What is the Removal of Director?

The foundation of a company lies on the pedestal of a director's performance. Either a proficient director can build your business, or an insufficient director can break it. Thereby it is indispensable for the shareholders to be vigilant during the appointment of directors. A company can remove a director before the completion of his tenure period under Section 169 of the Companies Act, 2013. Besides, removal of the director becomes ineffective, if the Central Government appoints a director.

Roles and Responsibilities of a Director

The directors play a significant part in managing the daily operations of a company. Since an organization is an artificial person, it cannot fulfill the objectives that were set before starting the company. Therefore, a company appoints a board of directors to take the required course of action. Here is the list of duties that a director ought to perform:

- Determine and implement progressive strategies;

- Prepare statutory documents and file it with the company’s office or other agencies;

- To summon shareholders in the meetings, call an annual meeting of shareholders;

- Maintain and keep financial records;

- A director must act as per the articles of the company;

- The directors should always work towards the interests of the company for the benefits and good faith of its employees, members, shareholders and others;

- Bind the company to seal contracts with lenders, suppliers, or other dealings with the company.

If a director breaches any regulations and doesn't perform his duties well, then the company can clench onto the procedure of removal of director.

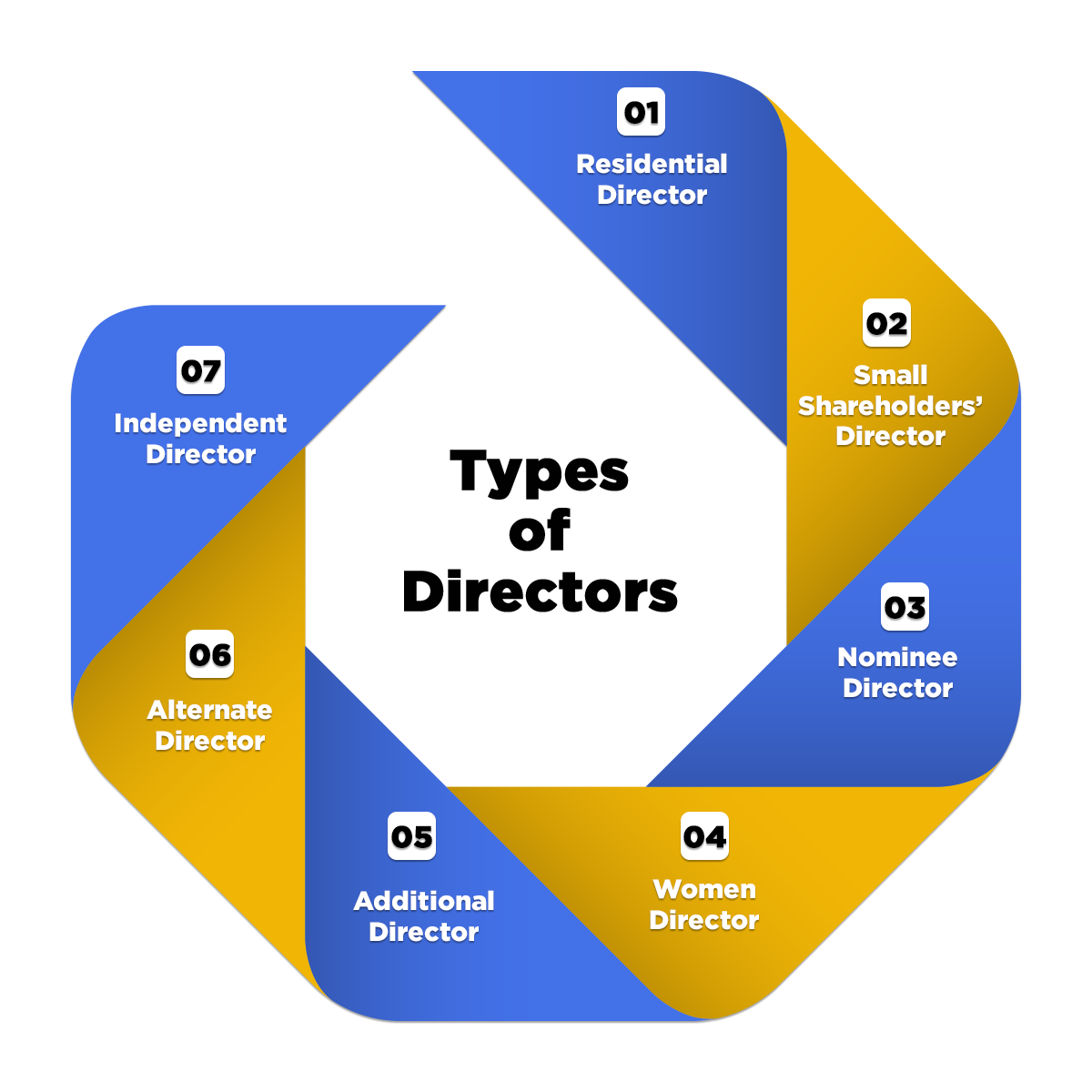

Types of Directors

Irrespective of a company’s business structure, it is essential to appoint different types of directors. The Companies Act has segregated the Board of directors in the following forms:

- Residential Director

According to the law, every company should appoint that director who is the resident of India for not less than 182 days in the previous calendar year.

- Small Shareholders’ Director

Upon the notice of minimum thousand small shareholders or 10% of the total number of small shareholders, whichever is less, a listed company shall have a director that will be elected by the small shareholders.

- Nominee Director

A nominee director is an individual appointed by financial institutions, banks, and other entities to monitor financial assistance like loans, investment into shares, etc.

- Women Director

Regardless of Private or Public, a company needs to appoint a minimum of one-woman director in case of.

- The listed company with its securities also listed on the stock exchange.

