An Overview of the Change in Registered Office of the Company

The registered office of a company is computed as a place where all the official connections concerning the company are sent. Other than the registered office, a company owns many various offices such as administrative office, branch office, corporate office, and factory. At the same time, it is essential for the registered office to register itself with the MCA (Ministry of Corporate Affairs). The company's operator decides the place and location of the registered office. Once the registered office of the company is announced through filing INC 22, any alterations in the registered office of the company are announced to the ROC (Registrar of Companies).

The registered office of the company determines the company's domicile. ROC is determined by the location of the registered office. Any alteration concerning the address of the registered office should be informed to the ROC (Registrar of Company) within 15 days.

Reason for Change in Registered Office Address

BODs (Board of Directors) or stakeholders residential area often determine the location of the registered office. The only grounds considered are their comfort. Although, in some cases require arises to change in registered office in the company location from one place to another.

- The company needed to change their registered office address when it is enlarging at a faster pace, and the office space and infrastructure doesn't fit in according to the company's current position.

- If you are in the last time of your company’s rent and you are thinking of hiring another office space at rent.

- If a company is preparing to discover the new genres for business growth and therefore preparing to shift their incorporated office to a place where they can discover better market opportunities.

- If another company is funded in your company or entity, your registered office address will bound to shift.

What are the Different Types of Registered Office Address Change?

- Amend in the registered office of a Private Limited Company with a similar state;

- Alteration in the registered office of Private Limited Company within the similar state but outside the present town, city, or village with the similar ROC (Registrar of Companies);

- Alteration in the incorporated office of a company within the similar state, however, from one ROC (Registrar of Companies) to another ROC;

- Alteration in the registered office of a Private Limited Company from one state to another state or from the jurisdiction of the one Registrar of Companies to another ROC.

What are the Registered Office Necessities at the time of Company Registration?

It is essential to introduce the registered office of the company during the registration of the company. Following are the vital documents required at the time of finalising a place for your registered office of the company:

- Submit the water bill or electricity bill;

- Property Tax Receipt;

- No Objection Certificate from a landlord concerning registered office;

- Rent Agreement between the company and the landlord.

Ensure that the address and name you have furnished on the water bill/property tax receipt/ electricity bill must match with the No Objection Certificate furnished by the landlord and mentioned in the lease or rental agreement. Further, free land or a building under construction cannot be allocated as a place for a registered office of the company. Hence, it is not required to announce a registered office as an industrial property or a commercial. A residential property can also be announced as a registered office of the company.

