Overview of Private Limited Company Registration in Maharashtra

"Maharashtra", the state of population and dreams is considered as the wealthiest and the most industrialised state of all. It not only attracts both foreign and domestic investments but offers great opportunities and scale to businesses as well. Therefore, the decision to obtain Private Limited Company Registration in Maharashtra requires a lot of strategic, business, and legal considerations.

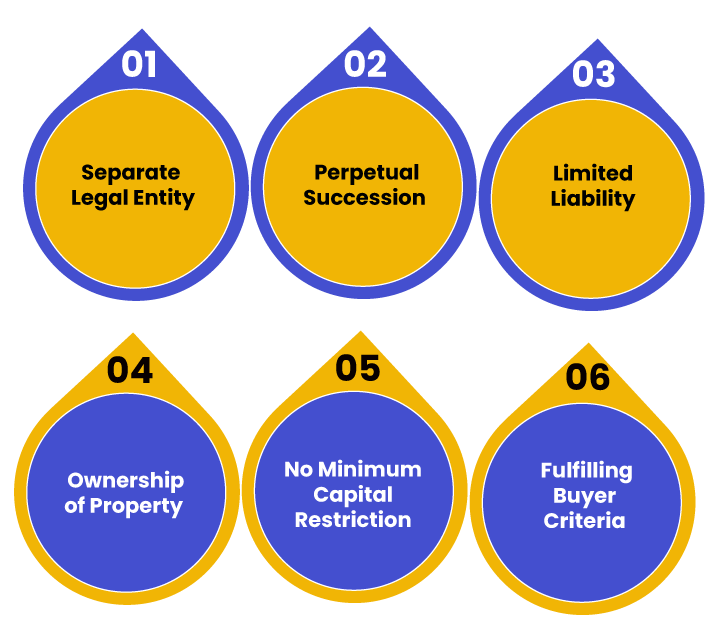

Benefits of Private Limited Company Registration in Maharashtra

The benefits of obtaining Private Limited Company Registration in Maharashtra are as follows:

Separate Legal Entity

A company registered under the provisions of the Companies Act 2013, enjoys the privilege of a separate legal entity. That means the company has the authority to sue and get sued. Also, the shareholders of such a company are liable only to the extent of the amount remaining on their share.

Perpetual Succession

The term Perpetual Succession means that the death, resignation, and retirement of a member will not have any impact on the existence of the company. That means the company will continue to exist despite the increase or decrease in the count of the total members.

Limited Liability

The term limited liability denotes that the members of a private company are not liable to pay off company’s debts from their personal assets and are accountable to pay the amount remaining on the shares held by them. That means the feature of Limited Liability protects the shareholder from the debts and loss of the company.

Ownership of Property

According to this feature, the company has the right to buy, hold, and acquire property in its name.

No Minimum Capital Restriction

Recently, MCA by way of the Companies (Amendment) Act, 2015, has removed the minimum capital requirement of Rs 1 lakh, required as capital for the incorporation of the company.

Fulfilling Buyer Criteria

It shall be significant to note that a registered private limited company needs to fulfil the buyer criteria, together with the meeting of various requirements prescribed by the customers or buyers.

Requirements to obtain Private Limited Company Registration in Maharashtra

The minimum requirements to obtain Private Limited Company Registration in Maharashtra are as follows:

- A minimum of two and a maximum of fifteen directors;

- A minimum of two shareholders and a maximum of two hundred;

- No Minimum Capital Requirement;

- Address Proof of the Registered Office in the state;

- A Private Limited Company is not eligible to accept deposit from the public;

- A Private Limited Company is not eligible to issues shares to the general public;

- Identity Proof of all the Directors and Shareholders;

- PAN Card for all the directors and company;

- Must use either “Private Limited Company” or ”Pvt Ltd” at the end of the company’s name;

- The company name must be unique in character;

Documents needed to obtain Private Limited Company Registration in Maharashtra

The documents needed to obtain Private Limited Company Registration in Maharashtra are as follows:

- PAN Card details for each director;

- Articles of Association (AOA);

- Memorandum of Association (MOA);

- Identity Proof of the Director, in the form of either of the following:

- Aadhar Card;

- Voter ID Card;

- Driving License;

- Passport

- Address Proof of each Director, in the form, either of the following:

- Up to two months old Bank Statement;

- Passbook with the last two months bank entries;

- Electricity Bill (not older than two months);

- Post-paid Mobile Bill;

- Post-paid Landline Bill;

- Passport sized photograph of each director;

- Address Proof of the Registered Place of Business, in the form of either of the following:

- Electricity Bill;

- Mobile Bill;

- Landline Bill;

- Gas Bill;

- Affidavit from each director on a stamp paper of Rs 100;

