Preferential Allotment of Equity Shares: A Complete Guide

Shivani Jain | Updated: Sep 24, 2020 | Category: SEBI Advisory

The term “Preferential Allotment of Equity Shares” denotes a process in which a company allots shares to the individuals, companies, and venture capitalists at a pre-determined price.

Further, these shares are mainly made to the individuals who want to acquire a majority or strategic stake in the company.

In this blog, we will discuss the concept of Preferential Allotment of Equity Shares, together with the Reasons and the Procedure for the same.

Table of Contents

Concept of Preferential Allotment of Equity Shares

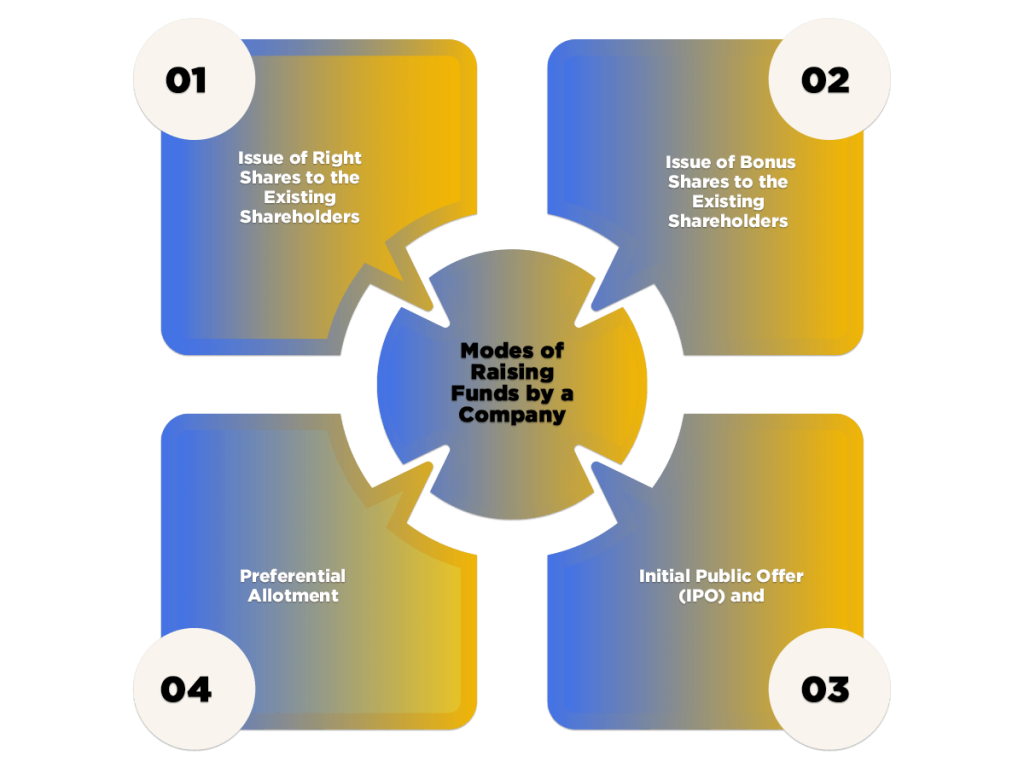

In India, if an existing company wants to expand its operation and affairs, it can raise funds in the manner as follows:

- Issue of Right Shares to the Existing Shareholders;

- Issue of Bonus Shares to the Existing Shareholders;

- Initial Public Offer (IPO); and

- Preferential Allotment;

Further, the term “Preferential Allotment” denotes the issuance of shares to a group of individuals at a pre-determined price. Further, this option allows the company to acquire Equity Participation from those whom it considers as being valuable as shareholders.

