Overview of Public Issues

A company relies on various methods to raise funds like public issues, debentures, financial assistance from banks, etc. to meet its day-to-day business needs and working capital requirements. The fund requirement of a company can either be short term or long term, and depends upon the type of project it is working on. The sources of funds available to a business in India can be classified as:

- Public Issue

- Initial Public Offer (IPO)

- Further Public Offer (FPO)

- Offer for Sale

- Right Issue

- Bonus Issue

- Private Placement

- Preferential Issue

- Qualified Institutional Placement

In India, Public Issues is one of the most prevalent forms of raising funds from a large group of investors. In this process, a company offers prospectus to invite the general public to purchase its shares by paying the share application money. It is a way of offering convertible shares or securities in the primary market to attract new investors for the subscription.

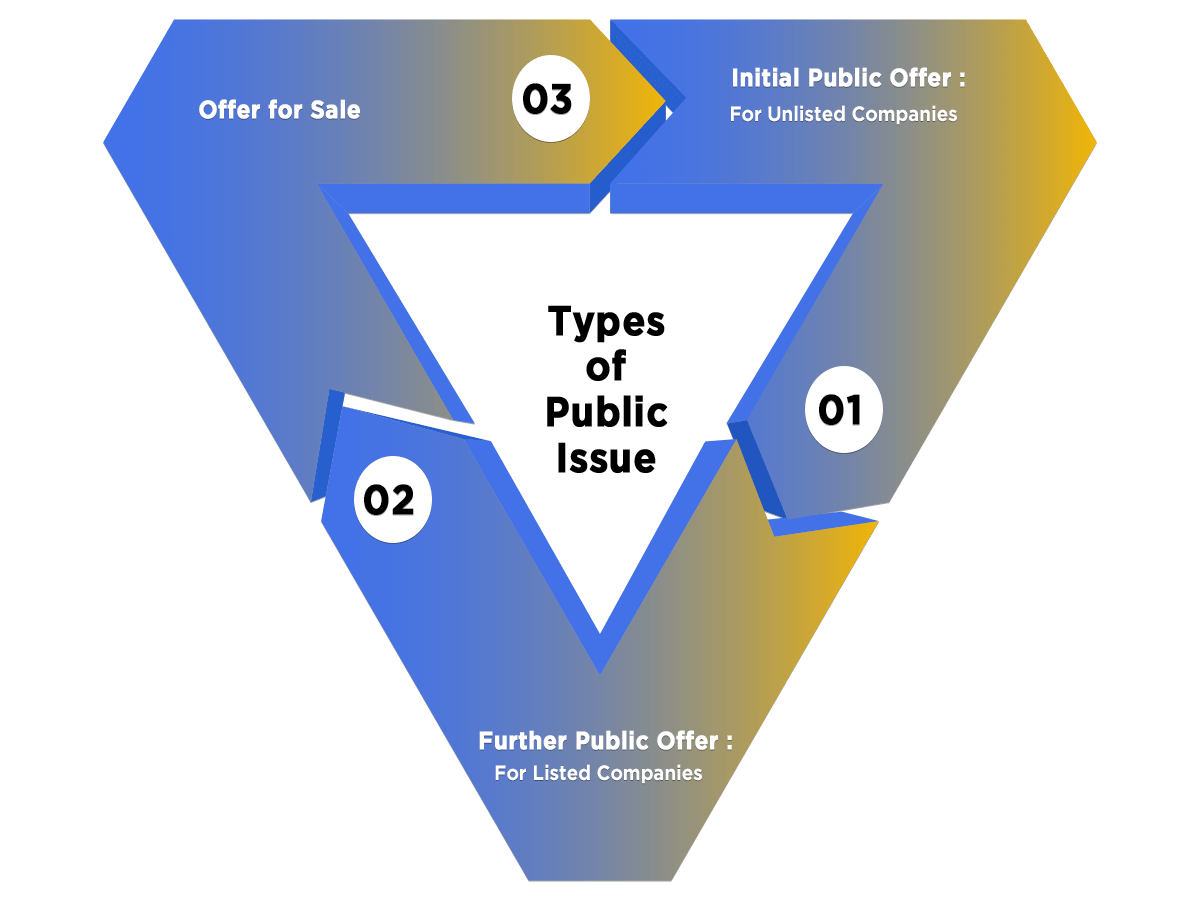

Initial Public Offer: For Unlisted Companies

An unlisted company is a public company that is neither listed on a stock exchange nor its shares are traded in any recognized stock exchange. It can also enter the primary market through Initial Public Offer. IPO is the first time when an unlisted company offers its shares to the public. Therefore, the process of IPO acts as a turning point for any unlisted company, as it helps in raising funds through public subscriptions. However, this process is much riskier than Further Public Offer as a company enters the market for the first time by issuing a prospectus.

Further Public Offer: For Listed Companies

When a listed company makes an offer for sale or comes out with a new issue of shares to the public to increase capital, it is known as Further Public Offer. FPO means a company which is already listed and has complied with the process of an IPO, is going to issue shares to the public. It is done to raise subsequent public investment. FPO is not as risky as an Initial Public Offer, as the investors are already aware of the company’s performance and have a fair idea about its growth opportunities.

Offer for Sale

The shareholders can offer a portion of their shareholding to the public in consultation with the BOD (Board of Directors). The prospectus of a company is considered as its LOI (Letter of Offer). Also, the shareholders of the Company reimburse any expenses regarding the offer. Hence, any dividend paid or declared on these shares is paid to the transferee.

