An Overview of Core Investment Company

A Core Investment Company is classified as an NBFC by the RBI (Reserve Bank of India). A Core Investment Company (CIC) is a restricted company with preference debentures or shares and equity in some other company. Such companies are created as group businesses to control the subsidiaries by holding a majority of the shares. These companies invest in shares of their group companies for stakeholding but cannot trade such instruments or carry out any other fiscal activity. The RBI states that CICs should register as Non-Banking Financial Companies (NBFCs). They cannot trade in debentures & shares. The Reserve Bank of India. The RBI states that the Core Investment Companies have a net asset of Rs. 100 crores or more will be considered as SICs or Systemically Important Companies.

Generally, around 90% of the equity exists in the group of companies. Such skate holding is in the form of equity & preference shares and other forms of shares. Such components or holdings should not be less than 60% of their assets. Though the Reserve Bank of India controls CICs, they don't participate in any lending and borrowing activities. Until the year 2010, such companies came under a similar regulation related to the Non-Banking Financial Company. But, in 2012, the Reserve Bank of India created a separate context for governing the working of Core Investment Companies (CICs).

Core Investment Company is a company mainly involved in carrying out investment activities. Most of the investments are carried out in the company’s shares. Core Investment Company is an NBFC which is regulated by the Reserve Bank of India (RBI) under Chapter III B of the RBI Act, 1934.

Features of Core Investment Company

Following are the features of CIC (Core Investment Company):

- The Reserve Bank of India has categorised this company as an NBFC (Non-Banking Financial Company), which operates activities relating to investing in securities and shares;

- These companies hold investments in the form of debts, equity, loan, and preference shares. Such investment amounts to 90 percent;

- Such form of investment in the form of equity in a group of companies should come to orcomprise more than 60% of their total asset size;

- The majority of such companies carry out investment activities such as investments can be made in other financial organisations, money market securities, government securities and different forms of instruments;

- Such activities concerning investment trading are not permitted to be carried out by CICs. But such companies can carry out transactions such as dilution/divestment.

Requirements for Approval for CIC

CICs with an asset size of Rs. 100 crores or more are treated as CIC-ND-SI (Systematically-Important-Core-Investment-Company) by the Reserve Bank of India. All such companies are needed to be registered with the RBI under Section 45 IA of the RBI (Reserve Bank of India) Act, 1934, and thereby obtain a Registration Certificate.

Capital Requirements for CIC-ND-SI

- The ANW or Adjusted Net Worth of the CIC-ND-SI is not less than 30% of the RWA (Risk-Weighted Assets);

- The value of the investment market would be the current or prevailing value of the price which is mentioned by the investment. This should be 26 weeks before preceding the financial year;

- Such AWN or Adjusted Net Worth can be understood as an aggregate of the funds as defined in the NBFC (Holding or Non-Deposit Accepting) Companies Prudential Norms of RBI Directions, 2007;

- In circumstances where the combined asset size is calculated, it is required that all the Core Investment Companies within the group require to be registered as individual CIC-ND-Si, the ANW being applied separately;

- Apart from this, 45 per cent of the amount is measured as the standing of credit concerning the depreciation reserve. This reserve can either be increased by or decreased by a specific amount;

- Leverage Ratio: The number of outside liabilities must not be more than 2.5 times the amount of adjusted net worth.

Vital Documents Required for Core Investment Company Registration

You can check the list of all essential documents required at the time of Core Investment Company Registration below:

- Submit MOA (Memorandum of Association) and AOA (Article of Association);

- Submit application form related to CIC Registration;

- Copy of the application should be kept with the registered office of the company;

- CIN of the company;

- Particulars related to the company, such as a copy of the Registration Certificate of the Company;

- Information of PAN of the Company;

- DIN (Director Identification Number) and DSC (Digital Signature Certificate) of the company’s director;

- Information on all the activities performed by CIC;

- Details on Net Assets, which are controlled by the company;

- Info on the number of liabilities controlled by the company;

- All signatures regarding the primary management executive should be present in the application. Along with this, the common company’s seal should be present in the company;

- Information about the Executives of the company;

- Facts relating to the statement of funds which are needed for performing the activities as mentioned by the CIC;

- Details related to the ANW (Adjusted Net Worth) of the business and WRA (Weighted Risk Assets).