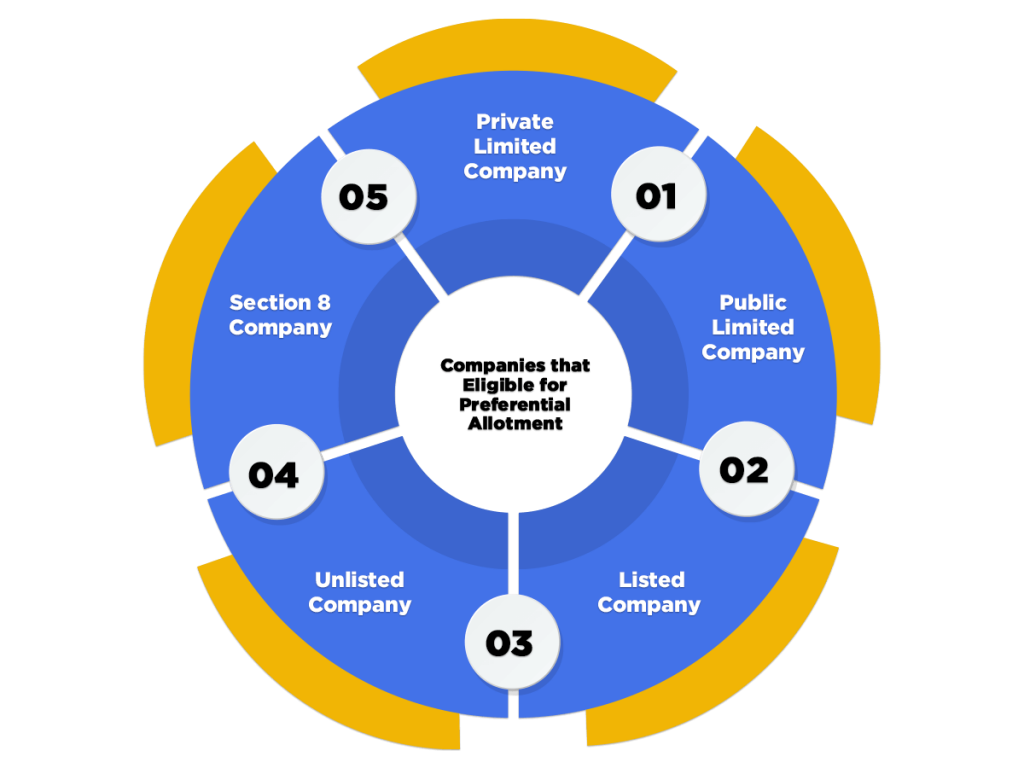

Which Companies are Eligible for Preferential Allotment?

The companies eligible for the Preferential Allotment of Equity Shares are as follows:

- Private Limited Company;

- Public Limited Company;

- Listed Company;

- Unlisted Company; and

- Section 8 Company;

