How to Issue a Company Share Certificate?

Dashmeet Kaur | Updated: Mar 21, 2020 | Category: SEBI Advisory

After completing the incorporation process, Company gets registered under Companies Act, 2013 and issues its shares to raise capital. During allotment of Shares, a Company grants Share Certificate to its shareholders as per the law. If you need complete knowledge about the procedure to issue a Company Share Certificate, then thoroughly study this write-up. It will provide an overview of Share Certificate and entail its important aspects like process, requirement and penalty in case of breach of the provisions.

Table of Contents

What does Share Certificate stand for?

A Share Certificate implies a written document signed by a Company which serves as legal evidence that a person specified is the owner of its Shares. Companies Act, 2013 has mandated Companies to issue Share Certificate within two months of its incorporation.

A list of essentials that a Company Share Certificate must contain:

- Name of the Company

- Corporate Identification Number or CIN of the Company

- Registered address of the Company’s Office

- Name of the shareholder

- Folio number of member

- Number of shares which are represented by Share Certificate

- Amount paid on such Shares

- Distinctive number of Shares

- Date of issuance of Shares

- Number of Share Certificate

Timelines to issue a Share Certificate

A Share Certificate is issued after the Company’s incorporation and after receiving capital from the shareholders. Companies Act, 2013 has stipulated a timeframe for the Companies within which they can issue the Certificates. It prescribes two conditions under which the Company needs to issue Share Certificate in the given timeframe, which is mentioned below:

- In case, Companies allot additional Shares to the new or existing shareholders; they are required to issue Share Certificates within two months from the date of Share’s allotment.

- In case of Shares transfer/transmission, Share Certificate must be issued to the Transferee within one month of the receipt’s date of the instrument of transfer by the Company.

- If the company issues debentures, then it needs to issue Share Certificate within six months from the date of Debenture’s allotment.

The signatories of a Share Certificate also differ for Private Company and One Person Company. In the Private Company, 1 or 2 Directors along with a Company Secretary (if appointed) has to sign Share Certificates whereas, when a One Person Company issues Share Certificates, it must be signed by 1 Director & Company Secretary or some person authorized by the Board.

Companies with a common seal shall stamp the same on the Share Certificate in the presence of the persons mentioned above required to sign the Certificate.

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your IPO or Comapny Takeover or SEBI Advisory Services.