- If the paid-up capital of a company is INR 100 crores or has a turnover of INR 300 crores or more.

- Additional Director

As the name suggests, it is an added person to occupy the post of a director till the next Annual General Meeting.

- Alternate Director

It refers to a person appointed by the Board as a substitute for the director who wasn’t present in the country for more than three months.

- Independent Director

It is the non-executive director that helps the company to enhance its corporate credibility and elevate the governance standards.

Liabilities of a director

Considering the amount of work that a director undertakes in the company, it goes without saying that he has to bear certain liabilities. As the company and its directors are two distinct entities, a director does not carry any personal liabilities on behalf of a company. However, under specific scenarios, the directors may be held liable, such as:

- Liable for Tax

If a Private company has tax due under the Indian Income Tax Act, in regards to an income of a previous year, then each director of that company becomes liable, for the payment of such tax during the relevant previous financial year.

- A Debt of the Company

Generally, a director is not liable for any personal debts of the company unless he commits any fraud during his tenure period as a director in that company.

- Repay share application money refund

In case, the share application money or surplus share application money was not repaid within a specified period, then the Board of directors is jointly liable to repay the same.

- Liable to pay for qualification shares

When a director does not obtain the qualification shares within a stipulated time frame, it affects the company in the form of liquidation after the expiry of that period. Thus, the Official liquidator summons that director to pay for such shares which he was supposed to acquire. In extreme cases a company may also choose the option of removal of director.

- Misstatement in the company’s prospectus

Company’s prospectus should always be authentic and accurate. If a director incorporates any false statement in the prospectus, he has to pay massive repercussions for it. Civil liability can be imposed on the directors for any fraudulent statement if he issues such a prospectus, except in the cases mentioned below:

- When the director proves that he withdrew his consent before the prospectus got issued.

- Provides evidence that the prospectus was issued without his consent/ authority or knowledge.

- Justifies he withdrew his consent and issue a public notice of the same, as soon as he became aware of the false statement.

- Confirms to the fact that he believed the doubted statements to be true.

