What is Annual Compliance of a Private Limited Company?

Under a private limited company, there is a limited liability protection and have various benefits such as raise fund from Venture capitalist, continuous existence. The confidence of the community come at the cost of increased annual compliance.

It is required for every private limited company to conduct its Annual General Meeting each financial year and file an annual return with the Ministry of Corporate Affair to maintain compliance. In case of a newly incorporated company, the annual general meeting must be held within 18 months from the date of incorporation or within 9 months from the date of closing of the first financial year, whichever is earlier. Whereas in case of a subsequent annual general meeting, it should be held within 6 months from the end of financial year. Annual Compliance of a Private Limited Company is required to be filed within 60 days from the date of the annual general meeting.

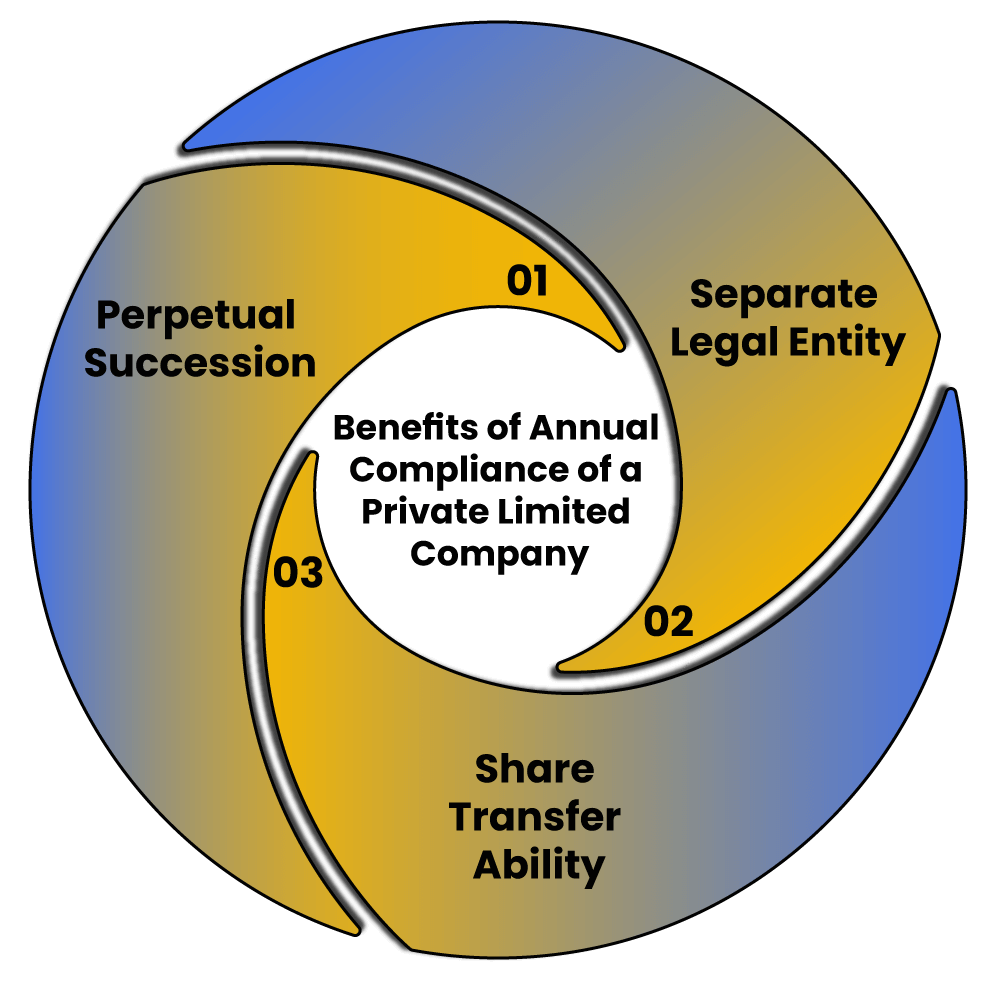

What are Benefits of Annual Compliance of a Private Limited Company?

