Overview of Conversion of Private Limited Company to OPC

When a promoter of a private company chooses to resign from his position, the structure of the company tends to collapse. In such a situation, the professional suggests the option of conversion of private limited company to OPC. An OPC is a business structure that needs only one shareholder for its incorporation.

What is the Concept of Private Limited Company?

A Private Limited Company (PLC) is a privately-owned business structure. The members of this company enjoy the feature of limited liability. That means the liability of shareholders is limited to the extent of shares held by them. Normally, people with high aspirations and goals tend to choose a private company as a business format.

As per the provisions of the Companies Act, 2013, a minimum of two and a maximum of two-hundred individuals can become members of a private company. Further, a minimum of two and a maximum of fifteen directors are required to run business operations. Furthermore, a foreign national/ NRI is eligible to become a director of a Private Limited Company.

As per the Companies (Amendment) Act, 2015, the minimum capital requirement of Rs 1, 00,000 for private limited companies, has been removed.

What is the Concept of One Person Company?

The concept of OPC or One Person Company is relatively new in the Indian Corporate Sector. This structure needs only a single individual for its incorporation. However, a person is not allowed to incorporate more than one OPC.

A One Person Company is different from a Sole Proprietorship. A significant difference between the both is that a proprietorship firm is not a separate legal entity. In contrast, an OPC is a separate legal entity. Further, a nominee cannot become a nominee for more than one company.