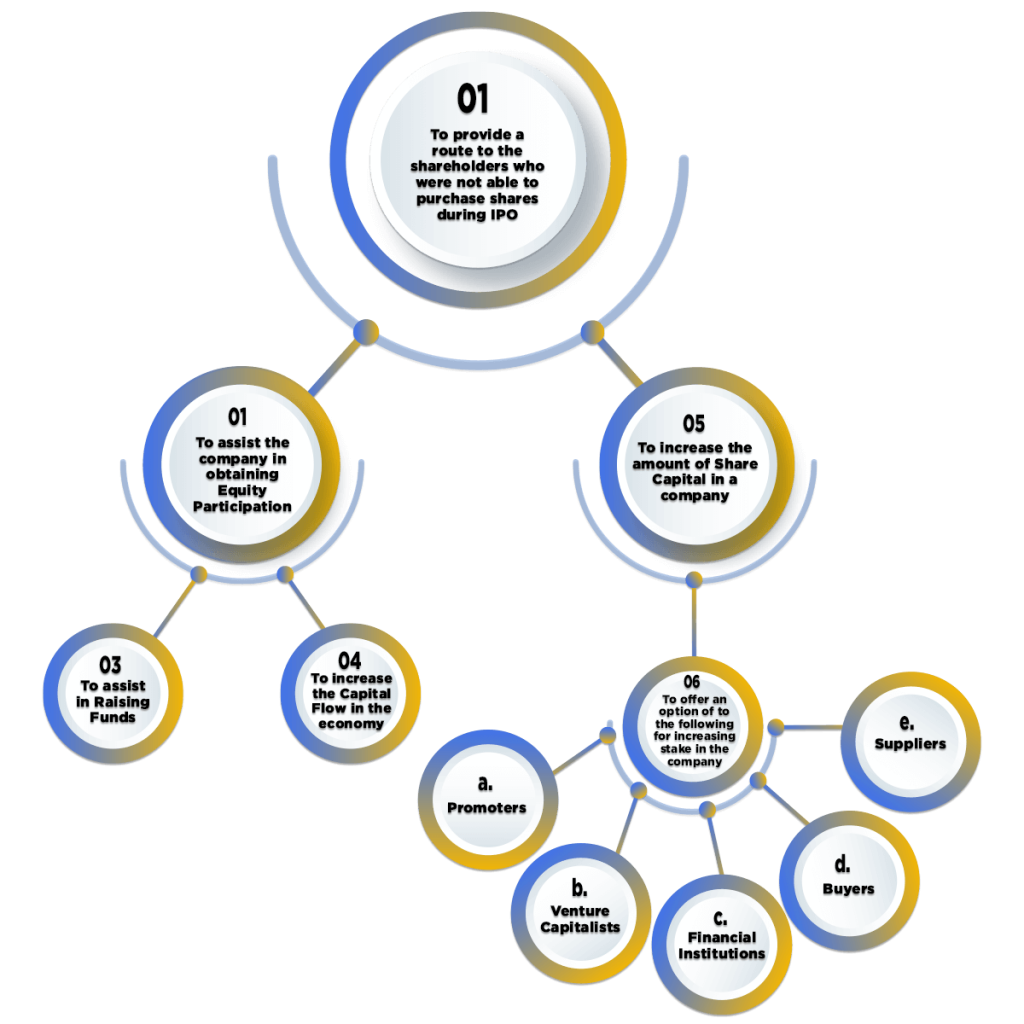

Reasons to Opt for Preferential Allotment of Shares

The reasons to opt for Preferential Allotment of Shares are as follows:

- To provide a route to the shareholders who were not able to purchase shares during IPO;

- To assist the company in obtaining Equity Participation;

- To assist in Raising Funds;

- To increase the Capital Flow in the economy;

- To increase the amount of Share Capital in a company;

- To offer an option of to the following for increasing stake in the company:

- Promoters;

- Venture Capitalists;

- Financial Institutions;

- Buyers;

- Suppliers;

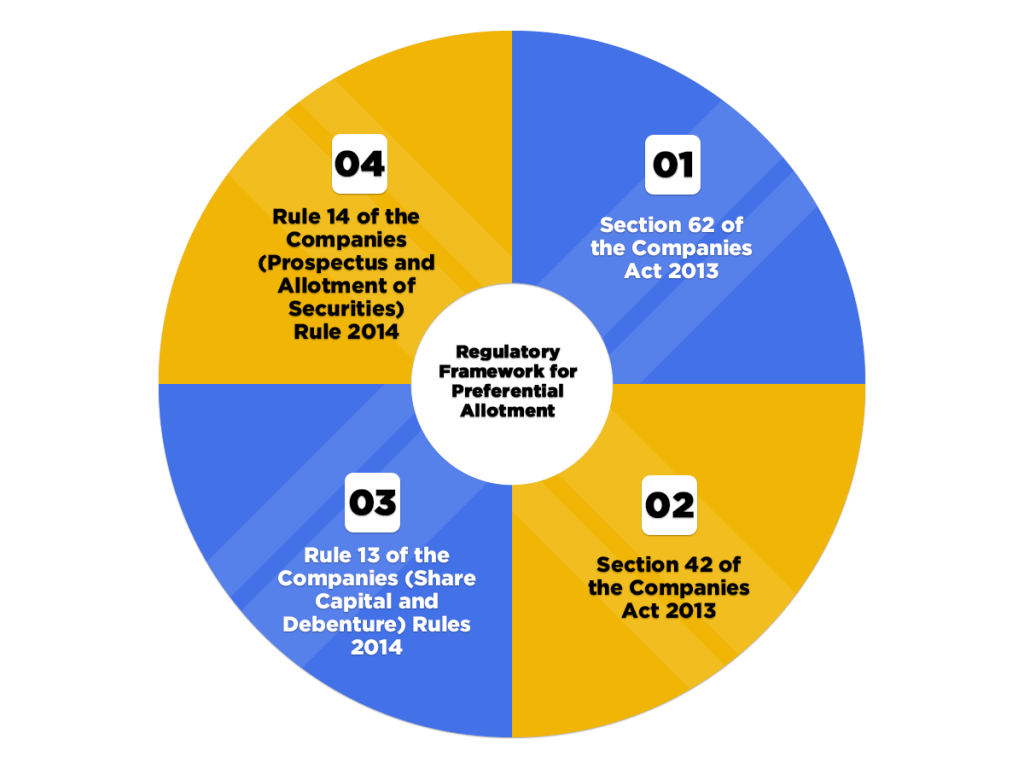

Regulatory Framework for Preferential Allotment

The Regulatory Framework for the Preferential Allotment of Equity Shares are as follows:

