Minimum Paid-Up Capital for Private Limited Company

Gonica Verma | Updated: Jul 10, 2019 | Category: Private Limited Company

In this era of Private Limited Companies, every existing business entity or start-up wants to register as a Private Limited Company. The reason for the same is the basic eligibility criteria and documentation. It is totally a delusion that registration under Private Limited demands huge investment.

In this article, we will discuss the minimum paid-up capital and authorized capital requirement for the formation of a Private Limited Company, but before that, we must know the basics of a Private Limited Company.

Table of Contents

Private Limited Company

Private Limited Company is one of the popular forms of business entities in India. Approximately 90% of companies in India are registered under Private Limited Company. These companies are governed under the Companies Act, 2013 by the Ministry of Corporate Affair (MCA). All those entrepreneurs who want to run their business entity as both Public limited company and Partnership, prefer to register their entity as Private Limited because it is the midway between both the forms of entities and offers several benefits.

Directors and shareholders of Private Limited Company can improve the credibility of the business by running its operations according to their own choice. And, the profits are divided among all its members as dividends. The requirement of minimum paid up and authorized capital to start the Private Limited Company is discussed further.

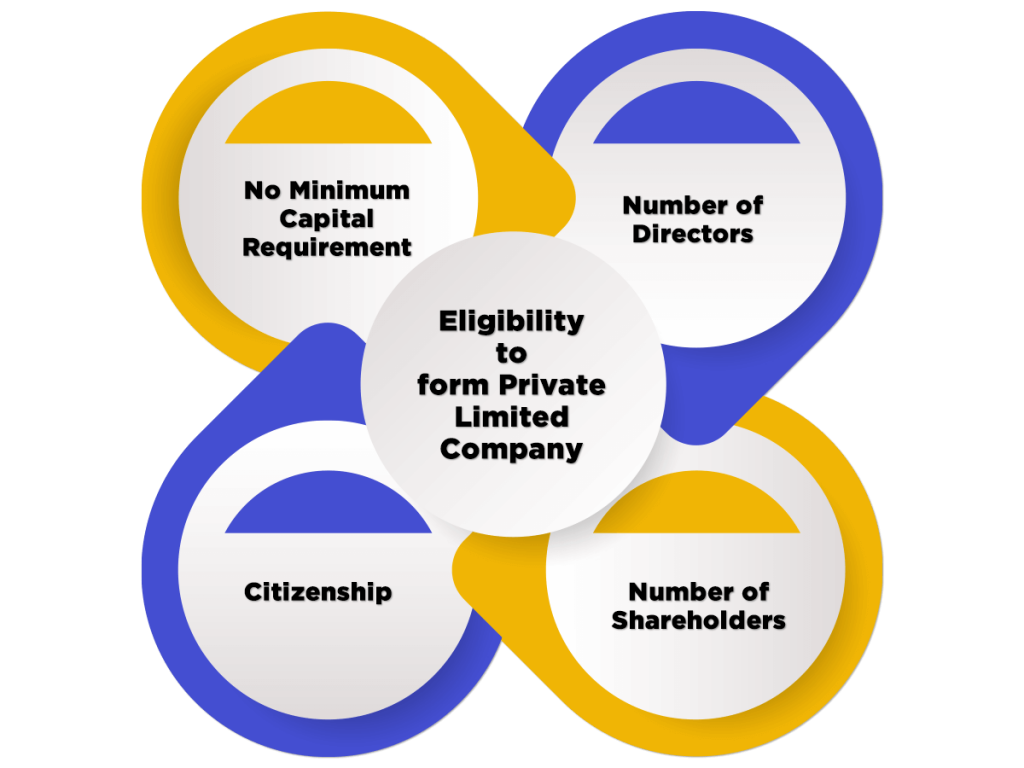

Eligibility to form Private Limited Company

- Number of Directors: A Minimum of 2 and a Maximum of 15.

- Number of Shareholders: A Minimum of 2 and a maximum of 200. However, one person can act as both director and shareholder.

- Citizenship: A private company can have a foreign director. However, at least one of the directors must hold Indian Citizenship.

- No Minimum Capital Requirement: Earlier, the minimum capital required to incorporate a Private Limited Company in India was Rs 100000. However, after the Companies (Amendment) Act, 2015, the said requirement was removed.

Authorized Capital for Private Limited Company

Authorized capital or authorized shares are the maximum number of shares which the Company can issue to its shareholders. The Company needs to prescribe its authorized capital in MOA and importance of AOA during its incorporation.

