An Overview of Asset Management Company

An Asset Management Company is often mentioned as AMC, is a company that directs various sorts of funds of retail invests & customers in different areas to increase the returns on them. The funds could be invested in stocks, bonds, properties, and mutual funds. Asset Management Companies are generally called money managers or asset. Such entities help investors in the diversification of their investments in different areas.

An Asset Management Company has asset managers working on estimating the investment structure that requires to be diversified. After valuation, they conduct market research about the possible investment option to know its viability as a viable investment destination. Supported by the outcomes of this research, they push ahead with the strategy of investment.

How does an AMC Work in India?

There are three primary steps involved in an Asset Management Company/Service, and you can check the same below:

1. Asset Criteria or Allocation

In this stage, the investment managers require to consider the assets forms that are available for allocation. The following elements have to be considered while Asset Allocation:

- Types of Assets Distribution – Debt or Equity Basis;

- Portfolio Research;

- Market Estimation;

- Experts Considerations & Practice in Assets Management.

2. Portfolio for Investment Management

In the next step, formulating an investment portfolio is essential for proper management. Asset managers should research the market and consider possible undoing & trends in the market. The potential risk aspects that pose as per the market analysis also should be considered. One of the primary considerations is where the investment should be made, whether in high-rated securities or vice versa.

3. Performance Observing

The final step of an Asset Management Company is the constant portfolio estimation and what is the return rate of investment the portfolio is furnishing. There should be given in the reports form. The managers of the asset should deliver their customer performance reports of the assets.

Regulatory Body of the AMC (Asset Management Company)

The primary regulatory or authority body for an AMC or Asset Management Company in India is the SEBI or Securities Exchange Board of India. Apart from this, the other regulatory body for the Asset Management Company is the AMFI (Association of Mutual Funds of India).

What is the Eligibility Criteria and Fees Required for Asset Management Company Registration?

Following is the eligibility criteria and fees required for Asset Management Company Registration:

- The aspirant has to pay a non-refundable fee of application of Rs. 1 lakh to the SEBI. The manager of the portfolio is needed to pay a sum of Rs. 10,000/- as registration fees at the time of grant of registration certificate by SEBI.

- The candidate should have two peoples who have at least five years of experience in portfolio or investment management.

- The SEBI would take other deliberation, such as the candidate having sufficient office space.

- The Certificate of Asset Management Company Registration is valid for a period of three years.

- The manager has a minimum net worth of Rs. 50 lakhs.

- Professionals or experts working as fund managers should have mandatory qualifications in accountancy, law, chartered accountants, or management from a professional university.

What are the Documents Required for Asset Management Company Registration?

If an investor is a company, then a board meeting or resolution should be passed that the entity will be investing in the assets or asset. The following are the documents that are needed for investing in an Asset Management Company:

- Submit an MOA (Memorandum of Association), AOA (Articles of Association), Investment Scheme of a Private Limited Company;

- Submit a DIN or Directors Identification Number of the company’s director;

- Submit KYC (Know Your Customer) documents;

- Submit any identity proof such as passport, voter’s id, driving license, etc.;

- Submit an address proof such as Aadhar Card;

- PAN Card.

Pros and Cons of the Asset Management Company Registration

Following are some pros and cons of Asset Management Company Registration:

Pros of Asset Management Company Registration:

- Improvised options for investment;

- Well-diversified Portfolio;

- Deliver an extensive range of financial services;

- Statistical examines the markets and trends;

- Brings economies of buying and scaling power;

- Assets managed by experts;

- Particular services to the association.

Cons of Asset Management Company Registration:

- Risk of Criminal Liabilities;

- High fees for customers;

- Risk of the underachieving market;

- Higher minimum investments;

- May increase conflicts of interest.