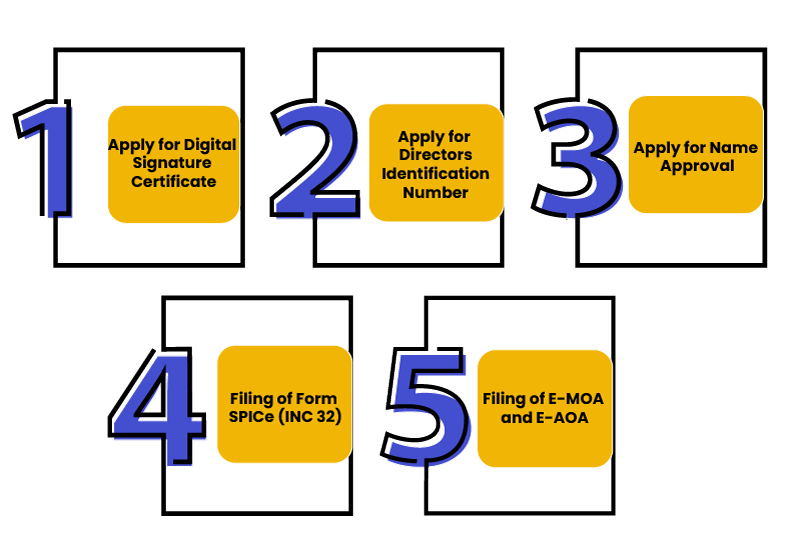

Procedure for Private Limited Company Registration in Maharashtra

The steps involved in the process to obtain Private Limited Company Registration in Maharashtra are as follows:

Apply for Digital Signature Certificate

In the first step, the applicant company needs to apply for DSC or Digital Signature Certificate for at least one of the proposed directors of the company. The main reason behind obtaining DSC is to enable the directors to sign a document electronically.

Apply for Directors Identification Number

It shall be significant to state that any individual who wants to become a director in a company needs to have DIN or Director Identification Number on a mandatory basis. Only one DIN is allotted to one director.

Apply for Name Approval

The directors of the company need to file SPICe (INC 32) with MCA (Ministry of Corporate Affairs) for the name approval. The same requires to be filed at the time of incorporation.

Filing of Form SPICe (INC 32)

In the next step, the directors of the applicant company require to file INC 32 with MCA after getting the same digitally verified by a practising Chartered Accountant or Company Secretary.

Filing of E-MOA and E-AOA

Prior to the introduction of SPICe forms, there was a need for the company to file MOA (Memorandum of Association) and AOA (Articles of Association) physically with MCA. However, after the implementation of SPICe forms, the same can be easily filed online, together with INC 32.

All the subscribers need to digitally sign the said E-MOA and E-AOA. Lastly, after proper verification, the ROC (Registrar of Companies) will issue a COI (Certificate of Incorporation), together with CIN (Corporate Identification Number) to the applicant company.

Post Registration Compliances for a Private Limited Company

The post registration compliances for a private limited company are as follows:

- A Private Limited Company must conduct at least two board meetings in a financial year;

- It should hold at least one Annual General Meeting with its shareholders;

- After incorporation, a Private Limited Company needs to appoint the first auditors within a period of 30 days from the date of registration or from the first annual general meeting;

- Every director of such a company needs to file Form MBP 1 for the disclosure of interest at the first Board Meeting;

- Within 60 days from the date of Annual General Meeting, the company needs to file its Annual Return in form MGT 7;

- The directors of the company need to file the financial statements in form AOC 4, within 30 days from the end of the Annual General Meeting;

- A Private Limited Company needs to file its ITRs (Income Tax Returns) by the 30th September of every financial year;

- A Private Limited Company needs to file its GST Returns on a monthly basis;

- All the other compliances will be done on the basis of change in dates;

Frequently Asked Questions

Yes, it is compulsory for every private limited company to use “Pvt Ltd” or “Private Limited” as a suffix at the end of the name.

No, any person who is below the age of 18 years is not eligible to become a director in a Private Limited Company.

The documents required for obtaining Private Limited Company Registration in Maharashtra include Address Proofs and ID of the Directors; Address proof and Utility Bills of the registered office; and Bank Statements.

Based on the amendments made in the Companies (Amendment) Act, 2015, the requirement to have Rs 1 lakh as the minimum capital requirement has been removed.

The term DSC stands for Digital Signature Certificate.

Yes, a Private Limited Company is eligible to accept FDI or Foreign Direct Investments from the Angel Investors and Venture Capitalists.

Yes, a private limited company can have a foreign director, but there must be at least one director who is an Indian Resident.

Yes, it is mandatory for a Private Limited Company to have GST Registration.

Yes, it is possible for a Private Limited Company to have multiple branches with just one company registration.

No, a private limited company is not eligible to list its shares on the recognised stock exchange.