How to Register a Mutual Fund with SEBI

Khushboo Priya | Updated: Aug 26, 2019 | Category: SEBI Advisory

To register a mutual fund in India, you require approval from SEBI. The Securities and Exchange Board of India (SEBI) is a body that controls and regulates the securities market. Hence, if you are thinking of how to start your own mutual fund in India, you should approach SEBI and seek its permission first.

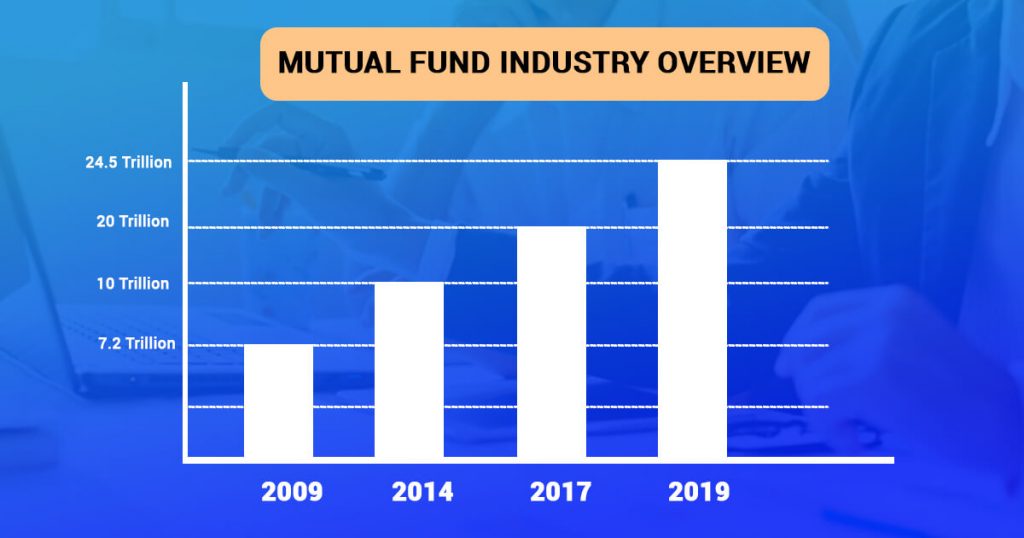

As per our research, we found that the Mutual Fund Industry in India is really doing well. In comparison to the year 2009, the AUM of the mutual fund industry experienced an increase of 3 ½ fold by 2019. We will discuss the same in the blog later. Hence, one thing is quite evident that the Indian Mutual Fund industry is growing at an excellent pace.

Therefore, if anybody is wandering to start a mutual fund in India, we must appreciate his/her idea. In this blog, we have described how one can register a mutual fund, its eligibility criteria, and more. But let us first understand what mutual fund really means.

Browse through our articles on services provided at Swarit Advisors, and just let us know if we can help you with your IPO or Comapny Takeover or SEBI Advisory Services.

Table of Contents

An Overview of Mutual Fund Industry in India

According to reports of the Association of Mutual Funds in India, the growth stats of the mutual fund industry in India are quite excellent. We have described the growth statics below:

- For the month of July 2019, AAUM (Average Assets Under Management) of Mutual Fund Industry stood at ₹25, 81,026 crores.

- However, AUM (Asset Under Management) stood at ₹24, 53,626 crores as on July 31, 2019.

- On 31st July 2014, the AUM of the MF industry was recorded to be ₹10 trillion.

- In August 2017, the same was recorded to be more than ₹20 trillion.

- On 31st July 2009, AUM of the MF industry stood at ₹7.22 trillion whereas on 31st July 2019, the same increased to ₹24.54 trillion.

- As per mutual fund parlance, the total number of accounts on July 31, 2019, stood at 8.48 million.

What is Mutual Fund?

Mutual fund refers to an investment vehicle constructed from a pool of money collected from a number of investors. The investors in a mutual fund, invest in securities such as money market instruments, stocks, bonds, liquid assets, debt funds, and other assets.

Just as rewards and profits earned during the investment tenure, losses are distributed equally among all the investors depending on the proportion of the contribution to the financial corpus.

Mutual Funds in India are registered with the SEBI- a body accountable for regulating security markets. Furthermore, investing in mutual funds is as simple as selling or purchasing stocks or bonds online.

Besides, the investors have the choice to sell out their shares whenever they need or want.

Types of Mutual Funds in India

The classification of mutual funds (MF) in India is done at large. There are various types of MF. They are as follows:

Based on Asset Class

- Equity Funds: These are funds invested in Stocks. Also known as Stock Funds.

- Debt Funds: These invest in fixed-income securities such as Liquid Funds, Bonds, Fixed Maturity Plans, securities and treasury bills, etc.

- Money Market Funds: Generally, such funds are run by the banks or corporations, and government by issuing money market securities such as bonds, dated securities, T-bills, etc.

- Hybrid Funds: Also known as Balanced Funds, it’s a combination of stocks and bonds which bridges the gap between equity & debt funds.

Based on Investment Goals

- Growth Funds: Such funds put a huge part of the investment in shares and growth sectors. It’s mostly suitable for investors having a surplus of idle money.