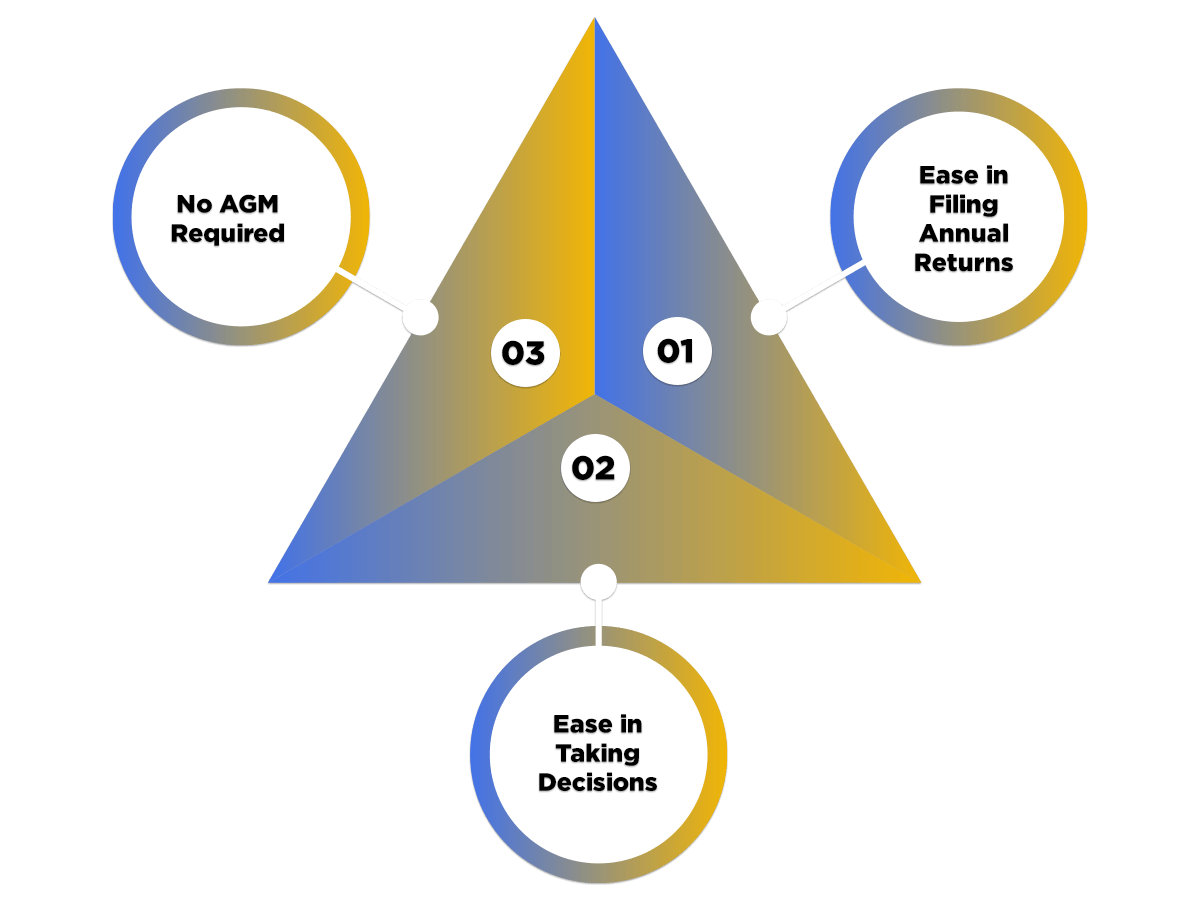

Benefits of Conversion of Private Limited Company to OPC

The benefits of the conversion of Private Limited Company to OPC are as follows:

- Ease in Filing Annual Returns

An OPC involves comparatively less annual and ROC compliance than any other business structure. There is no need for the director to take approval from a Company Secretary for filing the Annual Returns.

- Ease in Taking Decisions

Running an OPC is easy as it involves swift and fast decision making than any other business structure.

- No AGM Required

The provisions concerning an OPC are not that stringent like of private company. Therefore, holding an Annual General Meeting is not compulsory for a One Person Company.

