An Overview of Foreign Portfolio Investor Registration

To know the significance of Foreign Portfolio Investor Registration, it’s first essential to understand the meaning of a portfolio. A portfolio is unspoken as a group of securities that shows a particular pool of funds to carry out various forms of investment. Therefore, a foreign portfolio investor can be understood as an investor who invests in such securities. Entities or companies that issue securities and shares would be registered with the stock exchange. An Indian entity would have to obey the necessities concerning the SEBI (Securities Exchange Board of India).

Any individual or institution who desires to deal in securities as a foreign portfolio investor would have to make an application and acquire the COR (Certificate of Registration) from the particular board. Even an offshore fund under the discretion of an Asset Management Company (AMC) would have to apply under Foreign Portfolio Investor Registration. The fund of offshore would have to protect such registration within a time of 180 days.

Under the Securities Exchange Board of India (FPI) Regulations, 2019, any candidate would have to interact with the DDP (Designated Depository Participant) for making such an application for Foreign Portfolio Investor Registration. A Designated Depository Participant is an individual or an institution that has been consented to by the board under Chapter III Regulations 2019. To consider different registration types under Foreign Portfolio Investor, the DDP would act as a mediator between the board and the applicant. Therefore, an applicant or candidate would have to please the necessities of the DDP and the Board for Foreign Portfolio Investor Registration.

What are the Different Categories of investment under Foreign Portfolio Investor Registration?

Based on the risk of foreign investment, there are three different categories of investment under FPI Registration. Following are three categories under FPI Registration:

- Category I FPI

Generally, this form would consist of investment in various forms of government institutions. This would consist of central banks & international banks, sovereign wealth funds, and government institutions.

- Category II FPI

This category would consist of a pool of various forms of asset managers & pension funds. This will comprise asset management companies, pension funds, managers who maintain a portfolio, banks, and other funds which arsynchroniseded.

- Category III FPI

Any type of investors that are not comes under Category I or II FPI would fall under this form of category. This would comprise HNI, individual investors, binds which are held by corporate and families.

Advantages of Foreign Portfolio Investor Registration

Following are some significant advantages of Foreign Portfolio Investor Registration:

- Exchange Rate Benefits

By incorporating as a Foreign Portfolio Investor, various types of exchange rate benefits can be utilised by this investor.

- Raise in Secondary Market

There would be an increase in the secondary market. Secondary issues by various foreign institutions would deliver a significant encouragement to the issue of shares.

- More Competitive

As its foreign investment, the international market would be open. This would be helpful to foreign investors due to the level of competition delivered by the international market.

What is the Eligibility Criteria for Foreign Portfolio Investor Registration?

The DDP would decide the necessities for the candidate. After such necessities have been considered, the certificate would be approved. The following criteria have to be fulfilled by the candidate for Foreign Portfolio Investor Registration:

- The candidate shouldn't be a resident of India or an Indian citizen.

- The candidate shouldn’t be an OCI or NRI card owner. If the candidate comes under the categories mentioned above, they wouldn't be eligible for this registration form.

- Indian citizen, OCI or NRI, can be eligible based upon the necessities of the board.

- 25% more of the corpus should be delivered by the applicant.

- The candidate should not be a member of any greylisted member nation of the FATF (Financial Action Task Force).

- A candidate will also be entitled if he or she is a resident of the nation under the IFSC (International Financial Services Centre).

- The candidate should not have any sanctions, according to the UNSC (United Nations Security Council).

- The candidate should also please the category of the Fit & Proper Person Test. This necessity would be as per Schedule II of the SEBI (Intermediaries) Regulations, 2008.

- The candidate should be in an overseas nation who is a member and signatory to the International Organisation of Securities Commission's Multilateral MOU. If the candidate is not this, then he should be a signatory of the Bilateral MOU with the board.

- The Central Bank of the candidate's nation should be a Bank for I International Settlements member.

