Updates Regarding The New Functionalities on GST Portal

Khushboo Priya | Updated: Feb 28, 2019 | Category: GST, News

Recently, GST portal has updated itself, and therefore, we are again here with a new update. In this piece of article, we will acquaint you with the updates on new functionalities on GST portal.

The primary objective of making changes on the GST portal and introducing new functions is to make the website user-friendly. Furthermore, the aim is to make the site responsive to cater to the expectations and needs of the users.

Without stretching it anymore, let us start with the changes and updates on the GST portal.

Table of Contents

What are the new functionalities on GST portal?

New functions are not just introduced on the official GST portal, but the changes are also made on the official CBIC-GST portal. The additions on GST website took place during the last week of January 2019.

We will discuss the reorganization of both websites of GST one-by-one. Let’s start-

1. Latest functionalities on GST portal

With the new functionalities on GST portal, both taxpayers and tax officers can avail benefits and ease many of their tasks associated with GST registration, taxes, offenses, etc. The latest changes are as follows:

- Taxpayers can provide info of security/surety of provisional tax in Form GST ASMT-05

ASMT-05 is a form which can be used by the provisional taxpayers to furnish the details regarding the security or surety as a bank guarantee for an amount described as per provisional assessment order. Once they have submitted the form online, they need to provide the hard copy of the original bank guarantee or surety to the concerned officer.

As per provisions of Section 60 (1) of CGST Act, every taxpayer is allowed to request for the tax payment on a provisional basis. Moreover, the applicant needs to execute a bond following the provisions of Section 60 (2) in Form GST ASMT-05.

Earlier, this option wasn’t available on the GST portal. However, the website enables users to furnish the concerning details as described above.

- Using form GST CPD-1, taxpayers can make an application for compounding of offence

Now, applicants (taxpayers) would be able to submit an application for compounding of offence in two cases; either-

1. Before the institution of prosecution, and

2. After the institution of prosecution

Before the institution of prosecution

It means that the applicant is himself filing, i.e. voluntarily filing the application CPD-01 for Compounding of an offence. Furthermore, in this case, there’s a possibility that the applicant may have received an Order from the tax official.

After the institution of prosecution

It means that the prosecution has already initiated and an order has been issued against the taxpayer for the institution of prosecution. The tax office has issued a notice regarding the same to the taxpayer.

- Filing application for rectification of order passed by the appellate authority

Whether you are a taxpayer or tax officer, you can now be able to file an application for the rectification of order passed by the appellate authority. This is mandatory as per section 161 of the CGST Act.

- Now taxpayers can upload statements and supporting documents while filing refund applications in Form RFD-01A

As the GST portal has received new functionality, now it allows applicants to upload five supporting documents and notified statements while applying for a refund in the Form RFD-01A.

- After hearing, Tax officer can accept or reject an application for Compounding of Offense

As discussed above, the taxpayer can file an application for compounding his offense in CPD-01. Once he/she has submitted the application, the tax officer will scrutinize it and holds the right to accept or reject it. The tax officer can make the acceptance or rejection of application CPD-01 in the Form CPD-02.

2. Current functionalities on CBIC-GST portal

As per the new changes brought in on the CBIC-GST portal [1] , tax officers now could be able to avail the following facilities as described below:

- Download the documents or papers along with the form RFD-01A which is a refund application;

- See GSTR 2A on credit admissible;

- For goods sent for job-work, tax officers can see ITC 04;

- Access MIS report (Management Information Centre) on NIL return filers for different reports and a month.

- Access MIS report on formation wise number of taxpayers for a specified period.

The above described updates are taken from the newsletter published on the official website of CBEC-GST. These are all the GST portal has been updated with. If any other changes are made or functionality is upgraded, then we will update you. Stay tuned, and keep yourself updated with Swarit Advisors.

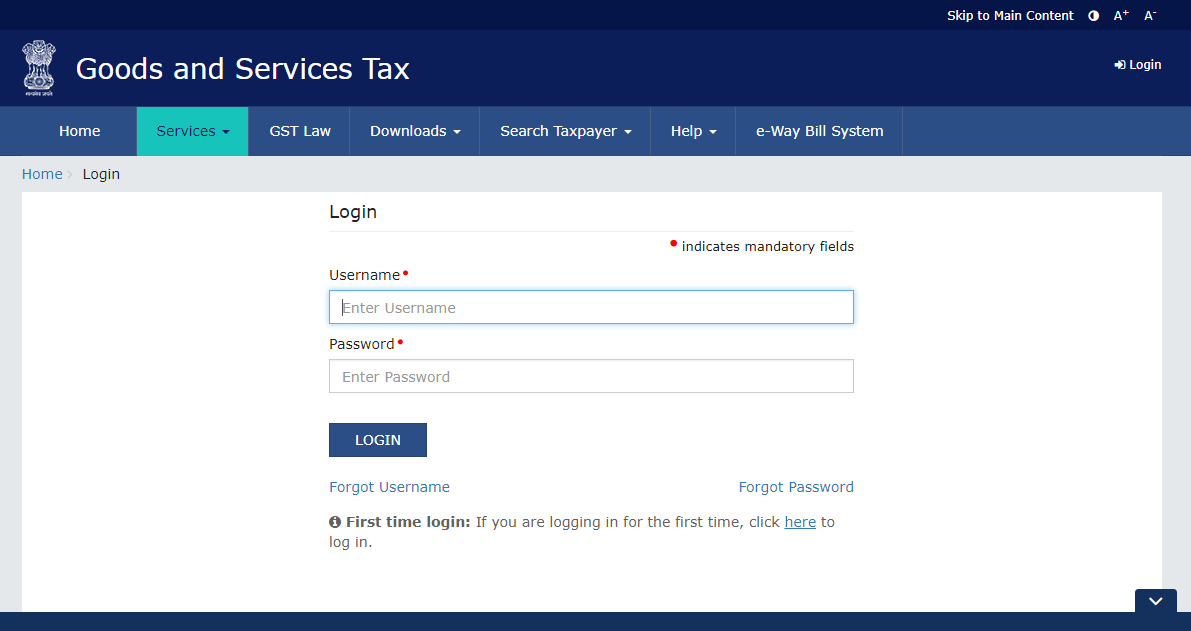

Also, Read: Know About GST Registration process step by step.