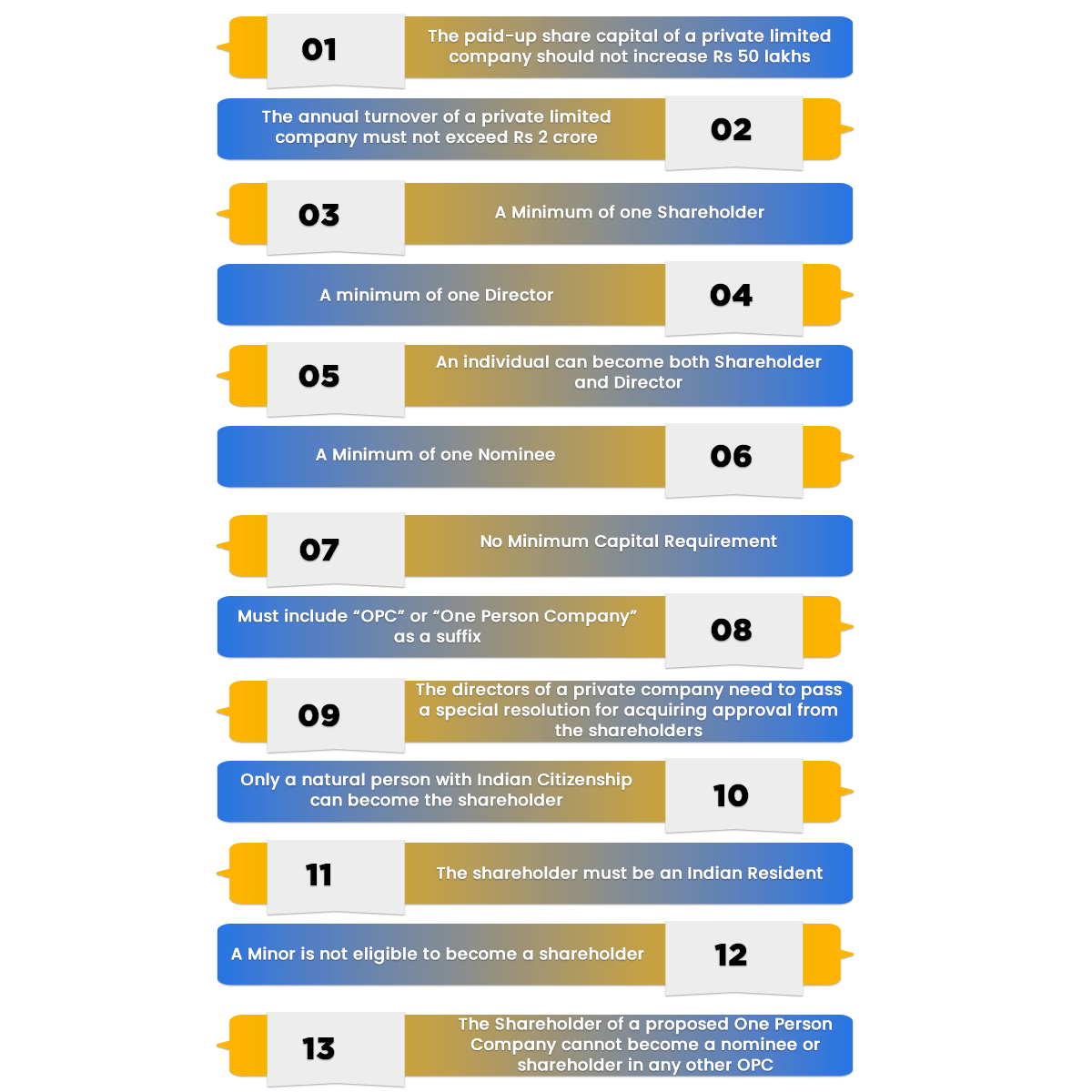

Minimum Requirements for the Conversion of Private Limited Company to One Person Company

In India, the minimum requirements for the conversion of private limited company to OPC are as follows:

- The paid-up share capital of a private limited company should not increase Rs 50 lakhs;

- The annual turnover of a private limited company must not exceed Rs 2 crore;

- A Minimum of one Shareholder;

- A Minimum of one Director;

- An individual can become both Shareholder and Director;

- A Minimum of one Nominee;

- No Minimum Capital Requirement;

- The name of a company must include “OPC” or “One Person Company” as a suffix;

- The directors of a private company need to pass a special resolution for acquiring approval from the shareholders;

- Only a natural person with Indian Citizenship can become the shareholder of the proposed OPC;

- The shareholder must be an Indian Resident. That means a person who has stayed in India for at least one-hundred and eighty days in the previous calendar year;

- A Minor is not eligible to become a shareholder or member of a One Person Company;

- The Shareholder of a proposed One Person Company cannot become a nominee or shareholder in any other OPC.

Conditions for the Conversion of Private Company to One Person Company

The conditions for a private company before undergoing the process of conversion are as follows:

- The applicant company needs to prepare and audit its Profit and Loss A/c, Balance Sheet, Financial Statements and other Books of Account;

- The applicant company needs to file all the returns and documents to the ROC before undergoing conversion;

- A private company must pay-off its stamp duty on the issue of share certificate;

- A private company must file its TDS Returns for all the deductions;

- A private company must file its GST Returns;

- The company should comply with all the provisions of the professional tax.