Removal of a Director under Section 169 of Companies Act, 2013

Section 169 of the Companies Act, 2013 clearly defines the removal of a director and the circumstances under which it can take place. Take a look at the various cases that incurs during removal of directors:

- Where the director submits his resignation to the Board

In such a case, follow these steps to remove his name from the register of directors:

- The first step is to hold a Board Meeting by issuing seven days of Clear Notice which implies to 21 days’ notice excluding the day on which it was sent and received.

- Then the Board will deliberate and determine whether to accept the director’s resignation or not.

- After accepting the resignation, the Board will pass a resolution stating acceptance of the director’s resignation.

- The next step that the outgoing director and Board need to take is to file a Form DIR – 11. Affix a proof of the resignation letter’s delivery and a copy of the resignation letter along with the form.

- Subsequently, the company must file a form DIR – 12 with the Registrar of Companies (ROC) along with the Board Resolution and Resignation letter.

- Lastly, after filling all the forms, the name of the director will get excluded from the master data of the company on the official portal of the MCA.

- Removal of director Suo-moto by the Board

A Company has the power to remove a director via passing an Ordinary Resolution unless the Central Government or the Tribunal hasn’t appointed that director. A company partakes Suo-moto in the following way:

- The primary step involves calling a Board meeting by giving seven days’ notice to all the directors. That notice will inform the directors about the removal of the concerned director.

- Finally, on the day of the Board meeting, a resolution shall be passed for holding of an extraordinary general meeting along with the special resolution for removal of directors under shareholder's approval.

- After that, the company shall have a general meeting by giving 21 days Clear Notice. Thereby, all the members will vote in the meeting, and if a majority of people shows their consent to the decision, a resolution shall be passed.

- Besides, the company will give an opportunity of being heard to the director before passing the resolution.

- Once the company passes the decision, then, the same procedure will be followed for removal of director. Wherein Forms DIR – 11 and DIR – 12 shall be filed with the same attachments of the Board Resolution, Ordinary Resolution.

- Thus, the name of the director will be removed from the Ministry of Corporate Affairs website.

- If the director does not attend three Board Meetings Consecutively

As per Section 167 of the Companies Act, 2013, if a director has not attended a Board Meeting for 12 months, it will be considered that he has vacated the office. Therefore, a Form DIR – 12 will be filed on his name and his name will get eliminated from the Ministry of Corporate Affairs.

Frequently Asked Questions

Directors are the natural person who is appointed by the Board of Directors for the growth of a company. The collective group of such individual directors are called as the Board of Directors of any company.

There are five categories of directors in a company. They are Managing Director, Additional Director and Nominee Director; whole-time Director and an Independent Director.

The different categories of Director have different appointment tenures such as Managing Director and whole-time directors have tenure of five years, Additional Director has term up to next General Meeting, Nominee director is appointed for a term as written into the agreement etc.

Removal of Director is a circumstance where the Board management of the Company decides by Suo-moto to remove any director from the Company.

Any company can remove a director if he seems to incur any of the disqualifications as mentioned under the Act or either absents himself from Board Meetings or is convicted by a Court or a Tribunal.

The shareholders need to file Form DIR-11 and Form DIR-12, along with all the attachments of the Board Resolution, as well as an ordinary resolution.

The members are granted a notice period of 21 days in order to hold a general meeting again.

The removal of Director of a Company has been dealt under section 169 of the Companies Act, 2013.

The prerequisites regarding the removal of a director is that the Director to be removed must be given the fair chance to explain about why he should not be removed.

The Company needs to file the required forms with all relevant attachments to the Registrar within thirty days from the passing of an ordinary resolution in general meeting thus, making an appropriate entry in the statutory register of the Company within the time prescribed under the Companies Act, 2013.

In case if a Company fails to comply the said provisions, the Company along with every officer of the company who is in default shall be held punishable with fine which shall not be less than fifty thousand rupees and may extend to five lakh rupees.

The resignation will be passed in the following format on accepting a board resolution “RESOLVED THAT the resignation of the (Director's Name) and is hereby accepted with an immediate effect”.