What is the Process to Register a Partnership Deed in Maharashtra

Shivani Jain | Updated: Nov 12, 2020 | Category: Partnership Firm

Initially, the process of registering a Partnership Deed in Maharashtra was manual and system-driven in nature. However, with the passage of time, things have changed significantly, and now there is a need to upload scanned documents in, together with the online application form.

In this blog, we will discuss the concept of Partnership Deed in Maharashtra, together with the documents required and the process of registration for the same.

Table of Contents

Concept of Partnership Deed

The term “Partnership Deed” signifies a written legal document, which is drafted on a judicial stamp paper and signed between two or more parties, who are willing to carry out business activities jointly.

Further, this document includes all the terms and conditions, profit sharing ratios, capital contribution, types of partners, working and operations of the firm, nature of the firm, dissolution or liquidation of the firm, roles and responsibilities of partners, etc.

Also, the main objective of a partnership deed is to ensure the smooth and hassle-free running of the business operations.

Concept of Partnership Firm Registration

The term “Partnership Firm Registration” denotes the registration of a business structure that requires a minimum of two people, who are ready to carry out business operations mutually. Also, these people individually are known as Partners and collectively are termed as Partnership Firm.

Further, this business format is governed and regulated by the provisions of the Indian Partnership Act 1932. It shall be relevant to mention that Partnership as a business structure is based on the concept of Mutual Agency.

Factors to Consider While Drafting a Partnership Deed

The factors to consider while drafting a Partnership Deed in India are as follows:

- Date of Execution of the Partnership Deed.

- Name of the Partnership Firm.

- Address of the Partnership Firm.

- Name of all the Partners.

- Address of all the Partners.

- Nature of the business activities to be carried out.

- Date of Commencement of Business Activities.

- Duration of Partnership.

- Capital Contribution by each Partner.

- Profit-sharing Ratios.

- Accounting Period.

- Rate of Interest on Loans and Capital.

- Method of Accounting.

- Policy concerning the Appointment of an Auditor.

- A Clause concerning the bank account opening.

- Powers, Duties and Responsibilities for each Partner.

- Salaries paid to each Partner.

- Mode of settling account.

- Adoption of the method of Arbitration.

- Clause for Adding or Removing partners.

- A Clause on Winding-up.

- A Clause concerning Credit Facility.

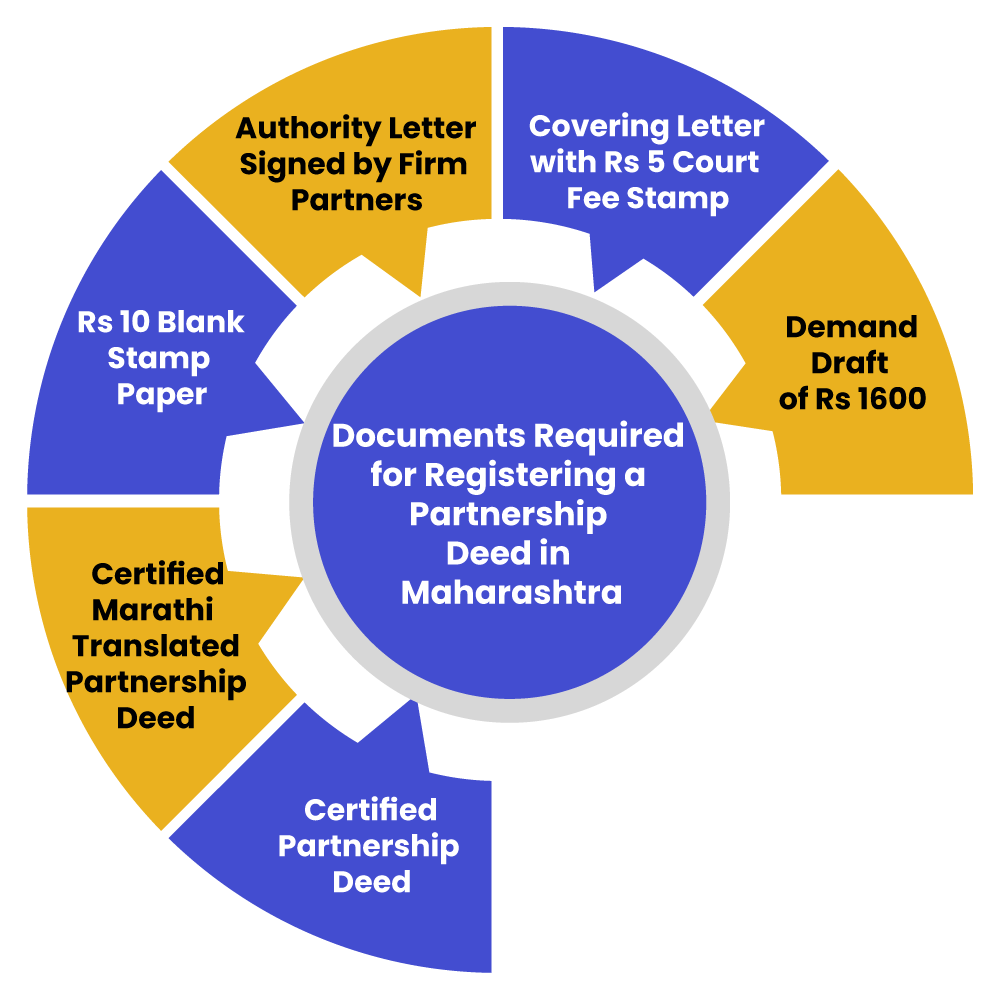

Documents Required for Registering a Partnership Deed in Maharashtra

The Documents Required for Registering a Partnership Deed in Maharashtra are as follows:

- A certified copy of the Partnership Deed.