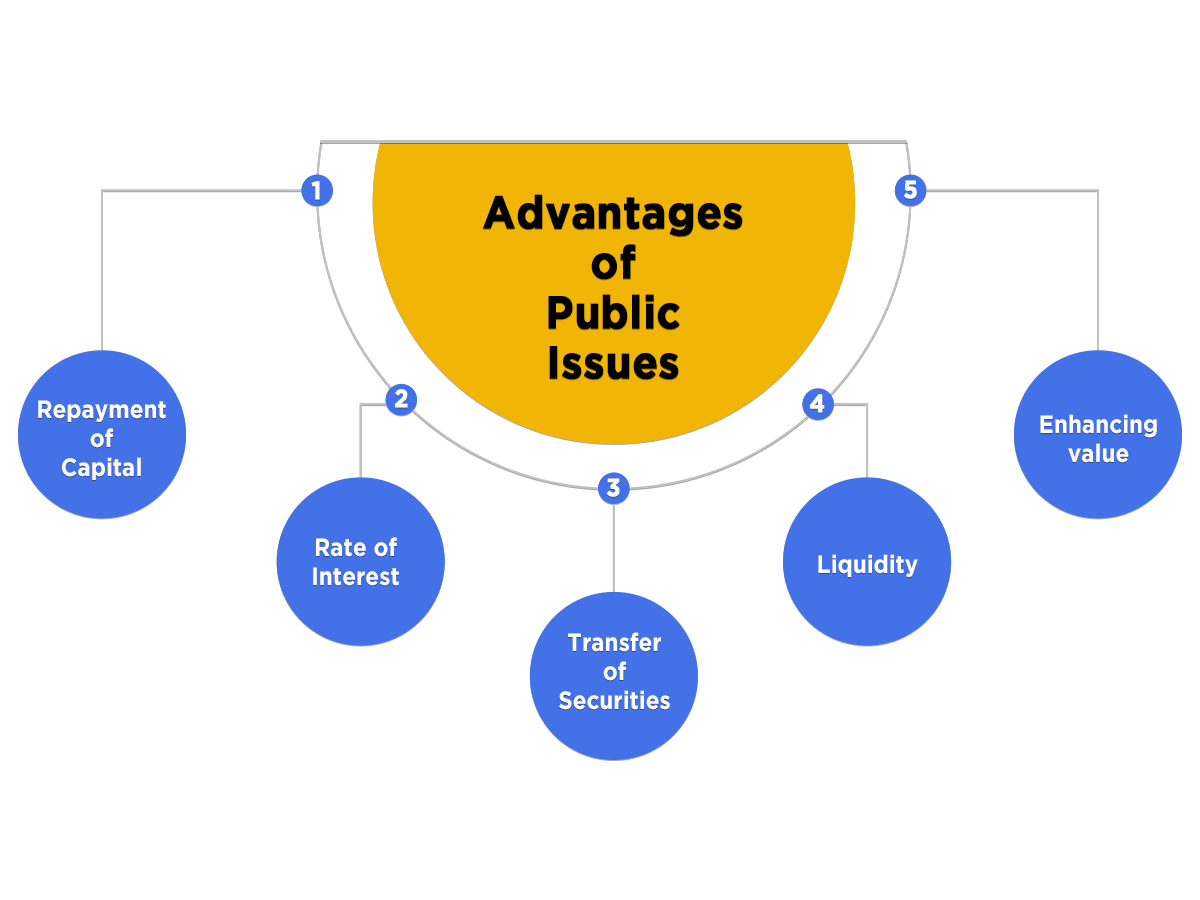

Advantages of Public Issues

The advantages of Public Issues can be summarised as follows:

- Repayment of Capital

If a company raises capital through Public Issues, there is no need to repay the amount to the investors except when the company goes into the winding-up process.

- Rate of Interest

Unlike debentures, public issues do not provide any fixed rate of interest.

- Transfer of Securities

In comparison to debentures, the ownership of a shareholder is easily transferable in the case of public issues.

- Liquidity

As compared to any other form of securities, shares are more liquid as they can be converted into cash easily.

- Enhancing value

The goodwill of a company increases when it trades shares on a recognised stock exchange. It also increases the level of transparency and trust among the investors and the public.

Regulatory Framework for Public Issues

In India, the legal provisions regulating the Public Issues are as follows:

- Chapter 3, Part 1 of the Companies Act, 2013;

- Rules and Regulations of the Securities Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulation, 2018;

- Rules and Regulation of Securities Exchange Board of India (Listing Obligations and Disclosures Requirements) Regulations, 2015;

- The Securities Contracts (Regulations) Act, 1956.

Types of Public Issues

The entry norms of public issue are governed by the SEBI (Securities Exchange Board of India) through its provisions under the SEBI (Disclosure for Investor & Protection) Guidelines, 2000. In India, the types of public issues are:

- Initial Public Offer (IPO) for Unlisted Companies;

- Further Public Offer (FPO) for Listed Companies;

- Offer for Sale.

Conditions Relating to Initial Public Offer

The following conditions must be fulfilled before undergoing the Process of Initial Public Offer:

- The company must have net tangible assets worth Rs 3 crores during the previous three financial years. Also, 50% of these assets are known as monetary assets. However, if a company makes public issues through an offer for sale, the limit of 50% is not applicable.

- The company must have a profit of a minimum Rs 15 crores for three years out of the immediately preceding five financial years. This profit must be an operating profit, i.e., PBT (Profit Before Tax).

- The company must have a net worth of Rs 1 crore during the previous three financial years.

- If a company decides to change its name, then at least 50% of the income generated in the previous financial year must be from the new activity represented by the new name.

- The company must not exceed the issue size more than five times the pre-issue net worth.

If a company does not fulfil the conditions prescribed above, it can make Initial Public Offer only if it satisfies the following term:

- An issue is made through the book-building process, with at least 75% of the net offer allotted to the QIBs (Qualified Institutional Buyers). If the company fails, then it needs to refund the subscription amount received.

Conditions relating to Further Public Offer

The following conditions must be fulfilled before undergoing the Process of Further Public Offer:

- If a company decides to change its name, then at least 50% of the income generated in the previous financial year must be from the new activity represented by the new name.

- The company must not exceed the issue size more than five times the pre-issue net worth according to the audited balance sheet of the preceding financial year.

If a listed company does not fulfil the conditions prescribed above, it can make Further Public Offer only by complying with QIB (Qualified Institutional Buyer) route, i.e., issue through book building method with at least 75% shares to be compulsorily allotted to the QIBs.

