What is the Process and Scenario to Claim GST Refund?

Shivani Jain | Updated: Nov 07, 2020 | Category: GST

The term “Claim GST Refund” denotes a situation where the GST paid by the taxpayer is more than the actual GST liability and the taxpayer can ask the authorities to refund the difference back to him/her.

Under GST Law, the process of claiming a refund is standardized in order to avoid confusion. Moreover, the process and time limits have also been set for the same. In this blog, we will discuss the concept of Claim GST Refund, together with the Process and Situations under which a taxpayer can claim it.

Table of Contents

Concept of Claim GST Refund

The term “Claim GST Refund” denotes the amount that is due or outstanding to a taxpayer from the tax department. Further, the refund of GST means the amount that is due with the GST Department being shown in the credit ledger of the said taxpayer and can be applied as a refund in the specified situations.

Who is Eligible to Claim GST Refund?

An applicant can claim GST refund in the situations as follows:

- The amount is the interest or tax borne by certain individuals whose name has been specified by the Central Government or State Government based on the recommendations or suggestions made by the GST Council[1].

- The amount being the refund of interest or tax thereon or any other sum which is paid by the said taxpayer. Also, the refund would be paid when the individual has not passed on the interest or tax thereon or any other amount to some other individual.

Scenarios for Claiming Refund under GST

The scenarios under which an applicant can claim GST Refund are as follows:

- Additional payment made regarding the tax due because of negligence or fault.

- Excess balance in the Electronic Cash Ledger.

- Refund on the taxes paid on purchase made by UN or embassies.

- Export with the payment of IGST or under Bond/LUT.

- Supplies made to SEZ (Special Economic Zone) unit/developer.

- Deemed Exports.

- Refunds to the International tourists regarding the GST paid on the purchase of goods in India.

- Inverted Duty Structure.

- Refund of Pre-deposits.

- Persons holding UIN.

- Export of Goods and Service.

- Finalization of Provisional Assessment.

- Miscellaneous refunds.

Factors to Consider While Claiming GST Refund

The factors to be considered to Claim GST Refund are as follows:

- While filling Form GSTR 1, it is not necessary to fill Port Code, Shipping Bill, Shipping Bill Date, but if an applicant does not fill this detail then the refund will be delayed.

- In case the applicant has not filed details mentioned above in Form GSTR 1 then he/she can amend the GSTR 1 within the prescribed time.

- The applicant also needs to check whether the custom department has uploaded accurate information or not by login on to his/her account.

- The applicant must reconcile GST Input taken in returns with Form GSTR 2A, as the department will allow only 110% of the input reflecting in Form GSTR 2A.

- In case of the supplies of services made to Special Economic Zone (SEZ), a declaration from the GST Zonal officer is needed that services have been utilized in this area.

- A certificate issued by a practising CA or CWA will be needed if the refund amount is above Rs 2.

- One cannot charge GST on the export /SEZ.

Time Limit for Claiming Refund under GST

The applicant needs to file the application for a GST refund within 2 years, starting from the relevant date. Also, the term “Relevant Date” is provided under section 54 of the CGST Act. Further, the same can be summarized as:

|

Scenarios of GST Refund |

Relevant Date |

|

Refund of GST when the goods are exported either by air or sea |

The date on which the ship or aircraft which are carrying the goods leaves the territorial jurisdiction India |

|

GST Refund when the goods are exported by land |

The date on which the goods passes the frontier |

|

Refund of GST when the goods are exported by post |

The date on which the goods are dispatched by the respective post office |

|

GST Refund when the goods are deliberated to be deemed exports |

The date on which the return of such goods is filed |

|

Refund of GST when the services have been exported, and the supply of services has been duly completed before receiving the payment |

The date on which the payment for the services made is received |

|

GST Refund when the services have been exported abroad and the payment for same services has been duly received before the issuance of the tax invoice |

The date when the invoice is issued |

|

Refund of GST due to the decree, judgement, order, direction issued by the Appellate Authority, Appellate Tribunal, or any other court |

The date when the order, decree, judgement, or direction is communicated |

|

GST Refund for the unutilised part of the ITC (Input Tax Credit) |

The last date of the fiscal year in which the claim for GST refund is made |

|

Refund of tax when the GST is paid provisionally under the provisions of the GST Act |

The date when the tax paid is adjusted after the completion of the final assessment |

What are the Documents Required to Claim GST Refund?

