Can a Foreign Citizen Become a Nominee in an OPC?

Dashmeet Kaur | Updated: Mar 26, 2020 | Category: One Person Company

Earlier, there were many speculations about a single person starting a Company. However, Ministry of Corporate Affairs put aside all those deliberations and established a new concept of One Person Company under Section 2 (62) Companies Act, 2013. It is similar to a Private Company yet requires only one member who acts as the Director & Shareholder. When an entrepreneur embarks an OPC, he can avail the benefits of limited liability as the Company has a separate legal entity. If you also want to start One Person Company but are you clueless whether an NRI can become the nominee in OPC or not? This write-up will clarify your dilemma.

Table of Contents

What is an OPC?

As per Section 2(62) of Companies Act, an OPC is a Company which has only one person as its member. Moreover, the member of such a Company is nothing but a subscriber to its (MOA) Memorandum of Association or Shareholder.

Generally, One Person Companies are formed when there is only one Promoter or Founder for the business. Also, entrepreneurs tend to create an OPC at the initial stage of the business due to their ability to generate more favourable outcomes with limited liability.

Features of One Person Company

Here are some predominant features of a One Person Company:

- Sole member- The primary characteristic of an OPC is that it has only one member. In the case of One Person Companies, a member implies to an individual who voluntarily writes to become a subscriber.

- Nominee in OPC- Since an OPC has only one member, so it is mandatory to nominate a person who will handle the Company’s operation in case of death or incapacity of the existing member to carry out the business. The existing member shall have to nominate a person as the member during OPC Registration. It has to be done with the written consent of the nominee under Form INC-3 which is regarding the nominee of One Person Company.

- No certain perpetual succession– While other Companies follow the concept of perpetual succession, it is not the case with One Person Company. If the member of an OPC dies or becomes insolvent, then it depends on the selected nominee’s decision to become its sole member or not.

- Minimum one Director– OPC needs to have at least one person as the Director and the maximum number of Directors can be 15.

- No minimum capital required- Companies Act, 2013 has not specified any particular amount to be the minimum Paid-Up capital for One Person Companies.

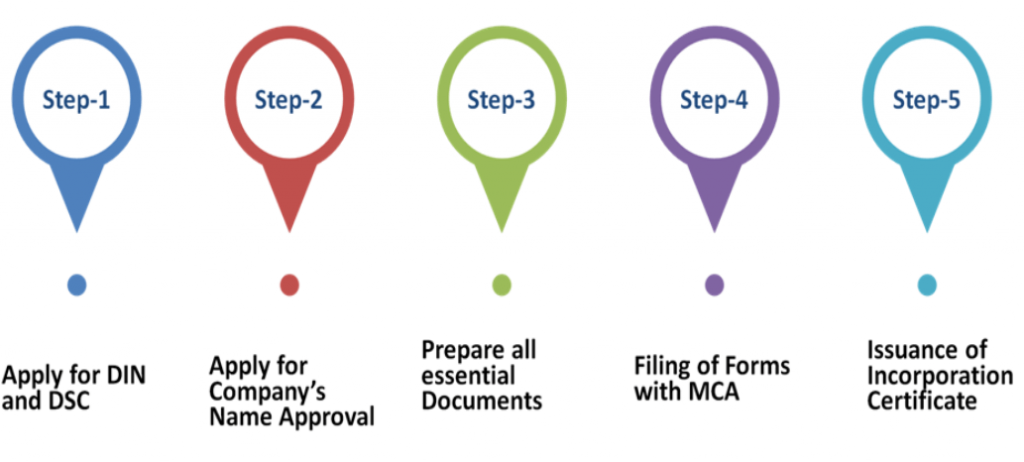

Step by Step Procedure of OPC Registration

Guidelines to form One Person Company

Section 3 of Companies Act, 2013 [1] prescribes the salient features in regards to OPC Incorporation as follows:

- Memorandum of Association of One Person Company must indicate the nominee’s name with his prior written consent. The selected nominee shall become the member of the Company in events of the death of subscriber or due to his incapacity to contract. It will thus ensure the perpetuity and sustainability of the Company.

- The written consent of a nominee in OPC shall also be filed with (ROC) Registrar of Companies during the time of Company’s Incorporation along with its Articles and Memorandum of Association.

- According to the provisions, only an Indian resident can avail the benefits of One Person Company. Further, the name of all the OPC’s must have the term ‘One person Company’ at the end of their names.

- The Paid-Up capital of One Person Company cannot be more than INR 50 lakhs and its average annual turnover cannot exceed INR 2 crores.

- A person can incorporate more than 5 OPC’s.

Can NRI or foreigner become a nominee in OPC?

Only an Indian resident or Indian citizen can become the Shareholder and Director of One Person Company. An NRI and foreign citizen can neither become a nominee of an OPC nor can they incorporate it.

Apart from that, even a minor cannot become a nominee or member of such Company. Also, the minor does not have the power to acquire Shares in another One Person Company.

Procedure of nominee withdrawal

Once a member is assigned to be the nominee of an OPC, he/she has the leverage to withdraw his name. Here is the simple process to withdrawal:

- A nominee can withdraw his/her name by providing Notice in writing to the existing member and the One Person Company. Therefore, the member will propose another nominee within 15 days.

- The sole member of an OPC must file a Notice in Form INC-3 which specifies the abandonment of consent by the original nominee and consent for the appointment of a new nominee.

- On receiving such intimation, the Company shall file a Notice to Registrar indicating the change in Form INC – 4. The Notice shall be affixed with the written consent of the new nominee in Form INC – 3 within 30 days of acknowledging the change.

Advantages of Incorporating One Person Company

Now that this document has clarified your doubts regarding the nominee, you must be eager to establish an OPC. Before undertaking the prolonged process of One Person Company Registration, you must perceive its benefits:

- Limited liability- Mishaps are inevitable in business. Therefore, the members need to secure their personal assets before anything happens. However, if you register an OPC, then your personal assets shall not be subject to any risk when the Company runs into loss, unlike a Sole Proprietorship Firm.

- No minimum capital requirement- There is no minimum Paid-Up capital required to register One Person Company. The Paid-Up capital of an OPC must not surpass INR 50 Lakhs in the course of the business or the Director shall have to convert it into Private Limited Company.

- Less compliance- In contrast to the Registration of Private Limited Company or Public Limited Company, there is less compliance and paperwork required for an OPC.

- No scope for legal disputes- As single person plays different roles of Director and Shareholder; it eliminates the scope of any legal disputes.

- Greater credibility- One Person Companiesare compelled to get their books audited on an Annual basis which makes them more organized and gradually increases the Company’s credibility.

Conclusion

If you want to build your OPC, consult Swarit Advisors. We can get it done with the Registration procedure within 2 weeks.

Read, More:Compliance for Limited Liability Partnership Firm