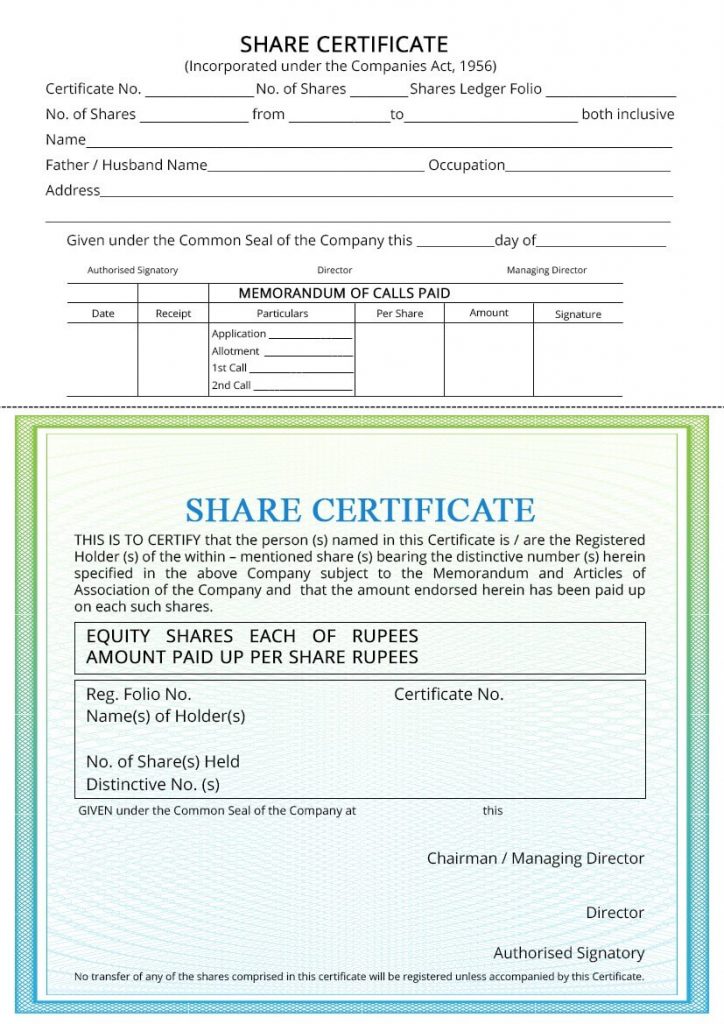

Format of a Company Share Certificate

As per Rule 5(2)-Companies (Share Capital and Debentures) Rules, 2014, a Share Certificate shall be issued in Form SH-1. Though the Rules have facilitated Companies to have their own format, yet it has to be similar to Form No. SH-1.

Prerequisites for issuance of Share Certificate

With effect from 1st April 2014, a Company must fulfill these conditions before issuing Share Certificates to the allottees:

- The Board must authorize the issue of such Certificate by passing a Resolution.

- Share Certificate shall only be issued on surrendering the “Letter of Allotment” or a “Fractional Coupon” of requisite value.

Procedure to issue a Company Share Certificate

Here are the insights of the process undertaken by a Company to issue Share Certificate:

- Summon Board Meeting & allot Shares:

The first step is to call for a Board Meeting is to determine the allotment of Company’s Shares. The Board of Directors shall assign a committee known as an allotment committee that will further decide about the distribution of Shares. Once the committee renders a report in regards to the allocation of Shares, the Board shall then approve the Report and pass the Resolution for Shares allotment to the respective members.

- Deliver Letter of Allotment:

Subsequent to allotting the Shares, the Company Secretary shall send the Letters of Allotment to the concerned members.

- Preparing the Register of Members:

The Company Secretary will maintain a Register of Members from the received Applications and allotment sheets. The Register will provide exclusive information about the Shareholders and details of the Shares that have been allotted to them.

- Draft and Print Share Certificate:

The Company Secretary must prepare the Share Certificate in the format (Form No. SH-1), as suggested by the Articles of Association. After drafting, he has to get the Form printed along with all the required details from the Register of Members and allotment sheets. It is indispensable for the Directors to sign the Certificate with the Secretary’s signature. Affix the Company’s seal and Revenue Stamp on each Share Certificate. Therefore, a Board Meeting shall be called again to pass the Resolution to issue Company Share Certificate.

After issuing the Share Certificate, the Secretary must fill and maintain its details in the Register of Members according to Section 88 of Companies Act, 2013.

- Intimate the members about delivery of Certificate:

During this stage, the Company Secretary will inform all the approved Shareholders that their Share Certificates are ready. He will intimate that the Certificates shall be delivered in exchange for Allotment Letters and bank receipts confirming the payment of allotment money. Thus, issue a public notice to notify the information of the members to the general public.

The Company will dispatch the Share Certificate through a Registered Post to the members who have provided their Allotment Letters whereas the local Shareholders can collect their Share Certificates from the Company’s Registered Office responsible for the dispatch of their Certificates.

Penalties for Contravention

When any Company fails to comply or breaches the provisions regarding the issue of Share Certificates, then it is subject to penalty. The penalty shall not be less than INR 25,000 but cannot extend a limit up to INR 5,00,000. Moreover, each defaulting Officer of such a Company will be liable to pay a minimum fine of INR 10,000 that can extend up to INR 1,00,000.

Conclusion

Thus, it’s better to seek expert guidance while issuing Share Certificate. Consult Swarit Advisors, a Legal firm with a competent team of Lawyers and CAs who can ease your legal hurdles.