- Separate Legal Entity

A company is a separate legal entity and a juristic person under the Act. Therefore, a company can own property in its own name and also incur debts. The members (Shareholders) and directors of a company have no liability to the creditors of a company for such debts. Being a juristic person, a company can acquire, own, enjoy and alienate, property in its own name. Member cannot claim upon the property of the company so long as the company is a going concern.

- Share Transfer Ability

One of the main benefit of Annual compliance of a Private Limited Company is Share Transfer ability. Shares of a company limited by shares are easily transferable by a shareholder to any other person. Shares can be easily transferred by filing and signing a share transfer form and handing over the buyer of the shares along with share certificate.

- Perpetual Succession

A company, being a separate legal person, is unaffected by the death of any member but continues to be in existence irrespective of the changes in membership. A company has 'perpetual succession' which has uninterrupted existence until it is legally dissolved.

So, if you want to get more insight details about Annual compliance of a Private Limited Company, then let us know by contacting our experts anytime.

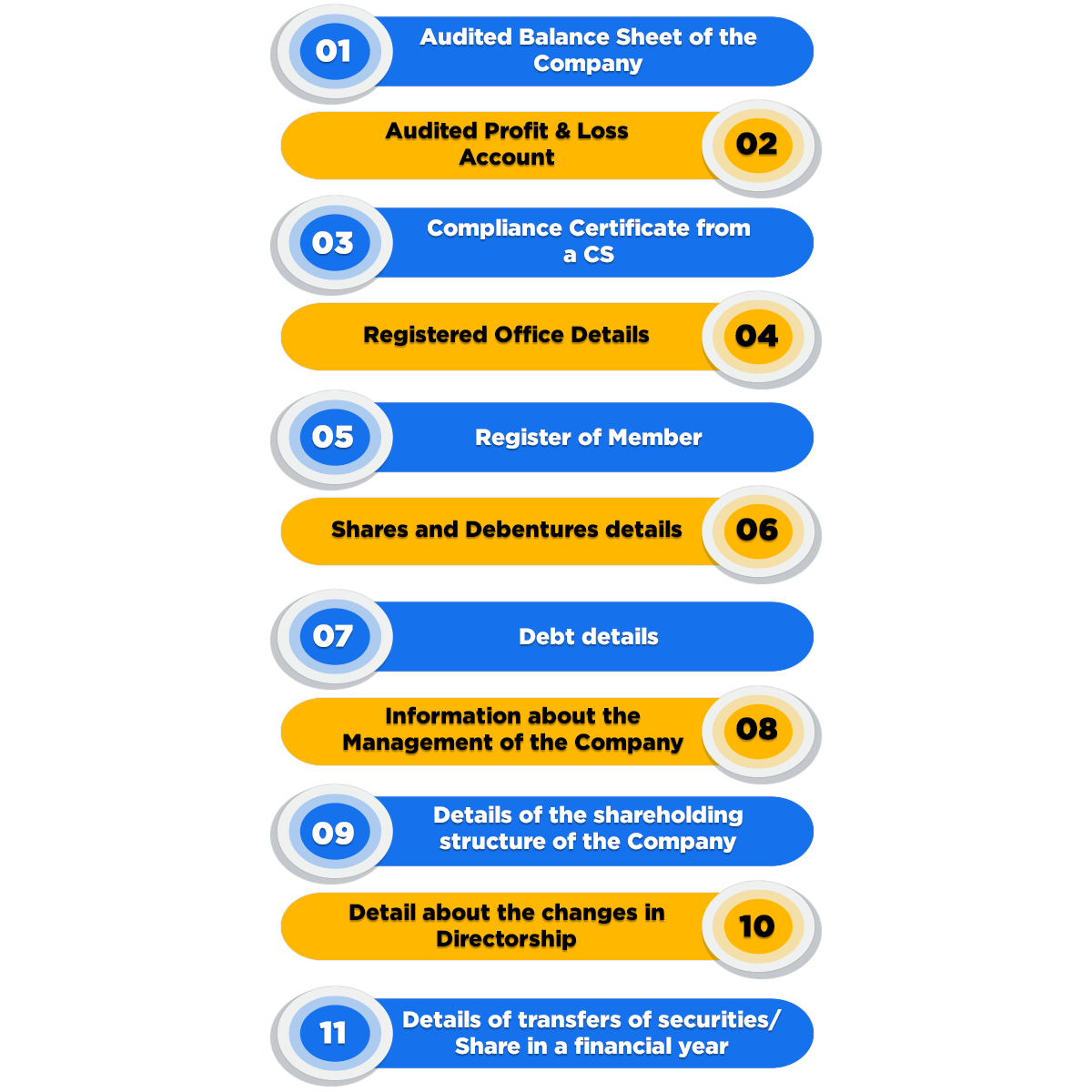

Annual Compliance of a Private Limited Company Consist of the Following

- Audited Balance Sheet of the Company.

- Audited Profit & Loss Account.

- Compliance Certificate from a CS.

- Registered Office Details.

- Register of Member.

- Shares and Debentures details.

- Debt details.

- Information about the Management of the Company.

- Current and details of the change in the shareholding structure of the Company.

- Detail about the changes in Directorship.

- Details of transfers of securities/ Share in a financial year.

Who is required to sign Annual Filing E-forms?

Annual filing E-forms are required to be signed digitally by the director of a company and CA/CS.