What are the Documents Required for Foreign Portfolio Investor Registration?

Following are some vital documents required for Foreign Portfolio Investor Registration:

- Address proof of the applicant: This would be required for both categories of investment which is Category I and Category II;

- PAN Card;

- MOA (Memorandum of Association) of the company;

- AOA (Articles of Association) of the company;

- A resolution was taken by the BODs (Board of Directors);

- The CRS Form of FATCA;

- KYC (Know Your Customer) details of the company’s directors;

- Applicant or candidate should submit an identity proof; this can be the passport information;

- Details of the beneficial company’s owners;

- A list of signatures should be offered authorised signatories, which would comprise the shareholders or members;

- Form 49AA.

Online Procedure of Foreign Portfolio Investor Registration

Following is the step by step procedure of Foreign Portfolio Investor Registration:

- The candidate can go to the following website, i.e., https://www.fpi.nsdl.co.in/;

- Then the “Common Application Form” can be utilised by the candidate for Foreign Portfolio Investor Registration;

- This would be available under “User Registration Form” at the official website of FPI NSDL, which is available in the link, i.e., https://www.fpi.nsdl.co.in/web/Users/UserRegistrationForm.aspx;

- A keeper can fill up the application on behalf of the candidate;

- The DDP (Designated Depository Participant) certifies the FPI Registration. Once the process of registration is carried out, the applicant can access the Common Application Form via the FPI NSDL website;

- Relevant documents can be uploaded via the website. Along with this, the copies of the documents should also be submitted in hard copy form to the DDP;

- All the pages of the application form should be signed by the applicant of FPI before it is sent. Once the DDP examines the registration application, a certificate of registration would be permitted;

- Then the FPI application would be forwarded by the DDP to the ITD (Income Tax Department) for the generation of PAN. Once the PAN is made, the applicant would be dejected.

What is the Procedure for Protecting Foreign Portfolio Investor Registration?

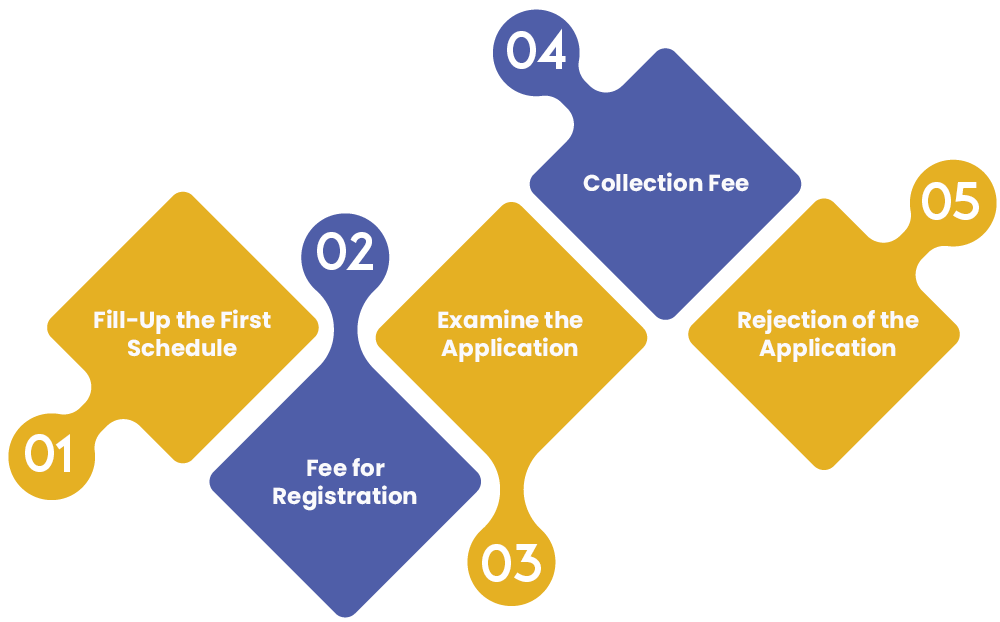

Following is the procedure has to utilised by the candidate to make an application for Foreign Portfolio Investor Registration;

- Fill-Up the First Schedule

A candidate considering registering as a Foreign Portfolio Investor would have to first provide information as per the first schedule under SEBI (FPI) Regulations, 2019. A candidate who desires to be registered as an FPI can also use the online method. The common application form from the website NSDL.

