Online Preferential Allotment - An Overview

In India, an existing company can expand its business operations and raise funds in three ways. These methods include the issue of right or bonus shares to existing shareholders in proportion to the shares held by them, initial public offer and preferential allotment.

Preferential allotment involves bulk allotment of fresh issue of shares by a company to individuals, venture capitalists and companies at a pre-determined price. Usually, a company chooses to make a preferential allotment to people who want to acquire a strategic stake in the company. This includes the existing shareholders like promoters, venture capitalists, financial institutions, suppliers or buyers who want to increase their stake in the company. Therefore, preferential allotment allows the company to get equity participation of those whom it considers to be a value addition as shareholders.

Every company, whether it is a private or public, listed or unlisted, and even section 8 company can opt for preferential allotment.

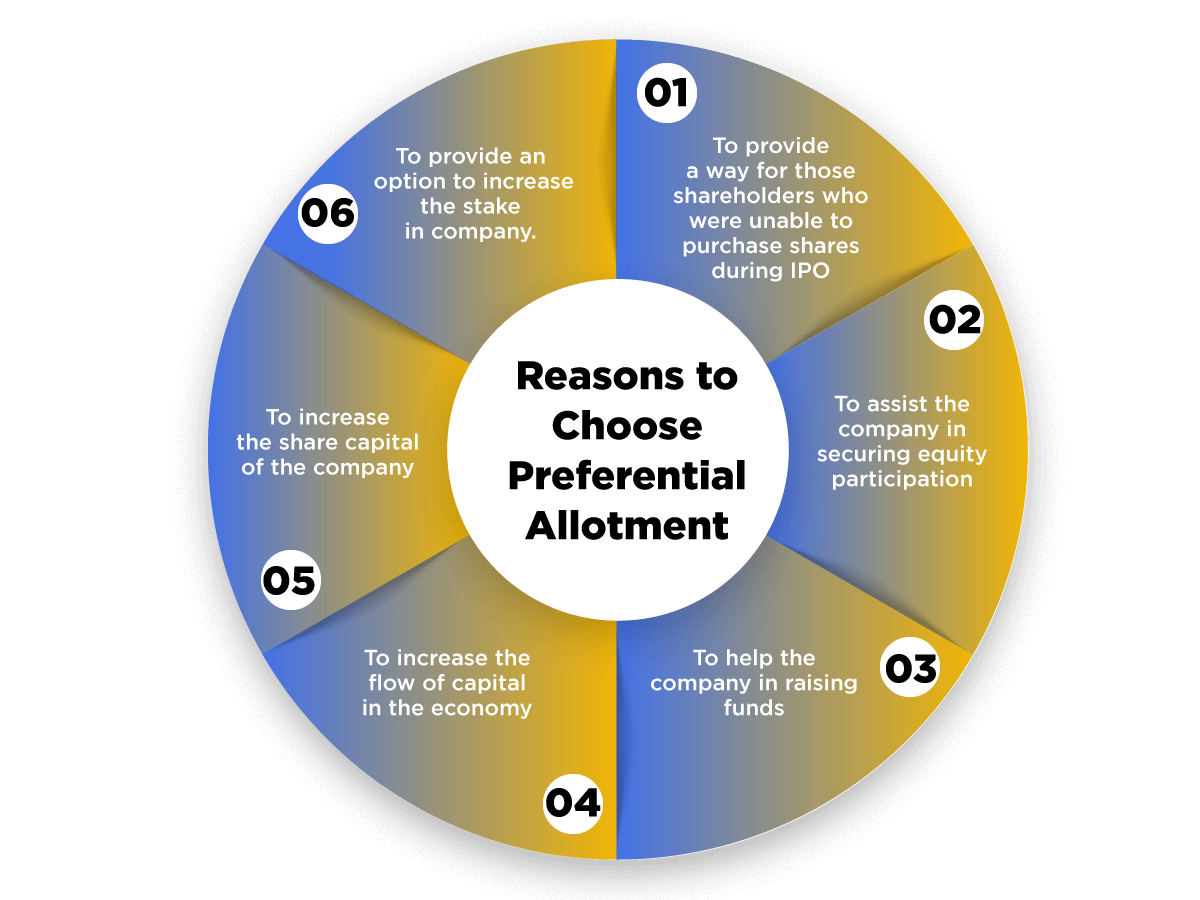

Reasons to Choose Preferential Allotment

The reasons for choosing preferential allotment can be summarized as:

- To provide a way for those shareholders who were unable to purchase shares during initial public offerings;

- To assist the company in securing equity participation;

- To help the company in raising funds;

- To increase the flow of capital in the economy;

- To increase the share capital of the company;

- To provide an option to promoters, venture capitalists, financial institutions, suppliers or buyers to increase their stake in the company.

