Overview of NBFC Business Plan in India

The term “NBFC Business Plan” denotes a document that acts as an executive summary for a company. It includes all the details, such as vision, mission, promoter document, business structure, growth aspect, market size, product and services, sales and marketing, etc.

Every company that is willing to secure profits, attract investments, or obtain a loan for fixed or working capital needs to first draft a business plan. That means it assists in achieving both short-term and long-term objectives of a company.

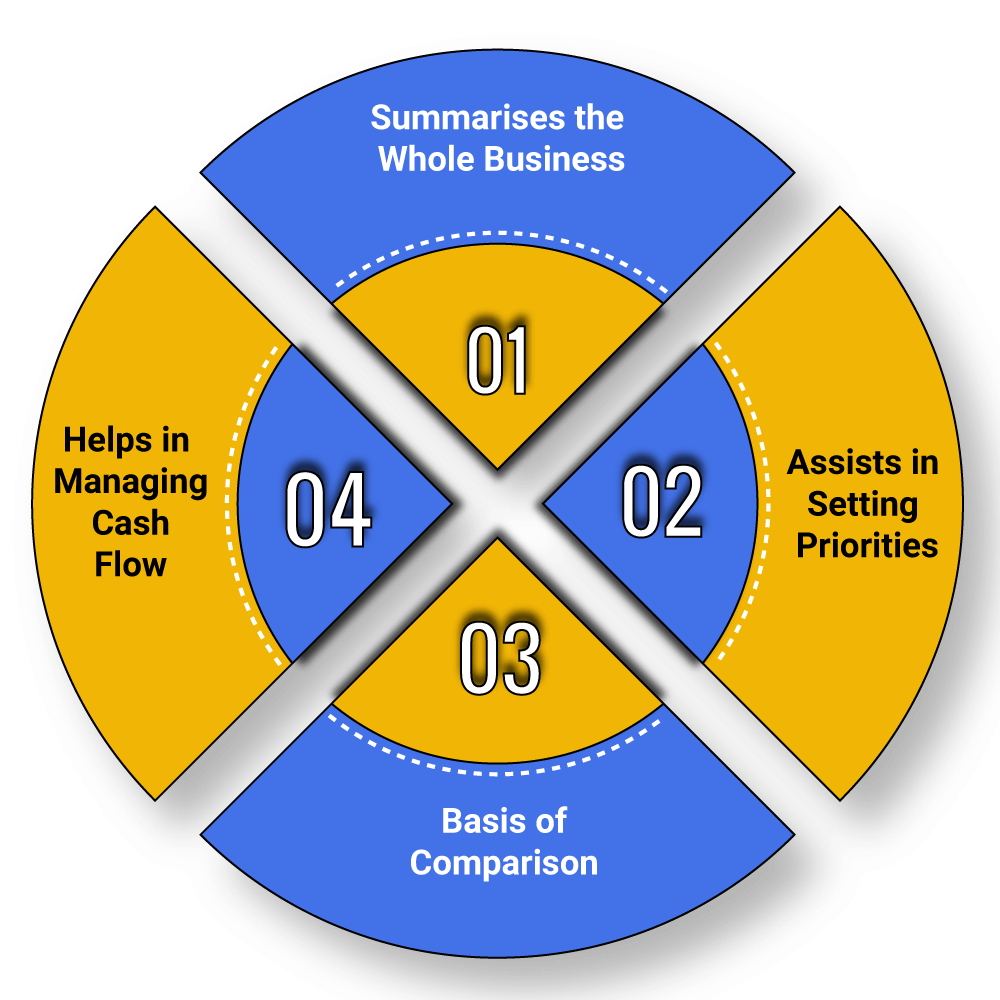

Benefits of NBFC Business Plan

The benefits of an NBFC Business Plan are as follows:

Summarises the Whole Business

Once the Business Model for an NBFC is properly drafted, it provides a clear image of the strategies, vision, and mission of the whole business. Moreover, it helps in comparing the achieved goals with the desired goals.

Assists in Setting Priorities

An NBFC Business Model assists in setting priorities of the work based on its significance. That means an effective Business Plan can help an NBFC to become productive and efficient in achieving its goals on-time.

Basis of Comparison

A Business Plan not only increases the productivity and efficiency of an NBFC but helps in comparing and analysing the achieved goals as well. That means one well drafted Business Plan is enough to track the progress of the business.

Helps in Managing Cash Flow

Just like traditional banks, NBFCs also provides loans, acquisition of stocks, and financial backing to people, especially the economically weaker section of the society. Thus, the management of Cash Outflow and Inflow becomes indispensable for an NBFC. A well drafted NBFC Business Plan will ensure both smooth cash flow and proper financial planning.