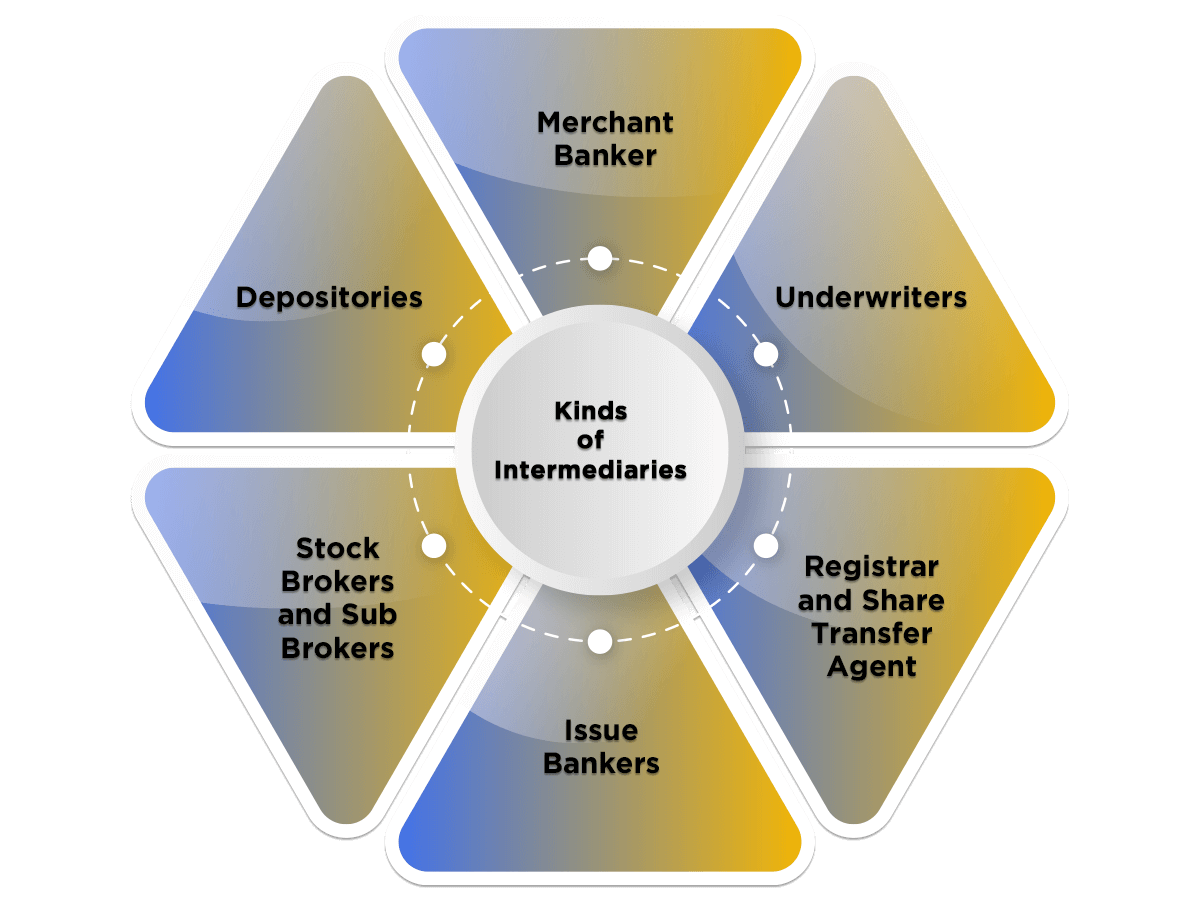

Kinds of Intermediaries

In India, the different kinds of intermediaries required with a valid proof can be classified as:

- Merchant Banker

Merchant Bankers are the most crucial intermediaries among all. From drafting of a prospectus to listing the company’s securities at the recognised stock exchange, they assist a company throughout. Merchant Bankers check and verify all the information provided in the prospectus, by carrying out due diligence for all the details that the prospectus provides. After that, they issue a certificate to the SEBI.