Government fee for Authorized capital

The Ministry of Corporate Affair charges the amount of Rs.5000 for minimum authorized capital of Rs.1 lakh. If the company raises additional authorized capital, then the charges by MCA are as follows:

| Additional Authorized Capital (Rs.) | Per lakh fees as prescribed by MCA |

| Rs.1,00,000- Rs.5,00,000 | Rs.4000/- lakh |

| Rs.5,00,000-Rs.50,00,000 | Rs.3000/- lakh |

| Rs.50,00,000-Rs.1,00,00,000 | Rs.1000/- lakh |

| More than 1 cr. | Rs.750/-lakh |

Paid-up Capital for Private Limited Company

Whereas on another side, paid-up capital is the part of authorized capital which states the number of Shares Company issued to its shareholders. For example, the company mentioned its authorized capital (maximum amount raised by issuing shares) of Rs.10 lakh at the time of incorporation but till now it raised only 7 lakh from its shares. So, it’s paid up capital is Rs. 7 lakh.

Different sources of Paid-up Capital for Private Limited Company

The two different sources for the funding of paid-up capital as follows:

Par value of the shares

This is the foremost source of the paid-up capital for any Private Limited Company. In this case, the shares/stocks of the company are issued at the par value. The par value is the fixed basic value of the stock mentioned in the Company’s guide to alter MOA during its Incorporation. It is also called as “Nominal value” or “Face value” of the share.

Premium/Discount value of the stock

Private Limited Companies in India can also raise funds by issuing the shares or stock of the company at discount or premium on their par value. For example; the company issues the share with the par value of Rs.10 at Rs.20 which means, it will be considered as premium shares. Whereas on other side, if company issues the share at Rs.7 whose par value is Rs.10 then, it will be considered as discounted shares.

Generally, companies issue shares at a discount when they lack capital for their business operations and urgently required capital. They also issue at discount value when a company is suffering with huge loses. On the other side, companies issue at premium value when they are enjoying huge profits and there is a high demand in a limited number of shares.

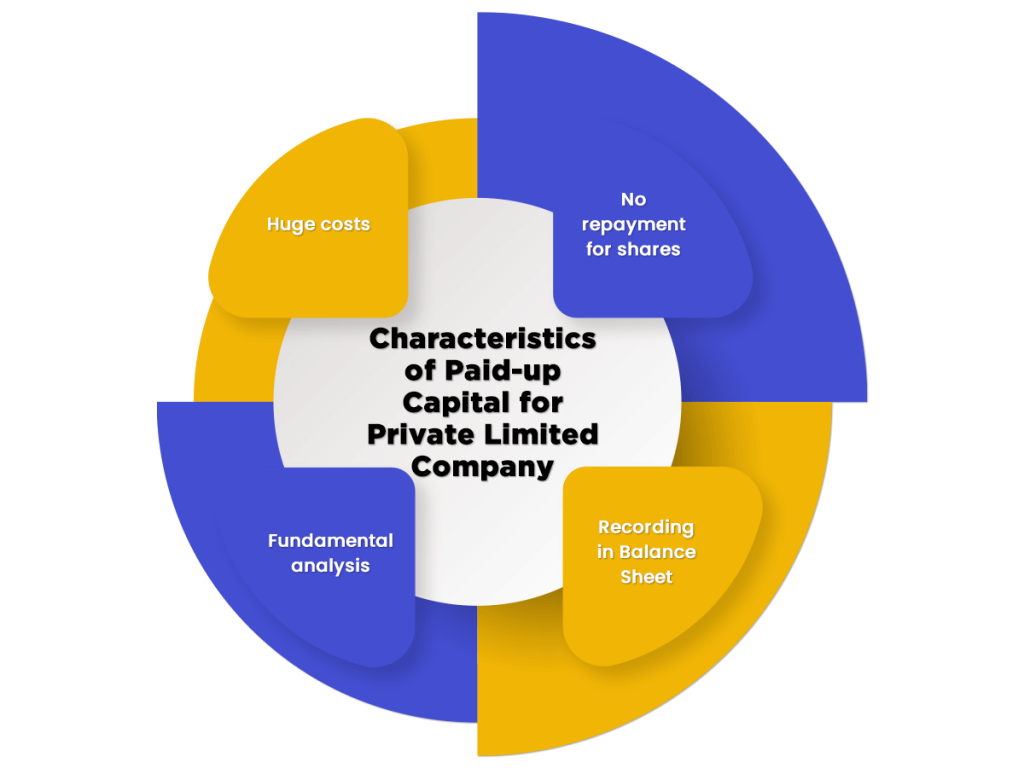

Characteristics of Paid-up Capital for Private Limited Company

No repayment for shares

This is one of the major characteristics of paid-up capital. This states that once investor purchases the share and invest in the company then, they do not require paying again for the shares they have purchased. They also don’t even need to buy-back their shares in the future.

