments, and deductions. Further, if the taxpayer has paid an additional tax for the following year, then he or she can claim a refund. Therefore, income tax return filing is one of the mandatory processes that every earning individual must do. In cases of ignorance, the income tax department will impose a hefty penalty on the taxpayer.

We assume this blog was helpful to you. However, you have questions regarding the ITR efiling processes, or if we think we have missed something, do leave a comment below. We will get back to you very soon.

Also, Read:Input Tax Credit under GST