- Fee for Registration

According to regulation 2 and regulation 7 (3), the candidate should pay the given fee for registering as a foreign portfolio investor. Following is the fee that should be paid for registration under the given categories:

• Category I $ 3000;

• Category II US $ 300.

Such fee has to be paid in three years (every block). This would be needed to be carried out till the registration validity.

- Examine the Application

The DDP would examine the Foreign Portfolio Investor Registration application. If there are no problems concerning the application, the DDP will deliver the Registration Certificate bearing the number of registration. This registration number would be generated by the NSDL. The DDP should make sure to carry out the procedures concerning application processing within thirty days. The DDP also has the power to call for information on the application.

- Collection of Fee

The DDP would gather the fee from the candidate in advance once every three years. After collecting the fee, the same would be remitted to the board. Such fee has to be remitted by the fifth working day of every month. With this, FPI details should be mentioned in the given format. But, the fee would only be remitted once the registration certificate is permitted to the candidate.

- Rejection of the Application

If the information furnished in the application is deceptive or doesn't confirm the necessities, then the application would be declined by the DDP. But, before decline the registration application, the DDP would deliver an opportunity to the candidate to be heard. From the application rejection date, the candidate has to make the communication for improvement of the application. This should be carried out within thirty days of the communication.

Suspension of Certificate of Foreign Portfolio Investor Registration

A Certificate of Registration (COR) granted to a foreign portfolio investor can be cancelled for different reasons. The candidate would have to make sure to obey the code of conduct according to the Foreign Portfolio Investors Regulations. The following are the reasons for the suspension of the registration certificate:

- Regulation 9(1) of the Foreign Portfolio Investor Regulation, 2019 defines that a candidate would remain valid unless it is declined by the DDP or suspended by the candidate;

- The provisions concerning the suspension of the registration certificate would be carried out as per the necessities of the Securities and Exchange Board of India or SEBI (Intermediaries) Regulations, 2008;

- If the FPI does not pay the fee, then such application for the registration would be considered to be surrendered by the candidate;

- A certificate of registration can be surrendered by a Foreign Portfolio Investor (FPI). But, to carry out the above, a demand should be made.

Investment Limitations under Foreign Investor Portfolio Registration

FPI (Foreign Portfolio Investors) are only permitted to invest in specific securities. There are several investment limitations for Foreign Portfolio Investors. Following are the securities that can be invested in:

- Any type of shares, warrants, securities, debentures by a Public limited Company. An entity that is listed its shares in a stock exchange would fall under this provision;

- Indian Depository Receipts (IDR);

- Any unit schemes which are launched as per the SEBI (Collective Investment Schemes) Regulations, 1999;

- Any type of instruments and securities which are issued by the RBI (Reserve Bank of India);

- Any types of unit schemes which are launched as per the necessities of SEBI (Mutual Fund) Regulations, 1996;

- Any type of units of Real Estate Investment Trust & Infrastructure Investments Trust.

Frequently Asked Questions

It is a foreign investor who carries out a particular form of investments in a portfolio.

As long as the FPI validity is present, an FPI can deal in securities. But, the conversion charges & fees should be paid.

Yes, present FPI would be permitted to deal or sell with securities till the registration expiry.

FPI is a form of investment in a specific portfolio of securities. FDI is a form of investment in the company’s capital instruments.

No, the validity will remain the same. There are no changes when the candidate is registered as a Foreign Portfolio Investor.

Any governing body or institution that has 50% foreign government authority is called a Foreign Government Agency.