As per Rule, 89(2) read with Section 54 (4) of the CGST Act, the refund application needs to be accompanied by the documentary evidence as Annexure I in FORM RFD 01. However, the Documentary evidence may vary in the cases as follows:

Export of Goods

A statement which is comprising of the Shipping Bill Number and Shipping Date or the bills of export, together with the date and number of the relevant export invoices.

Export of Services

A declaration which is containing the date and number of tax invoices, together with the foreign inward remittance certificates and bank realization certificates.

Deemed Exports

A statement which is comprising of the number and date of tax invoices together with such other evidence as may be specified in this behalf.

Inverted Duty

A declaration which is containing the number and date of tax invoices issued and received during a specific period, where the GST claim relates to refund of any unutilized input tax credit under GST (ITC) and the credit has accrued on account of the tax rate on the inputs being more than the tax rate on the output supplies, other than the nil-rated or fully exempt supplies.

Difference in Supply Nature

A statement which is showcasing the details of transactions acknowledged as Intra-State supply but which is consequently held to be the Inter-State supply.

Excess Payment of Tax

A declaration which is showcasing the details of the amount to be claimed on account of the excess payment of tax.

Also, Read: CGST, SGST, and IGST: Understanding the difference

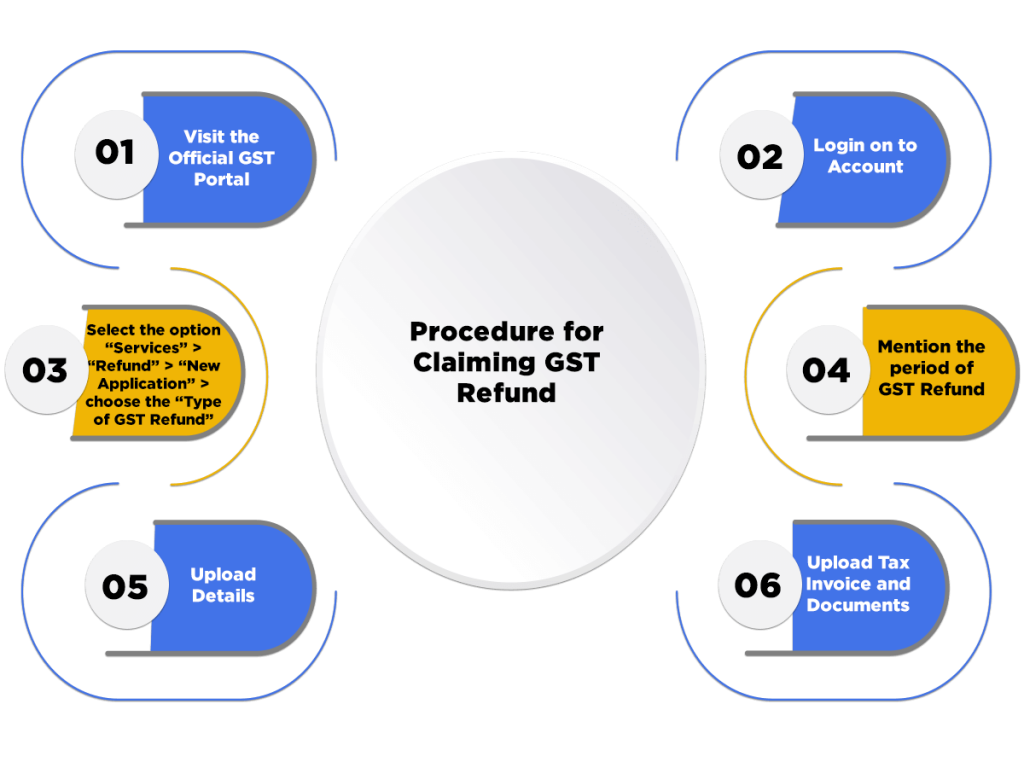

What is the Procedure for Claiming GST Refund?

A taxpayer can claim GST Refund only by applying online for the same. That means there is no offline mode for claiming GST Refund.

