Compliance for Limited Liability Partnership Firm

Dashmeet Kaur | Updated: Apr 13, 2020 | Category: Compliance, Limited Liability Partnership

Setting up a business is not so easy; an aspirant has to invest a sufficient amount of time, effort, money, and determination during the inceptive stage. The struggle starts right from the selection of the business structure to forming and implementing the plan. Entrepreneurs always look for those business structures which provide maximum benefits with minimal legal compliances. An ideal business model for such entrepreneurs is LLP. It is a perfect amalgamation of a Partnership Firm and a Company. This document covers all the essential aspects and mandatory compliance for Compliance for Limited Liability Partnership firm.

Table of Contents

A brief about Limited Liability Partnership

An LLP is a separate legal corporate entity registered under the Limited Liability Partnership Act, 2008. The Ministry of Corporate Affairs[1] regulates the operation of an LLP. Here are the primary features of a Limited Liability Partnership that precisely defines its nature of business:

- The fundamental characteristic of an LLP is that it is a separate legal entity. It implies that a Limited Liability Partnership exists differently from its members.

- It required a minimum of two “designated” members to start an LLP.

- Members of an LLP are subject to pay tax in their share of the gains or income.

- The “trading disclosure” of a Limited Liability Partnership is similar to that of a company.

- Likewise, an LLP can issue debentures on fixed or floating charges similar to that of a company.

- A Limited Liability Partnership needs to get registered at Companies House.

- The filling and accounting compliances for an LLP are similar to companies.

- All LLPs functions as per a private document (LLP Agreement) that needs to remain confidential amongst the members.

- The members of an LLP avails the benefit of limited liability.

- There is no fixed sum of minimum capital contribution required to start an LLP.

Benefits of LLP Registration over a Company Registration

Though LLP is a new concept in the corporate world, yet it has drawn several companies to either covert their business into an LLP or incorporate a new one. Let’s look at the major advantages of LLP Registration:

- No constraint on the number of members– To establish a Limited Liability Partnership, one requires at least two individuals, while there is no limitation on the maximum no. of members, unlike a Private Limited Company.

- No minimum capital required- A considerable benefit of an LLP is that its partners don’t have to contribute a particular share of minimum capital. Whereas, the minimum paid-up capital required for a Private Limited Company is INR 1 Lakh and INR 5 Lakh for a Public Company.

- Lower Compliance burden– Companies are required to adhere to various annual compliances. On the other hand, a Limited Liability Partnership just has to deal with a few compliances like filing of Annual Return and Statement of Accounts.

- Exemption from taxes– LLPs are very privileged in terms of taxation. An LLP is liable to pay Income Tax without any additional taxes imposed, such as Dividend Distribution Tax or Corporation Tax.

- No mandatory account auditing- Private or Public Limited Companies are obliged for account audited. However, an LLP only have to get its account audited under the following conditions:

- Contribution exceeds INR 25 Lakhs, or;

- When the Annual Turnover is more than INR 40 Lakhs.

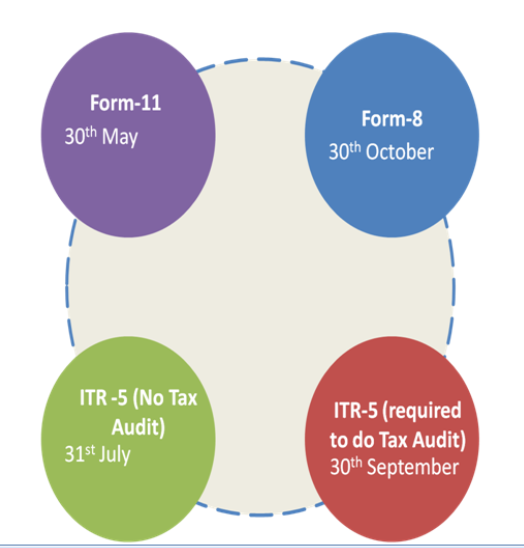

Due Date for LLP Compliances

Checklist of Annual Compliances for LLP

In correspondence to the benefits, all LLPs need to follow some annual compliances and file certain statutory accounts with the Government. These are the major compliance requirements for an LLP:

- Books of Account- All the Limited Liability Partnership Firms must maintain a proper book of accounts in regards to their affairs each year on a cash or accrual basis. The book of accounts must be maintained as per the double-entry accounting system at the registered office. If the turnover of LLPs is more than INR 40 Lakhs or capital exceeds the limit of INR 25 Lakhs, then the accounts must be audited by a proficient Chartered Accountant.

- Annual Return Filing- A mandatory compliance for all LLPs is that they have to file two kinds of annual returns in each financial year in Form 8 and Form 11.

- Form 8- It is filed within 30 days from the closure of six months of the financial year with the prescribed fee. Form 8 must be digitally signed by at least 2 designated partners of an LLP and certified by a Company Secretary/ Chartered Accountant/Cost Accountant. Further, this Form is sub-divided into two parts, Part A which includes the Statement of Solvency and Part B that entails the Statement of Accounts, Statement of Income and Expenditure

- The penalty for not filing Form 8 is INR100 per day until the LLP complies with it.

- Form 11- This Form includes the information of all the partners, such as the total no. of partners, contribution received by each partner, details of the corporate body, and summary of the partners. All LLPs must file Form-11 within 60 days from the closure of the financial year along with the prescribed fee. Therefore, the due date for filing this Form is 30th May of each year.

An LLP cannot be closed or wind up unless all the annual returns are filed. Hence, it is indispensable to file the Annual Returns on or before the due date to avoid any penalty.

- Filing of Income Tax Return- Another essential compliance for LLP is to file an annual income tax return, irrespective of the profits or revenue. Hence, even a dormant LLP that has not undertaken any transactions needs to file an income tax return.

- Maintain important documents– Once registered, an LLP is required to keep a record of its incorporation document, proof of the fee paid, names of the partners (any changes made), Statement of Account & Solvency, Annual Returns filed with the Registrar. Such documents must be readily made available for verification at the request of the concerned authority.

Conclusion

In a nutshell, an LLP has fewer compliance requirements in comparison to companies. Thereby, LLPs have to spend less cost in adhering to such compliances. However, any non-compliance can be too heavy on the pockets of a Limited Liability Partnership Firm.

Reach out to Swarit Advisors for legal advisory in documentation and filing of annual compliance for Compliance for Limited Liability Partnership firm.

Also, Read: Benefits of LLP over Private Limited Company