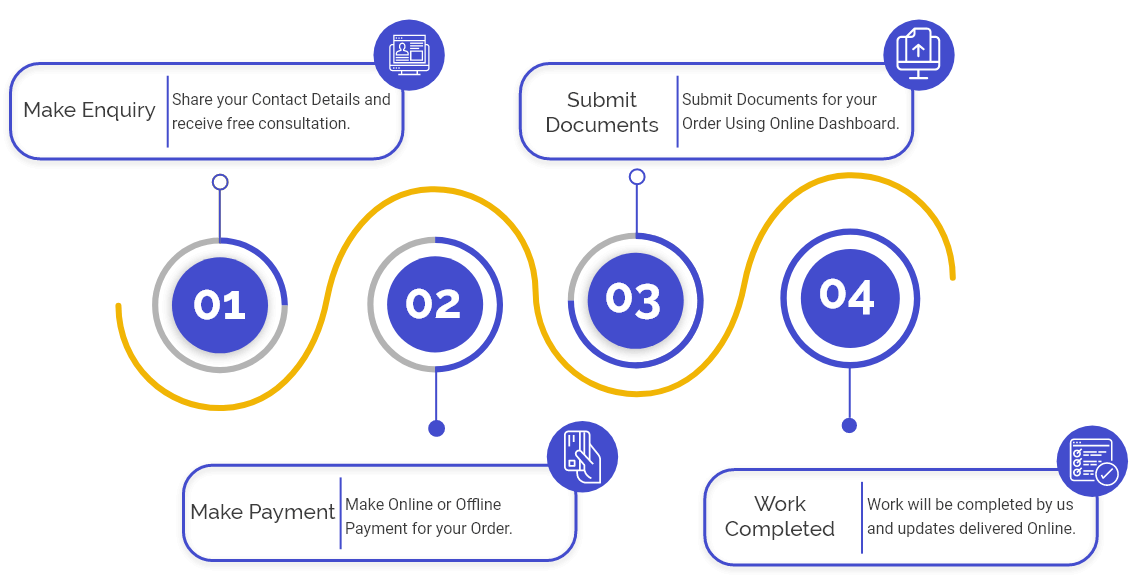

Process for the Change in the Registered Office of the Company Address

Let’s go through the procedure that must be followed during the change in the registered office of the company address as offered in the Companies Act, 2013:

1. Change in Registered Office of the Private Limited Company within the Same State

Following is the procedure is followed, in case of any change in the registered office of the company address of a Private Company (Pvt. Ltd.) from one place to another within the territories of a similar state:

- A board meeting is conducted and take a decision on the same;

- A candidate or an applicant is needed to file Form INC-22 with the Registrar of Companies and within fifteen days from the date of passing the resolution.

Documents required with Form INC-22:

- Submit a copy of the present address of the registered office of the company;

- Submit the latest copy of utility bills such as electricity bill, water bill, phone bill, etc.;

- No Objection Certificate (NOC) in relation to the use of Premises procured from the owner.

2. Change in the Registered Office of the Company (Private Limited Company outside the Territories of Present Town, Village, or City):

When the Private Limited Company transfers its registered office from outside the territories of the present village, town or city, the following procedure is needed to be followed:

- A board meeting is managed in which the day, time, date and the venue of the Extra Ordinary General Meeting is fixed;

- A decision concerning the change in the registered office of the company’s address is passed in the Extra Ordinary General Meeting;

- With the ROC Form, MGT-14 is filed within thirty days from the date of passing the resolution.

Documents Required:

Form MGT-14

- Submit a certified copy of the resolution;

- Within fifteen days of passing, the decision Form INC-22 is filed with the ROCs.

Form INC-22

- Submit a copy of the registered office address;

- Submit a copy of the latest utility bills;

- No Objection Certificate for the use of area attained from the proprietor;

- Special Resolution.

3. Alteration in the Registered Office of the Company within a similar state but from one ROC to another:

In case of change in the present registered office address of a private company from one ROC to another, however, within the territorial limits of a similar state, the following are some norms that should be fulfilled as per the Companies Act, 2013;

- A meeting of the board is conducted, which will be finalised the time, date, day, and venue of the Extra Ordinary Meeting;

- In such meeting, an exclusive decision is made for the alteration of MOA (Memorandum of Association) and the shifting of the registered office;

- Form MGT-14 is filed with the (ROC) Registrar of Companies within thirty days from the date of coming to an end;

- Submit an authenticated copy of the decision of the Extra Ordinary General Meeting.

Application to the Director in Form INC-23

- Publish a notice in a regular newspaper in English and regional language of that area where the registered office is located;

- A separate notice on each holder of debenture, depositor, or creditor of the company sends specifying the application matter and tells that any individual whose interest is considered to be affected by the designated alteration in MOA.

Documents Require

- Submit a certified copy of the Notice of an Extra-Ordinary General Meeting (EGM);

- Submit a copy of the resolution passed at Extra-Ordinary General Meeting;

- Minutes of Extra-Ordinary General Meeting;

- Submit a copy of the newspaper ad;

- Submit a copy of the altered MOA;

- An affidavit confirming the application;

- A detailed list of Debenture holders and creditors qualified to the objections;

- Declaration from the KMP (Key Managerial Personnel);

- Declaration from any two directors that the entity has not defaulted in payments due to their worker.

After receiving the confirmation, the regional Director is interfaced within thirty days from the date of getting the application by the company's Director. Once you have received the Regional Director's order, you must file Form INC-22 with the ROCs. Following are the documents you may require to submit:

- Submit the copy of the registered office address;

- Submit the copy of the latest utility bills;

- NO Objection certificate for the use from the proprietor.