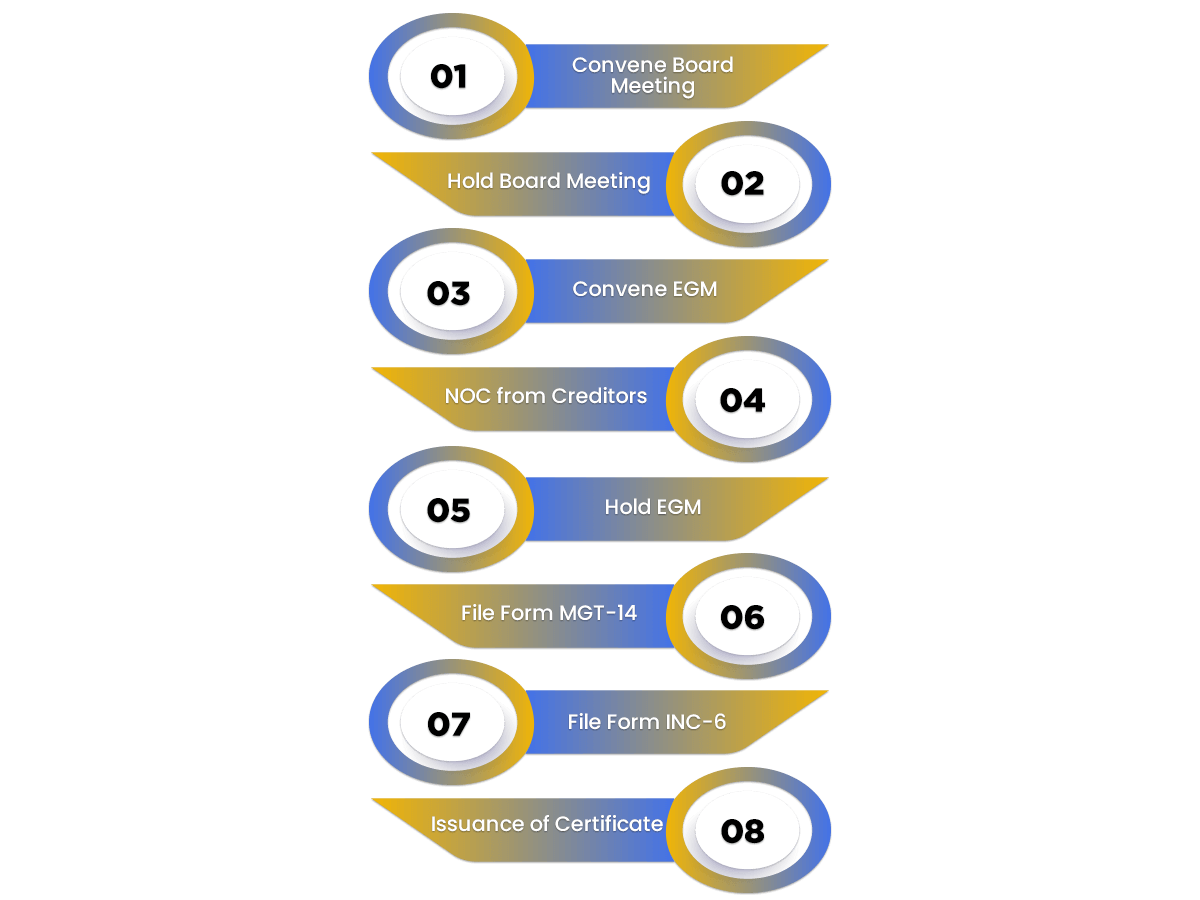

Procedure for Conversion of Private Limited Company to One Person Company

The steps involved in the procedure of conversion of private limited company to OPC are as follows:

- Convene Board Meeting

The directors need to send a notice for Board Meeting at least seven days before the meeting. The notice must include the agenda of the meeting as an attachment.

- Hold Board Meeting

Directors need to pass a board resolution for approving Conversion of Private Limited Company to OPC. They also need to decide the business items as follows:

- Fix date, day, place, time of the EGM (Extraordinary General Meeting);

- For the approval of the notice of EGM;

- For the approval of the explanatory statement and agenda of the EGM;

- To authorise directors to issue a notice for Extraordinary General Meeting;

- Convene EGM

Directors need to send a notice for EGM to all the members, auditors, and directors of the Company. They need to send it at least twenty-one days before the date of the EGM.

- NOC from Creditors

The company needs to obtain No objection Certificate in a written form from the Creditors and Shareholders of the company.

- Hold EGM

The shareholders need to pass a special resolution for approving the conversion of private limited company to OPC.

- File Form MGT-14

The directors of the company need to file MGT-14 with the ROC within thirty days from the passing of the resolution. The attachments with the form are as follows:

- Notice of EGM together with a copy of explanatory statement;

- Certified Copy of Special Resolution;

- Altered Memorandum of Association;

- Altered Article of Association;

- Certified Copy of Board Resolution.