- Underwriters

Underwriters are required to subscribe to the unsubscribed shares of a company. Therefore, underwriters come into play when there is a situation of under subscription of shares.

- Registrar and Share Transfer Agent

The Registrar and the Share Transfer Agent decide the basis for allotment to the share application received from the public. They are also responsible for dispatching the share certificates or refund orders.

- Issue Bankers

The Issue Banker accepts all the applications on behalf of the Issuer Company. These applications are then submitted with the Registrar and Share Transfer Agent to further process.

- Stock Brokers and Sub Brokers

The Stock Brokers and Sub Brokers receive a commission from the Issuer Company for inviting the public to subscribe to the shares offered by it.

- Depositories

Depositories hold securities in dematerialized (DEMAT) form for the shareholders. In India, there are two main depositories, i.e. CDSL (Central Depository Securities Limited) and NDSL (National Securities Depository Limited).

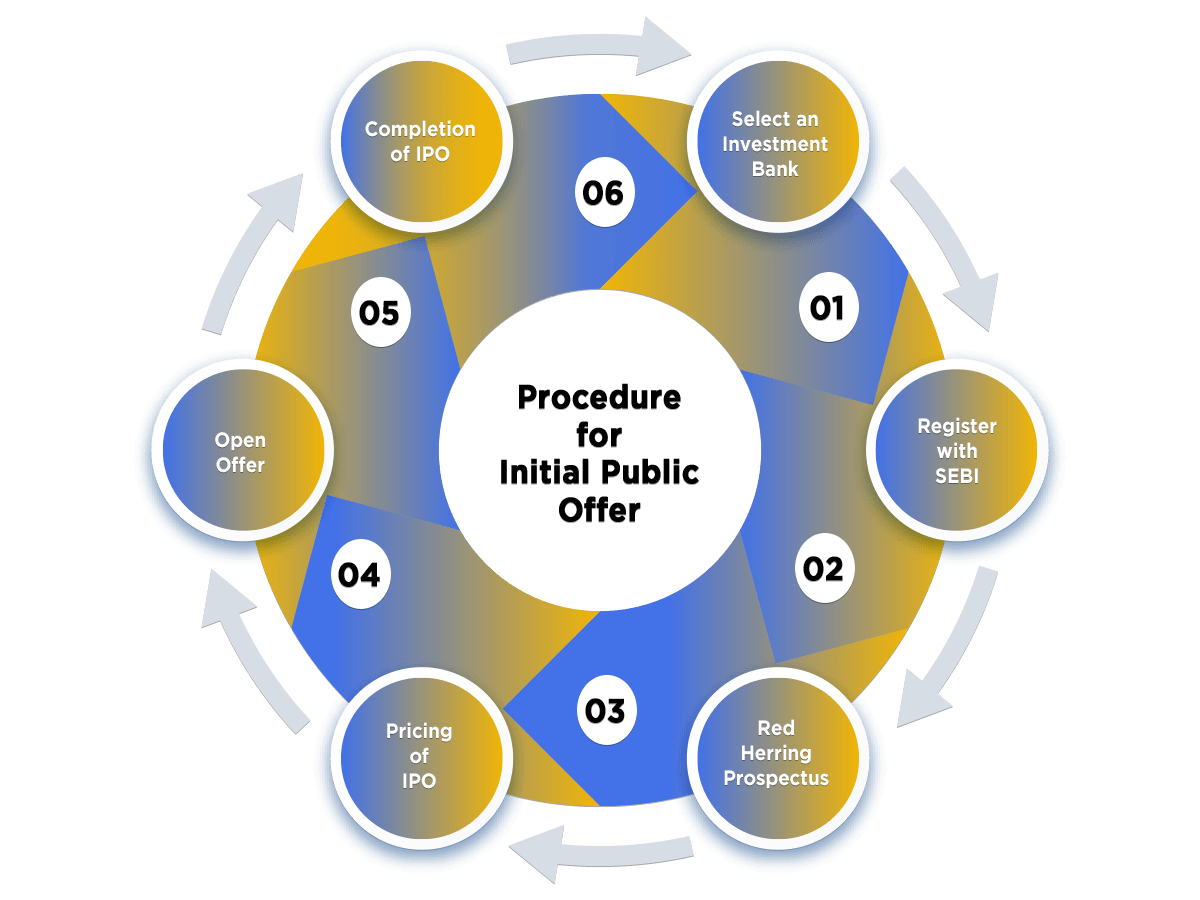

Procedure for Initial Public Offer

In India, the steps involved in the process for Initial Public Offer are as follows:

