Top 10 reasons why you should form Private Limited Company in India

Monisha Chaudhary | Updated: Mar 20, 2019 | Category: Private Limited Company

Setting up a business is the most rewarding and exciting experience for every interested entrepreneur. When you decide to start a business, you should choose the right kind of business structure. Furthermore, selecting the proper business structure is also an important decision because it has enduring implications throughout the life-cycle of your business. Hence, you are advised to adopt the highly appropriate entity which will support both the vision and objective of your business. Many entrepreneurs opt for Private limited company in India due to various reasons which are shared in this post.

Table of Contents

Everything about the private limited company (PLC)

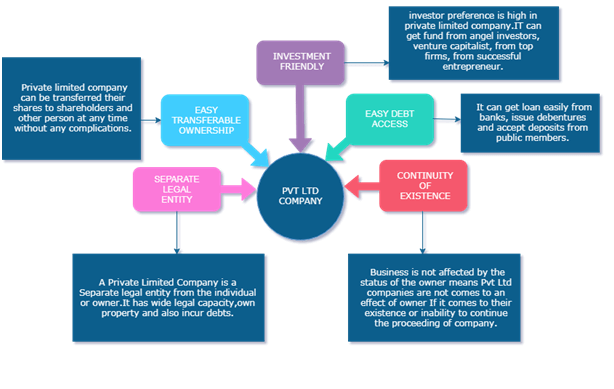

This entity refers to the privately held company that includes few limitations on the liability of owners on shares and limitations on the count of shareholders. According to various studies, this entity will involve extensive ranges of administrative tasks. They lead to incurring more amounts when compared with sole trader business type. Even though it has certain limitations, but it will bring numerous benefits to the entrepreneur. Financial liability is a key benefit of forming a Private limited company in India. It never put you at the danger of any personal bankruptcy problem in the happening of your business failure.

If you’re looking for registering your business as a private limited company in India, contact Swarit Advisors.

Why opt for this business entity?

It is a highly preferred vehicle for running your business successfully while making more profit. You can also enjoy the advantages of a fully incorporated entity, especially limited liability. Along with minimal statutory and limited liability compliances, the private limited company in India provides numerous benefits. It includes:

1. Boost the credibility of your business

The number of newly entering ventures and businesses is increasing day by day. Due to this, suppliers, customers, and investors are seeking for better business credibility. The partnership or proprietorship firm in India is not registered with the Indian Ministry of Corporate Affairs. It will lead to various hassles. With private limited registration, the entrepreneurs make the information such as company status, registered address, name and other details available easily for customers and investors in the public databases. It boosts the overall business credibility.

Learn about the process of private company registration.

2. Going large-scale

The private limited registration brings foreign investors and companies an excellent opportunity to invest in the company with no governmental approval. It makes the process simpler for entrepreneurs to go international. It is essential for all new business entrepreneurs to have this unique feature for allowing both collaborations and FDI with global businesses.

3. Enjoy better savings on tax

Everyone knows that the corporate tax amount is lesser when compared with income tax. If you register your company as a Private limited company in India, you are able to save a considerable amount of money on taxes. Along with the common salary, the business can pay dividends to the shareholders. These kinds of dividends include minimal tax deductions, so the shareholders receive higher benefits. This process will ring scope for staffs to receive the pension benefits from the companies.

Learn why annual compliances of PLC are mandatory.

4. Develop a talented team

The competition level is increasing continuously in the present market. To beat the competition, the companies must retain their talent pool. Many business entrepreneurs offer various benefits such as ESOPs and stock ownership to their employees for achieving their goal. It is a valuable advantage among both the targeted employee and also companies. It is only possible in Private limited company in India because it only offers stock ownerships or ESPO plans to their staffs.

5. Simple Funding

It is a well-known fact that funding plays the most important role in establishing, growing or even maintaining your business. If you want to grow your business quickly, you should have the required funding types. When it comes to partnership firms or proprietorship firms, they can limit their funding to debits, self-funding, and also funding by investors and family. They never enjoy the equity funding facility. It will affect startup to use this essential source of funding. To avoid unwanted hassles, the private limited registration makes that the companies are capable of using the risk-free funding option.

6. Exit approach

This unique business entity brings scope for a promoter for selling it in the upcoming days. As an owner, you can acquire a clean distance and break effective from business and get monetary advantages that appear as the best financial source for your upcoming venture. You can avail the relief against the capital gains tax. There is no easy way to achieve this kind of benefit in other company structures.

7. Pursuing opportunities

If you register your business as the private limited firm, you are able to make sure that your businesses are not tied to their promoter as well as are simply a unique legal entity. It means that your promoter can actually pursue various opportunities when your business evolves. In the case of partnership companies or sole traders, they do not have this kind of freedom. It is because they are attached to their promoter and do not have their own entity. Therefore, Private limited company in India will result in fast growth and the capability of independently enjoying lots of beneficial opportunities in this present market. Apart from that, it also ensures that you have an excellent edge over your competitors.

8. Is this business entity facilitating financial liability?

One of the main benefits of forming a Private limited company in India is that it offers financial liability. The limited liability will affect members and shareholders to handle the overall burden of their debts when they experience severe financial losses. The best business entity ensures that both the finances and assets of shareholders remain safe. It allows your company to bring better services.

9. Can you get a professional image in private limited registration?

The private limited registration not only creates better status but also boost the overall value of your business. They are actually viewed as highly credible and established when compared with sole traders. This kind of entity also offers a security sense to both professionals and investors selecting to utilize the services of a business. It also opens up business opportunities truly with big companies. In simple words, this kind of registration ensures your brand uniqueness.

10. Is private limited registration offering separate authorized entity?

It is good news for everyone that this business entity has a separate entity for your business. It makes sure that both formal documents and contracts are linked with your company and not your shareholders or founders. When it comes to this specialized entity, it will bring the security sense to your employees. It will avoid your need for showing some financial transactions for proving your existence. It is highly beneficial for every start up with limited time or finance for developing the business.

Expert’s take on forming Private Limited Company in India

From the above discussion, it’s quite explicit why a private limited company in India is so popular among beginners and other entrepreneurs. A PLC is pretty easy to form and can be started even with a paid-up capital of zero. Furthermore, to encourage the youth for start-up, the Honourable PM of India, Shri Narendra Modi has started a Start-up India campaign. Under this campaign, start-ups are provided with several benefits and tax exemptions for three consecutive years. Rest of the benefits, we have already described above.

Therefore, if you are planning to register your business as a private limited company in India, then contact Swarit Advisors. Our dedicated team will help you register your company in the least possible time. Moreover, if you have any query related to PLC registration or annual compliances, you can again contact us.