- Income Funds: These belong to the family of debt mutual funds. The money is distributed in a mix of bonds, certificates of securities and deposits among others.

- Liquid Funds: The maximum fund one can invest in it is Rs. 10 lakhs. Additionally, it belongs to the category of debt fund as it invests in the debt market.

- Tax-Saving funds: Such mutual funds are best-suited for salaried and long-term investors. Equity Linked Saving Scheme (ELSS) serves investors with the double benefit of building wealth. Moreover, it also saves on taxes with the lowest lock-in period of three years only.

- Aggressive Growth Funds: These are intended to make steep monetary gains.

- Capital Protection Funds: This form of mutual fund serves the purpose of protecting your principal while earning comparatively smaller returns.

- Fixed Maturity Funds: These bring down the tax burden on the investors investing in securities, bonds, money market, etc.

- Pension Funds: In this, the applicant puts a part of his/her income in a chosen Pension Fund. This is to accrue over a long period.

Based on Structure

- Open-ended Funds: Such funds aren’t constrained in a number of units or time-period. Furthermore, the investor has the choice to trade funds at his own convenience and exit when they want at the NAV (Net Asset Value).

- Close-ended Funds: The unit capital to invest is fixed beforehand. Hence, one cannot sell more than a pre-agreed number of units.

- Interval Funds: Such a mutual fund has traits of both open and closed-ended funds. No transaction is permitted for at least two years.

Based on Risk

- Very Low-Risk Funds: Such funds may be used to fulfill short-term financial goals and keep the investor’s money safe while returns are low.

- Low-Risk Funds: Investors put their money in either one or the combination of liquid, arbitrage or ultra-short-term funds.

- Medium-Risk Funds: Since the manager invests a part in debt and the rest in equity funds, therefore, the risk factor is of medium level.

- High-Risk Funds: Recommended for investors without any risk of aversion and those who seek high returns in the form of dividends and interest, etc.

Specialized Mutual Funds

These include sector funds, index funds, funds of funds, emerging market funds, and asset allocation funds.

Eligibility Criteria to Register a Mutual Fund in India

As per Regulation 7 of SEBI (Mutual Funds) Regulations, 1996, the applicant seeking mutual fund registration needs to satisfy the following criteria:

- The sponsor must hold a sound track record, integrity, and general reputation of fairness in all his business transactions.

Explanation : For the purposes of this clause “sound track record” shall mean the sponsor should

• Be carrying on business in financial services for a period of not less than five years; and

• The net worth is positive in all the immediately preceding five years; and

• The net worth in the immediately preceding year is more than the capital

• Contribution of the sponsor in the asset management company; and

• The sponsor has profits after providing for depreciation, interest, and tax in three out of the immediately preceding five years, including the fifth year.

- In the case, it’s an existing mutual fund; it must be in the form of a trust. Furthermore, the trust deed must be approved by the Board.

- Moreover, the contributor should have contributed or contributes at least 40% to the net worth of the asset management company:

Provided : any person who holds 40% or more of the net worth of an asset management company shall be deemed to be a sponsor and will be required to fulfill the eligibility criteria specified in these regulations;

- The sponsor or the principal officer or any of its directors to be employed by the mutual fund must not have been guilty of fraud. Furthermore, they must not have been guilty of any economic offense or convicted of an offence involving moral turpitude.

- Besides, the appointment of trustees to act as trustees for the mutual fund should be in accordance with the provisions of the regulations.

- Appointment of AMC (Asset Management Company) for managing the mutual fund and operating the scheme of such funds based on the provisions of these regulations.

- Appointment of custodian should be in order to keep custody of the securities or gold and gold-related instrument or other assets of the mutual fund held in terms of regulations. Besides, it must provide such other custodial services as may be authorized by the trustees.

Steps to Register a Mutual Fund with SEBI

Anybody willing to register a mutual fund with SEBI must follow the following steps:

Step 1: Filing of Form A

Firstly, the applicant needs to file Form A, which is an application for mutual fund registration. Along with this, the sponsor has to provide essential details as required by the SEBI.

Step 2: Submission of the Application Fee

Under regulation 3 of the SEBI (Mutual Funds) Regulations, 1999, the applicant needs to submit an application fee for registration. Additionally, the registration fee is non-refundable and as specified in the Second Schedule.

Step 3: Application to conform to the requirements

If the authority finds the application to be incomplete, it will reject the application. However, before rejecting the application, it will give the applicant an opportunity to complete such formalities within the timeframe as prescribed by the Board.

Step 4: Furnishing Information

The SEBI may require the applicant/sponsor to provide further information or clarification.

Step 5: Inspection of Application

On the receipt of the application for registration, the Board will check for the information if it’s valid or not. Accordingly, it will decide the application.

Step 6: The issuance of Certificate of Registration

If the information is true and the application is complete, the Board will grant the sponsor the certificate of registration in Form B.

Hence, if you wish to register a mutual fund with SEBI, please fill the inquiry form. We will contact you soon.

Also, Read: How Can I Start My Own Mutual Fund Company.