We are well aware that GST is levied on the supply of goods and services. And hence, travel agencies are no exception. Therefore, GST on Travel Agents and Tour Operators...

MORE

GST migration is considered as a process for insurance of the provisional GSTIN for existing and registered taxpayers under the Central Excise or Service Tax to enable the smooth transition...

MORE

Before we proceed with Invoicing of GST, it's highly crucial to understand a few terms such as invoice, types of GST invoice, bill of supply, etc. So, let's first start...

MORE

Generally, the concept of Reverse charge mechanism under the GST regime can be considered as complicated one. Apart from that there also exists a misconception about the GST reverse charge...

MORE

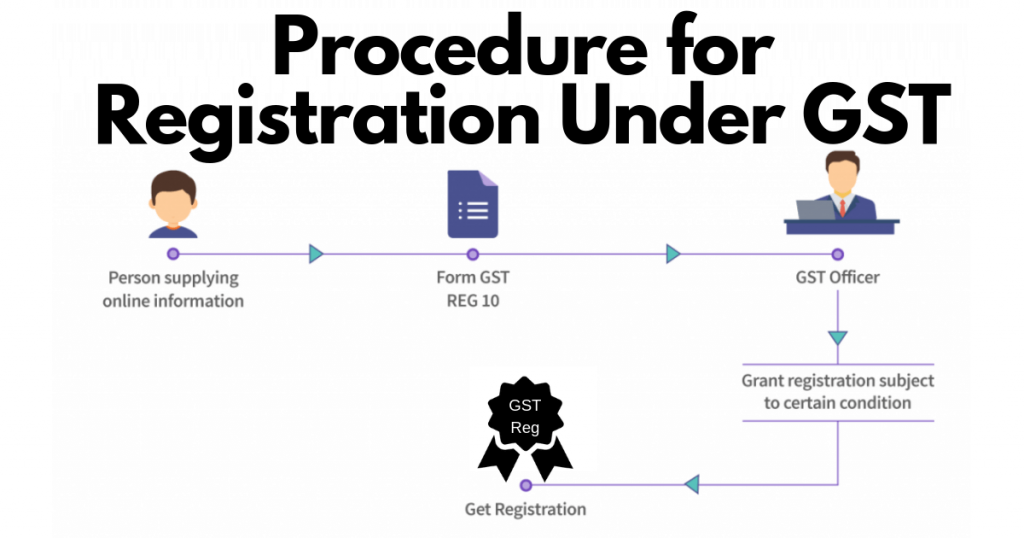

In order to gather knowledge on GST registration process step by step, we suggest you to read the entire article thoroughly so that you don't miss any vital part essential...

MORE

Recently, GST portal has updated itself, and therefore, we are again here with a new update. In this piece of article, we will acquaint you with the updates on new...

MORE

In the 33rd GST council meeting, the Union Finance Minister, Arun Jaitley said-"The GST rates on Under-Construction housing would be 5% without ITC. We have accepted this recommendation of the...

MORE

Finally, the real estate sectors are expected to get a sigh of relief on the GST rates. A meeting, regarding the rationalization of GST rates on real estates, which was...

MORE

The concept of GST has no doubt has many advantages, however apart from that there are also some disadvantages and demerits of the same. Let's discuss some of the Demerits...

MORE

Understanding the significance of Goods Transport Agency (GTA) under GST is vital because GTA holds an extremely invaluable role under the Goods and Services Tax as well as for businesses....

MORE