Further, the steps involved in the procedure to claim GST Refund are as follows:

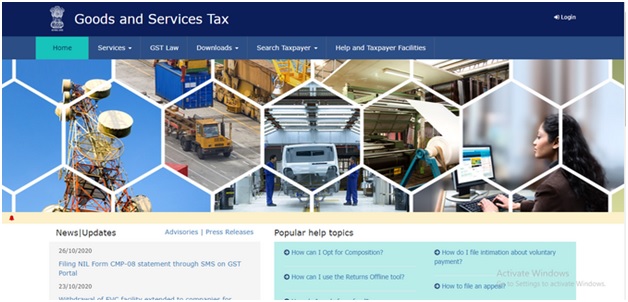

1- Firstly, visit the official GST portal[2]

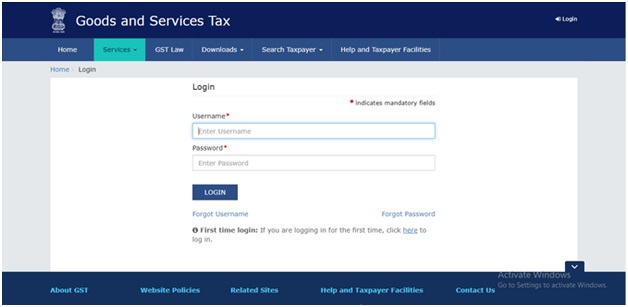

2- Now, the applicant needs to login to his/her GST Account by using the Login Credentials (Username and Password) provided;

3- Now, select the option “Services” > “Refund” > “New Application” > choose the “Type of GST Refund”;

4- Mention the period for which the refund is applied;

5- Now, the applicant needs to upload an excel sheet in the form of json file. This file will include details such as invoice date, invoice number, invoice amount. However, in the case of export of goods, the applicant needs to mention the Shipping Bill no., EGM No, Shipping Bill Date, EGM Date, etc. However, in the case of export of services,the applicant needs to provide FIRC Reference no.

5- Lastly, the applicant needs to upload all the invoices on which GST input has been claimed.

What is the Maximum Limit for Claiming GST Refund

The applicant can calculate the amount eligible to be claimed as GST Refund by using Maximum Refund Formula.

Maximum Refund = (Annual Turnover of Zero Rated Supply of Goods + Turnover of Zero Rated Supply of Services) x Net ITC (Input Tax Credit) /Adjusted Total Turnover

The above mentioned formula can be understood by the example as follows:

Question:

ABC Ltd, a manufacturing company deals in both export and domestic sales. The Percentage for the export sales exceed that of the total domestic sales, and all the raw materials are acquired from India itself. As a result, there is an accumulation of the ITC.

Further, the details relating to the sale and purchase for the month of December 19 are as follows (excluding the applicable taxes):

|

|

|

|

Goods Exported for the month of December |

Rs 300000 |

|

Services Exported for the month of December |

Rs 200000 |

|

Domestic supply of the goods in the month of December |

Rs 60000 |

|

Domestic supply of the services in the month of December |

Rs 60000 |

|

Domestic supply of the goods and services including exempted item |

Rs 20000 |

|

Accumulated Input Tax Credit (ITC) till December end |

Rs 15000 |

|

Total Payment received during the month of December for the export of services |

Rs 150000 |

|

Advances received in the month of December, but the supply of services has not been completed yet |

Rs 20000 |

|

Payment received during the month of December for export of goods |

Rs 200000 |

|

Advances received in the month of December, but the supply of goods has not been made yet |

Rs 10000 |

Solution: –

Adjusted Total Turnover for the Year = Rs 600000 (300000+ 200000+ 60000+ 60000- 20000)

Turnover of the Zero Rated Supply of Goods = Rs 300000

Turnover of the Zero Rated Supply of Services= Rs 130000 (150000- 20000)

Maximum Refund Amount = (Turnover of the Zero Rated Supply of Goods + Turnover of the Zero Rated Supply of services) x Net ITC (Input Tax Credit) ÷ Adjusted Total Turnover.

= (300000+ 130000) *15000 = Rs 10750

600000

Hence, ABC Limited can claim a maximum refund of Rs 10750 within 2 years, starting from the relevant date.

Conclusion

In a nutshell, to claim GST Refund, one needs to follow a stringent and intricate GST Refund process. That means the government will not allow the GST payment to the applicant just like that.

Further, it is always advised to appoint professionals to fill in the form for GST Refund, known as Form RFD 01. At Swarit Advisors, our experienced Chartered Accountants will fill in the form for you to claim GST Refund.

For more details, visit our services for Online GST Registration and GST Return Filing.

Also, Read: Valuation of GST on MRP products