- A certified copy of the Marathi Translated Partnership Deed.

- Rs10 Blank Stamp Paper.

- An Authority Letter duly Signed by Firm Partners.

- A Covering Letter, together with Rs 5 Court Fee Stamp.

- A Demand Draft of Rs 1600.

Also, Read: Gift Deed Registration: How to Draft a Gift Deed Format?

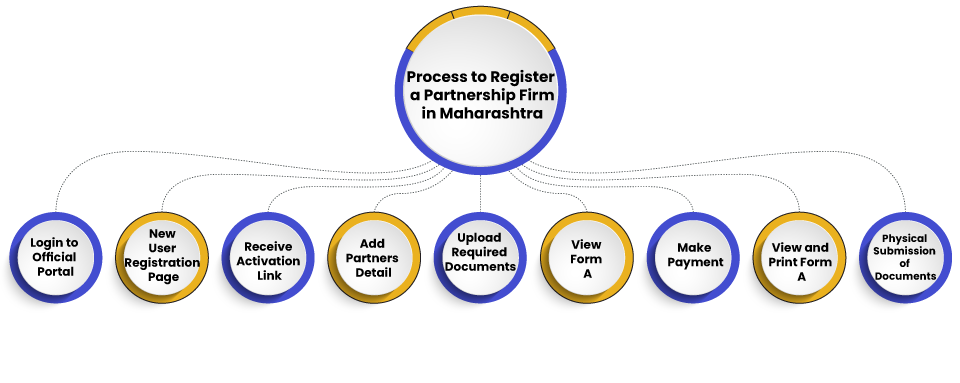

Process to Register a Partnership Firm in Maharashtra

The steps involved in the process to register a Partnership Deed in Maharashtra are as follows:

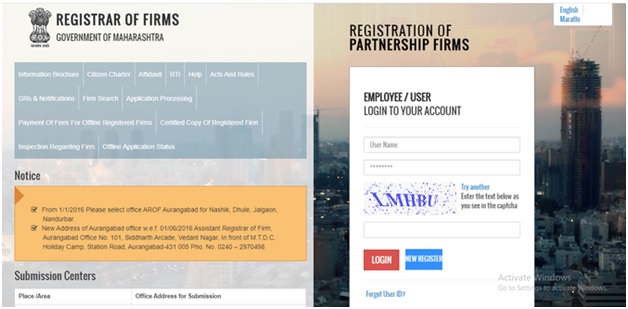

Login to Official Portal

In the first step, the applicant requires to visit the official website for Registrar of Firms, Maharashtra at https://rof.mahaonline.gov.in/. After that, click on the option “New Registration”;

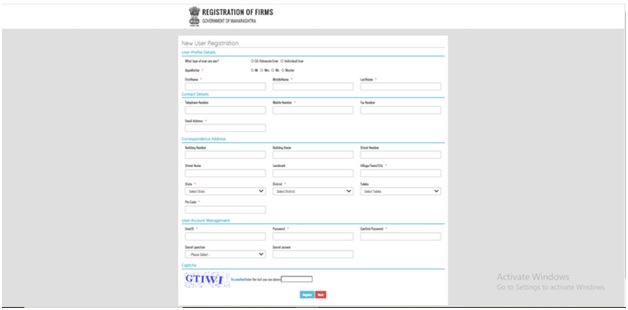

New User Registration Page

In the next step, the applicant will be re-directed to “New User Registration Form”. Here he/she will be able to create a unique ID and Password. However, the applicant will require to provide basic details, such as Profile Details, Contact Details, Correspondence Address, User Account Management, etc.

Receive Activation Link

Now, the applicant will receive an activation link on his/her registered email address. Further, he/she needs to click on the link provided to complete the process for “Login Registrations”.

After that, login with the provided credentials and select “Form A” under “My Application” from the Dashboard and furnish the required details.

Further, the application form is divided into 4 parts which are as follows:

Part 1: Firm Details

Under this head, the applicant requires to submit all the details regarding Partnership Firm, such as Firm Name, Nature and Size of Partnership Firm, etc.

However, such details must be in both English and Marathi and must not include titles before the name, such as Messers, M/S, Inc, Indian, etc.

Part 2

This part will include details concerning the Principal place of business of the Partnership Firm, as mentioned in the English Partnership Deed.

Part 3

This part will include details concerning the Principal place of business of the Partnership Firm as mentioned in the English Partnership Deed, together with the duration of the partnership as “At WILL”;

Part 4

The last part of the form will comprise of details, such as Name and Address of the additional place where the firm is carrying out its business operations.