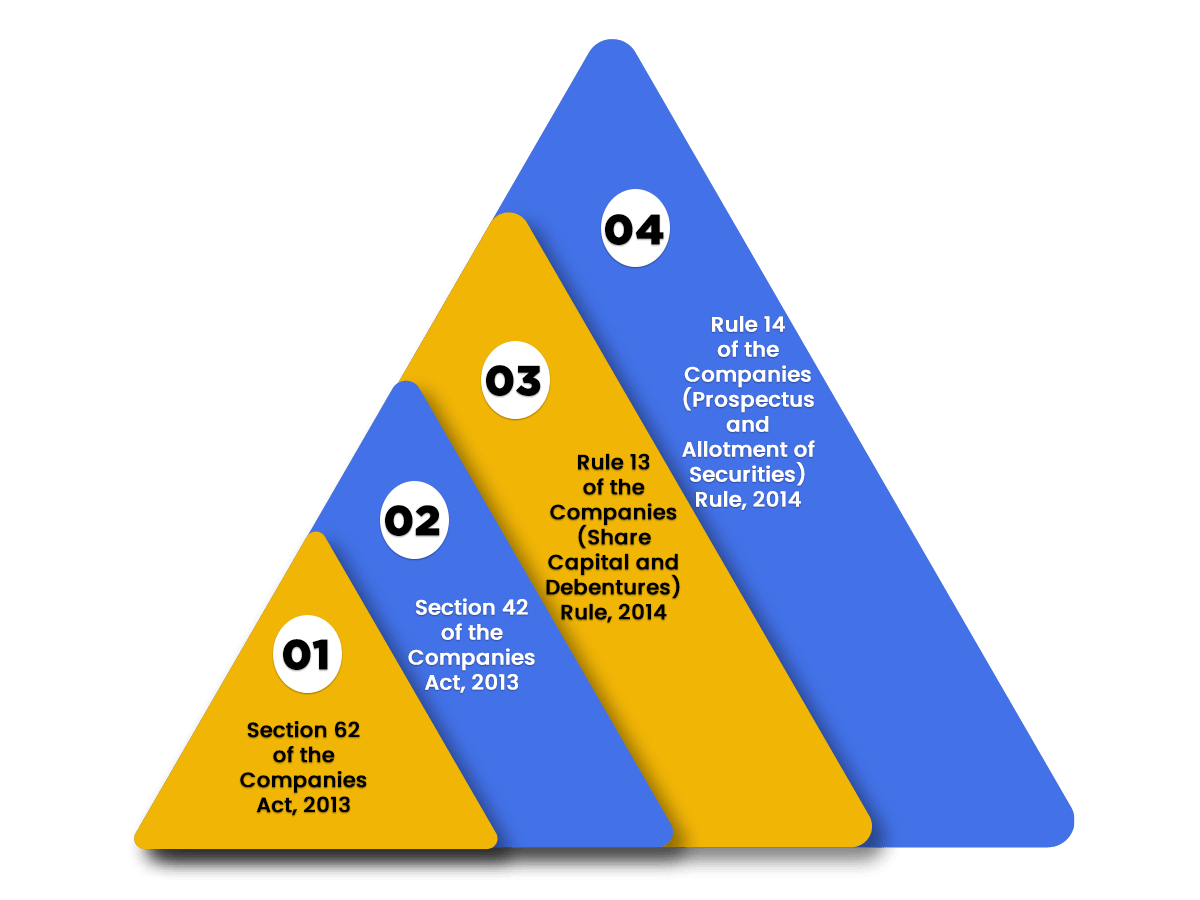

Laws Relating to Preferential Allotment

In India, the legal provisions regulating the concept of Preferential Allotment are as follows:

- Section 62 of the Companies Act, 2013;

- Section 42 of the Companies Act, 2013;

- Rule 13 of the Companies (Share Capital and Debentures) Rule, 2014;

- Rule 14 of the Companies (Prospectus and Allotment of Securities) Rule, 2014.