Need for NBFC Business Plan

Recently, there has been significant growth in the NBFC Sector of India, and it has been recognised as a crucial component of the Indian Financial System. Moreover, this sector plays a dominant role in the growth of different aspects, such as follows:

- Employment Generation;

- Transport;

- Core Infrastructure;

- Economic Development;

- Financial Backing to Economically Weaker Section;

- Contribution to State Exchequer, etc.

Thus, an NBFC regulates and administers the financial position of India, it is crucial to draft a proper business plan for the same.

Objectives of the NBFC Business Model

The key objectives of an NBFC Business Model are as follows:

- It provides information to Stakeholders, such as prospective Financial Institutions, Investors, and Funding Institutions for obtaining Loan;

- It encourages the company to achieve its desired goal;

- It keeps the employees updated with the Plans and Objective of the Company;

- It provides a Roadmap to Tackle critical situations;

Therefore, every company must have a well-drafted Business Plan.

Key Aspects of an Effective Business Plan for NBFC

The factors to consider while drafting a NBFC Business Plan are as follows:

- Senior Management is responsible to Integrate the Business Plan into the Management Cycle for the company;

- Stakeholders must hold Primary Position in every Planning Process;

- Explicit Focus should be given during the Process of Business Planning and Management Work;

- Every Business Plan must be based on Base Statistics;

- Employees must have proper knowledge about the Strategic Business Plan before its implementation;

- Periodical Operational Discussion must take place for effective Business Cycle;

- The process of Implementing Strategic Plan must not be of a complicated nature;

- All the Initiatives or Risk undertaken must be in Sync with the Strategic Objectives;

- Business Planning must be done keeping in mind the Future Growth Prospects;

Factors that Affect an NBFC Business Plan

The factors that affect an NBFC Business Plan are as follows:

- Technological Advancement;

- Digitisation of Market Forces; and

- Change in Consumer Preference;

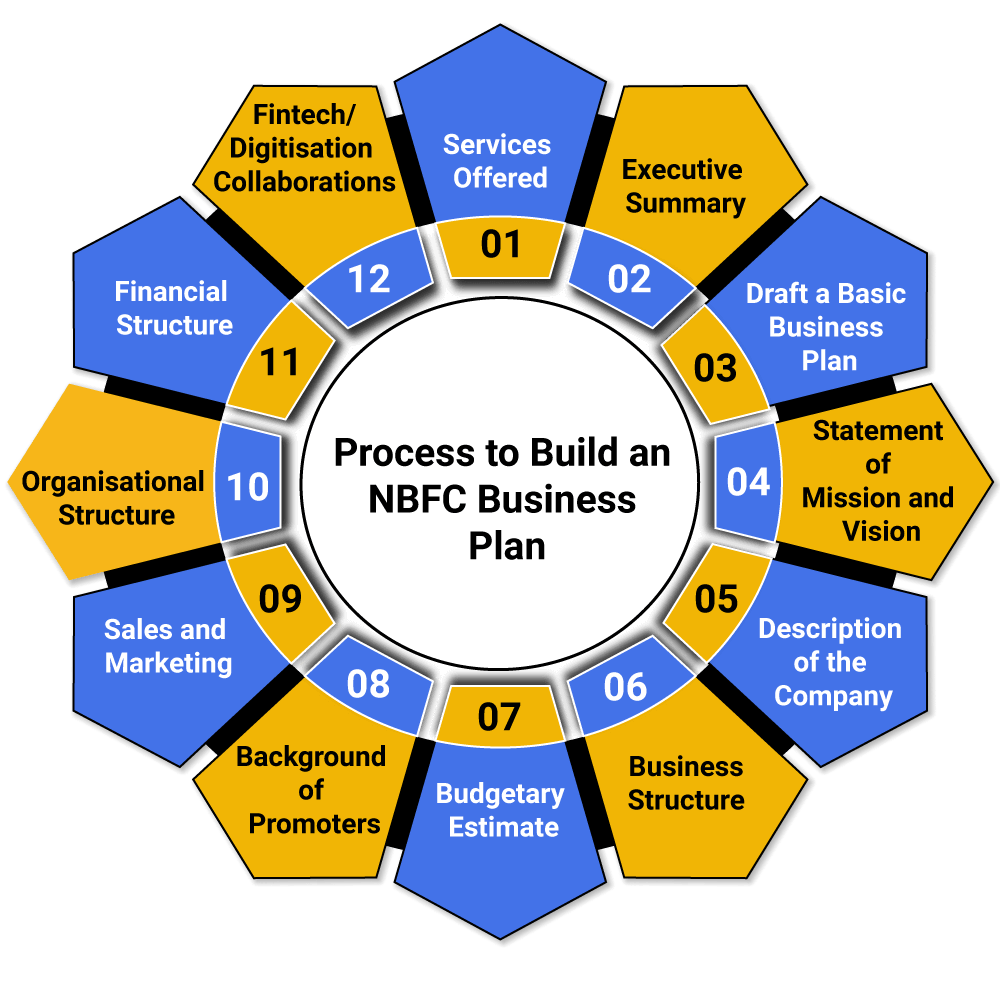

Process to Build an NBFC Business Plan

The steps involved in the procedure for NBFC Business Plan are as follows:

Services Offered

The first and foremost step to consider in a Business Plan is to decide the services that the company will be offering to its customers. However, while deciding the services, the management of the company must understand the market needs. Moreover, the Business Plan must specify the target audience for the company as well.

Executive Summary

The term “executive summary” denotes the main aim and objectives of an NBFC. By this step, the reader will get an overview of the business facts. However, it shall be relevant to note that the executive summary must be precise, clear, concise, and understandable.

Draft a Basic Business Plan

This step requires in-depth research on the different forms of NBFC Models available in the market. After deciding the business model, draft a proper template matching the business needs.

Statement of Mission and Vision

The statement of Mission and Vision will define the goals of the NBFC to the stakeholders in a summarised form.

Description of the Company

Now, after preparing the statement of Mission and Vision, it is necessary to specify the sectors on which the company will mainly focus.

Moreover, the management needs to mention the geographical locations in which it would be serving. The main benefit of this step is that it will assist the potential investors or clients in making an informed decision regarding the services of an NBFC.

Business Structure

It is necessary for an NBFC to mention a brief of its business structure in the plan. The term “business structure” includes legal formalities and business types.

Further, it shall be relevant to note that while drafting an NBFC Business Plan, the most common structure used is a company as prescribed under the provisions of the Companies Act 2013.

Budgetary Estimate

In the initial phase of the business, every financial institution or a company must have a budgetary estimate for meeting its day to day requirements. This budgetary estimate will also be needed for long-term financial planning.

Further, it is mandatory for an NBFC to keep a specific portion of the budget aside for formalities and registration with the Apex Bank.

Background of Promoters

The term “Background of Promoters” denotes the qualification and experience of the Directors, Shareholders, and Promoters of an NBFC. This step will provide easy access for market recognition.

Sales and Marketing

All the strategies concerning Sales and Marketing are specified under this section. The main of the marketing and sales strategies is to reach out the potential customers and investors. Moreover, the company needs to mention the ways of marketing the products as well.

Organisational Structure

It is one of the key aspects of an NBFC Business Plan. Further, the term “organisational structure” denotes the following:

- Roles and Duties of the Shareholders;

- Proper Governance Mechanism;

- Roles and Duties of the Directors;

Financial Structure

Along with the Budgetary Estimate, another key factor of an NBFC Business Plan is the proper Financial Structure. This section will deal with all the spending requirements and expenses of an NBFC.

Fintech/Digitisation Collaborations

This step is required when an NBFC is planning to offer Digitised or Fintech Financial Products in the future. Normally, NBFCs choose this option to attract more customers and investors.

Validity of an NBFC Business Plan

A well-drafted NBFC business plan dealing with the current market factors will remain valid for a specific period. That means it does not have an indefinite validity.

FAQs of NBFC Business Plan

Yes, an NBFC Business Plan can act as a basis for comparing planned and achieved goals.

An NBFC Business Plan dealing with the current market factors will remain valid for a specific period.

The benefits of an NBFC Business Plan are Summarises the Whole Business; Assists in Setting Priorities; Basis of Comparison; and Helps in Managing Cash Flow.

The traits are Integrate the purpose of an organization in the plan; Business Plan must be in Sync with Business Management Cycle; Planning must be based on Financials; Business Strategy must be linked to Business Performance Levers; and Business Plans must be of Refined Nature.

The factors that affect an NBFC Business Plan are Technological Advancement; Digitisation of Market Forces; and Change in Consumer Preference;

No, an NBFC Business Plan does not have an Indefinite Validity.

The term “Organisational Structure” includes the Role and Duties of Director and Shareholder and Mechanism for Proper Governance.

Some of the famous examples of NBFCs that are incorporated in India are HDB Financial Services; Muthoot Finance Ltd; Aditya Birla Finance Ltd; Tata Capital Financial Services Ltd.

The working and operations of an NBFC are regulated by the RBI within the structure of the RBI Act 1934 (Chapter III-B), together with the guidelines issued by it.

Any company incorporated under the Companies Act 2013 can become an NBFC if it has a minimum NOF (Net Owned Fund) of Rs 2 Crore and one full-time director.