Lastly, after filing the details asked, the applicant requires to select the option “Next”;

Add Partners Detail

Now, after clicking the option “Next”, the applicant requires to provide “Partner Details”. Further, the term “Partner Details” include Name and Address of the Partners, Date of Joining for each Partner.

Also, the applicant can add the name of the new partners by clicking on “Add Partner Tab”. However, it shall be relevant to note that a minor is not eligible to become a member of the partnership firm.

Lastly, after adding details of all the partners, the applicant requires to click on “Save and Added”.

Upload Required Documents

In the next step, the applicant needs to upload the required document for registering a Partnership Deed in Maharashtra. Further, for uploading documents, the applicant requires to choose the “File” and click on the option “Upload”.

Furthermore, the documents required are as follows:

- A Certified True Copy of the Partnership Deed.

- A Certified True Copy of the Marathi Translation of Partnership Deed.

- Affidavit Copy/Carbon Copy of License.

- An Authority Letter duly signed by all Partners.

- If in case Company is a partner then a Certified True Copy of the MOA (Memorandum of Association) and AOA (Articles of Association) if documents are submitted by C.A. or Advocate, together with the copy of Resolution.

- If in case Trust is a partner then a Certified True Copy of the Trust Deed.

- If in case the business requires License from any Government Department then the Certified True Copy of such License.

- Other Document

Note:

- All the documents must be duly certified by a Practising CA or Advocate.

- Also, after uploading the documents, the applicant must cross-check the upload documents to avoid the event of error and omission.

View Form A

In this step, the applicant can check or revise all the details filed by clicking on “View Form A”. Also, he/she can make changes in the information filed by choosing “Modify Form A”.

However, if in case there are no changes to be made, the applicant must click on the “Proceed To Payment” tab.

Make Payment

An applicant can make payment for the registration of Partnership Deed in Maharashtra by choosing either of the following listed modes:

- Paytm Wallet

- Net Banking

- Credit Card/Debit Card

- IMPS

Further, after choosing the desired mode of payment, click on “Proceed to Payment” Tab. Also, the amount required to be paid is Rs 1623, which includes (Registration Fee = Rs 1600 + Service Charge = Rs 20 + SGST = Rs 1.80 + CGST = Rs 1.80).

After that, click on the option “Make Payment”.

View and Print Form A

After successfully making the payment, the applicant requires to click on “My Applications” > click on “View Link” > choose “Print Button” to view and download PDF for Form A.

Further, it shall be noteworthy to take into consideration that the applicant requires to take the print of Form A on Green Ledger Paper. After that, it is mandatory for all the partners to sign on the said document.

Also, the applicant needs to get the form Notarized by a notary officer. The term “Notarized” includes details, such as Notary Registration Details, Name and Address of the parties involved.

Lastly, the applicant requires to upload the Notarized document by clicking on “My Application” tab and then “Upload” the Notarized Form A.

Physical Submission of Documents

After uploading the documents, in the next step, the applicant requires to furnish the physical copies of certain documents to ROF (Registrar of Firms) with 7 days, starting from the date of Online Submission.

Further, the documents required for physical submission are as follows:

- Covering Letter, together with Rs 5/- Court Fee Stamp.

- Certified Copy of the Partnership Deed.

- A Blank Stamp of Rs 100/-.

- A True Copy of License/ Undertaking/ Affidavit Form on an appropriate Stamp Paper.

- Xerox Copy of the Covering Letter to take Receiving of the Submission Date.

- A Copy of the Online Payment Receipt generated.

However, it shall be relevant to note that the applicant is not supposed to upload Authority Letter, Blank Stamp Pater, and Covering Letter.

Stamp Duty for the Registration of Partnership Deed in Maharashtra

The stamp duty paid for the registration of Partnership Deed in Maharashtra, and the selection of Non-Judicial Stamp Paper depends on the basis of Fixed Capital of the firm. Further, the stamp duty for the registration of Partnership Deed in Maharashtra can be summarised as:

- In case there is no sharing of contribution, and the amount does not exceed the Rs 50000, then the Stamp Duty paid is Rs 500.

- If the Fixed Capital paid in Cash is more than Rs 50000, then the Stamp Duty will be less than 1% of the amount paid, i.e., Rs 15000.

- In case the Share Contribution includes property, the Stamp Duty charged as per clause (a), (b), or (c) of Article 25 of the Maharashtra Stamp Act will depend on the Market Value of the Property.

Conclusion

In a nutshell, if an applicant wants to register a Partnership Deed in Maharashtra, then he/she requires to visit the official website for Registrar of Firms, Maharashtra. Also, after uploading the documents, the applicant requires to furnish the physical copies of certain documents to ROF with 7 days, starting from the date of Online Submission.

Therefore, we can rightly state that the process of registering a Partnership Deed in Maharashtra is a tiring, intricate, and back-breaking task, and the same requires professional assistance.

At Swarit Advisors, our experts will assist you with the process of registering a Partnership Firm and Partnership Deed in Maharashtra.

Also, Read: Partnership Deed Format: A Guide to Draft Partnership Deed?