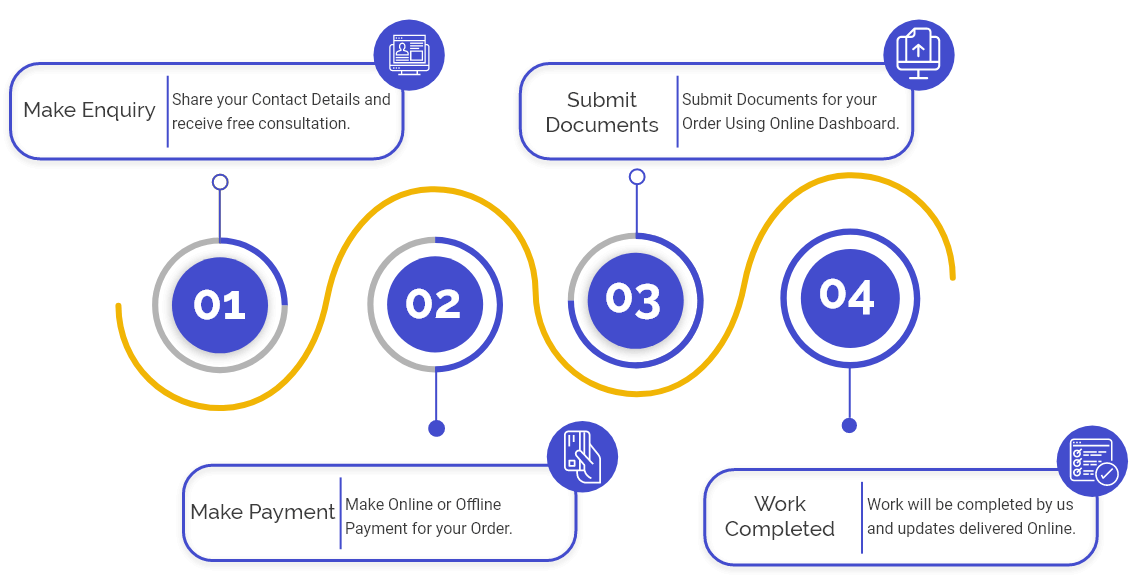

Procedure for Core Investment Company Registration

To register a CIC, the application needs to follow the steps mentioned below:

- First, the applicant needs to download the application for the registration of CIC from the official portal of the RBI.

- Once the applicant downloads the application form, it needs to be correctly filled and submitted to the office of DNBS (Department of Non-Banking Supervision) along with the relevant documents mentioned above. The Department of Non-Banking Supervision has to be the one under whose jurisdiction the company is registered.

- This application should be accompanied by the checklists concerning the documentation required for CIC registration.

- If the Reserve Bank of India requires additional documents to be submitted, the same can be called by the Reserve Bank of India. In case of the documents requirements, the applicant has to submit the documents within thirty days of the notification.

- There are some companies that are exempted from the registration, but such companies have to qualify a Board Resolution that they will not in the forthcoming indulge in accessing public funds.

Rules Related to the Operation of Core Investment Company

Following are the specific rules which are brought out related to the Operation of a CIC:

- The company have to compulsory secure requirements for the registration with the RBI;

- The company must maintain records regarding carrying out investment activities;

- Any investment must be cited at a particular market value or the value which is determined;

- The company must have the minimum capital ratio related to registration requirements;

- Specific standards regarding the ICAI must be followed when it comes to long-term investment;

- Overseas investments are limited to a value of 400% of CIC’s owned funds;

- Such investment must be categorised or diversified as long-term investments & short term investments;

- Statutory Auditors' annual certification is to be procured necessarily & submitted to DNBS for overseas investments.

Exemptions of NBFC-CIC

- CICs that have an asset size of not more than Rs. 100 crores are excused from registration as per the Act. The total asset size of a CIC is estimated by totaling the individual sizes of all the CICs belonging to a specific group. In case the collective asset size of Rs. 100 crores or more than the CIC has to register.

- CICs that are priced Rs. 100 crores or more but are not retrieving public funds are exempted. But, it is essential to note that these companies have an asset size of less than Rs. 100 crores would be required to obligatorily register with the Reserve Bank of India in case they are planning to make foreign investments in the financial sector. They are also required to comply with all the necessities and conditions as applicable to registered CIC-ND-SI. But, if the specific CIC is investing foreign in the non-financial area, it doesn't need to be registered with the RBI.

Note: According to the Act, all CICs that have asset sizes not more than Rs. 100 crores must apply for the Registration Certificate within three months from the date of accomplishing Rs. 100 crores in the balance sheet.

Common Obligation for a Core Investment Company

According to the CIC (Reserve Bank) Directions, 2016, the following need to be fulfilled by all CICs, according to the former audited balance sheet:

- The CIC need to hold not less than 90% of their total assets in the form of investment in equity shares, bonds, debt, preference shares, loans, debentures or loans in group companies. The 10% balance of total assets that the Core Investment Companies can hold outside the group consists of real estate or other forms of fixed assets that are vital for operating the company but cannot be economical investments or loans in non-group companies.

- The company's investment in the shares of the group companies requires to be a minimum of 60% of the total worth of its assets.

- The entity or company can issue guarantees on behalf of group companies.

- It can invest in bank deposits, liquid mutual funds, money market mutual funds, and other money market tools, government securities, bonds & debentures of companies groups, and granting loans to group companies.

A Systematically Important Core Investment Company (CIC-ND-SI) needs to have an asset size of Rs. 100 crore and more must raise or hold public funds and fulfill all the criteria mentioned above. For this company, it is obligatory to register under the RBI (Reserve Bank of India) as operating without attaining a Registration Certificate from the Apex Bank; they are noticed as violating the CICs (Reserve Bank) Directions 2016.

Frequently Asked Questions

A CIC-ND-SI is a Systemically Important Core Investment Company, and it is a part of NBFC with a total asset size of Rs. 100 crores or more, and it performing the business as on the date of the earlier audited balance sheet.

Such funds are not public deposits, and they consist of bank finance, inter-corporate deposits, and all funds received from outside sources either indirectly or directly, such as funds elevated by issuing debentures, commercial papers, etc.

For such an application, the applicant has to visit the website of RBI to file an application for registration.

Yes, such a company with total assets of more than Rs. 100 crores require to register with the RBI.

Usually, any CIC can be classified in one of the below-mentioned types:

- CIC-ND-SI;

- CIC-ND-NSI.

Generally, the net turnover would be considered to determine the Rs. 100 crores.

CIC or CIC-ND-SI group companies contain two or more companies related to each other by any of the following relationships, subsidiary-Parent, associate, joint venture, promote entity, or any type of listed entity under the significant entity regulations.