- File Form INC-6

Now file INC-6 as the application for the conversion of private limited company to OPC. The attachments with the form are as follows:

- List of Members;

- List of Creditors;

- Latest Audited Balance Sheet;

- Updated Profit and Loss Statement;

- NOC from the creditors;

- NOC from the shareholders;

- Declaration from the directors stating the following:

- Consent has been obtained from all the Creditors has been obtained;

- Paid-up share capital of the company is Rs 50 lakhs;

- Annual Turnover is less than Rs 02 crores.

- Issuance of Certificate

After scrutinising the documents, the ROC will issue a certificate for the Conversion of Private Limited Company to OPC.

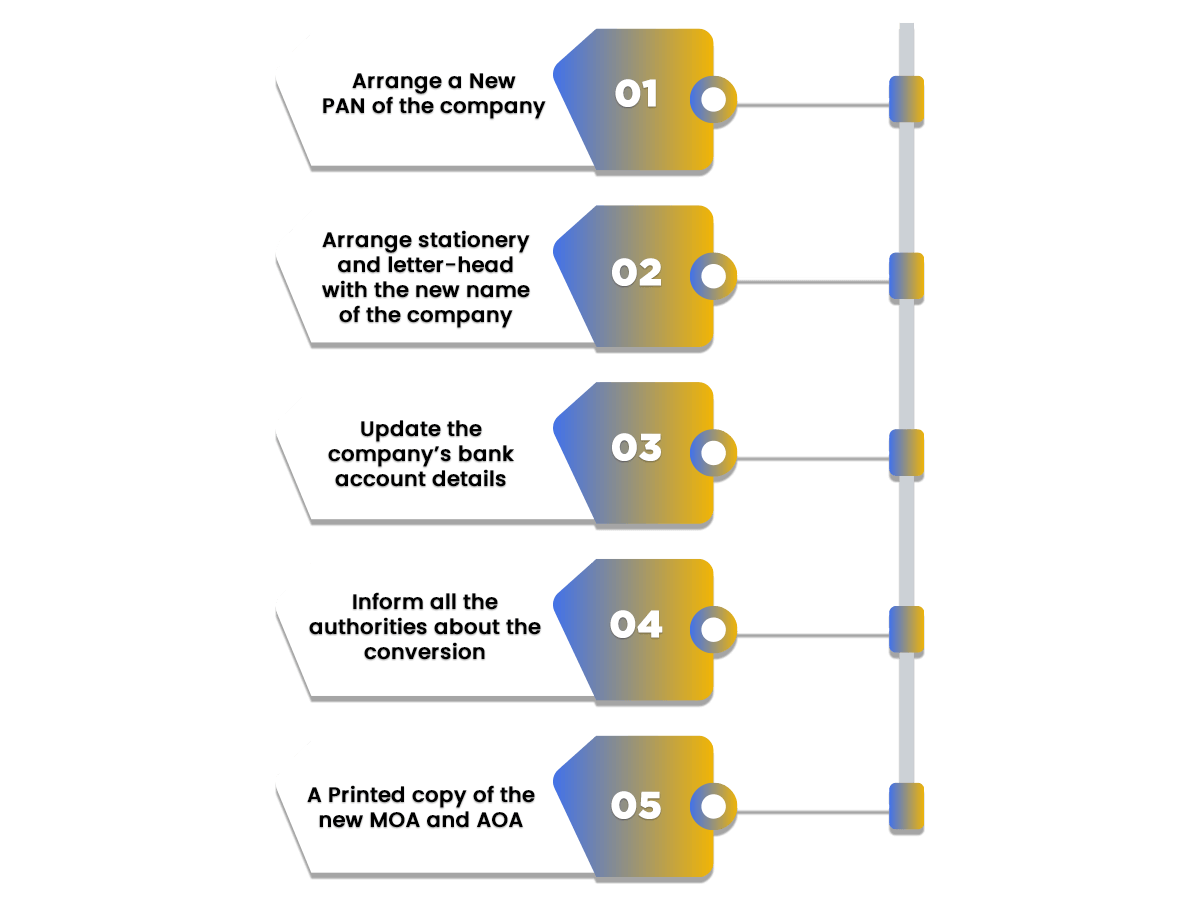

Post Conversion Requirements

The Post conversion requirements are as follows:

- Arrange a New PAN (Permanent Account Number) of the company;

- Arrange stationery and letter-head with the new name of the company;

- Update the company’s bank account details;

- Inform all the authorities about the conversion;

- A Printed copy of the new MOA and AOA.

