How to Become an Investment Adviser in India

Swarit Advisors | Updated: Aug 28, 2019 | Category: SEBI Advisory

In India, if you want to be an Investment Advisor, then you must be registered with SEBI. A registered investment adviser isn’t allowed to receive any compensation or remuneration from any person except the client who is being advised. It implies that an investment adviser in India can only work on a fee prescribed for advisory.

The SEBI Investment Advisers Regulation, 2013 has isolated commission selling from investment advice. Initially, the advisor community in India criticized this regulation highly. However, later, investors began seeking advice from fee-only advisers.

Therefore, according to the regulation, nobody can become an investment adviser without seeking approval from SEBI. The process for becoming an Investment Advisor in India has been detailed in this blog. Let’s proceed-

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your IPO or Comapny Takeover or SEBI Advisory Services.

Table of Contents

What does an Investment Advisor mean?

Investment advisors are the professionals who provide guidance & assistance to the investors in the area of fields related to financial matters. Investment advisors offer guidance on all matters relating to monetary issues such as retirement planning insurance options or investment strategies. For pursuing a career as an investment advisor in India, one has to obtain a certificate of registration from SEBI.

Who all can be the Investment Adviser in India?

Any of the following entities could be the Investment Adviser in India:

- An Individual

- A company or body corporate

- Partnership Firm

Eligibility to become an Investment Advisor

For applying to become an investment advisor in India, the following are the minimum qualifications that are required:

- An individual should hold Professional qualification or PG diploma or PG degree in the subjects of finance, accounts, business management, commerce, economics, capital market, banking, insurance.

- Graduation from any discipline with an experience of minimum 5 years in activities relating to advisory services in a financial product, services, funds, assets or portfolio management.

- An individual should have post-graduation in finance or similar subjects & graduated in any discipline with 5 years of experience in the financial sector can appear on the following two exams for certification requirement which conducted by National Institute of Securities Market:

- Certification Examination of NISM – Series-X-A: Investment Advisor (Level-1)

- Certification Examination of NISM- Series – X-B: Investment Advisor (Level-2)

- Apart from this, an individual can also appear for a Certified Financial Planner examination conducted by the Financial Planning Standards Board India (FPSB).

- Net tangible assets for an individual or in case of the partnership firm shall be not less than INR 2 Lakhs.

- For others, Net worth shall be not less than INR 25 Lakhs.

- Any insurance agent having 5 years of experience in selling of insurance product are also eligible to become RIA provided they carry any graduate degree of any of the disciplines.

Documentation

Following is the list of documents that need to be submitted along with the application:

- Address proof

- Identity proof

- Qualification proof including degrees, NISM certificate & CFP certificates.

- Certificate issued by CA declaring the net worth

- Income Tax Return of the preceding 3 years

- Other necessary declaration

How to get registered as an Investment Advisor?

Following are the step-by-step procedure for online registration of investment adviser from the website of SEBI:

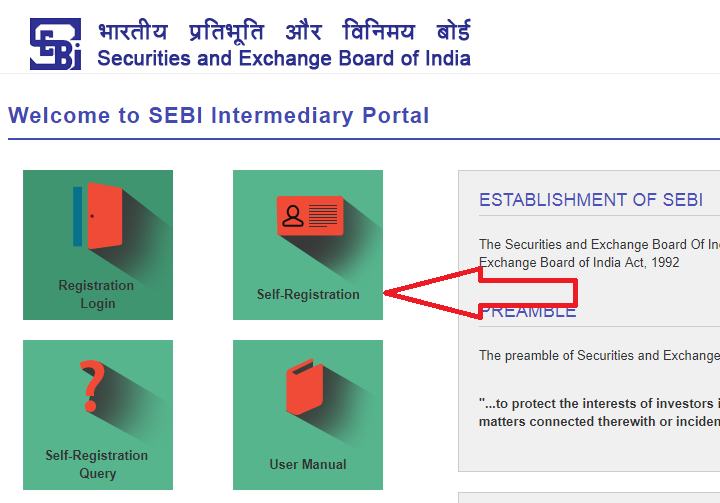

Step 1: Visit the SEBI Intermediary Portal

Go to online website & click on an option of Self-Registration.