4. Alteration in the Registered Office of a Private Company from one state to another from the Jurisdiction of one Registrar of Companies to another:

Below is the process that should be followed in the aforementioned case:

- A meeting of the board is conducted that will choose a date, time, day, and the location for holding EGM;

- In EGM, a special resolution is passed;

- A notice is published in the regional newspaper;

- You have to fill the Form MGT-14 within thirty days from the date of passing such resolution.

Note:

- Publish a notice in a regular newspaper in English and regional language of that area where the registered office is located;

- A separate notice on each holder of debenture, depositor, or creditor of the company sends specifying the application matter and tells that any individual whose interest is considered to be affected by the designated alteration in MOA.

- Procuring No Objection certificate within twenty-one days from the Director defines that it will be entitled to the transfer of the registered office of the company.

Documents Required:

- Submit a certified copy of the Notice of an Extra-Ordinary General Meeting (EGM);

- Submit a copy of the resolution passed at Extra-Ordinary General Meeting;

- Minutes of Extra-Ordinary General Meeting;

- Submit a copy of the newspaper ad;

- Submit a copy of the altered MOA;

- An affidavit confirming the application;

- A detailed list of Debenture holders and creditors qualified to the objections;

- Declaration from the KMP (Key Managerial Personnel);

- Declaration from any two directors that the entity has not defaulted in payments due to their worker.

Regional Director will deliver you his or her confirmation within thirty days from the date of application receiving. The next thing an entity has to do is that they have to file a Form INC-28 with the Registrar of Companies within thirty days from the submission date.

After that, Form INC-22 is filed with the Registrar of Companies within fifteen days of the alteration in the registered office of the company along with the following documents:

- Submit the copy of the registered office address;

- Submit the copy of the latest utility bills;

- No Objection Certificate for the use of premises.

Change in the Private Limited Company's address based upon the case whether the address alteration is within the state or from a state to another, within the same Registrar of Companies or the different. Procedures are followed as per the classification which is given in the Companies Act, 2013.

Frequently Asked Questions

The term “Registered Office” of a company means a place where all the senior officials of a company sit.

Yes, a company can change its Registered Office from one place to another

Normally, there is no set time limit for the Change of the Registered Office of a Company. However, 2 to 3 business working days are required for the processing of the application form for the change of the Registered Office of a Company.

Yes, it is necessary for the company to alter its AOA and MOA after the Change of the Registered Office.

Yes, Registered Office is the same as the Head Office. The only difference between the two is that the former is termed by a registered company, whereas the latter is used by a partnership firm.

The process and time for the change of the Registered Office of a Company vary case to case.

The directors of the company will inform the ROC (Registrar of Companies) about the Change in the Registered Office by filing MCA Form INC 22.

The documents needed to be filed are proof of the registered address, utility bill, NOC (No Objection Certificate) from the landlord, and the copy of the Special Resolution passed.

The basic documents required for the process of the Change of Registered Office are Utility Bill, Property Tax Receipt, NOC from the owner, and the lease or rent agreement signed between the company and the owner.

Yes, two or more companies can have the same Registered Address.

The factors to consider are that the company shall paint or affix both the new and old name. The notice for the change of the registered office must be filed within 15 days to the ROC. Lastly, the company needs to pass a special resolution for the change in registered office.

The laws that govern the process of the Change in Registered Office are the Companies Act 2013, SEBI (LODR) Regulations 2015, and Companies (Incorporation) Amendment Rules 2020.

The company needs to pass both Board Resolution and Special Resolution. Moreover, it needs to obtain Approval from the Regional Director as well.

Section 12 (5) and 12 (6) of the Companies Act 2013 governs the process for the change of the registered office from one ROC to another ROC.

No, there is no need to change or alter the AOA or MOA of the company when the registered office is shifted with the local limits of the city or district.

The different types of Change in Registered Office are, Within the Local limits of City or Village, from one city to another city (Within the same ROC and state), from one ROC to another ROC within the same state, and from one state to another state.