- Section 62 of the Companies Act 2013;

- Section 42 of the Companies Act 2013;

- Rule 13 of the Companies (Share Capital and Debenture) Rules 2014;

- Rule 14 of the Companies (Prospectus and Allotment of Securities) Rule 2014;

Securities Covered Under Preferential Allotment

The Securities Covered under Preferential Allotment are as follows:

- Equity Shares;

- Fully Convertible Debentures;

- Partly Convertible Debentures;

- Any other Security that is Converted or Exchanged into Equity Shares;

Benefits of the Preferential Allotment

The benefits of the Preferential Allotment of Equity Shares are as follows:

- No Brokerage Cost Involved;

- Preference Shareholder are given Preference over Shareholders at the time of Winding Up;

- Preference Shareholders have a Right to Claim “Unpaid Dividend”;

- Safer than Issuance of Equity Shares;

- Preference Shareholders are paid first in the case of Bankruptcy and Insolvency;

Forms Required for Preferential Allotment of Equity Shares

The forms required for the Preferential Allotment of Equity Shares are as follows:

Form MGT 14

A Company requires to file MCA Form MGT 14 when it needs to pass Shareholders Resolution in the Annual General Meeting (AGM) or Extraordinary General Meeting (EGM). Further, the directors must file this form with the Registrar of Companies (ROC) within 30 days commencing from the date of resolution.

Moreover, the requirements of Form MGT 14 are as follows:

- A copy of the SR (Special Resolution);

- Explanatory Statement;

However, it shall be relevant to note that the certified copies of both documents are required for the process of Preferential Allotment.

Form PAS 3

The directors of the “Issuer Company” required to file the “Return of Allotment” in Form PAS-3 with the Registrar of Companies (ROC) within 15 days from the date of Allotment.

Further, the documents required with Form PAS 3 are as follows:

- List of Allottees;

- A copy of SR (Special Resolution);

- Explanatory Statement;

- Valuation Report;

- A copy of the Contract signed, in the case of “Issue of Shares for Consideration other than Cash”;

- A copy of the Books of Account regarding the offer of Private Placement;

- A copy of the Acceptance filed in Form PAS 5;