- Select an Investment Bank

A company needs to hire an investment bank for seeking advice and guidance for Initial Public Offer. After that, an underwriting agreement is signed between the parties which lays down all the details such as:

- Number of securities to be issued;

- Price of the securities to be issued.

- Register with SEBI

The Company needs to apply for registration with the SEBI by filing an application that includes the complete details of the company’s business plan. It also needs to provide a declaration about the utilization of the capital it raised from an IPO.

- Red Herring Prospectus

The directors of the company need to file an initial prospectus that includes the details of the price estimate of the shares. It is known as the Red Herring Prospectus because it contains the warning that it is not the final prospectus.

- Pricing of IPO

SEBI has no role in the pricing of shares. It is the issuer company that consults with the investment bank while fixing the issue price based on the market's prevailing rates. A company considers the following factor for determining the issue price:

- Employee Pension Scheme;

- Private Equity;

- Return on Net Worth, etc.

Further, a company can issue shares either through Fixed Price Issue or by Book-Built Issue. In a fixed price method, a share is issued at a fixed price. Whereas in a Book-Built method, the shares will have a price bracket within which an investor can bid.

- Open Offer

A company can provide the application form and prospectus, both online and offline. The investors can get the same from any designated bank. Further, the directors of the company need to submit an application form and a cheque to the designated bank.

- Completion of IPO

After deciding the issue price, a company discusses the number of shares an investor would get. However, the company needs to make sure that the offer is fully subscribed. All the shares allotted are then credited to the DEMAT (Dematerialised) Account of the investors. Once the company has allocated the shares, it is ready to trade on the stock market.

Lock-in Requirement for Initial Public Offer

The promoter of a company must contribute at least 20% of the total post-issue capital. The lock-in period for such a contribution is three years. However, the lock-in period for pre-issue capital is one year. For determining the lock-in period, a company needs to consider the following dates:

- Date of Commencement of business;

- Date of Allotment of Public Issues.

Duration of Initial Public Offer

The duration of the Initial Public Offer depends upon the type of issue, such as:

- Fixed Price Issue

It remains open for 3 to 10 working days;

- Book Built Issue

It remains open for 3 to 7 working days;

- Right Issue

It remains open for 15 to 30 days.

Difference between IPO and FPO

|

Point of Difference |

Initial Public Offer |

Further Public Offer |

|

Meaning |

Initial Public Offer refers to an offer of securities made for the first time by the company to the public for subscription. |

Further Public Offer refers to an offer of securities made by a listed company to the public for subscription. |

|

Issuer Company |

Unlisted company |

Listed company |

|

Raising Capital |

A company raises capital for the first time from the public. |

A company raises capital from subsequent public investment. |

|

Risk Factor |

High Risk, as the company enters the primary market for the first time. |

Comparatively lower risk |

|

Objective |

The main objective of an IPO is to raise capital through public investment. |

The main objective of an FPO is to raise capital by subsequent public investment. |

|

Predictability |

Less predictable |

More predictable |

|

Profit |

Higher than Further Public Offer |

Lower than Initial Public Offer |

|

Types |

Equity shares and Preference shares |

Dilutive offering and Non-Dilutive offering. |

Difference between Public Issue and Private Placement

|

Point of Difference |

Public Issue |

Private Placement |

|

Meaning |

Public Issue is a method to raise share capital by selling securities to the public at large. |