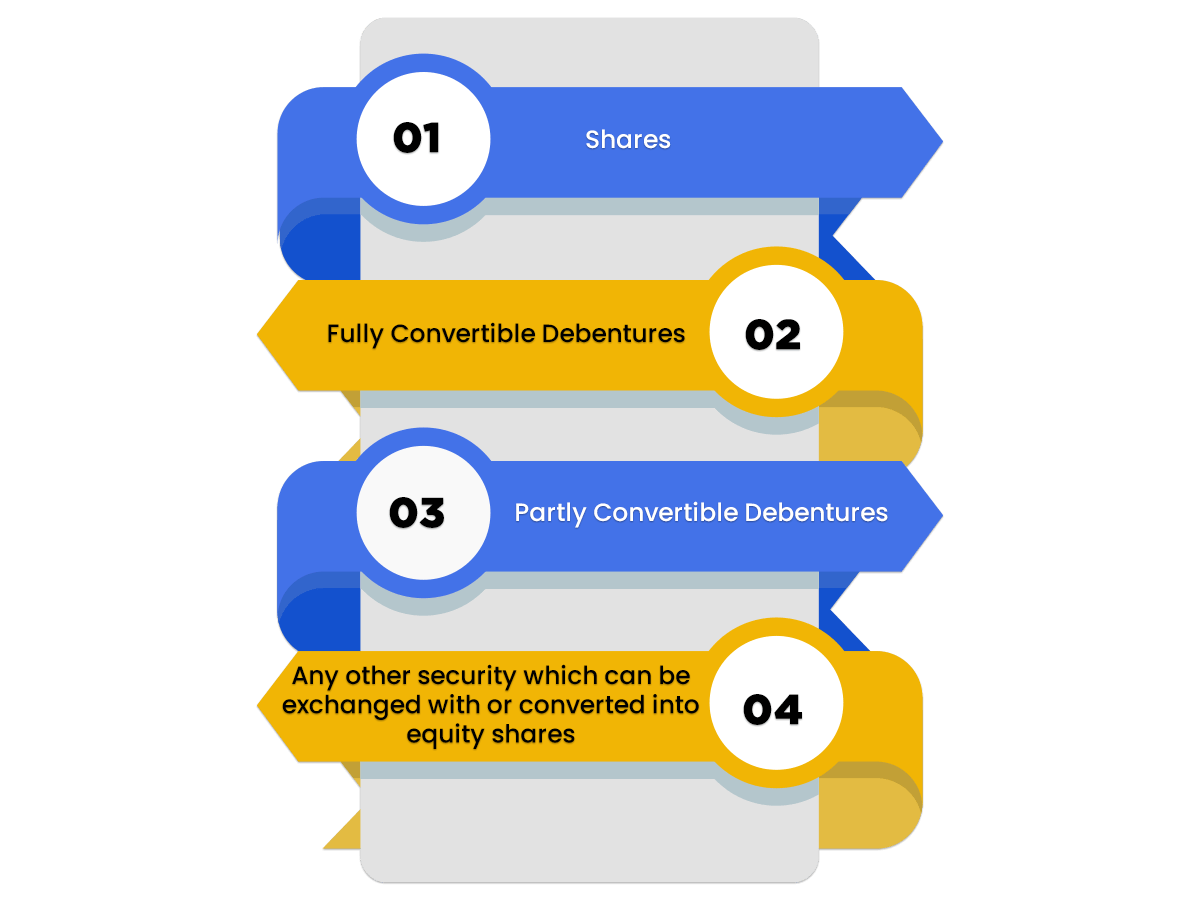

Types of Securities covered under Preferential Allotment

The types of securities covered under Preferential Allotment in India are as follows:

- Shares;

- Fully Convertible Debentures;

- Partly Convertible Debentures;

- Any other security which can be exchanged with or converted into equity shares at a later date.