Recording in Balance Sheet

Paid-up capital is also recorded in the balance sheet of the company. It is recorded under stockholder’s equity. The paid up capital can be recorded differently for each source as mentioned above. All the equity generated by issuing shares at par value recorded under “common stock paid-up capital” and the shares issued at discounted or premium value recorded under “additional stock paid-up capital” accounts.

Fundamental analysis

Paid-up capital helps the company to determine whether its equity is exceeding its debts or not. If equity exceeds the company’s debts then it shows that the company is having a lower debt-equity ratio. Lower debt-equity ratio means that the company is less dependent on its debts and more dependent on its equity. So, the company always tries to maximize its paid up capital to lower its ratio.

Huge costs

The cost of maintaining paid-up capital is quite expensive because if investors invest in the company then, they want some share of its profits in the form of dividends. As a result, the payment of dividends or non-cash benefits is pricey for the company.

Importance of Paid-up Capital for Private Limited Company

- Paid up capital is the amount of capital raised by the company by issuing all of its shares. More paid-up capital means the lesser dependence on debts. A Private Limited Company that is called as fully paid-up capital company is the company that issued all its shares and now it can raise its capital by exceeding its authorized capital limit or by debts.

- The paid-up capital figure in the balance sheet of the company determines the company’s health in the market. It represents how much extent the company is dependent on equity for its financing. The level of equity is compared to the level of debt to determine the financial condition of the company.

Minimum Paid-up Capital to form Private Limited Company

As per Companies Act, 2013, the minimum paid-up capital to form the Private Limited Company was Rs.1 lakh but after the amendments in Companies Act (2013), Companies (Amendments) Act, 2015 [1] states that there is no minimum limit of Paid-up capital to form Private Limited Company but the Authorized capital of minimum Rs.1 lakh is still mandatory to form this Company.

Difference Between PLC, OPC and LLP

| Basis of Difference | Private Limited Company | One Person Company | Limited Liability Partnership |

| Regulating Act | Companies Act, 2013. | Companies Act, 2013. | Limited Liability Partnership Act, 2008. |

| Registration Requirement | It is mandatory to obtain registration for a Private Limited Company | It is mandatory to obtain registration for a One Person Company | It is mandatory to obtain registration for a Limited Liability Partnership |

| Number of Members Needed | A Minimum of 2 and Maximum 200 | Only 1 person required | A Minimum of 2 and Maximum no limit |

| Status of Separate Legal Entity | Yes, this business format enjoys the status of a Separate Legal Entity. | Yes, this business format enjoys the status of a Separate Legal Entity. | Yes, this business format enjoys the status of a Separate Legal Entity. |

| Limited or Unlimited Liability | Limited Liability | Limited Liability | Limited Liability |

| Requirement of Getting Statutory Audit Done | Yes, a private company must get its Statutory Audit done. | Yes, an OPC must get its Statutory Audit done. | Depends on the situation |

| Transferability of Ownership | Transferability of Ownership is Restricted for this business format | Transferability of Ownership is Restricted for this business format | Transfer of Ownership is Allowed in this business format |

| Perpetual Existence | Yes, this business format has the feature of Perpetual Existence | Yes, this business format has the feature of Perpetual Existence | Yes, this business format has the feature of Perpetual Existence |

| Foreign Participation Allowed or Not Allowed | Foreign Participation is allowed in this business format | Foreign Participation is not allowed in this business format | Foreign Participation is allowed in this business format |

| Applicable Tax Rates | Moderate | Moderate | High |

| Statutory Compliances | High | Moderate | Moderate |

Conclusion

Hence, it is concluded that our perception regarding huge investments in forming Private Limited is totally fake. The government is all supporting the entrepreneurs to develop the country’s economy and waived off huge capital requirements. Forming an entity as Private Limited helps the company to grow better and far with all government support. So, what are you waiting for? Obtain your Private Limited Company Registration today with Swarit Advisors. Our team of experts ranks high in providing on-time registration.

Also, Read: Designations in a Private Company