Step 2: Furnish the details

Fill in the complete details of an application & click on proceed which takes you to another page of payment. Login credentials will be created online on SEBI’s portal.

Step 3: Make the payment

The next step is to make the payment. Payment can be made through an option of internet banking or debit card. Click on payment mode “Online” and then click “Proceed to pay” that will direct you to the payment gateway.

Step 4: Receipt of the confirmation email from SEBI

Next, the applicant will receive the confirmation mail from SEBI for the payment of fees along with receipt of login credentials within 7-10 working days.

Step 5: Login and fill up the application

Login to the account using the credentials & complete the application details. Attach all the documents & declaration needs to be annexed with an application. Furthermore, ensure that the application is submitted within 14 days of the receipt of login credentials.

Step 6: Fill the Form A

Next, you need to login to the SEBI portal with credentials & click on the Investment Advisor option. Select Navigate to the registration option in a drop-down menu. This opens the registration Form-A which has the following 7 sections which have to be filed & completed by an applicant:

- General information: It includes Name, Registered Address, correspondence address, and address or principle place of business, details of any registration with SEBI, RBI or IRDA.

- Details of an applicant: It comprises a Self-certified copy of identity proof, address proof, supporting documents of the qualification, Exam certificate of NISM, Income Tax Return of 3 years, & a copy of the net worth certificate from a chartered accountant.

- Business plan: Upload the PDF copy of the proposed business plan such as financial planning, stock advisory, etc.

- Infrastructure details: Give the necessary details of office equipment, address, furniture & fixture, communication facility, etc.

- Execution services: This section is important for a body corporate that is willing to offer distribution services to its clients through a subsidy or separate department or division. However independent applicants give a declaration that they will not be carrying on distribution and execution services post-grant of registration of investment advisor by SEBI.

- Miscellaneous declaration: Under this, an applicant has to submit a declaration stating that he is fit & proper as per the criteria specified in Schedule II of SEBI (Intermediaries) Regulations, 2008 and the applicant will not obtain any form of consideration other than the fee from the client being advised.

- Declaration statement: Declaration in PDF format that an applicant complies with the certification & qualification requirement as stated under section 7 of SEBI (Investment Advisor) Regulation, 2013.

Step 7: Response from SEBI

Communication is received within one month of filing of an application. In case of any query by SEBI, the response has to be made within the time allotted.

Step 8: Grant of the certificate of registration

Receipt of an email from SEBI for granting the registration number on mail & the certificate of registration is received through the post at the registered address mentioned on an application.

Types of investment advice that can be rendered

Following is the list of restricted advisory service that can be given by registered investment adviser:

- Life insurance, health insurance or other form of insurance.

- Post-office scheme

- Bank fixed deposits, recurring deposits,

- Small savings like PF, Sukanya Samriddhi Yojna, Kisan Vikas Patra, etc.

- Pension & annuity

- Mutual Funds

- Income Tax Planning & Tax Saving Strategies.

Fee structure

The fee structure is different for different categories:

- Application fee:

- Individual or partnership firm: INR 5000

- Body Corporate or LLP: INR 25000

- The registration fee for the grant of certificate of registration after approval of application from SEBI:

- Individual or partnership firm: INR 10000

- Body Corporate or LLP: INR 500000

Conclusion

After receiving the registration certificate of an investment advisor from SEBI, applicants can work as an investment advisor. To continue their career without hurdles advisor needs to stay updated about the latest regulations.

For that purpose, it is advisable to visit the official website of SEBI and find the latest news about the circulars and amended guidelines. Also, they must every time follow the reporting requirement of SEBI from time to time.

Investment Adviser shall not deny the terms and conditions, renewal rules and various other matters that can prevent from being a great potential investment advisor.

Also, in case if an applicant is a bank or NBFC, permission must be granted by RBI to act as IA.

Reference: Investment Advisers Regulation, 2013