An Overview of Money Transfer Service Scheme (MTSS)

Money Transfer Service Scheme or MTSS is the most appropriate option for the purpose of inward transfer of money from overseas to India. The facility offered by this scheme can be availed by the tourists travelling to India. By using the Money Transfer Service Scheme facility, money can be transferred to India. But, in this scheme, no outward transfer is allowed. Only inward remittance in India is permitted. In this scheme, remittance can be done in a quick and hassle-free manner.

The idea of MTSS has been announced as inward remittances contribute to the national income of India, and it is the primary source of external financing. With the help of this scheme, cross-border inward remittances can be received by the people via banking and postal channels. The most common postal channel used for this purpose is the IFS (International Financial System) platform of UPU (Universal Post Union). Generally, banks are allowed to enter into agreements with other banks for the money transfer business.

Apart from this, for the purpose of receiving inward remittance, there are two different modes:

- RDA or Rupee Drawing Arrangement;

- MTSS (Money Transfer Service Scheme).

Who is an Overseas Principal?

The Overseas Principal (OP) should be a registered entity licensed by the Government or Central Banks or financial regulatory authority of the country regarding carrying out Money Transfer Activities. The registration of the Overseas Principal should obtain mandatory authorisation from the DPSS, RBI under the provisions of the Payment & Settlement Systems Act, 2007 to operate or commence a payment system.

Who can carry the money transfer business to India?

Under the Money Transfer Service Scheme, the RBI may grant permission to any individual to perform as an Indian Agent as per Section 10(1) of the FEMA Act, 1999 or the Foreign Exchange Management Act, 1999. Unless the RBI or the Reserve Bank of India has granted permission, no individual can handle the business of cross-border transfer of money to India.

- To become an Indian Agent, an applicant should be an Authorised Dealer Category-1 Bank or;

- An FFMC (Full Fledged Money Changer) or Authorized Dealer Category-II, or the Department of Posts, or a Scheduled Commercial Banks.

Further, also the Indian Agents can appoint sub-agents which can be retail outlets, commercial entities having a business plan, and whose bonafides are acceptable to the Indian Agent.

Essential Documents required for filing an Application for MTSS

- Submit a declaration that no proceedings have been started or are pending against the applicant and its director before the Directorate of Revenue Intelligence or the Directorate of Enforcement or any other law implementing authorities;

- Submit a declaration regarding the proper policy framework that has been framed in respect of AML or CFT, or KYC in accordance with the guidelines issued by RBI;

- Details such as full name and full address of the registered company (Overseas Principal) with whom the Indian Agent will come into an agreement under MTSS;

- Through Overseas Principal, full details of the scheme operation;

- In this scheme, the measured volume of business per month or year;

- Facts of branches in India where MTSS (Money Transfer Service Scheme) will be directed by the applicant;

- Audited applicant's financial statements for the past two years, if available otherwise, copy of the latest audited accounts along with a certified copy of NOFs (Net Owned Funds) from the legal auditor as on application date;

- Submit a copy of the AOA (Articles of Association) and MOA (Memorandum of Association) of the applicant where there is a provision regarding the transfer of money business or make the suitable amendment;

- A confidential report in a sealed cover from a minimum of two applicant's bankers;

- Details of linked concern of the applicant operating in the financial sector;

- Submit a certified copy of the Board Resolution by the applicant concerning the transfer of money business;

- A letter from the suggested Overseas Principal who agrees to enter into an agreement with the applicant and also to offer essential collateral.

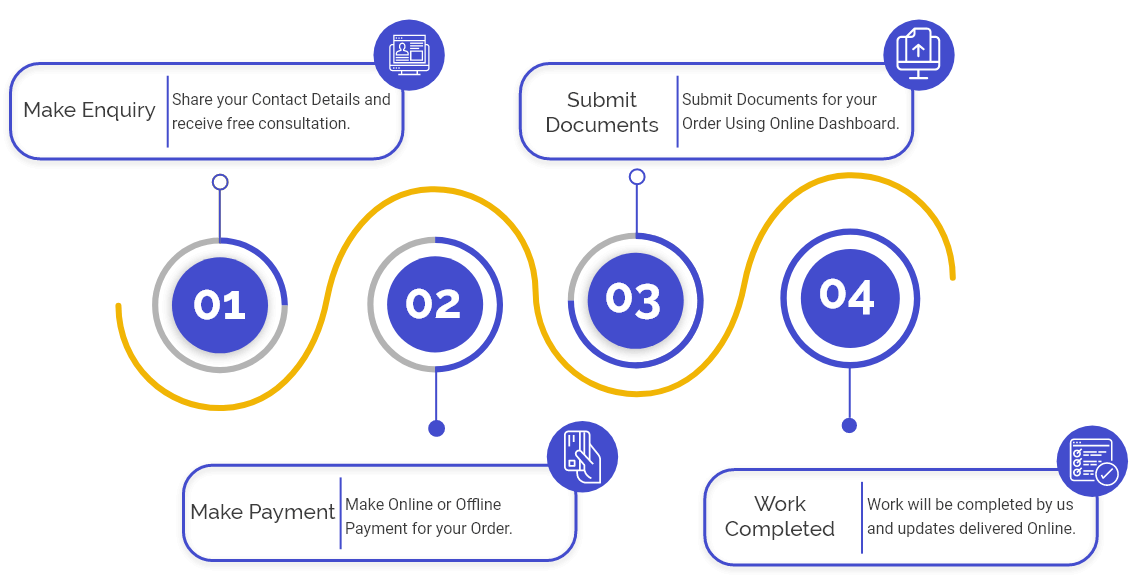

Procedure for Making Application to the RBI

Application for permission to act as an Indian Agent may be made to the respective Regional Office of the Foreign Exchange Department of the RBI, under whose jurisdiction the registered office of the applicant fails & should be accompanied by the documents regarding its proposed Overseas Principal as mentioned below:

- A declaration to the effect that no proceedings have been started by or are pending with the DRI (Directorate of Revenue Intelligence) or DoE (Directorate of Enforcement) or any other law enforcing authorities against the applicant or its directors & that no criminal cases are started or pending against its directors or applicant.