Difference between One Person Company and Private Limited Company

|

Particulars |

One Person Company |

Private Limited Company |

|

Law Applicable |

Companies Act, 2013 |

Companies Act, 2013 |

|

Minimum share capital |

No minimum share capital requirement. However, the paid-up share capital must not exceed Rs 50 lakhs. |

No minimum share capital requirement. |

|

Members required |

A Minimum of one A Maximum of one |

A Minimum of two Maximum up to two-hundred |

|

Directors required |

A Minimum of two A Maximum of fifteen |

A Minimum of two A Maximum of fifteen |

|

Board Meeting |

At least one board meeting in each half of the financial year. Further, the gap between the two board meetings must be at least ninety days. |

At least one meeting in each quarter of the financial year. Further, the maximum gap between the two board meetings must not exceed one hundred and twenty days. |

|

Statutory Audit |

Compulsory |

Compulsory |

|

Annual Filing |

Annual returns and Financial Statements to be filed with the Registrar of Companies. |

Annual Returns and Annual Accounts to be filed with ROC. |

|

Liability |

Limited |

Limited |

|

Transferability of Shares |

Can be made after altering the MOA |

Can be easily transferred |

|

Foreign Direct Investment |

Not eligible for Foreign Direct Investment |

Eligible through Automatic Route |

|

Suitable to which type |

Individuals whose capital requirements are Rs 50 lakhs and turnover is less than Rs 2 crores. |

Trade, Business, Manufacturers, and Large Industrial Establishments. |

|

Company Name |

Must end with (OPC) Pvt. Ltd. or (OPC) Ltd. |

Must end with Pvt. Ltd. |

Frequently Asked Questions

Yes, a private limited company can be converted into an OPC after satisfying the 2 major conditions. First, the paid-up capital must not be more than Rs 50 lakhs, and the annual turnover should not exceed Rs 2 crores.

No, a One Person Company cannot have more than one director and shareholder. A single person can act as both director and shareholder.

According to the provisions of section 122 of the Companies Act, 2013, there is no need for an OPC to hold an EGM. Further, the member of an OPC just needs to inform the company about the resolution and needs to get it record in the Minutes of the Meetings.

The major benefits of conversion are No need to hold Annual General Meeting, Ease in Filing Annual Returns, and Ease in Taking Decisions.

No, an OPC is not allowed to be converted into an NPO or a charitable institution. Moreover, it cannot perform financial, investment, and non-banking operations.

The process of conversion will not affect the liabilities and debts of the previous company. That means the company will still be liable for its previous outstanding debts.

The steps involved are Convene Board Meeting, Hold Board Meeting, Convene EGM, NOC from Creditors, Hold EGM, File Form MGT-14, File Form INC-6, and Issuance of Certificate.

There are two main differences between both. First, the PLC is managed by a group of people, and OPC is owned and managed by a single individual. The second difference is that a PLC cannot appoint a nominee for a member, whereas in an OPC, a member can appoint a nominee.

No, only a Natural person with Indian Citizenship can become the shareholder of the proposed OPC.

Yes, a One Person Company can have a stake in another company.

No, a minor is not allowed to become a member of a One Person Company.

Yes, an OPC can hire employees, as the provisions of the Companies Act, 2013 does not restrict the number of employees.

No, a One Person Company is not allowed to accept FDI (Foreign Direct Investment).

The post conversion requirements for a One Person Company are Apply for a fresh PAN, Update all the stationery and business letterheads, Inform all the Authorities, Increase the number of Directors, ad Print the copies of new MOA and AOA

A person can become a director and shareholder in only one OPC.

The governing laws for the conversion of private limited company to an OPC are Section 18 of the Companies Act 2013, and Rule 7 of the Companies (Incorporation) Amendment Rules 2020.