Analysis of Merger and Acquisition

Dashmeet Kaur | Updated: Feb 17, 2020 | Category: SEBI Advisory

It requires an efficient business plan to achieve success in this competitive arena. However, any plan is futile without sufficient resources and proper execution. Therefore, one needs to look for a robust method that will help to scale a business. The most valuable strategic tool for business expansion is Merger and Acquisition. It is the biggest boon for Companies that are striving hard to generate more revenue. M&A is the fastest way to enlarge the business at a high level. This write-up will provide a complete analysis of Merger and Acquisition.

Table of Contents

What is the concept of Mergers and Acquisitions?

Merger and Acquisition refer to the consolidation of companies. Often both M&A are misinterpreted as one; however, they are poles apart in terms of implementation:

Merger– When two companies voluntarily unite to form a single entity; it is known as Merger. Such an agreement can take place between two existing Companies of the same size.

Acquisition – Acquisition occurs when one Company attains a portion or entire assets/shares of another Company. The transactions made under Acquisition can either be a Friendly or Hostile Takeover.

M&A represents organic growth of business with sustainable development and expansion of services.

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your IPO or Comapny Takeover or SEBI Advisory Services.

Advantages of Merger and Acquisition

An individual may not determine the importance of Merger and Acquisition on the surface level. Thus, let’s perceive an in-depth analysis of the Merger and Acquisition benefits:

- Financial synergy: It refers to the higher joint value of two entities, as compared to when the companies operate separately. The total value added is more powerful than a single unit; likewise, if two small companies merge, it results in a larger Company. M&A forms a Company that has more bargaining power to attain a lower Cost of Capital.

- Eliminates competition: The most significant advantage of Merger and Acquisition is that it reduces the level of competition in an industry. For instance, Flipkart acquired its chief rival, Myntra in May 2014 that helps both the Companies to maintain a competitive edge.

- Diversifies the range of products: A merger Company gets an access to a broader market and better sales opportunities. It enables the Company to experiment with new products and services without the risk of failure.

- Adequate finances & resources: When two Companies combine, it gains ample funds and competent workforce. M&A is a gateway to success with optimal utilization of resources.

- Tax benefits: Through Mergers and Acquisitions, a Company avails the Tax benefits. In such a case, the losses of a Company shall be written off against the profits of another. Thus, it reduces the total Net Taxable Income.

Head to head comparison between Mergers and Acquisitions

The nature of M&A varies to a great extent. Here are some highlights of their fundamental differences:

|

Basis of Differences |

Merger |

Acquisition |

|

1. Definition |

A merger occurs when two Companies come forward to work jointly as one. |

Under the acquisition, one Company takeovers or purchases another Company. |

|

2. Title of the Company |

A new name is given to the merged Company. |

The target Company runs under the name of the acquirer Company. |

|

3. Terms of expansion |

A merger takes place with the consent of both the parties and is planned. |

An acquisition can be hostile and is not voluntary at times. |

|

4. Purpose |

A merger company aims to decrease competition and increase operational efficacy. |

Acquirer objective remains to accomplish instantaneous growth. |

|

5. Authority |

Both Companies share the same level of power. |

The acquirer Company monitors and dictates the roles of the acquired Company. |

|

6. Framework |

Companies which are equal in size can merge. |

In case of an acquisition, the target Company is smaller than the acquirer organization. |

|

7. Legal Stipulations |

More legal formalities are there in the merger. |

The acquisition is done quickly with less legal provisions. |

|

8. Example |

Vodafone India merged with Idea Cellular Ltd. renamed as Vodafone Idea Limited. |

Tata Motors Limited acquired Jaguar Land Rover. |

Different Types of M&A

Mergers and Acquisitions are categorized into various forms that are segregated below:

- Horizontal Merger: It is the union of two or more Companies that are in direct competition with each other in regards to their product lines and markets.

- Vertical Merger:When two Companies of the same supply chain combine, it is referred as a Vertical merger/ acquisition.

- Market-extension Merger: It is theunity of those Companies who sell the same products or services but operate in distinct markets.

- Product-extension Merger: As the name suggests, it is the merging between Companies that belong to the same market but sell different yet related products & services.

- Conglomerate Merger:Such type of merger or acquisition happens amongst two unrelated businesses like a clothing company and software company.

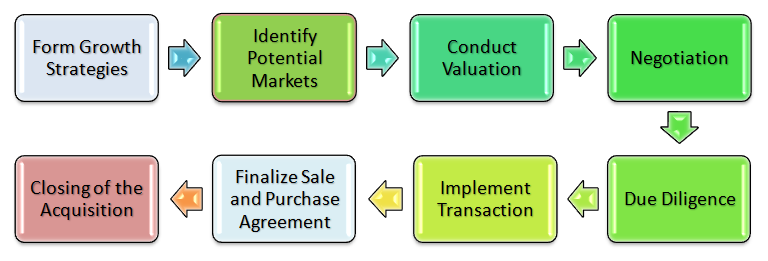

Analysis of Merger and Acquisition Process

Things to consider before undertaking Merger & Acquisition

There are some essential factors to keep in mind before uniting with another Company which are as follows:

- Set a Well-Defined Plan– M&A is a long term commitment that can either lead to a blissful future or turn into an eternal damnation. Therefore, it is important to pre-determine the Company’s objective and contemplate whether you will reap those goals after M&A or not.

- Structuring the Deal– It is the trickiest yet substantial part of Merger and Acquisition. The target and acquirer Company needs to resolve all the possible disagreements beforehand such as financial liabilities, warranties, indemnity for successful M&A.

- Due Diligence of Tax and Regulatory- Merger and Acquisition drive numerous taxes based on the industry type that requires Regulatory oversight. By Tax due diligence, the acquirer will get an insight into the target Company’s Tax Returns filing with Tax Sharing and Transfer Pricing.

- Assessment of Insurance Policies– The buyer Company must investigate the insurance policies of the target Company that can be beneficial after M&A. The Company should mainly seek the insurance policies of an employee liability, general liability and an intellectual property.

Conclusion

We at Swarit Advisors cater legal and financial services related to Merger and Acquisition. Our team helps to prepare documents and draft agreement of M&A. So look no further and consult us.

Recommended Post: Difference between Merger, Acquisition, and Amalgamation.