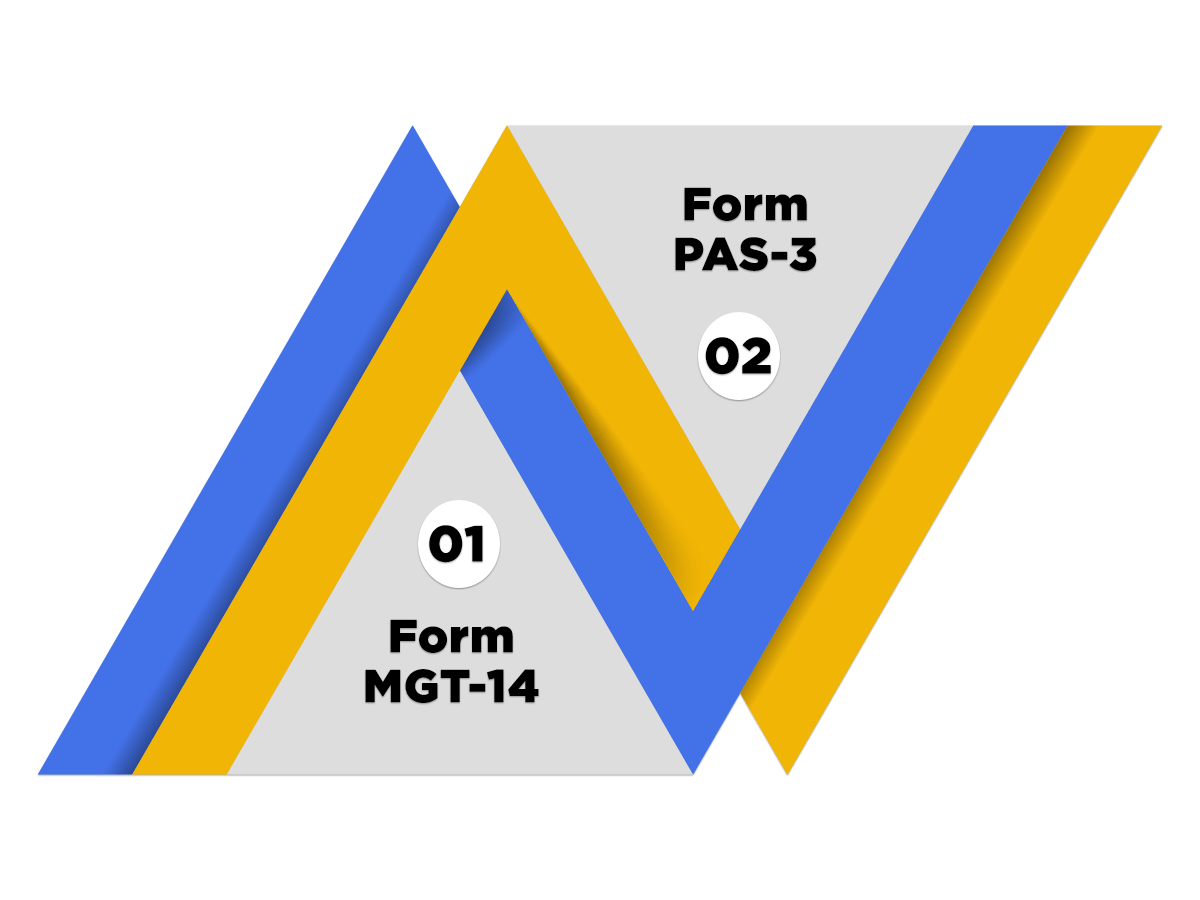

Forms required for Preferential Allotment

In India, the process of Preferential Allotment requires only two forms, which can be summarized as follows:

- Form MGT-14

A company needs this form to pass the shareholders resolution in the AGM (Annual General Meeting) or EGM (Extraordinary General Meeting). The directors need to file this form with the ROC (Registrar of Companies) within thirty days starting from the date of passing the resolution. Form MGT-14 also requires the following attachments:

- A copy of the Special Resolution (SR) and Explanatory Statement;

- Both the copies must be certified by a Practising CA, CS or any Cost Accountant of the Company.

- Form PAS-3

The directors of the issuer company need to file the Return of Allotment in Form PAS 3 with the Registrar of Companies within fifteen days of allotment. Form PAS-3 also requires the following attachments:

- List of Allottees;

- A copy of the Special Resolution (SR) and Explanatory Statement;

- Valuation Report;

- A copy of the contract, if the company issues shares for consideration other than cash;

- A copy of records concerning the offer of private placement;

- A copy of acceptance in Form PAS-5.