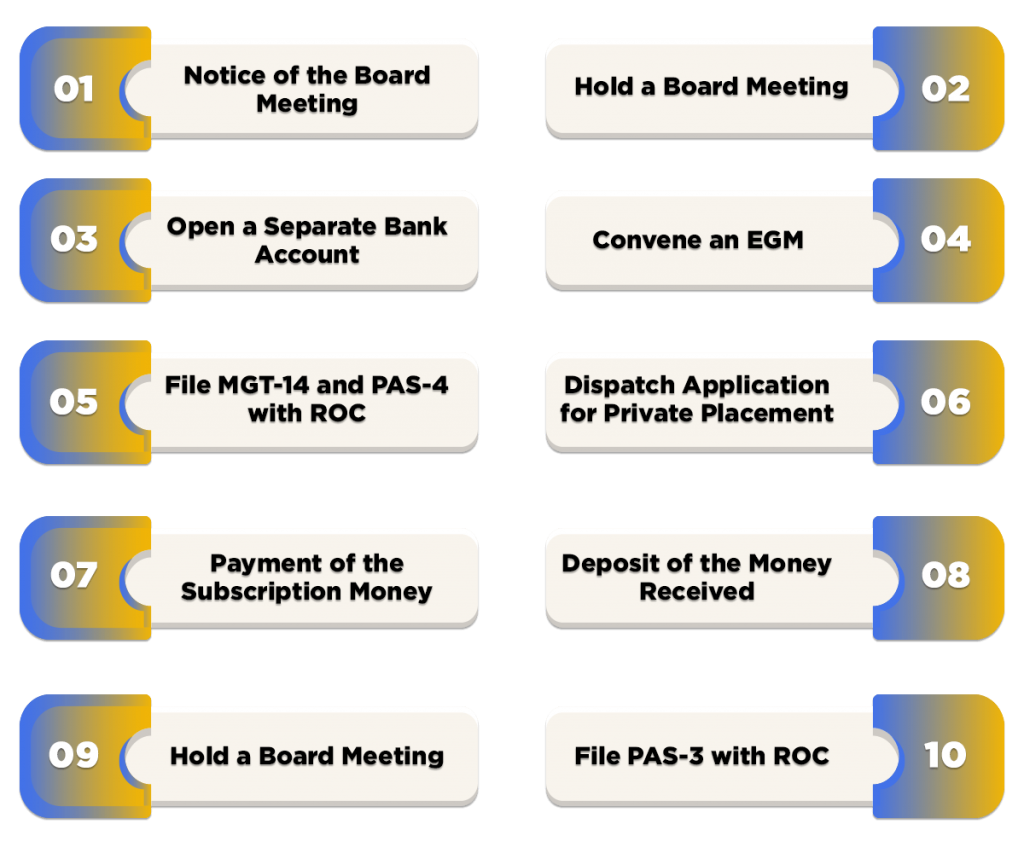

Procedure for the Allotment of Equity Shares

The steps involved in the procedure for the Allotment of Equity Shares are as follows:

Notice of the Board Meeting

In the first step, the company needs to send a notice for Board Meeting at least 7 days before the date of Meeting.

Hold a Board Meeting

On the date of the Board Meeting, the Directors of the Company need to discuss and pass a resolution on the issues as follow::

- To analyze the “Valuation Report” as received from the “Registered Valuer”;

- To fix the list of allottees (It shall be relevant to note that an issuer company can send an invitation to only 50 people “at a time” and 200 in “aggregate” in a financial year. However, such an invitation will be exclusive of Qualified Institutional Buyer (QIBs);

- To decide a Date, Day, Venue, and Time of the Extraordinary General Meeting (EGM);

- To settle the Offer Period;

- To approve Letter of Offer in accordance with Form PAS 4;

- To make a decision on the Agenda in the Notice, together with the Explanatory Statement for an Extraordinary General Meeting;

Open a Separate Bank Account

Now, in the next step, the directors of the company need to open a separate Current Bank Account to receive the total application money.

Convene an EGM

Now, the shareholders of the company need to pass a Special Resolution (SR) for allowing the process of Preferential Allotment of Equity Shares at the EGM.

File MGT-14 and PAS-4 with ROC

After passing the Special Resolution (SR) at the EGM, the directors need to file MCA form MGT 14 with the Registrar of Companies, India (ROC), and then require to file the “Application Cum Offer Letter” for the process of Private Placement in form PAS 4.

Further, the directors will dispatch the application to the “proposed allottees”, along with the documents as follows:

- A Copy of the SR (Special Resolution);

- Explanatory Statement;

However, it shall be relevant to note that the certified copies of both documents are required for the process of Preferential Allotment.

Dispatch Application for Private Placement

Now, the directors require to send the “Application Cum Offer Letter” for Private Placement to all the “Proposed Allottees” at least 3 days prior to the opening of the issue.

Further, they need to send the application within 30 days, starting from the date of passing SR in either of the methods as follows:

- Registered Post;

- Speed Post;

- Courier;

- E-mail;

- Hand Delivery;

Payment of the Subscription Money

Under this step, all the proposed allottees need to subscribe the shares offered to them in “Application Cum Offer Letter” for Private Placement.

Further, the allottees need to pay the “Subscription Money” either by DD (Demand Draft)/ Cheque/ or by any other mode of banking. However, it shall be relevant to note that the allottees are not permitted to pay “Subscription Money” in cash.

Deposit of the Money Received

Now, the directors need to deposit or submit all the money received as “Application Money” in the current bank account opened.

Hold a Board Meeting

After that, the company requires to hold a Board Meeting (BM) for the preferential allotment of equity shares within 60 days, starting from the receipt of share application money.

File PAS-3 with ROC

Lastly, the directors require to file MCA Form PAS 3 with the ROC (Registrar of Companies) within 15 days, starting from the date of preferential allotment of equity shares.

Conclusion

The term “Preferential Allotment of Equity Shares” denotes a process in which a company allots shares to the individuals, companies, and venture capitalists at a pre-determined price. Further, these shares are mainly made to the individuals who want to acquire a majority or strategic stake in the company.

Moreover, this option allows the company to acquire Equity Participation from those whom it considers as being valuable as shareholders.

However, it shall be noteworthy to note that the process of preferential allotment is an intricate and lengthy process, and includes a lot of documentation and approvals. At Swarit Advisors, we have a team of experts who are proficient and experienced in the field of Corporate Laws. They will not only provide a lucid understanding of the concept but will ensure successful completion of the work as well.

Read, Also:Cross Border Mergers and Acquisitions in India: A Complete Guide