- A declaration to the effect that proper policy framework on KYC (Know Your Customer) norms or AML (Anti-Money Laundering) Standards or CFT (Combating the Financing of Terrorism), as per the guidelines issued by RBI, DBR (Department of Banking Regulation), Central Office as referred to in their Master Direction (KYC Direction, 2016 and other instructions regarding this and time to time in future, applicable to Indian Agents & their sub-agents in place on getting the authorisation of the RBI and before the commencement of money transfer operations.

Process of Transferring Money to India through Money Transfer Service Scheme

- For the money remittance, the remitter has to come Western Union Money Transfer or Money Gram location in such a nation where the service is functional. Then the form has to be filed with the fees as required with the extra charges applicable. Then, a unique Money Transfer Control Number will be created by the system, which performs as the reference number;

- The remitter has to tell the payee concerning the deposit; then the payee has to go to the Post Office to fill out the essential form and to show identification documents for verification;

- After that, Money Transfer Control Number is required to be given to an officer who inspects the record of the transaction;

- After the inspection, money is delivered to the payee in INR currency. In a single transaction, the transfer of money up to USD 2500 is allowed by the guidelines of the Reserve Bank of India, which cannot be overruled. Only up to Rs. 50,000/- can be paid in cash above this, and the amount can be directly deposited in the account or submit a cheque in the beneficiary's name;

- The process of money transfer to India barely takes time. Infect there is a limit of thirty transactions yearly, many peoples are taking benefits from this;

- We strongly recommend people must apply for such an opportunity to become an Indian Agent and take the consent of the proposed authority and disburse funds to recipients in India at ongoing exchange rates.

Guidelines for Overseas Principal

- It is required to obtain earlier permission from the Department of Payment and Settlement Systems. RBI under such provisions of the Payment and Settlement Systems Act, 2007 to function as a payment system by the overseas principal;

- There must be a minimum net worth of one million US dollars of the registered company;

- They should be registered with the industry bodies or overseas trade;

- The overseas principal must be a registered company with the Government or Financial Regulatory Authority or Central Bank concerned for carrying on the transfer of money activities;

- A personal report must be submitted from at least two of its bankers;

- It will be the full duty of the overseas principal concerning the activities of their agents and sub-agents in India;

- The Apex Bank may lessen the minimum net-worth criteria in the case of overseas principals incorporated in FATF member nations observed by the Government Authority;

- This principle must be well established in the transfer of money business with a record of operations in a well-regulated market.

Difference between MTTS (Money Transfer Service Scheme) and RDA (Rupee Drawing Arrangement)

- RDA (Rupee Drawing Arrangement) is a type of method by which the money can be received from foreign in the remittance form. Rupee Drawing Arrangement is only limited to individuals, but for the purpose of trade, money can be transferred up to a certain limit through RDA (Rupee Drawing Arrangement). In this way, only the Authorised Dealer-I (AD-I) category bank is allowed to transact. For the purpose of money exchange under the Rupee Drawing Arrangement, authorised exchange houses as their representative overseas are used by the certified banks, which are approved by the Reserve Bank of India (RBI). Remitted money is transferred to the receiver's bank account, while no remittance in cash is allowed. Under Rupee Drawing Arrangement (RDA), there is no such limit on the money transfer to a bank account of the individual. For the purpose of trade, there is an upper limit on the exchange of money of Rs. 5 lakhs. There is no facility for cash remittance under RDA.

- RDA and MTSS are slightly different from the viewpoint of the Reserve Bank of India. Inward remittance via MTSS is done through the transfer of fund services outside India, which work by coordinating certified agents in India. Funds cannot be transferred by this way for trade or charity.

- There are definite limits for inward remittance through MTSS (Money Transfer Service Scheme) which are topped at USD 2,500 per transfer; along with this, a maximum limit of thirty transfers can be received by a particular recipient in one calendar year.

- Under Money Transfer Service Scheme, there is an allowance for cash transfers. Currently, for cash transfers, there is a limit of Rs. 50,000/- and in case of amount more than Rs. 50,000/- then it will be paid through cheque, DD (Demand Draft), etc. But in the case of foreigners or tourists, more than Rs. 50,000/- is permitted in the case through MTSS.

Frequently Asked Questions

For the candidate, there is a necessity for minimum NOFs of Rs. 50 lakhs.

To perform as an agent, an application must be filed with the RBI (Foreign Exchange Department) under whose authority the registered office of the applicant is located.

RDA stands for Rupee Drawing Arrangement, is a network to receive cross-border money transfers from foreign jurisdictions. Under this arrangement, the AC-I banks enter into tie-ups with non-resident Exchange Houses in the FATF compliant nations to maintain and open their Vostro Account.

The overseas inward remittances to India under Rupee Drawing Arrangement is mainly on private account. The beneficiary or the remitter must be individuals, excepting a few exceptions. Remittances via exchange houses for the financing of trade transactions are also allowed up to the definite limit.

No, cash payment of remittances is permitted under RDA. The remittances have to be transferred to the beneficiary’s bank account.