Procedure for Preferential Allotment

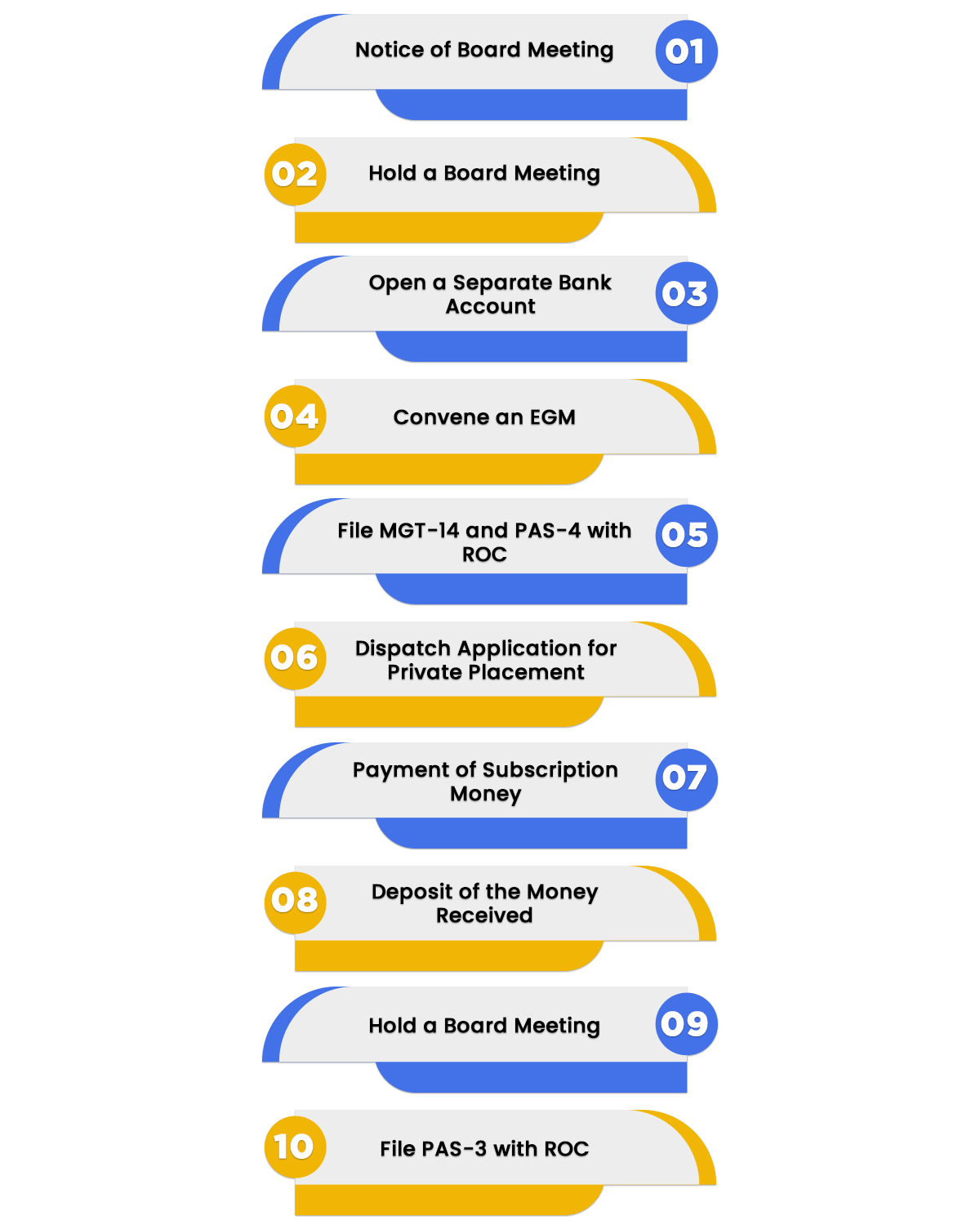

The steps involved in the process for preferential allotment in India are as follows:

- Notice of Board Meeting

A notice of the Board Meeting (BM) must be sent at least seven days before the date of BM.

- Hold a Board Meeting

In a Board Meeting, the directors need to discuss and pass resolutions on the following:

- To consider the valuation report as received from the registered valuer;

- To decide the list of allottees (a company can send an invitation to only fifty people at a time and two hundred in aggregate in a financial year, excluding the QIB (Qualified Institutional Buyer);

- To fix a day, date, time and venue of the EGM (Extraordinary General Meeting);

- To decide the offer period;

- Approval of Letter of Offer as per form PAS-4;

- To decide the agenda in the notice together with the Explanatory Statement for an EGM.

- Open a Separate Bank Account

The company needs to open a separate bank account to receive share application money.

- Convene an EGM

A Special Resolution (SR) for authorising the preferential allotment of securities must be passed in the EGM.