In Private Placement, a company sells securities directly to a few pre-decided numbers of investors or institutions. |

|

Business Size |

Public Issues is primarily used by large-scale companies to raise funds |

Private Placement is generally used by small-scale companies to raise funds. |

|

Floatation cost |

For Public Issue, a floatation cost is included as there is a need for an underwriter. |

For Private Placement, no floatation cost is included in the as there is no need for an underwriter. |

|

Investment Bankers |

In a Public Issue, the Investment Bankers act as a Mediator between the Issuer Company and Investors for raising long-term funds from the Capital Market. |

In a Private Placement, there is no need for an investment banker to act as mediators as all the dealings are done directly done by the Issuer Company and Investors. |

Public Issues FAQ

Whenever an Issue or Offer of Securities is made to the New Investors for becoming a part of Issuer’s Shareholders’ Family, it is known as a Public Issue.

The different types of Public Issues are Initial Public Offer (IPO), Follow on Public Offer (FPO), and Offer Sale.

The term “Free Pricing of Public Issue” denotes a situation where an unlisted company is eager to get its security listed on an RSE (Recognised Stock Exchange) pursuant to a public issue. In this, it may freely price its equity shares or any other securities convertible at a future date into equity shares.

The main difference between the both is that in the former, a company offer or issue of securities to the new investors, the same is known as Public Issue. However, in the latter case, the company gives a formal invitation to the already existing shareholders to buy additional new shares in the company.

The provisions governing the concept of a public issue are the Companies Act 2013 and the Securities and Exchange Board of India (SEBI).

The necessity for marketing the public issue arises due to the highly competitive character of the capital market. Further, there is a surplus of companies that knock at the investor’s doors for seeking to sell their securities.

The term “Red Herring Prospectus” denotes a prospectus, which does not include details and particulars of the price, the amount of issue, and the number of shares being offered. That means if the price is not disclosed, then the number of shares together with the lower and upper price bands are disclosed.

The term “Regulatory Framework” includes the Companies Act 2013; SEBI (Issue of Capital and Disclosure Requirements) Regulation, 2018; SEBI (Listing Obligations and Disclosures Requirements) Regulations 2015; and Securities Contracts (Regulations) Act 1956.

The advantages of Public Issues are the Repayment of Capital; Rate of Interest; Transfer of Securities; Liquidity; and Enhancing Value.

The different types of intermediaries are Merchant Broker, Underwriters, Registrar and Share Transfer Agent, Issue Bankers, Stock Brokers and Sub Brokers, and Depositories.

The steps involved in the Procedure to issue Public Issues are Select an Investment Bank, Register with SEBI, Red Herring Prospectus, Pricing of IPO, Open Offer, and Completion of IPO.

The lock in period requirement for Initial Public Offer is 3 years.

A Fixed Price Issue remains valid for 3 to 10 working days.

A Book Built Issue remains valid for 3 to 7 working days.

An offer of Right Issue remains valid for 15 to 30 days.

The term FPO stands for Further Public Offer.

Further Public Offer refers to an offer of securities made by a listed company to the public for subscription.

An Unlisted Company is the Issuer of Initial Public Offer.

A Listed Company is the Issuer of Further Public Offer.

The main objective of an FPO is to raise capital by subsequent public investment.

The main objective of an IPO is to raise capital through public investment.

Equity shares and Preference shares are the two different types of shares issued in Initial Public Offer.

Dilutive offering and Non-Dilutive offering are two different types of shares issued in Further Public Offer.

The term “Floor Price” denotes the minimum price at which one can make the bid.

When the shareholders decide to offer a portion of their shareholding to the public in consultation with the BOD (Board of Directors), it is known as Offer for Sale.

The company must have a profit of minimum Rs 15 crores for 3 years out of the immediately preceding 5 financial years.

The company must have a net worth of Rs 1 crore during the previous 3 financial years.

The profit earned must be an operating profit.

The term Public Issue denotes a method to raise share capital by selling securities to the public at large.

Public Issues is primarily used by large-scale companies to raise funds.

In a Public Issue, the Investment Bankers act as a Mediator between the Issuer Company and Investors for raising long-term funds from the Capital Market.