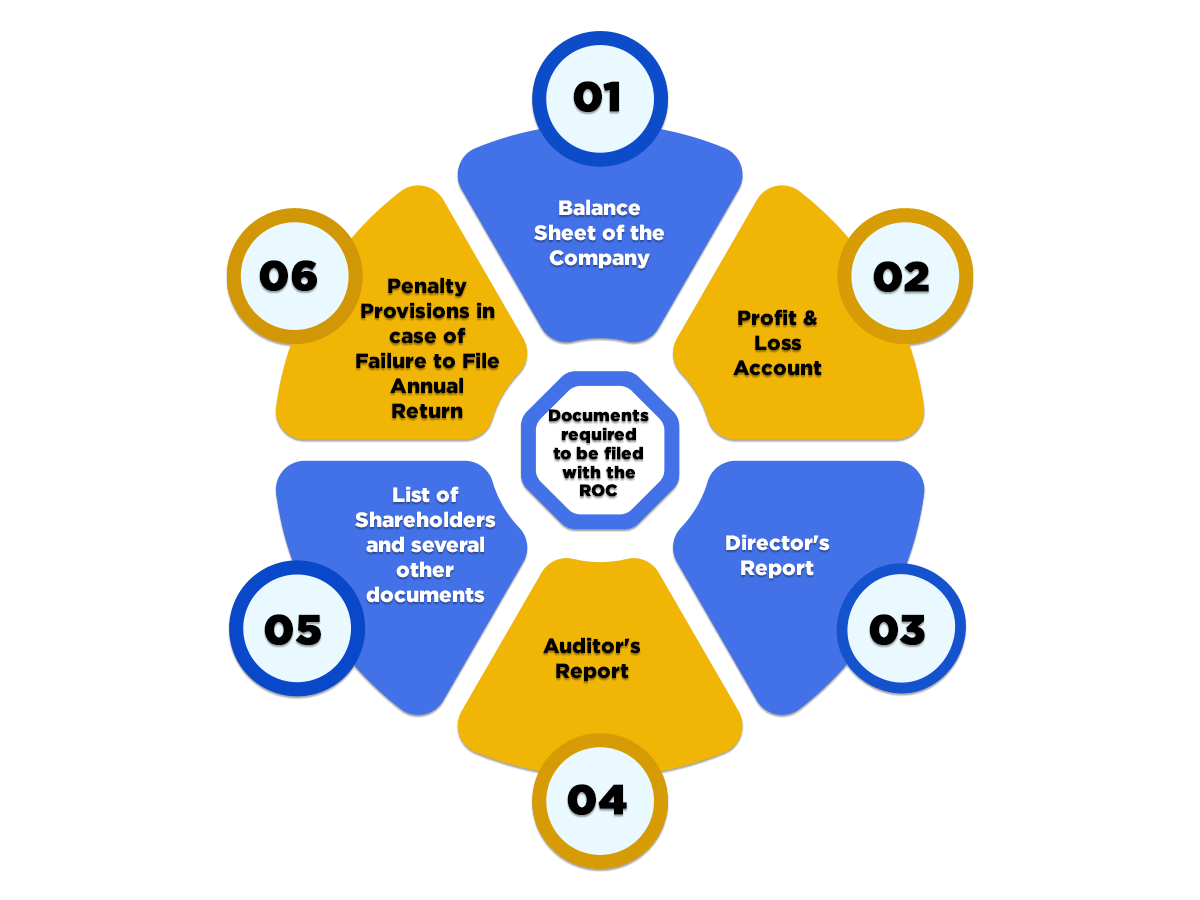

Following are the documents that are required to be filed with the Registrar of companies for Annual compliance of a Private Limited Company:

- Balance Sheet of the Company

- Profit & Loss Account

- Director's Report

- Auditor's Report

- List of Shareholders and several other documents.

- Penalty Provisions in case of Failure to File Annual Return

In case company fails to file its annual return, it is punishable with a fine which shall not be less than Rs.50,000 but which may extend to Rs. 5 lakhs and every Officer in default shall be punishable with imprisonment for a term which may extend to six months or with fine which shall not be less than Rs.50,000 but which may extend to Rs. 5 lakhs or both.

Frequently Asked Questions

A company having a minimum of two and a maximum of two hundred members which offers limited liability along with legal protection for its shareholders are known as Private Limited Company.

According to the Companies Act,2013 every Company shall hold an Annual General Meeting in each financial year, however, the gap between two such AGMs shall not be more than 15 months along with the financial statements of that financial year.

In India, all Private Limited Companies are regulated and governed by the Ministry of Corporate Affairs (MCA) under the Companies Act, 2013.

The first meeting for the filing of annual compliance of a Private Limited Company has to be conducted within 30 days of incorporating a business. However, after which four meetings shall be held every quarter in a calendar year.

A gap of more than 120 days should be avoided in order to have two consecutive meetings for a private limited company.

The company has the right to issue share certificate to any subscribers of memorandum within 60 days of incorporation.

Any Private Limited Company shall conduct a minimum of one Annual General Meeting each year. However, the first Annual General Meeting of a company must be held within nine months from the closing of the first financial year of the company.

All statutory registrations such as GST, PF, ESI, and IEC are required to be made for the filing of annual compliance of a private limited company.

Yes, it is deemed necessary for every company irrespective of the number of transactions has to get the compliance filings done.

There are numerous documents which are required for the filing of annual compliance such as Balance sheet and Annual Returns. These must be filed once a year. Companies must file Form 3 for Return of Allotment and Form No INC-22 in case of change in registered office.

Event-based compliances are defined as such compliances which gets triggered upon following of certain events such as change in directors of a company, change in approved share capital or change of registered office.

If a Company fails to follow any of the administrative compliances, then in such cases the Company along with every officer shall be held guilty for a period for which default remains along with the fine. However, the penalties will keep on increasing as the period of non-compliance increases.

Documents such as Incorporation Certificate, Financial statements, Audit reports, Board Reports and DSC of a Director are required for the filing of annual compliance.