- File MGT-14 and PAS-4 with ROC

After passing the special resolution, the directors are required to file form MGT-14 with the ROC (Registrar of Companies), and then file an application cum offer letter for the private placement in form PAS-4. The company will dispatch the application to the proposed allottees together with the following attachments:

- A copy of the Special Resolution (SR) and Explanatory Statement.

- Both the copies must be certified by a Practicing CA, CS, or by any Cost Accountant of the Company.

- Dispatch Application for Private Placement

The directors need to send the application cum offer letter for private placement to all the proposed allottees at least three days before the opening of the issue. Such an application should be sent within thirty days of passing a special resolution through a registered post/ speed post/ courier/ E-mail/ hand delivery, etc.

- Payment of Subscription Money

All the proposed allottees must subscribe to the shares offered in the application cum offer letter for private placement. They need to pay the subscription money either by demand draft or cheque or by any other banking channel. Allottees are not allowed to pay the subscription money in cash.

- Deposit of the Money Received

The directors need to deposit all the share application money received in a separate bank account.

- Hold a Board Meeting

The company needs to hold a Board Meeting for the allotment of shares within sixty days of the receipt of share application money.

- File PAS-3 with ROC

The directors need to file form PAS-3 with the ROC (Registrar of Companies) within fifteen days of allotment of shares.

Difference between Preferential Allotment, Private Placement, and Right Issue

|

Sr. No |

Basis of Difference |

Right Issue |

Private Placement |

Preferential Allotment |

|

1 |

Applicable provisions under the Companies Act, 2013. |

Section 62 (1) (a) read with Securities Exchange Board of India (ICDR) Regulations, 2009. |

Section 42 read with Rule 14 of the Companies (Prospectus and Allotment of Securities) Rules, 2014. |

Section 62(1) (c) read with Rule 13 of the Companies (Share Capital and Debentures) Rules, 2014, and Section 42 along with Rule 14 of the Companies (Prospectus and allotment of securities) Rules, 2014. |

|

2 |

Type of Security |

A company can only issue shares, i.e. equity and preference shares. |

A company can issue any kind of security, i.e. equity shares, preference shares, and debenture. |

A company can only issue shares, i.e. equity and preference shares. |

|

3 |

Eligible for Offer |

A company can issue shares to the existing equity shareholders in proportion to their shareholding |

A company can offer shares to investors, any pre-selected group of persons or any outsider (other than public offer). |

A company can issue shares to existing shareholders and outsiders. |

|

4 |

Approval Required |

For the Right Issue, a company needs to pass a board resolution in the board meeting of the company. |

A company needs to take approval from both directors and shareholders in the general meeting. |

A company needs to take approval from both directors and shareholders in general meeting. |

|

5 |

Offer period |

A minimum of fifteen days and a maximum of thirty days. |

No minimum period is defined under this section. However, an offer remains open for a maximum period of 365 days. |

No minimum period is defined under this section. However, an offer remains open for a period of 365 days. |

|

6 |

Format of offer Letter |

No specific format is prescribed. |

A company needs to make the letter of offer as per form PAS-4. Further, it needs to maintain records as per PAS-5. |

A company needs to make the letter of offer as per form PAS-4. Further, it needs to maintain records as per PAS-5. |

|

7 |

Forms Required |

A company needs to file PAS-3 twice with the Registrar of Companies. Firstly, within thirty days from passing the board resolution for allotment of shares and secondly, within thirty of allotment of the shares. |

A company needs to file MGT-14 with the ROC within thirty days from passing the special resolution in the general meeting. |

A company needs to file MGT-14 with the ROC within thirty days from passing the special resolution in the general meeting. |

|

8 |

Prescribed time for the allotment of securities (otherwise it will be treated as a deposit) |

Within sixty days from the date of receipt of share application money. |

Within sixty days from the date of receipt of share application money. |

Within sixty days from the date of receipt of share application money. |

|

9 |

Opening of Bank Account |

No separate bank account is needed. |

A separate bank account is needed. |

A separate bank account is needed. |

|

10 |

Fund utilisation |

A company can utilise its fund any time after receiving them. |

A company can utilise its fund only after filing PAS-3. |

A company can utilise its fund only after filing PAS-3. |

|

11 |

Valuation Report |

Valuation Report is not compulsory in the right issue. |

Valuation Report is not compulsory. |

Valuation Report is compulsory. |

|

12 |

Renunciation |

Shareholders need to renounce their rights to accept or reject the offer letter. |