Measures on Which Investor Picks Asset Management Company

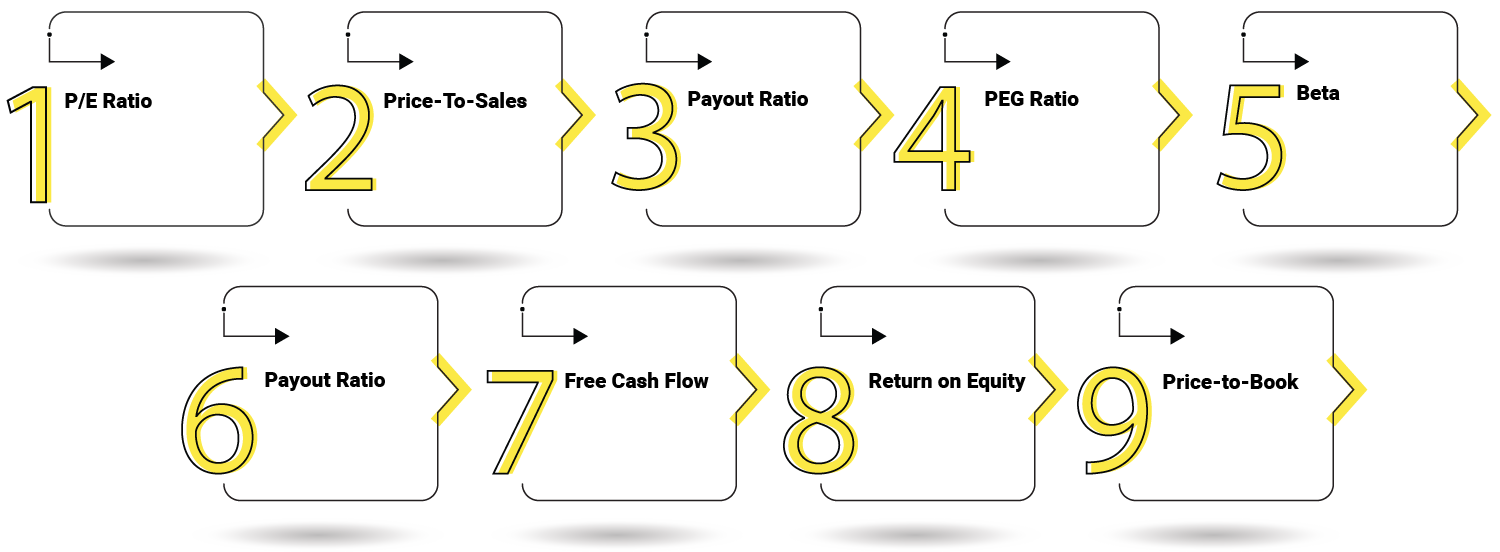

The vital measures that an inventor should remember before selecting an Asset Management Company are given below:

- P/E Ratio

It's to understand the expensive/cheap rates of the stocks & guide how much an investor desires to pay.

- Price-To-Sales

By dividing the market capitalisation of the company by its annual revenue furnishes the price-to-sales.

- Payout Ratio

The company's payout ratio is estimated as the company's annual dividend rate divided by the earning of the company.

- PEG Ratio

The P/E ratio of the company is divided by the expected earnings growth rates gives the PEG ratio, which aids in levelling the field by taking proposed growth into account.

- Beta

It is a measurement of how the thoughtless stock is compared to the entire market. The beta of less than one shows that a stock is less receptive to market swings, while a beta of more than one shows a more unstable stock.

- Payout Ratio

The payout ratio of the company is estimated as the company’s yearly dividend rate divided by the earning of the company.

- Free Cash Flow

It is calculated by the cash flow statement of the company, which is minus its capital expenditures. This cash flow describes that how much money is generated by the company.

- Return on Equity

This is estimated by dividing the net income of the company by its shareholder's equity. This suggests that how capably a company is using its shareholder’s equity to get a profit.

- Price-to-Book

The estimation of price-to-book is done when the stock price of the company is divided by its net assets. Tangible goods are the goodwill & other intangible assets on the balance sheet and aid the investors willing to pay for assets of the company.

Duties of AMFI and SEBI in AMC Operations

An Asset Management Company is regulated by the capital market controller, SEBI. When it comes to observation, considering, and managing how the investment managers work, SEBI is the primary authority dealing with asset managers.

Securities and Exchange of India also deliver a proper system for grievances and other complaints concerning asset managers. All the Asset Management Companies in India are governed & controlled by the SEBI (Securities Exchange Board of India). Moreover, the Asset Management Companies are also passively governed by the AMFI (Association of Mutual Funds of India).

How does an Asset Management Company (AMC) handle its Fund?

The AMC or Asset Management Company examines the funds' management on the following factors, which are:

- Analysis and Research;

- Assessment of Performance;

- Allocation of Assets;

- Preparing an Investment Portfolio.

Frequently Asked Questions

The SEBI or Securities Exchange Board of India is the main regulatory body for AMC in India.

Asset Management includes the managing investments portfolio, which comprises shares, real estate, and securities. The primary objective of the asset manager is to maximise the investment return.

An Asset Management Company manages the assets portfolio like securities, stocks, and real estate. The objective of AMC is to maximise the investment return from the assets. Private individuals can initiate a hedge fund, high net-worth individuals and a Private Limited Company. For establishing an Asset Management Company, there is a necessity to apply to the SEBI. But, there are no such necessities for establishing hedge funds.

The Asset Management Company is the governing body for the mutual funds. It supervises the administrative, managerial and operating functions of the mutual funds.

The AMC’s size is measured as per the value based on the net assets in the management. At present, DSP is the largest Asset Management Company (AMC) in the globe.

- Registration with SEBI.

- Nominal Capital for commencing AMC.

- Professional Necessities – Experienced in the area of securities and fund management.

- Documents like Passport, Aadhar Card, and application to the SEBI along with the prescribed fee.