No such right is available. |

No such right is available. |

|

13 |

Explanatory Statement |

There is no need to attach an explanatory statement with the notice as the right issue does not require shareholders’ approval. |

The notice must contain an explanatory statement according to rule 14 (2) of the Companies (Prospectus and Allotment of Securities) Rules, 2014. |

The notice must contain an explanatory statement according to Rule 13 (d) of the Companies (Share Capital and Debentures) Rules, 2014, read with Rule 14 (2) of the Companies (Prospectus and allotment of securities) Rules, 2014. |

|

14 |

Investment Size or Minimum Subscription |

A company does not require minimum subscription in right issue. |

A company does not require minimum subscription in private placement. |

A company does not require minimum subscription in preferential allotment. |

|

15 |

Mode of the receipt of subscription money |

A company can receive subscription money either in cash or through the banking channel. |

A company can receive subscription money only through the banking channel. |

A company can receive subscription money only through the banking channel. |

|

16 |

Issue of Debenture |

A company cannot issue debenture through the right issue of shares. |

A company can issue debenture through the private placement of shares. |

A company cannot issue debenture through the preferential allotment of shares. |

|

17 |

Non-Convertible Preference Shares |

A company cannot issue non-convertible preference shares through right issue of shares. |

A company can issue non-convertible preference shares through the private placement of shares. |

A company cannot issue non-convertible preference shares through the preferential allotment of shares. |

FAQ of Preferential Allotment

The term “Preferential Allotment” denotes a process in which a company allots the share to a different group of people or companies on a preferential basis.

The Preference shareholders will be paid a dividend on a priority basis by a company.

A company that is listed on any stock exchange and comply with the rules and provisions of SEBI is eligible to make a Preferential Allotment.

The main difference between the both is that the former deals with the issuance of shares to a group of people from a listed company. In contrast, the latter acts as an invitation to offer securities to a pre-decided and specified group of investors.

A company undergoes the process of Preferential Allotment with an aim to raise cash.

No, the Rights Issue is not a Preferential Allotment.

The main difference between the both is that the former deals with the offer or an invitation to offer shares and securities to a specified group of people. In contrast, the latter acts as an offer to the existing shareholders of the company.

The benefits of a Preferential Allotment are the Preference Shareholders are directly paid by the company, Zero Brokerage Cost, Ease in Claiming Dividends, Safe and Secure, and Priority to be paid first.

If in case the shares are issued to the shareholders according to Sec 62(1)(a), then, in that case, the passing of special resolution and filing of MGT-14 is mandatory.

The steps involved in the procedure for the Allotment of Shares are Notice to Board Meetings, Hold a Board Meetings, Open a Separate Bank Account, Convene an EGM, File MGT-14 and PAS-4 with ROC, Dispatch Application for Private Placement, Payment of Subscription Money, Deposit of the Money Received, Hold a Board Meeting, and File PAS-3 with ROC.

Allotment of Shares shall be done within a period of 60 days, starting from the receipt of application money.

If in case the Allotment of securities is not done within a period of 60 days, then the said company is liable to refund the whole application money received within the next 15 days.

The laws that govern preferential allotment are the Companies Act 2013, the Companies (Share Capital and Debentures) Rule 2014, and the Companies (Prospectus and Allotment of Securities) Rule 2014.

The different types of securities issued under Preferential Allotment are Shares, Fully Convertible Debentures, Partly Convertible Debentures, and any other security which can be exchanged with or converted into equity shares at a later date.

The 2 forms that are required for the process of Preferential Allotment are Form MGT 14 and Form PAS 3.

No, a company cannot issue non-convertible preference shares through the preferential allotment of shares.

No, a company cannot issue debenture through the preferential allotment of shares.

A company does not require a minimum subscription in the preferential allotment.

Yes, a company can issue shares to existing shareholders for Preferential Allotment.

The section 42 and 62 of the Companies Act 2013 deals with the concept of Preferential Allotment.

Yes, a company needs to take approval from both directors and shareholders in general meeting.

Yes, there is a need to open a separate bank account for Preferential Allotment.

A company can utilise its fund for Preferential Allotment only after filing Form PAS-3.

Within 60 days from the date of receipt of share application money, the company needs to allot the securities.

No, the right of renunciation is not available in the process of Preferential Allotment.